简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: EURUSD Traders Eye ECB Meeting, Fed Minutes

Abstract:EURUSD overnight implied volatility jumped to its highest level in over a month as forex traders gear up for potentially sharp reactions to the latest ECB meeting and Fed minutes expected tomorrow.

CURRENCY VOLATILITY: EURUSD, ECB, FED – TALKING POINTS

货币波动率:欧元兑美元,欧洲央行,美联储 - 谈话要点

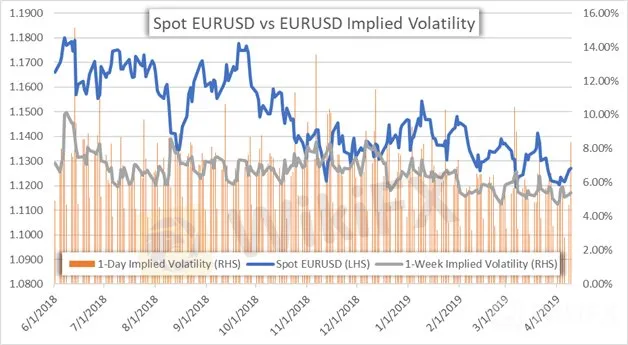

EURUSD overnight implied volatility nearly doubled from 4.65 percent to 8.39 percent, the metrics highest reading since March 7

欧元兑美元隔夜隐含波动率接近从4.65%翻倍至8.39%,自3月7日以来的最高指标

The jump in anticipated price action is likely in response to potential market-moving event risk from the April ECB meeting and March Fed minutes release tomorrow

预期价格行动的跳跃可能是为了应对潜在的市场变动明天4月欧洲央行会议和3月美联储会议纪要公布的事件风险

Check out this article for information on the Top 10 Most Volatile Currency Pairs and How to Trade Them

查看本文,了解有关十大最易变货币对的信息以及如何贸易他们

Download the free DailyFX Trading Forecasts for comprehensive second quarter outlook on the US Dollar, Euro, British Pound, Japanese Yen, Gold, Oil and Equities

下载免费的DailyFX交易预测,全面了解美元,欧元,英镑,日元,黄金,石油和股票

EURUSD overnight implied volatility has soared to a one-month high ahead of key event risk posed by the ECB meeting and Fed minutes expected tomorrow. The 1-day implied volatility measure now sits at 8.39 percent which suggests a potential move of 49 pips during Wednesdays session.

在欧洲央行提出的关键事件风险之前,欧元兑美元隔夜隐含波动率飙升至一个月高点明天会议和美联储会议纪要。 1日隐含波动率指标目前位于8.39%,表明周三会议可能会有49个点。

EURUSD IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (JUNE 01, 2018 TO APRIL 09, 2019)

欧元兑美元汇率波动价格表:每日时间框架(6月1日, 2018年至2019年4月9日)

Although, overnight implied volatility remains elevated ahead of key event risk tomorrow, expected price action measures show a slow-and-steady decline overall. The waning trend is likely in response to the most liquid currency pair notching its narrowest trading range since August 2014 according to the 14-day ATR.

虽然明天的关键事件风险之前隔夜隐含波动性仍然保持高位,但预期价格行动指标显示缓慢而稳定整体下降。根据14天的ATR,自2014年8月以来最具流动性的货币对开始回落,这一趋势可能是最具流动性的货币对。

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

外汇市场隐含的波动性和交易范围

The ECB is expected to announce its April monetary policy update at 11:45 GMT Wednesday. Markets will likely focus on supplementary commentary from ECB President Mario Draghi, however, seeing that OIS futures are pricing a 96.7 percent chance that the ECB holds its policy interest rate at -0.40 percent.

预计欧洲央行将于格林威治标准时间周三晚上11:45宣布其4月货币政策更新。市场可能会关注然而,欧洲央行行长马里奥·德拉吉的补充评论认为,OIS期货定价为96.7%的可能性,欧洲央行将其政策利率维持在-0.40%。

Aside from the ECB, the US is due to release its latest consumer price index which is projected to show muted signs of inflation. The headline and core CPI measures are slated to cross the wires at 12:30 GMT. If the inflation readings are reported higher than expected, the Fed could be forced to rethink its recent dovish tilt which could support the US Dollar.

除欧洲央行外美国将公布其最新的消费者价格指数,预计将显示通胀迹象不明显。标题和核心CPI指标预计将于格林威治标准时间12:30交叉。如果通胀数据高于预期,美联储可能被迫重新考虑其最近可能支撑美元的温和倾斜。

FOREX ECONOMIC CALENDAR – EURUSD

外汇经济日历 - 欧元兑美元

The Federal Reserve‘s FOMC minutes from its March meeting is scheduled for release at 18:00 GMT and will likely cap off Wednesday’s busy session for EURUSD traders. The report is expected to provide further insight on the Feds latest dovish position following its decision to cut economic projections and plan to end balance sheet normalization. Language from Fed officials that bolsters confidence by touting a strong economic backdrop could bolster the US Dollar while a tepid stance that leaves the door open for further policy easing may put downward pressure on the USD.

美联储3月份会议的FOMC会议纪要定于格林威治标准时间18:00发布,可能会让周三欧元兑美元交易者忙碌。在决定削减经济预测并计划结束资产负债表正常化之后,该报告有望进一步了解联邦调查局最近的温和立场。美联储官员通过强烈的经济背景支撑信心的语言可能会支撑美元,同时为进一步宽松政策打开大门的温和立场可能会给美元带来下行压力。{/ p>

EURUSD PRICE CHART: DAILY TIME FRAME (FEBRUARY 04, 2019 TO APRIL 09, 2019)

EURUSD PRICE CHART:每日时间框架(2019年2月4日至2019年4月9日)

Spot EURUSD is trading slightly below the 1.1300 handle after rallying off support found at the 1.1200 price level. The derived trading range calculated from EURUSD overnight implied volatility sees the currency pair trading between 1.1221 and 1.1319 with a 68 percent confidence interval. However, the recent uptrend formed could provide support near the 76.4 percent Fibonacci retracement line which rests near the 1.1250 price level. Resistance posed by the 61.8 percent Fib and 100-day EMA could hinder EURUSD upside.

现货欧元兑美元交投清淡在支撑位于1.1200价格水平的支撑后,低于1.1300手柄。根据欧元兑美元隔夜隐含波动率计算得出的交易区间,货币对在1.1221和1.1319之间交易,置信区间为68%。然而,最近形成的上升趋势可能在76.4%斐波纳契回撤线附近提供支撑,该回撤位于1.1250附近。 61.8%的斐波那契和100天EMA构成的阻力可能会阻碍欧元兑美元的上涨。

Check out additional EURUSD technical analysis here.

在此查看额外的EURUSD技术分析。

EURUSD TRADER CLIENT SENTIMENT

EURUSD TRADER客户感受

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

查看IGs客户情绪,了解欧元兑美元,英镑兑美元,美元兑日元,黄金,比特币和标准普尔500指数的看涨和看跌偏见的更多细节。

According to client positioning data from IG, 62.8 percent of traders are net long-resulting in a ratio of 1.69 traders long to short. However, the percent of traders net-long is 10.6 percent and 13.8 percent lower relative to the data readings yesterday and last week respectively.

根据IG的客户定位数据,62.8%的交易者净多头,导致1.69交易者多头做空。然而,相对于昨天和上周的数据读数,交易者净多头的百分比分别为10.6%和13.8%。

TRADING RESOURCES

交易资源

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator