简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast: Bearish Sequence Snaps Ahead of 2019-Low

Abstract:Gold may stage a larger rebound over the coming days as the price of bullion snaps the series of lower highs & lows from the previous week.

Gold Price Talking Points

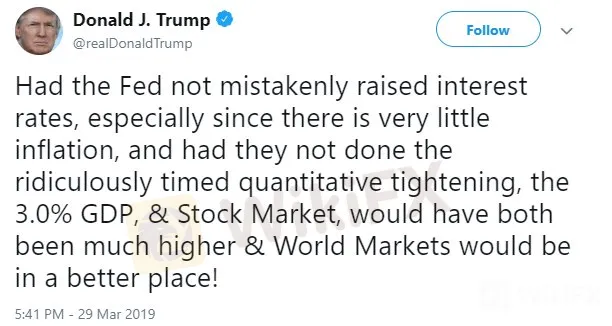

Gold attempts to retrace the sharp decline from the previous week as U.S. President Donald Trump tweets that the Federal Reserve has ‘mistakenly raised interest rates,’ and the price for bullion may stage a larger rebound over the coming days as it snaps the recent series of lower highs & lows.

Gold Price Forecast: Bearish Sequence Snaps Ahead of 2019-Low

The broader outlook for gold remains constructive as the pullback from the February-high ($1347) fails to produce a test of the 2019-low ($1277), and the lack of momentum to break the yearly opening range may keep the precious metal afloat as the Federal Open Market Committee (FOMC) faces accusations of a policy error.

It remains to be seen if the FOMC will continue to change its tune over the coming months as the inversion in the U.S. Treasury yield curve warns of a looming recession, but it seems as though the central bank largely endorse a wait-and-see approach at the next interest rate decision on May 1 as Fed Governor Randal Quarles remains ‘optimistic about the outlook for the U.S. economy.’ Recent comments from Governor Quarles suggest the FOMC has yet to abandon the hiking-cycle as ‘further increases in the policy rate may be necessary at some point,’ and Fed officials may continue to project a longer-run interest rate of 2.50% to 2.75% as the central bank pledges to be ‘data dependent.’

Nevertheless, Fed Fund Futures still reflect a greater than 50% probability for a rate-cut in December, and Chairman Jerome Powell and Co. may continue to adjust the forward-guidance over the coming months as the central bank plans to wind down the $50B/month in quantitative tightening (QT). In turn, upcoming changes in Fed policy may shore up gold prices throughout 2019, with the price for bullion at risk of exhibiting a more bullish behavior over the coming days amid the string of failed attempts to test the 2019-low ($1277). Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

The opening range for April is in focus as gold prices snap the series of lower highs & lows from the previous week, with the lack of momentum to close below the $1289 (23.6% expansion) area raising the risk for a larger rebound.

In turn, a move back above the Fibonacci overlap around $1298 (23.6% retracement) to $1302 (50% retracement) brings the $1315 (23.6% retracement) to $1316 (38.2% expansion) region back on the radar, with the next area of interest coming in around $1328 (50% expansion) to $1329 (50% expansion), which sits just above the March-high ($1324).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Gold Analysis: Steady Prices Amid Key Economic Data

Gold prices remain steady as investors anticipate Federal Reserve Chairman Jerome Powell’s upcoming speech and the U.S. Non-Farm Payrolls data. Geopolitical tensions and economic uncertainties continue to support safe-haven demand for gold, while higher U.S. yields exert downward pressure. Key economic events this week include JOLTs Job Openings, ADP Employment Change, and the Non-Farm Payrolls report.

Gold Supported by Weak U.S. Data and Inflation Concerns

Gold prices are buoyed by weak U.S. economic data, reduced Fed rate hike expectations, and ongoing geopolitical tensions. The precious metal is set for its third consecutive quarterly gain, with upcoming U.S. inflation data being closely monitored.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator