简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crucial Things to Do Immediately After Getting Scammed

Abstract:Abhorrent internet frauds and crimes have been mushrooming as the internet finance industry develops. The tactics used by syndicate groups are constantly evolving in various forms and scales making it difficult to predict and prevent, let alone for the police to prosecute them.

Nowadays, most telecom fraud crimes, as well as forex broker scams, are being conducted overseas. These fraudsters usually commit crimes in a gang operation and have a specific division for each stage of conduct. This makes it easy for them to launder the money that they scammed to make it difficult to trace over time.

If you have unfortunately fallen prey to a scam by your forex broker, the most important thing is to not panic. There are some important “SOS” steps that you need to carry out within the golden 30 minutes after you have been scammed. If done right, there is a chance that you could recover your losses.

The fraud victim should immediately carry out self-help measures as below:

Call the bank immediately. Deliberately call the bank that you have done the transfer. Any bank will have an automatic voice prompt in place for password and identity checks. At this stage, you must deliberately give them the wrong information, so the bank in concern will lock that bank account. The fraudster now cannot have access to his bank account through internet banking, ATM, or over-the-counter. Your transferred funds could be rejected and be redeposited back into your personal account. Simultaneously, this gives the police more time to step in for an investigation while the bank is also alerted about this specific account and user.

It should be noted that this method can only keep the fraudsters account locked within the day and he could regain access after that. Therefore, you can keep doing this step until his account gets locked and frozen.

At the same time, you should also gather as much evidence as you can and quickly submit them to the police. Bring the police report to the bank to bring this issue to their attention. Most banks will have a specialized team that works to prevent money laundering and financial crimes, and they will likely cooperate with the police as well.

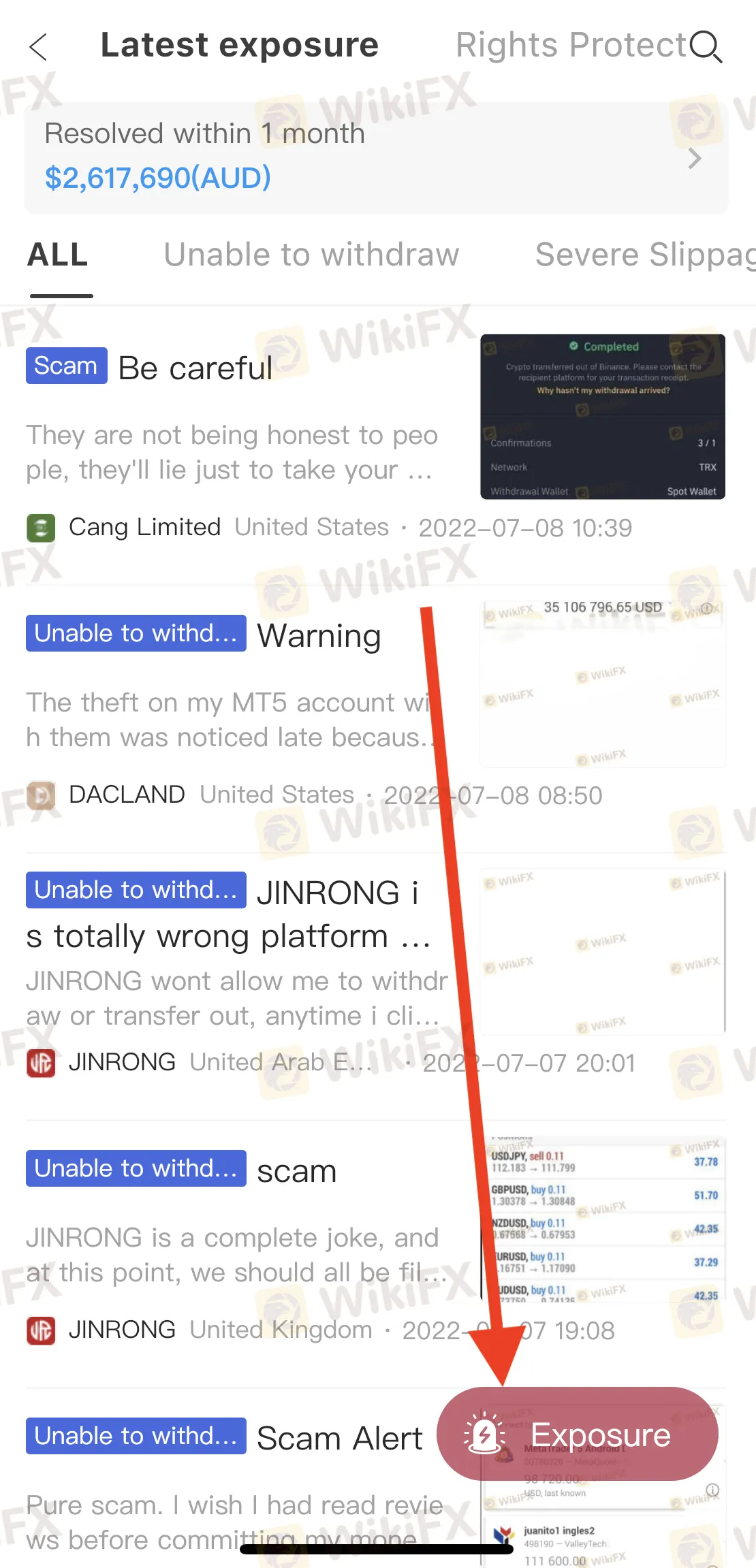

Another thing that you can do is lodge an Exposure case on the WikiFX mobile app along with the gathered evidence. WikiFX is a global forex broker regulatory query app that specializes in any broker-related information and issues. We also act as a mediator for unresolved dispute cases between traders and their brokers – without any fees or charges.

Follow the simple steps below:

Alternatively, get in touch with WikiFXs customer support team for assistance and guidance via any of the channels below:

Within the golden half an hour after one finds out that he has been cheated, the first thing is to report to the police and contact the bank with the official police report. This step if done in a timely manner can increase the chances of stopping the transaction from going through.

Criminal groups often open multi-level of accounts and transfer money through banks in rapid layers. Determine this golden half hour, is to consider the fraudster found the money to the account also need about half an hour or so to find someone to transfer money, so it is a race against the fraudster in time. The quicker the scammed person finds out he or she has been scammed the more effective it is to save themselves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Review: Is PU Prime a decent broker?

In today’s article, we have made a comprehensive review of a broker named PU Prime. We wonder if PU Prime is a scam or a reliable broker.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

Investment Scams in Malaysia: Telegram Tops Scammers’ List

In the first 11 months of 2024, Malaysia recorded 5,685 investment scams, with Telegram emerging as the most commonly used platform for fraudulent activities.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator