简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

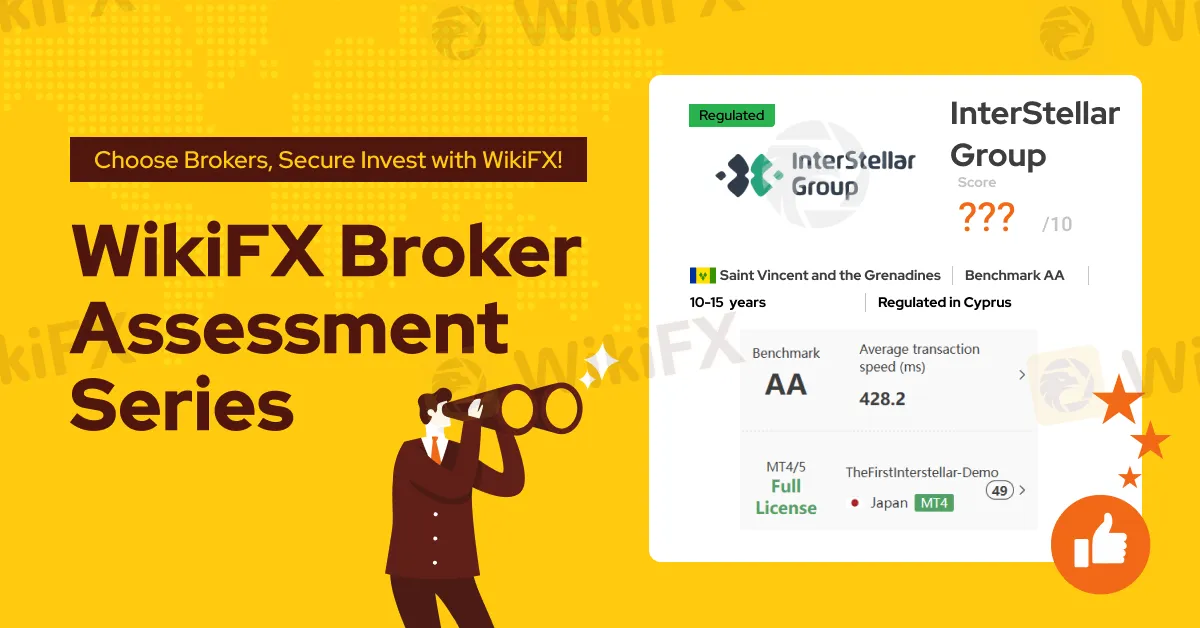

WikiFX Review: Is InterStellar Group Trustworthy?

Abstract:In today’s article, WikiFX made a comprehensive review of a broker named InterStellar Group. We wonder if InterStellar Group is a scam or a reliable broker.

Please continue to read if you want to know whether InterStellar Group is a reliable forex broker.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of InterStellar Group based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform that provides basic information and regulatory license inquiries. |

| WikiFX can evaluate the safety and reliability of more than 63,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether InterStellar Group is a scammer, we evaluated this broker based on various aspects, such as regulatory status.

1. Evaluate the reliability of InterStellar Group based on its general information and regulatory status

To understand InterStellar Group better, we explore it by analyzing two main perspectives:

A. General Info of InterStellar Group

B. Regulatory Status

A. General Info of InterStellar Group

InterStellar Groups general info is shown below:

About InterStellar Group

InterStellar Group is a forex and CFD broker that was founded in Cyprus in 2011. Tradable financial assets that investors can trade with the Interstellar FX platform include CFDs on forex, shares, indices, and commodities.

Account Types

It offers four types of accounts: Standard Account, ECN Account, Union Account, and Cent Account.

Leverage

The maximum trading leverage is 1:400 for Forex currency pairs, 1:50 for indices, 1:200 for gold, 1:100 for silver, and 1:100 for energy products. It's important to note that while leverage can magnify gains, it can also magnify losses, so traders should use it with caution and ensure they have a solid risk management strategy in place.

Trading Platform

The trading platforms provided by InterStellar Group include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Spreads and Commissions

Standard Account

The Standard Account offers a balance between cost and accessibility, with typical spreads such as 2.6 pips for EURUSD and 2.1 pips for GBPUSD. This account is ideal for traders who are looking for a straightforward trading experience with essential features.

ECN Account

The ECN Account provides the most competitive spreads, such as 0.2 pips for EURUSD and 0.6 pips for GBPUSD, making it suitable for traders who prefer a more direct market access model with potentially tighter spreads and faster execution speeds.

Union Account

The Union Account features moderate spreads, including 1.0 pips for EURUSD and 1.2 pips for GBPUSD. It is tailored for traders who may be looking for specific trading conditions or benefits associated with this account type.

Cent Account

The Cent Account is designed for beginners or those who wish to trade in smaller volumes, with spreads such as 2.2 pips for EURUSD and 1.8 pips for GBPUSD. This account is perfect for learning and practicing trading strategies with minimal risk.

Deposits & Withdrawals

InterStellar Group offers a variety of convenient and efficient methods for depositing and withdrawing funds.

Customer Service

This broker offers a variety of convenient customer contact methods. The options include email, phone, social media, and real-time chat.

B. Regulatory Status

What is a Legitimate License?

- The legitimate license is the business license issued by the financial regulatory institution of each country/region.

- Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under protection to some extent.

- Whether a forex brokerage firm holds a legitimate license or not is one of the important factors in evaluating the reliability of forex brokers.

- The regulation's content and the difficulty of obtaining a license vary by country and agency issuing the license.

The legitimate license of InterStellar Group

According to WikiFX, InterStellar Group operates under a strong regulatory frame.

2. Engagement on social media platforms

To figure out whether this broker is a scam or not, we did a survey about this broker on social media platforms.

InterStellar Group has official accounts on YouTube, Instagram, and Facebook

3. Special survey about InterStellar Group from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

WikiFX has given InterStellar a decent rating of 7.62/10.

B. On-site Survey

InterStellar Group joined the Wiki Finance EXPO Singapore 2023, booth number: D9. Established in 2011, and headquartered in Cyprus, after more than a decade of development, InterStellar Group has grown into a world leader in forex and CFD trading.

C. WikiFX Review

On the InterStellar Group page of WikiFX, there is a comment section that allows users to make comments about this broker. As of January 17, 2025, there are 5 positive comments and 2 neutral comments.

4. Conclusion

All over, InterStellar Group is a sophisticated broker that offers excellent trading services to its global clients. It is regulated and welcomed by many traders. WikiFX has given this broker a considerably high score. It may be a good choice for you to start your trading journey. However, we still want to remind you of the potential risk in the forex trading. If you want more information about the reliability of certain brokers, you can visit our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Enters Direct Investment Market with £160 Million Freetrade Buyout

IG Group, a prominent global financial trading and investment company, has announced its acquisition of Freetrade, a commission-free investment platform, for £160 million. The deal, funded through IG’s existing capital resources, marks a strategic move to expand its footprint in the United Kingdom.

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

Cinkciarz.pl, one of Central Europe’s largest currency exchange platforms, has made headlines after accusing major Polish banks of conspiring to undermine its operations. The company has threatened legal action amounting to 6.76 billion zlotys ($1.6 billion) in damages. However, the platform is now under intense scrutiny following allegations of fraud and the mismanagement of customer funds.

BSP and JICA Renew Partnership to Expand Credit Risk Database for SMEs in the Philippines

On December 11, 2024, a significant milestone was reached in the Philippines' financial sector as the Bangko Sentral ng Pilipinas (BSP) and the Japan International Cooperation Agency (JICA) officially signed the ‘Records of Discussion’ for the second phase of the Credit Risk Database (CRD) project. The ceremony at the BSP headquarters in Manila marked a pivotal moment in widening access to financing for small and medium enterprises (SMEs) across the country.

Why Copy Trading is Perfect for New Investors

Learn why copy trading is ideal for new investors. Follow expert traders, minimize risks, and start earning confidently—no prior expertise is required.

WikiFX Broker

Latest News

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

Currency Calculator