简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD 1-Week Implied Volatility at Highest Level Since January

Abstract:Canadian Dollar forex traders are expecting heightened price volatility ahead of the Bank of Canada's upcoming interest rate decision.

Implied Volatility – Talking Points:

CAD traders eye upcoming event risk with a focus on Bank of Canadas interest rate decision expected tomorrow

Currency option traders continue to price in higher anticipated price swings across EUR, GBP, AUD and NZD forex pair

Looking to refine your trading skills? Check out the DailyFX Top Trading Lessons here!

USDCAD 1-Week implied volatility remains elevated as currency traders anxiously await the Bank of Canada‘s interest rate decision on deck for 15:00 GMT tomorrow. Although the central bank is widely expected to keep its policy rate unchanged at 1.75 percent, follow-up commentary provided from BOC’s Governor Stephen Poloz will likely provide markets with an update on Canadas economy and future policy outlook.

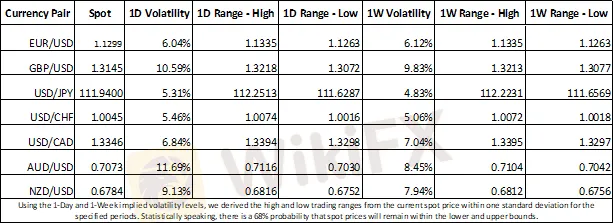

CURRENCY MARKAT IMPLIED VOLATILITY AND TRADING RANGE

Implied volatility on 1-Day and 1-Week currency options contracts has steadily crept higher in recent days. USDCAD implied volatility has been moving higher over the last 5 trading days with currency option hedging costs rising from 5.93 percent last Tuesday to 7.04 percent today. AUDUSD and NZDUSD also look to experience some price volatility as markets digest Chinas weak economic growth estimates released this morning.

USDCAD CURRENCY PRICE CHART: DAILY TIME FRAME (JANUARY 30, 2018 TO MARCH 05, 2019)

Recent USD strength on the back of relatively upbeat economic data has pushed the USDCAD higher as indicated on the chart above. Spot prices rebounded aggressively off uptrend support and the 61.8 percent Fibonacci retracement level yesterday but have remained range-bound between the 1.310 and 1.336 handles since the start of the year.

Despite near-term resistance at the 78.6 Fibonacci retracement line, the currency pair may break out above this price ceiling judging by USDCAD trading ranges derived from by implied volatility. BOC remarks that are more dovish than expected could serve as a fundamental driver for a topside breakout.

USDCAD RETAIL FOREX TRADER CLIENT POSITIONING

Take a look at IGs real-time Client Sentiment tracker to see the bullish and bearish biases of traders on other forex markets.

USDCAD traders have grown increasingly bearish on the currency pair ahead of the BOCs rate decision with the number of traders net-long falling 7.6 percent while the number of traders net-short jumped 20.7 percent higher compared to last week. This has resulted in a short-to-long ratio of 1.41.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

5 Advantages of Choosing a Regulated Broker

Currency Calculator