简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Lot in Forex?

Abstract:Forex is often transacted in lots, which are effectively the number of currency units you will buy or sell. A "lot" is a unit of measurement for the quantity of a transaction.

Forex is often transacted in lots, which are effectively the number of currency units you will buy or sell.

A “lot” is a unit of measurement for the quantity of a transaction.

When you make orders on your trading platform, they are put in lots of a certain size.

It's similar to an egg carton (or egg box in British English). When you go shopping for eggs, you normally buy a carton (or box). One carton contains 12 eggs.

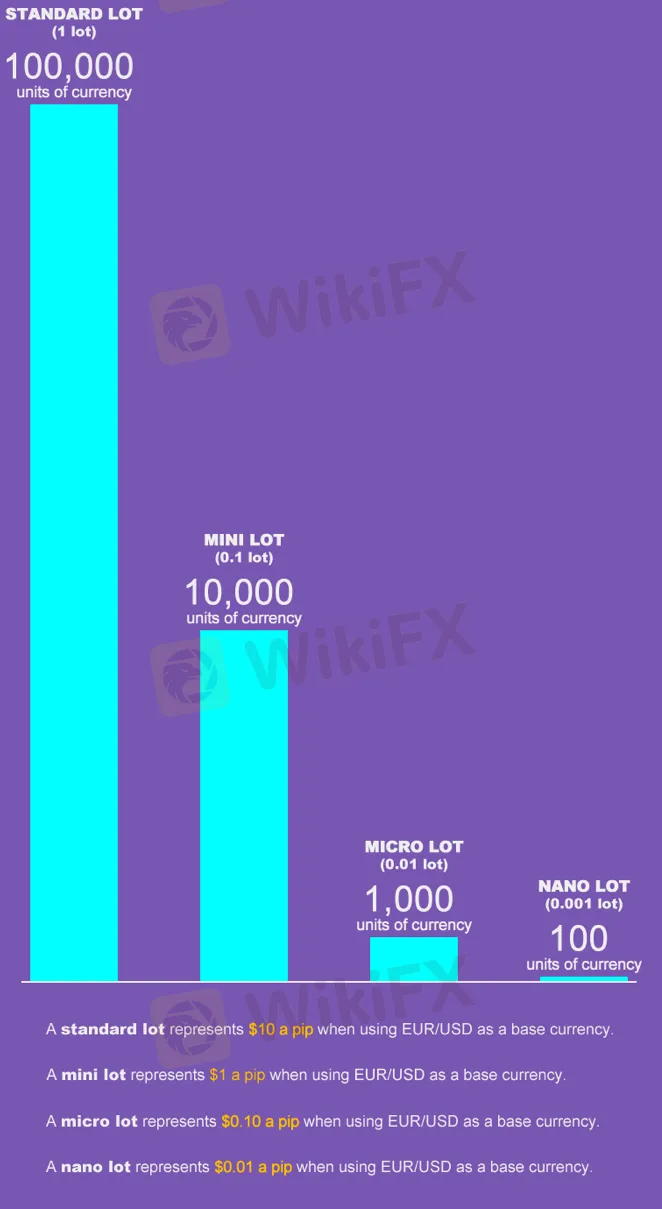

The typical lot size is 100,000 units of cash, but there are now mini, micro, and nano lot sizes of 10,000, 1,000, and 100 units.

| LOT | NUMBER OF UNITS |

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

| Nano | 100 |

Some brokers display the quantity in “lots,” while others display the actual currency units.

As you may know, the change in the value of one currency compared to another is measured in “pips,” which is a very, very small proportion of the value of a unit of money.

To profit from this minute shift in value, you must trade big amounts of a specific currency to notice any significant profit or loss.

Assume we'll be using a standard lot size of 100,000 units. We'll recalculate some instances now to see how it affects the pip value. At an exchange rate of 119.80, USD/JPY is equal to (.01 / 119.80) x 100,000 = $8.34 per pip. At an exchange rate of 1.4555, USD/CHF is equal to (.0001 / 1.4555) x 100,000 = $6.87 per pip.

The calculation is slightly different when the US dollar is not listed first.

· EUR/USD @ 1.1930 exchange rate: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 rounded up to $10 per pip

· GBP/USD at 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 rounded up will be $10 per pip.

The following are samples of pip values for EUR/USD and USD/JPY based on lot size.

| PAIR | CLOSE PRICE | PIP VALUE PER: | ||||

| Unit | Standard lot | Mini lot | Micro lot | Nano lot | ||

| EUR/USD | Any | $0.0001 | $10 | $1 | $0.1 | $0.01 |

| USD/JPY | 1 USD = 80 JPY | $0.000125 | $12.5 | $1.25 | $0.125 | $0.0125 |

Your broker may use a different method for determining pip values relative to lot size, but they will be able to tell you what the pip value is for the currency you are trading at the time.

In other words, they perform all of the math for you!

Depending on the currency you are trading, the pip value will change as the market changes.

What the heck is leverage?

You might be wondering how a little investor like yourself can trade such enormous sums of money.

Consider your broker to be a bank that lends you $100,000 to buy currencies.

All the bank requires is a $1,000 good faith deposit, which it will hold for you but not necessarily keep.

Isn't it too good to be true? This is how leveraged forex trading works.

The amount of leverage you utilise will be determined by your broker and your level of comfort.

A deposit, commonly known as “margin,” is usually required by the broker.

You will be able to trade once you have deposited your funds. The margin required per position (lot) traded will also be specified by the broker.

For example, if the permissible leverage is 100:1 (or 1% of the position required), and you wish to trade a $100,000 position but only have $5,000 in your account.

No issue, your broker will set aside $1,000 as a deposit and let you to “borrow” the remainder.

Of course, any losses or gains will be withdrawn or added to your account's remaining cash amount.

The minimum security (margin) for each lot will differ amongst brokers.

In the preceding case, the broker demanded a 1% margin. This means that for every $100,000 exchanged, the broker will require $1,000 as a position deposit.

Assume you want to purchase one ordinary lot (100,000) of USD/JPY. If your account is permitted 100:1 leverage, you must put up $1,000 in margin.

The $1,000 is a deposit, not a cost.

When you close your trade, you get it back.

The broker demands the deposit since there is a danger of losing money on the position while the deal is open!

Assuming that this USD/JPY transaction is the only one active in your account, you must keep your account's equity (the absolute worth of your trading account) at least $1,000 at all times in order to keep the trade open.

If the USD/JPY falls and your trading losses reduce your account equity to less than $1,000, the broker's algorithm will immediately close out your transaction to prevent future losses.

This is a safeguard that prevents your account balance from becoming negative.

Understanding margin trading is so vital that we have devoted a whole section to it later in the School.

If you don't want to blow up your account, this is a must-read!

Now, let's go on...

How the heck do I calculate profit and loss?

So, now that you understand how to determine pip value and leverage, let's have a look at how you compute profit or loss.

Let's exchange Swiss francs for US dollars.

· The rate you've been given is 1.4525 / 1.4530. Because you are purchasing US dollars, you will be working with the “ASK” price of 1.4530, which is the rate at which traders are willing to sell.

· So you purchase one normal lot (100,000 pieces) at 1.4530.

· After a few hours, the price has moved to 1.4550, and you decide to exit your deal.

· The new USD/CHF quote is 1.4550 / 1.4555. Because you first bought to begin the deal, you must now sell to close the trade, hence you must accept the “BID” price of 1.4550. The price at which dealers are willing to buy.

· The difference between 1.4530 and 1.4550 is.0020, or 20 basis points.

· Using the previous method, we now have (.0001/1.4550) times 100,000 = $6.87 per pip x 20 pips = $137.40.

Bid/Ask Spread

Remember that whether you enter or quit a transaction, you are susceptible to the bid/ask spread.

When purchasing a currency, the offer or ASK price will be used.

You will utilise the BID price when selling.

Following that, we'll offer you a rundown of the most recent forex jargon you've picked up!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator