简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

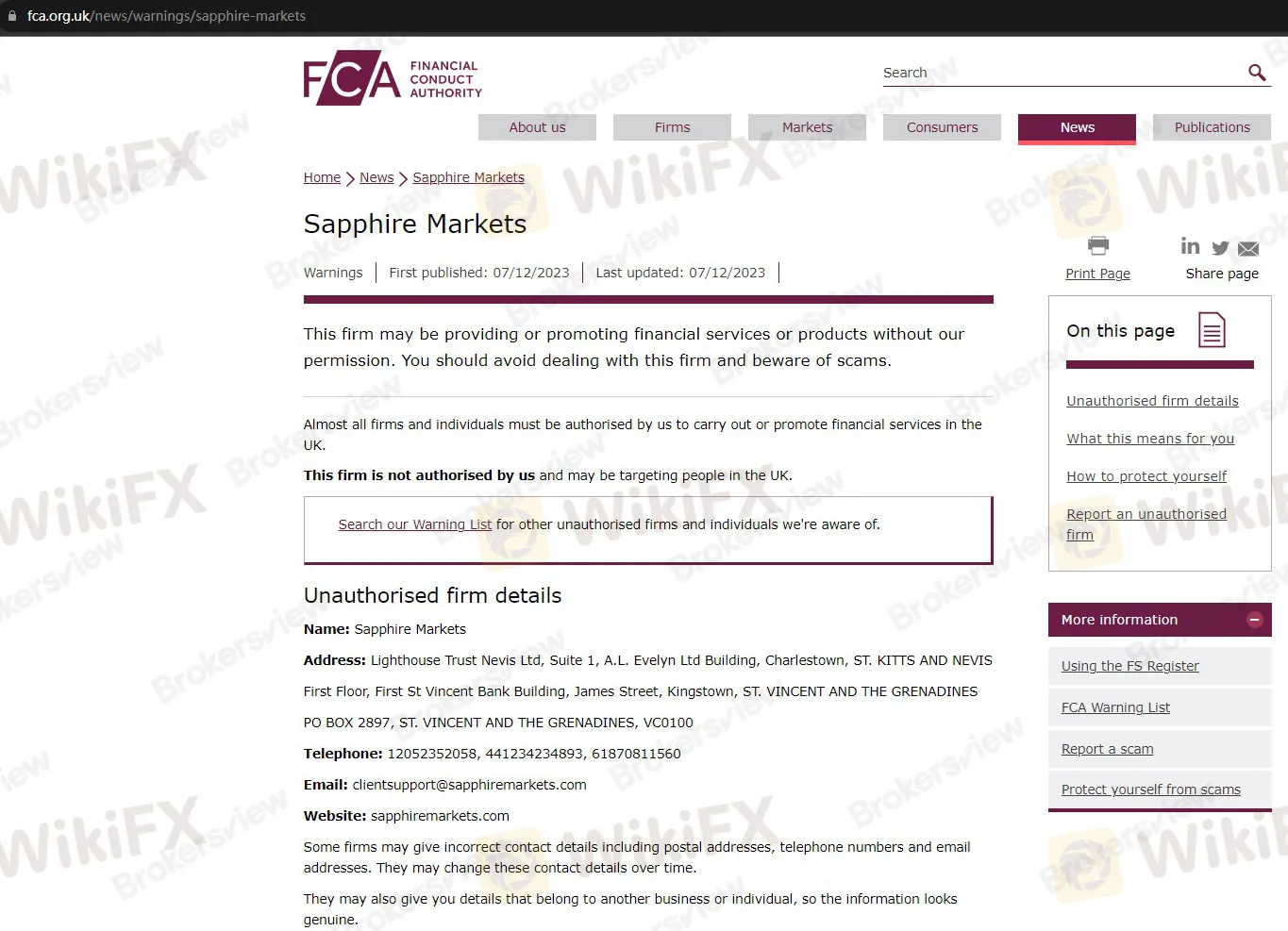

FCA Warns an Unauthorized Broker Named 'Sapphire Markets'

Abstract:On December 7, the UK's Financial Conduct Authority (FCA) regulator warned against an unauthorized broker called Sapphire Markets, reminding the public to be aware of financial safety.

On December 7, the UK's Financial Conduct Authority (FCA) regulator warned against an unauthorized broker called Sapphire Markets, reminding the public to be aware of financial safety.

Sapphire Markets operats a website to promote financial services, including currency trading services. According to the website, it purportedly offers various financial instruments such as foreign exchange, indices, metals, oil, and cryptocurrencies. This company also claims to offer investors fixed spreads and competitive commission rates.

From the bottom of its homepage, we find that this broker claims to be a company registered in St. Kitts and Nevis, an island nation located in the Caribbean. Besides, this company provides visitors with three contact numbers attributed to the United States, the United Kingdom, and Australia.

Other than that, we could not find any valid regulatory information.

Please note that business registration is not the same as financial authorization. Not all registered businesses are qualified to offer financial products and services. Only entities and individuals authorized by financial regulators can legally offer financial services, with the types of offerings limited by strict regulations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator