简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD April Range on Radar as U.S. CPI Fails to Sway Fed Outlook

Abstract:USD/CAD may stage a larger rebound following the updates to the U.S. Consumer Price Index (CPI) as the exchange rate initiates a fresh series of higher highs and lows.

Canadian Dollar Talking Points

加元谈判积分

USD/CAD climbs to a fresh weekly-high (1.3346) even though the U.S. Consumer Price Index (CPI) instills a mixed outlook for the worlds largest economy, and recent price action raises the risk for a larger rebound as the exchange rate initiates a fresh series of higher highs and lows.

尽管美国消费者价格指数(CPI)前景不一,美元/加元仍攀升至每周新高(1.3346)对于全球最大的经济体而言,最近的价格走势增加了反弹的风险,因为汇率开始出现一系列新的高点和低点。

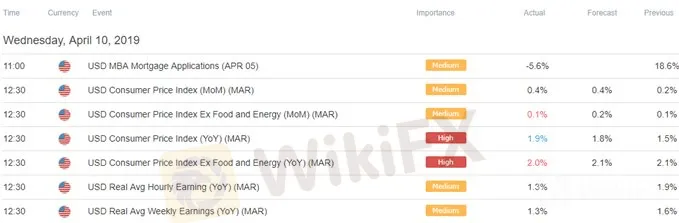

The reaction to the CPI report suggests currency traders are taking the uptick from 1.5% to 1.9% per annum as a positive development for the greenback as USD/CAD extends the advance from earlier this week.

对CPI报告的反应由于美元/加元延续了本周早些时候的涨势,货币交易商每年从1.5%上涨至1.9%,这是美元的积极发展。

{3}

{3}

Limited wage growth along with signs of ‘muted’ inflation may encourage the Federal Reserve to abandon the hiking-cycle as ‘data arriving since September suggest that growth is slowing somewhat more than expected,’ but indications of a goldilocks may keep the Federal Open Market Committee (FOMC) on the sidelines as the central bank pledges to be ‘patient in assessing the need for any change in the stance of policy.’

有限的工资增长以及“低迷”通胀的迹象可能会鼓励美联储放弃远足周期,因为'自9月份以来的数据显示增长放缓程度略高于预期',但有关金发姑娘的迹象可能会让联邦公开市场委员会(联邦公开市场委员会(FOMC)持观望态度,因为央行承诺“耐心评估政策立场变化的必要性。”

{5}

{5}

Keep in mind, the broader outlook for USD/CAD has become clouded with mixed signals following the break of the June-high (1.3386) as the Relative Strength Index (RSI) snaps the upward trend from earlier this year and appears to be carving a bearish formation. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

请记住,随着相对强弱指数(RSI)从之前的上升趋势突破6月高位(1.3386)之后美元/加元的广阔前景已被混合信号蒙上阴影今年,似乎正在形成看跌形态。注册并加入DailyFX货币分析师David Song LIVE,有机会讨论潜在的交易设置。

USD/CAD Rate Daily Chart

USD / CAD Rate Daily Chart

The USD/CAD advance from the March-low (1.3130) appears to have stalled following the string of failed attempts to close above the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement).

美元/加元从3月低点(1.3130)上涨似乎已经停止,因为一系列失败的尝试收盘高于斐波纳契重叠1.3420(78.6%回撤位)至1.3460(61.8%回撤位)。

As a result, USD/CAD may continue to face range-bound conditions as the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region acts as near-term support, but a break of the near-term range opens up the next downside hurdle around 1.3130 (61.8% retracement), which largely lines up with the March-low (1.3130).

因此,美元/加元可能继续面临区间震荡的情况由于1.3290(61.8%扩张)至1.3310(50%回撤)区域作为近期支撑,但近期区间突破开启下一个下行阻力位1.3130附近(61.8%回撤位),大致排列3月低点(1.3130)。

Will keep a close eye on the RSI as it continues to track the bearish formation carried over from the previous month.

将继续密切关注RSI跟踪前一个月结转的看跌形成。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

SEC Warns on Advance Fee Loan Scams in the Philippines

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator