简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Outlook for SEK, Riksbank Monetary Policy, Swedens Economy

Abstract:The outlook for Sweden‘s economy and the Riksbank’s monetary policy suggests that USD/SEK will continue to trend higher as 2019 unfolds.

SEK TALKING POINTS – USD/SEK, SWEDISH KRONA, RIKSBANK, SWEDEN ECONOMY

Riksbank governor has unexpected optimism – markets shrug

Sweden economy still vulnerable to domestic, international risk

Will USD/SEK continue to trade above 9.2002 for all of 2019?

See our free guide to learn how to use economic news in your trading strategy!

At the most recent policy meeting, Riksbank Governor Stefan Ingves gave off an unexpectedly upbeat tone and – relatively – hawkish outlook on policy going forward. The central bank kept the benchmark rate at -0.25 percent but reiterated that they are still looking to raise rates at least once in the latter half of the year.

‘It is the economic outlook and inflation prospects that will determine future monetary policy’ Ingves said. Looking past his comments on the Swedish economy‘s strength and global developments now being in a ’calmer phase‘ the majority of the Riksbank board members don’t seem to share this same sentiment. One needn‘t look further than the December policy meeting minutes to see other policymakers’ concerns.

Domestic risks from high household indebtedness combined with international risks from Brexit and the US-China trade war are still matters of concern. Markets appear to be betting that the Riksbanks policy will be blown away by these headwinds and will compel the central bank to adjust its policy to a more dovish approach.

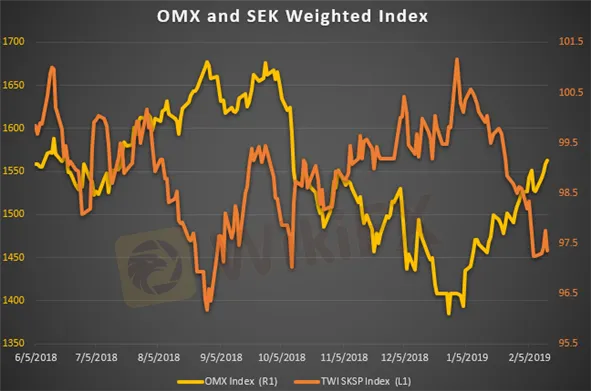

Despite SEK – measured here as a weighted index against a basket of other currencies – dropping along with Sweden‘s economic performance, the country’s benchmark OMX equity index has continued to climb. This seems to complement the theory that investors are expecting for the central bank to implement a policy conducive for countering a slowdown in the business cycle via looser credit conditions.

The potential turmoil in Europe may also play a bigger role in weighing on the Swedish economy. For the time being, markets appear to be kicking the proverbial can down the road and ignoring that the three largest Eurozone economies are slowing down faster than forecasts had suggested. The potential impact it may have on Swedens economy has to do with the unique political economy of EU-Nordic relations.

USD/SEK in this environment may rise as investors pivot away from chasing yields to preserving capital. The pair have skyrocketed through several resistance levels and are now trading above a key support at 9.2027. As of February 11, USD/SEK reached its highest point since December 2016. However, the pair in the coming days may cool down as it exits what appears to be overbought territory in the RSI indicator.

USD/SEK – Daily Chart

Within the coming months the pair may aim for 9.4066 with potentially minor resistance levels along the way. The broader fundamental outlook for global politics and the economy suggests investors may feel more skittish on the export-driven Krona and might instead flock to the US Dollar and Japanese Yen as risk appetite sours.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

SEK, NOK Brace for Turbulence Ahead of FOMC and Sweden GDP

The Swedish Krona and Norwegian Krone will likely experience unusually high volatility with Swedish GDP, the FOMC rate decision and other high-event risk in the week ahead.

NOK Eyes Crude Oil Prices, Norges Bank and FOMC Rate Decisions

The Norwegian Krone will likely experience higher-than-usual volatility alongside crude oil prices ahead of rate decisions by the Norges Bank and Fed.

US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Currency Calculator