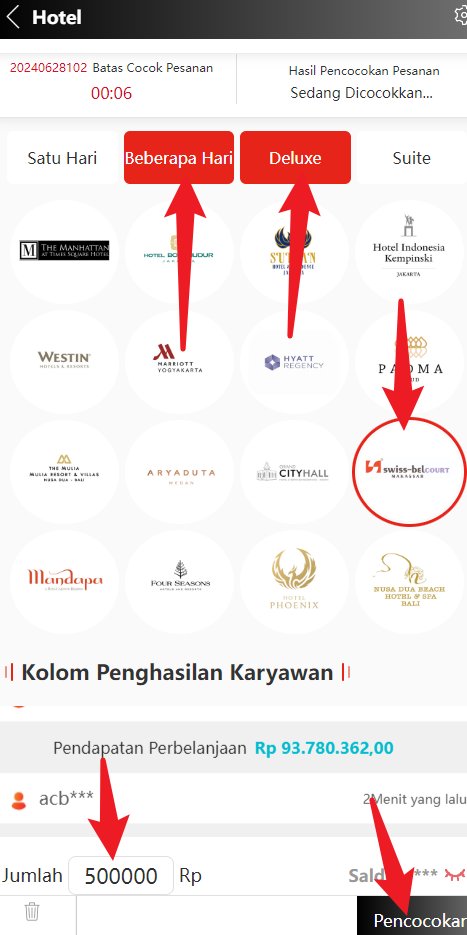

Score

PT Fintech

China|1-2 years|

China|1-2 years| https://www.ptfintech.com/zh

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaAccount Information

Users who viewed PT Fintech also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ptfintech.com

Server Location

United States

Website Domain Name

ptfintech.com

Server IP

104.21.10.223

Company Summary

| PT Fintech Review Summary | |

| Registered Country/Region | China |

| Regulation | No Regulation |

| Market Instruments | Forex, Indices, Precious Metals, Energy, Cryptocurrency |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | From 1.0 pips |

| Trading Platform | MetaTrader 4 (Desktop and Mobile) |

| Minimum Deposit | $10 |

| Customer Support | Email: info@ptfintech.com |

| Social Media: Facebook, Twitter, Instagram, YouTube, and more | |

What is PT Fintech?

PT Fintech serves as a global online trading platform, presenting a range of financial instruments for investment. It highlights user-friendly attributes like mobile compatibility and a diverse array of assets such as forex, stocks, commodities, and cryptocurrency. The platform accentuates the potential for high returns facilitated by low spreads and high leverage. However, it currently has no valid regulations.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

Wide Range of Investment Options: PT Fintech offers a diverse selection of assets to trade, including forex, stocks, indices, precious metals, energy commodities, and cryptocurrency. This allows for portfolio diversification within a single platform.

User-Friendly Platform: They advertise a user-friendly mobile app and the popular MT4 trading platform, potentially making it easy to access and manage investments.

Low Minimum Deposit: With a $10 minimum deposit, PT Fintech is accessible to new investors with limited capital.

Practice with Demo Account: The availability of a demo account allows users to practice trading without risking real money.

Cons:

Unregulated: The lack of regulatory oversight is a major concern. Unregulated brokers pose a higher risk of scams or unfair practices.

Unclear Fees: There is no complete and detailed information on fees and commissions on its website, making it difficult to assess the overall cost of trading with PT Fintech.

Is PT Fintech Legit?

Whether PT Fintech is considered legitimate hinges significantly on its regulatory status. Regulated brokers are accountable to financial authorities, ensuring a level of oversight and consumer protection.

However, PT Fintech operates without any regulatory oversight, which casts doubt on its legitimacy. Without regulatory oversight, there are fewer assurances regarding the fairness of trading practices, the security of funds, and the integrity of the platforms operations.

Market Instruments

PT Fintech entices investors with a rich buffet of tradable assets, catering to a range of investment styles.

Foreign Exchange (Forex): This dynamic market allows you to speculate on currency movements. PT Fintech provides major currency pairs (USD/EUR, USD/JPY) and exotic options.

Indices: Instead of picking individual stocks, you can trade entire market segments with indices. PT Fintech could offer popular indices like the S&P 500 (US stocks) or the FTSE 100 (UK stocks). This provides diversified exposure to a particular market.

Precious Metals: Precious metals like gold and silver have historically been considered safe-haven assets. PT Fintech allows you to trade these metals, offering a hedge against inflation or market downturns.

Energy: The price of oil and natural gas can be influenced by global events and supply/demand dynamics. PT Fintech enables you to trade these energy resources and futures, profiting from price fluctuations.

Cryptocurrency: The world of digital currencies like Bitcoin and Ethereum is rapidly evolving. PT Fintech provides access to this exciting asset class, but be aware of the inherent volatility and regulatory uncertainty surrounding cryptocurrency.

Account Types

PT Fintech provides traders with two distinct account options.

The demo account simulates real market conditions, allowing traders to familiarize themselves with the platform and test different strategies without risking real money.

The Pro X account from PT Fintech is tailored for traders seeking a low-cost entry into the markets with the potential for high returns. With a minimum deposit requirement of just $10, this account offers accessibility to traders of all levels.

Leverage

PT Fintech offers high leverage (up to 1:500), allowing traders to control positions much larger than their initial investment. For example, with 1:500 leverage, a trader can control a $50,000 position with just a $100 deposit. While leverage can amplify profits, it also significantly increases the risk of losses.

For beginners, high leverage can be especially risky. Therefore, beginners should start with lower leverage levels and gradually increase as they gain experience and confidence in their trading abilities.

Spreads & Commissions

PT Fintech highlights low starting spreads (from 1.0 pips), appealing to cost-conscious traders. Spreads represent the difference between the buy and sell price of an asset, directly impacting your trading costs. Lower spreads generally mean less money paid on each trade.

However, there is no information about commissions on its website. Commissions are fees charged by the broker for executing trades on your behalf. Knowing the commission structure is important to understand the total cost of trading with PT Fintech.

Trading Platform

PT Fintech provides traders with access to the popular MetaTrader 4 (MT4) platform, available for both desktop and mobile devices. MT4 is renowned for its user-friendly interface, advanced charting tools, and customizable features, making it suitable for traders of all levels. MT4 offers a wide range of technical analysis tools, including various chart types, indicators, and drawing tools, allowing traders to analyze market trends effectively. The platform also supports automated trading through Expert Advisors (EAs), allowing traders to automate their trading strategies and execute trades based on predefined parameters.

Deposits & Withdrawals

PT Fintech offers a low minimum deposit requirement of just $10 to open an account, making it accessible to a wide range of traders. The platform claims to charge no deposit fees, which is advantageous for traders looking to fund their accounts without incurring additional costs. Additionally, PT Fintech promotes quick withdrawal processing, allowing traders to access their funds promptly and without unnecessary delays.

However, the website lacks detailed information regarding the deposit and withdrawal processes. Specific details such as the exact methods supported, potential withdrawal fees, processing times for various payment methods, and any conditions or limits that might apply are not provided. For traders, having transparent and comprehensive information about these processes is crucial for effective financial planning and risk management.

Customer Service

PT Fintech provides multiple channels for customer support to ensure traders can get assistance when needed.

Email Support: Traders can reach PT Fintech's support team via email at info@ptfintech.com.

Social Media: PT Fintech maintains a presence on several social media platforms, including Facebook, Twitter, Instagram, and YouTube. These channels can be used for general inquiries, updates, and community engagement.

Conclusion

PT Fintech presents itself as a versatile trading platform offering a variety of financial instruments, including forex, stocks, commodities, and cryptocurrency. It also boasts features like mobile compatibility and a low minimum deposit.

However, a significant point to consider is PT Fintech's lack of regulatory oversight. While the absence of regulation does not inherently imply negative practices, it does reduce the level of consumer protection and transparency typically associated with regulated brokers. Please weigh these factors carefully when deciding to engage with PT Fintech.

Frequently Asked Questions (FAQs)

What is the minimum deposit required to open an account with PT Fintech?

$10.

What trading platforms are available at PT Fintech?

PT Fintech provides the MetaTrader 4 (MT4) platform, available for both desktop and mobile devices.

Are there any deposit fees at PT Fintech?

No.

Does PT Fintech have regulatory oversight?

No, PT Fintech operates without any regulatory oversight.

What market instruments can I trade on PT Fintech?

Forex, indices, precious metals, energy commodities, and cryptocurrency.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

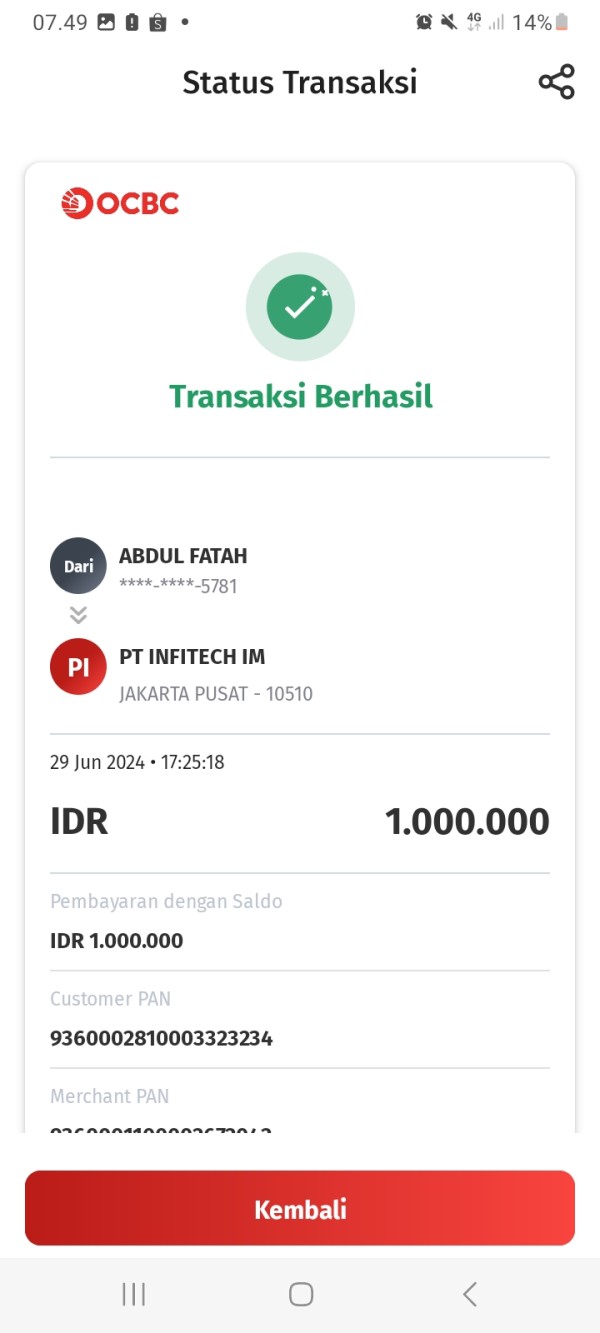

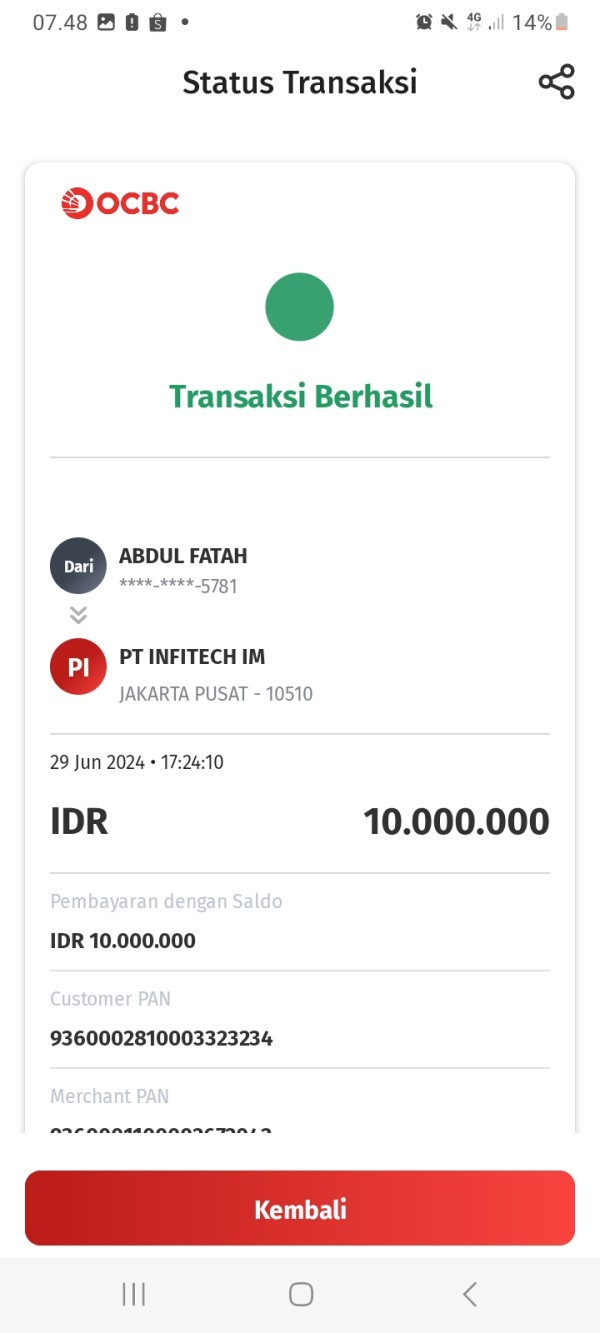

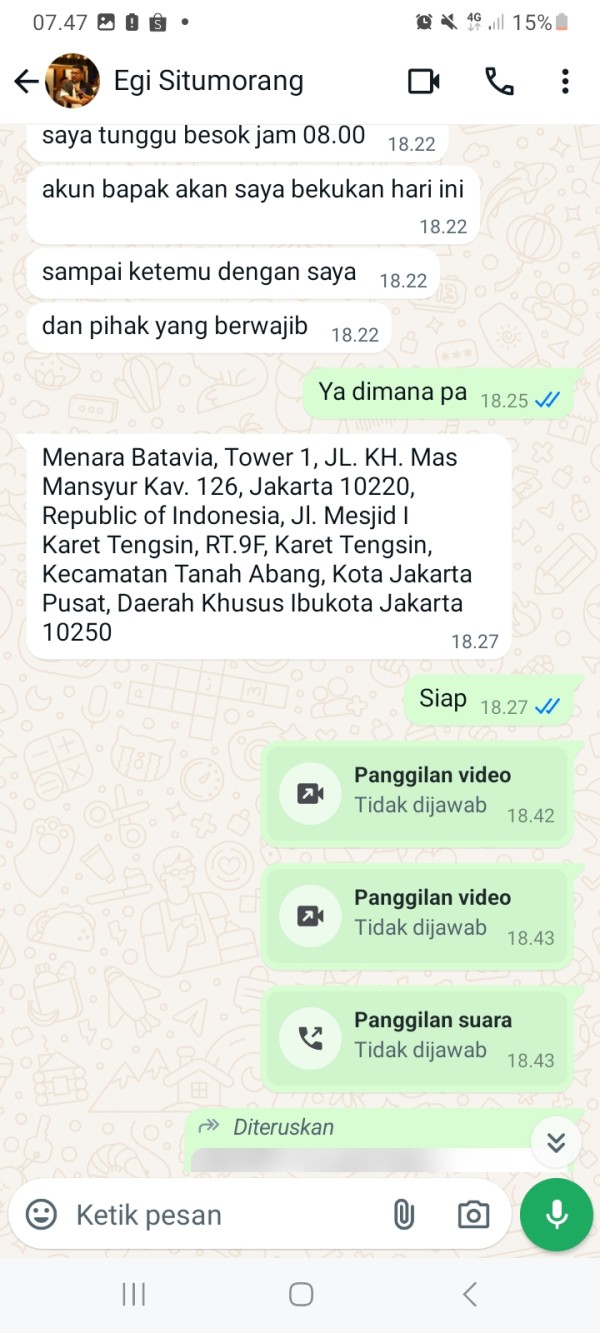

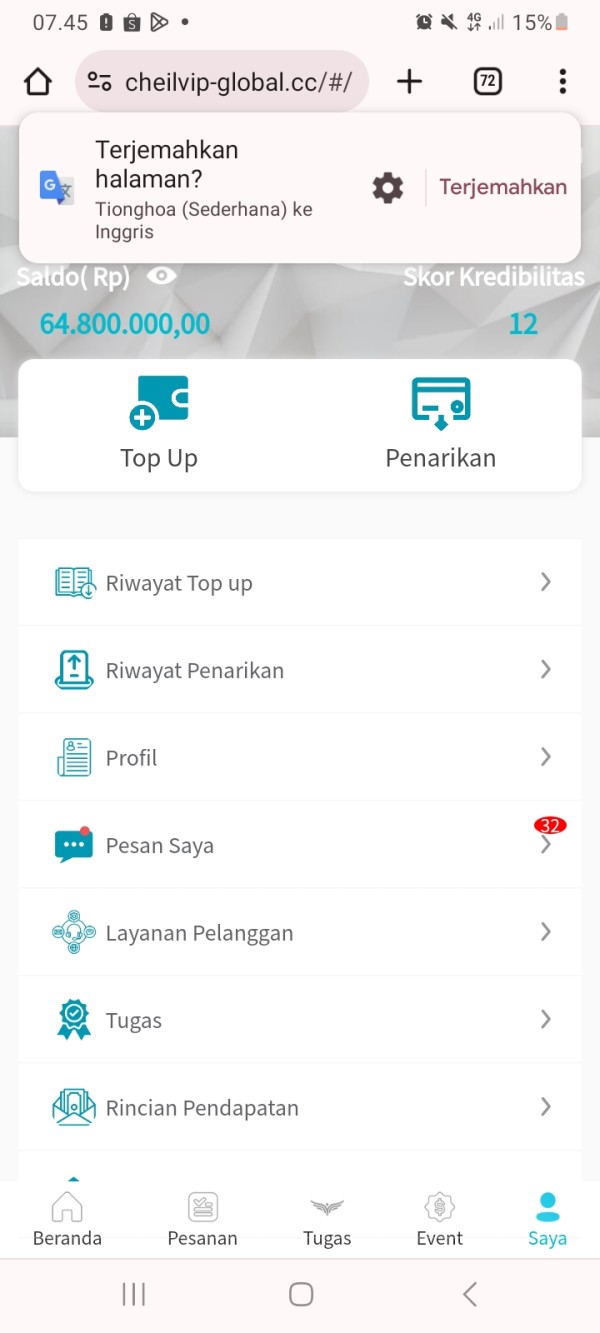

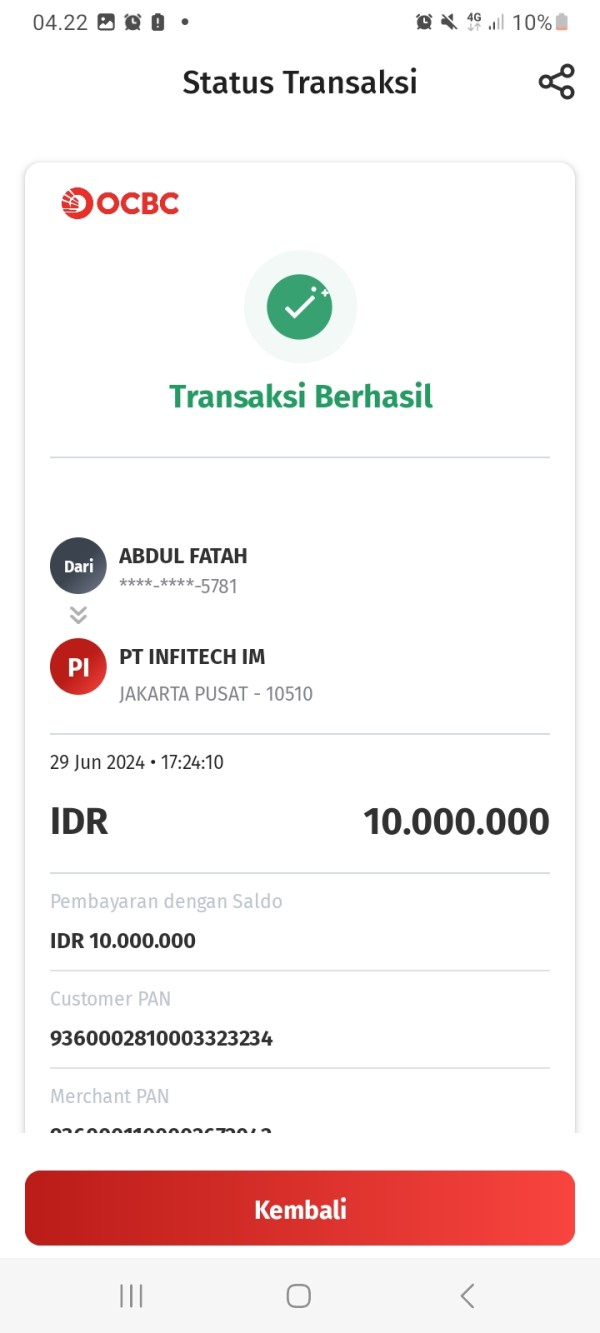

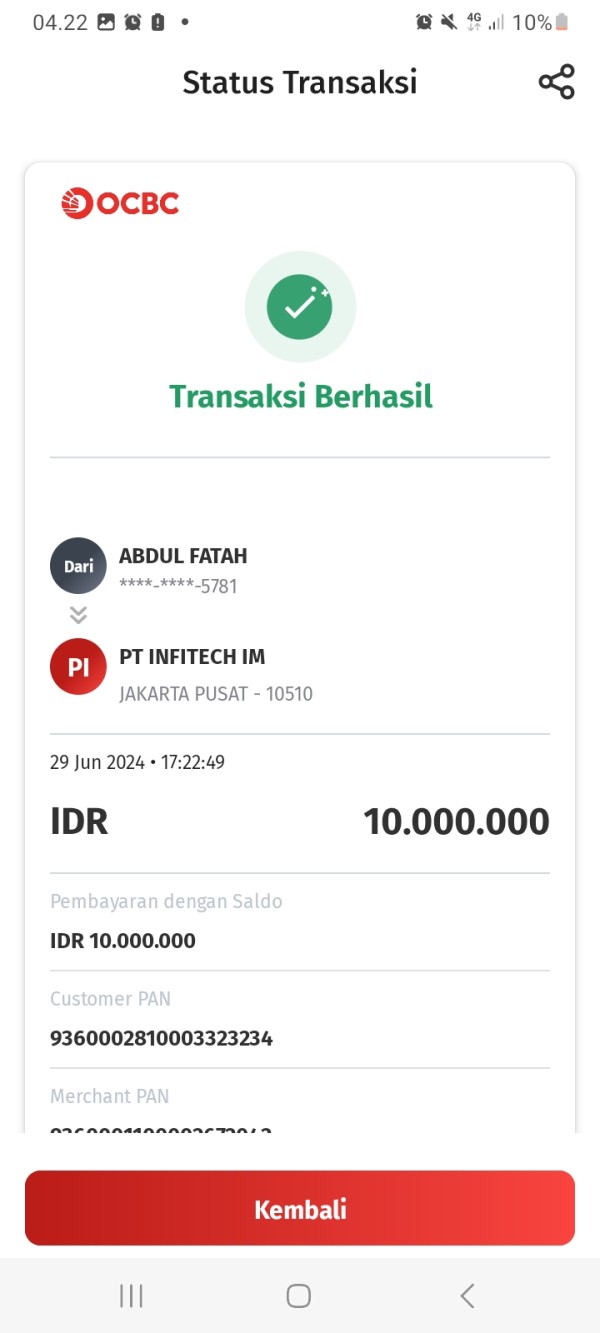

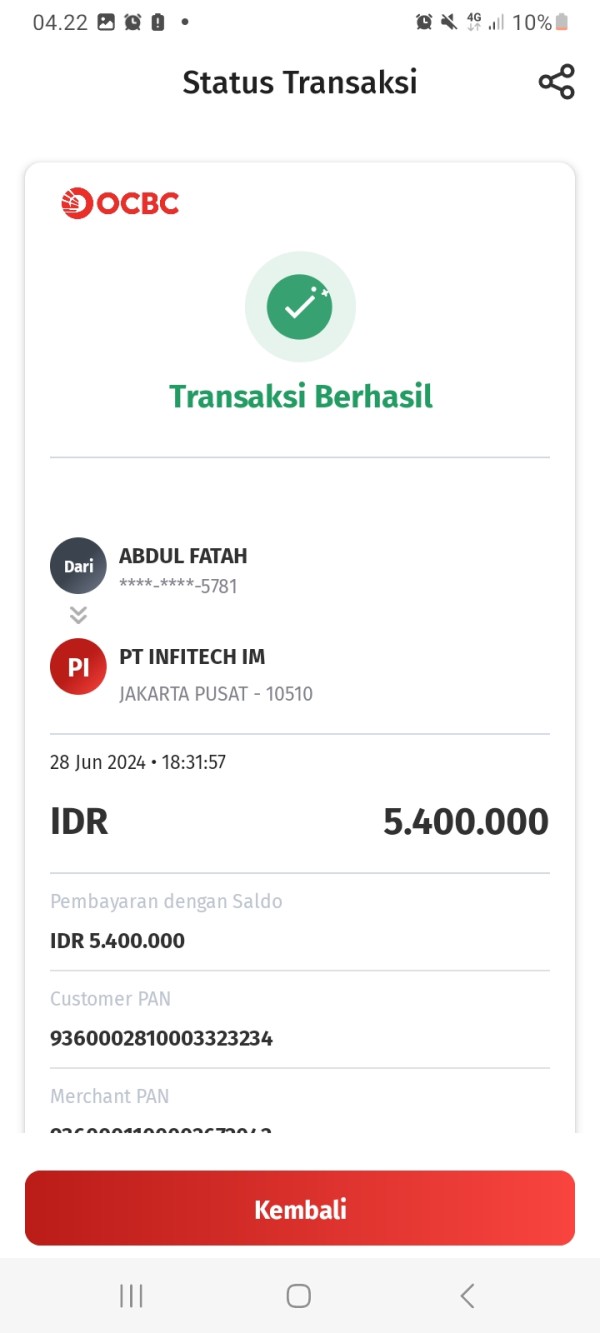

abdul9524

Indonesia

At first I came from IG and went to wasthap, I was told to top up 50 thousand, you can withdraw it with the commission, then I was told to top up 100 thousand to 500 thousand, you can still withdraw it with the commission, then the top up was 1.2 million to 21.6 million, you couldn't withdraw it on the grounds that I haven't done the last task until I've finished my 48 million, this method is in the name of PT Cheil Worldwide, even though PT Cheil doesn't charge any fees. My account balance has been frozen. Please get my money back, it's money I borrowed from a friend.

Exposure

07-03

lisda

Indonesia

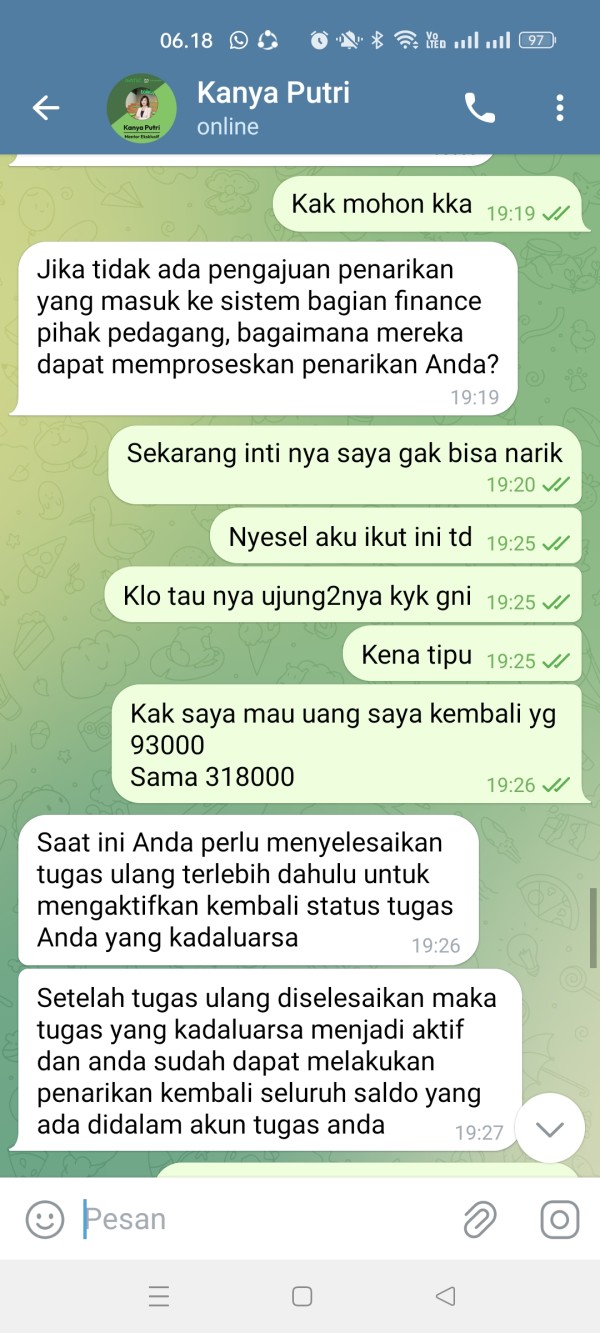

On June 21, 2024, I was tricked. First I was told to transfer 47 thousand, then I was told to transfer 93 thousand and finally, I was told to transfer 318,000. After that I couldn't withdraw money, it said there was an error, please process it so I can get my money back.

Exposure

06-27

FX1872651566

Taiwan

My friend recommended me to come and trade. I'm testing it out with a demo account. The trading environment is pretty good. I'm going to deposit some money and give it a try.

Positive

12-03

Housework

Cyprus

Find PT Fintech platform robust and staff helpful if I have any problems. Would recommend PT Fintech setup that I have used for over 10 years.

Positive

07-19