简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones, S&P 500, DAX 30 and FTSE 100 Fundamental Forecast

Abstract:The start of earnings season in the United States will play a key fundamental role for both the S&P 500 and Dow Jones. Elsewhere, Brexit and trade wars remain key themes.

Dow Jones, S&P 500, DAX 30, and FTSE 100Fundamental Forecast:

The Dow Jones and S&P 500 will look to FOMC minutes and the start of earnings season on Friday

FTSE 100 traders will once again await Brexit clarity following Fridays deadline

{3}

Interested in longer-term forecasts? Second quarter forecasts for equities, commodities and currencies are now available on DailyFX

{3}

Dow Jones Fundamental Forecast: Bullish

The Dow Jones faces a relatively uneventful week from a data perspective, following last weeks slew of releases. That said, the index came out on top with assistance from news of a potential trade war resolution. In the week ahead, the Industrial Average will look to FOMC minutes on Thursday followed by the advent of earnings season on Friday.

Learn the differences between the Dow Jones and S&P 500 and how they might contribute to different outlooks.

Dow Jones Price Chart: 4-Hour Time Frame (January 2019 to April 2019) (Chart 1)

{8}

How to day-trade the Dow Jones

{8}

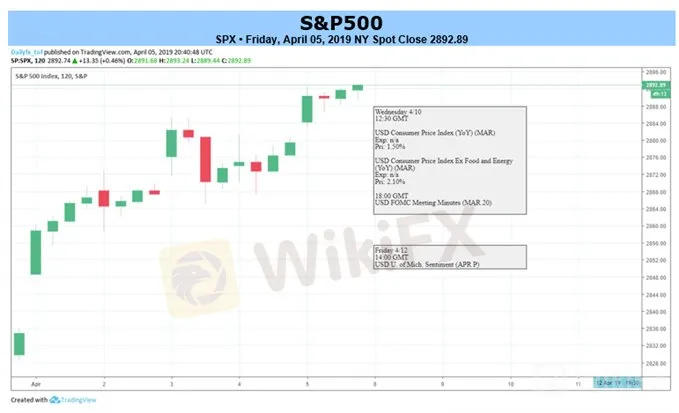

S&P 500 Fundamental Forecast: Bullish

Last quarters earnings were relatively underwhelming, and another season of disappointment may materially impact share valuation – unlike last quarter. The S&P 500 should see greater volatility as the reports come out due to sheer numbers.

With only 30 constituents, the Dow Jones is exposed to far fewer reports and therefore the surprises that result in drastic price swings. With a locked-in monetary policy path and a potential trade deal on the horizon, it seems likely that the recent price trend will prevail again next week.

{12}

Looking for a technical perspective on equity? Check out the Weekly Equity Technical Forecast.

{12}

S&P 500 Price Chart: 4 – Hour Time Frame (January 2019 – April 2019) (Chart 2)

DAX 30 Fundamental Forecast: Bullish

The German DAX rallied significantly last week. Amid a flurry of technical levels and waning fundamental data, the index seems to be tied to other factors. One such factor is further easing from the ECB. Next Wednesday the central bank is scheduled to comment on its interest rate and monetary policy framework.

Further insight into the next round of TLTROs will be critical for the DAX. Like its US counterparts, there seems to be few reasons to bet against the trend heading into next week from a fundamental perspective. But the technical outlook may offer a different view.

{17}

DAX 30 Price Chart: 4 – Hour Time Frame (December 2018 – March 2019) (Chart 3)

{17}

DAX day-trading strategies

FTSE 100 Fundamental Forecast: Neutral

As always, Brexit remains the commanding risk for the FTSE 100. Discussions between Theresa May‘s government and Jeremy Corbyn’s Labour party seemingly broke down Friday – just one week before the UK is scheduled to leave the EU. The extent to which UK MPs can agree, and progress, on an agreement next week will dictate the FTSEs direction. In the meantime, follow @PeterHanksFX on Twitter for insight on earnings season and the equity space

Brexit Timeline

FTSE 100 Price Chart: 4 – Hour Time Frame (June 2018 – March 2019) (Chart 4)

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the Pound or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Other Weekly Fundamental Forecast:

{27}

Australian Dollar Forecast – Australian Dollar Could Ride US-China Trade Hopes Higher Again

{27}

Oil Forecast– Crude Oil Prices Risk Fresh 2019 Highs as RSI Sits in Overbought Territory

British Pound Forecast – Leaning Towards a Softer Brexit?

Gold Forecast –Prices at Risk with ECB Rate Decision, FOMC Minutes in Focus

Euro Forecast – Bearish, EURUSD May Fall on ECB. Brexit Deadline Near

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dow Jones, DAX 30, FTSE 100, S&P 500 Forecasts for the Week

The Dow Jones, DAX 30, FTSE 100 and S&P 500 may look to melt higher ahead of a monumental Fed meeting on Wednesday, but will past peaks look to rebuke a continuation higher?

Dow Jones Forecast: TGT, LOW Earnings Expected to Highlight Trade Wars

After Home Depot (HD) delivered robust second quarter results despite trade war headwinds, the table is set for Lowes (LOW) and Target (TGT) to follow suit.

Dow Jones Suffers Largest Decline in 2019 as Trade War Fears Rage

The Dow Jones Industrial Average sank over 750 points on Monday as the US-China trade war entered a new phase over the weekend which shook investor confidence to the core.

Dow Jones Earnings to Offer Insight on Global Growth & Trade Wars

Two economic activity bellwethers in Caterpillar (CAT) and UPS are slated to report earnings Wednesday morning and investors will look closely for insight on global growth. Boeing (BA) will also report.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator