简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

Abstract:US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

MARKET DEVELOPMENT –US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows

市场发展 - 零售销售,黄金和日元汇率在安全避风港上涨美元上涨

DailyFX Q2 2019 FX Trading Forecasts

DailyFX 2019年第二季度外汇交易预测

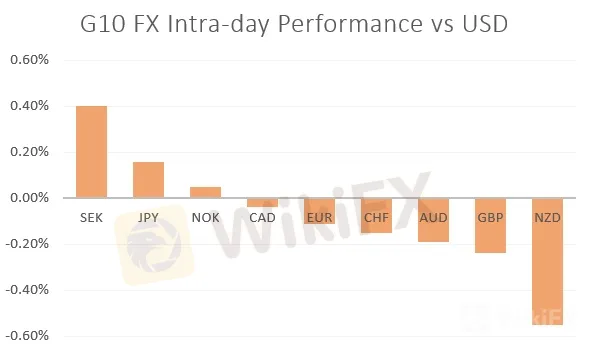

USD: A bounce in the greenback after the relatively robust retail sales data, which saw the retail sales control beat analyst estimates. In turn, this has seen a pullback in Fed easing expectations, which in effect raises the question as to whether the market is too aggressively priced for rate cuts.

美元:在零售销售数据相对强劲之后,美元反弹,零售销售控制超出分析师预期。反过来,美联储放松预期的情况有所回落,这实际上引发了一个问题,即市场是否过于激进地定价降息。

Gold: Gold prices are soaring this morning following the break above its 2019 high ($1346) and as such is on course for its 4th consecutive weekly gain. The latest catalyst behind this mornings jump in gold looks to be more technical, having broken above the prior YTD high. (full analysis)

黄金:在突破2019年高点(1346美元)之后,今早金价飙升,因此连续第四周上涨。今早金价上涨的最新催化剂看起来更具技术性,突破了之前的年初至今的高点。 (全面分析)

JPY: The Japanese Yen is up marginally with the risk aversion providing support for the safe-haven. 108.00 remains the stumbling block for further JPY gains for now, as USDJPY holds a relatively tight range.

日元:由于风险厌恶情绪为避险资产提供支撑,日元略微上涨。 108.00仍然是目前日元进一步上涨的绊脚石,因为美元兑日元持有相对较窄的区间。

SEK: Firmer footing for the Swedish Krona to close out the week, gaining against the USD and EUR following this mornings inflation report, which surprised to the upside. However, while this puts the Riksbank at ease, it is unlikely to raise expectations that the central bank would raise interest rates anytime soon.

瑞典克朗:瑞典克朗本周收盘走强,兑美元走强今早上涨的通胀报告显示美元和欧元,这令人意外。然而,虽然这使得瑞典央行放松,但不太可能提高央行将很快加息的预期。

Source: DailyFX, Thomson Reuters

来源:DailyFX,汤森路透

IG Client Sentiment

IG客户情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

BoJ Holds Firm on Tightening Path Fuels Yen

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House.

Eye on Today’s FOMC Meeting Minutes

Wall Street took a pause in the last session, with all three major indexes remaining relatively flat as investors awaited the highly anticipated FOMC meeting minutes.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator