简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen May Extend Rise as German, US Data Stokes Growth Fears

Abstract:The anti-risk Japanese Yen rose as the markets started the week in a sour mood. It may extend the move as downbeat German and US data may stoke global slowdown fears.

TALKING POINTS – YEN, US DOLLAR, STOCKS, GERMAN TRADE, US DATA

谈话要点 - 日元,美元,股票,德国贸易,美国数据

Yen gains, Aussie Dollar leads commodity FX lower in risk-off APAC trade

日元收益方面,澳元兑美元导致商品外汇在亚太地区风险偏好中走低

{2}

Downbeat German, US economic data may stoke global slowdown worries

{2}

JPY gained close to 9% in 2018 as global growth dynamics deteriorated

由于全球经济增长动态恶化,日元在2018年接近9%

Financial markets started the trading week in a defensive mood. The sentiment-geared Australian, Canadian and New Zealand Dollars weakened alongside Japans benchmark Nikkei 225 stock index and bellwether S&P 500 futures. The anti-risk Japanese Yen and similarly-minded Swiss Franc traded higher.

财务市场以防守态度开始交易周。与日本基准日经225股票指数和领头羊标准普尔500指数期货相比,澳大利亚,加拿大和新西兰元的情绪疲软。抗风险的日元和同样意识的瑞士法郎交易走高。

This may reflect a variety of influences. Two weeks of marathon US-China trade talks ended without a tangible, formal breakthrough. BOJ Governor Kuroda warned that Japanese exports and output will be affected by a global slowdown. A week packed with potent event risk looms ahead.

这可能反映了各种各样的影响。两周的马拉松式中美贸易谈判在没有实际的正式突破的情况下结束。日本央行行长黑田东彦警告称,日本的出口和产出将受到全球经济放缓的影响。一周充满强烈事件风险的一周即将来临。

The US Dollar was unable to leverage this backdrop to attract haven-seeking demand. That might be because Fridays US jobs report revealed an unexpected drop in wage inflation. Traders may have read this as worthy of a dovish adjustment in Fed policy bets.

美元无法利用这一背景来吸引寻求避险的需求。这可能是因为周五的美国就业报告显示工资通胀意外下降。交易员可能已将此视为值得美联储政策押注的温和调整。

GERMAN, US DATA MAY STOKE GLOBAL SLOWDOWN FEARS

德国,美国数据可能引发全球性的低迷恐惧

Looking ahead, German trade balance data as well as US factory and durable goods orders numbers are due to cross the wires. Soft results echoing the recently disappointing trend in macro news-flow may stoke global slowdown fears, offering fresh fodder for a risk-off pivot.

展望未来,德国贸易平衡数据以及美国工厂和耐用品订单数量将由电汇引发。柔和的结果与宏观新闻流动近期令人失望的趋势相呼应,可能引发全球经济放缓的担忧,为风险转移提供新的素材。

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

我们交易的是什么?查看DailyFX团队2019年的最佳贸易理念并找出答案!

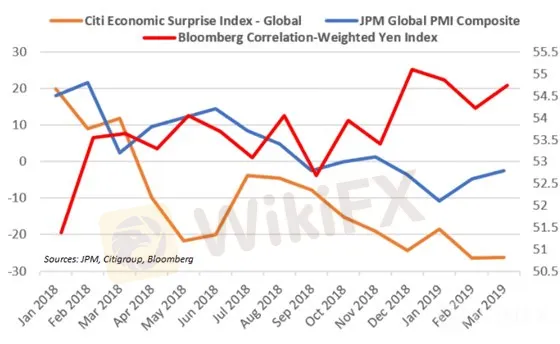

CHART OF THE DAY – YEN GAINS AS GLOBAL ECONOMIC GROWTH COOLS

当天的图表 - YEN获得全球经济增长的支持

The chart above reveals a steady decline in the pace of global economic acitivity (JPM Global PMI Composite) and an increasingly downbeat tone to incoming data flow (Citi Gobal Econmic Surprise Index) since the beginning of 2018. JPY traded broadly higher against this backdrop, adding 8.8 percent last year.

上图显示全球经济活动速度(JPM全球PMI综合指数)稳步下降且越来越多自2018年初以来,对于即将到来的数据流(Citi Gobal Econmic Surprise Index)持悲观态度。日元兑美元在此背景下大幅上涨,去年增加8.8%。

FX TRADING RESOURCES

外汇交易资源

Just getting started? See our beginners guide for FX traders

刚开始?请参阅我们的外汇交易员初学者指南

Having trouble with your strategy? Heres the #1 mistake that traders make

您的策略出现问题?这是交易者犯的第一个错误

Join a free Q&A webinar and have your trading questions answered

加入免费的问答网络研讨会并拥有您的交易问题已经回答

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator