Score

CLSA

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.clsa.com/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Hong Kong 6.41

Hong Kong 6.41Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed CLSA also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

clsa.com

Server Location

United States

Website Domain Name

clsa.com

Website

WHOIS.NETWORKSOLUTIONS.COM

Company

NETWORK SOLUTIONS, LLC.

Domain Effective Date

1997-04-03

Server IP

104.71.149.212

Company Summary

| CLSA Review Summary | |

| Founded | 1986 |

| Registered Country/Region | Hong Kong |

| Regulation | No Regulation |

| Services | Asset Management, Equities, FICC, Fund Services, EQD & Prime Services, Corporate Finance & Capital Markets, and Alternative Investment |

| Forums | Available |

| Charity Efforts | CITIC CLSA TRUST |

| Customer Support | Tel: +852 2600 8888 |

| Email: info@citicclsa.com | |

| Twitter: https://twitter.com/clsainsights | |

| YouTube: https://www.youtube.com/channel/UC0qWp_lLnOcRYmBlCNQgZKA | |

| Linkedin: https://www.linkedin.com/company/clsa | |

What is CLSA?

CLSA, founded in 1986 and headquartered in Hong Kong, is a prominent financial services firm offering a diverse range of services. The company operates globally, with a presence across Asia, Australia, the Americas, and Europe. CLSA provides services such as asset management, equities, FICC, fund services, EQD and prime services, corporate finance and capital markets, and alternative investments. The firm is also known for its philanthropic efforts through the CITIC CLSA TRUST. However, CLSA operates without regulation.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Diverse Services: CLSA offers a wide range of financial services, including asset management, equities, and FICC, catering to various client needs.

Global Presence: With operations spanning Asia, Australia, the Americas, and Europe, CLSA provides clients with access to international markets and expertise.

Charity Efforts: The firm's involvement in the CITIC CLSA TRUST demonstrates a commitment to philanthropy and community engagement.

Cons:

Lack of Regulation: CLSA operates without regulatory oversight, which leads to questions about the adherence to industry standards.

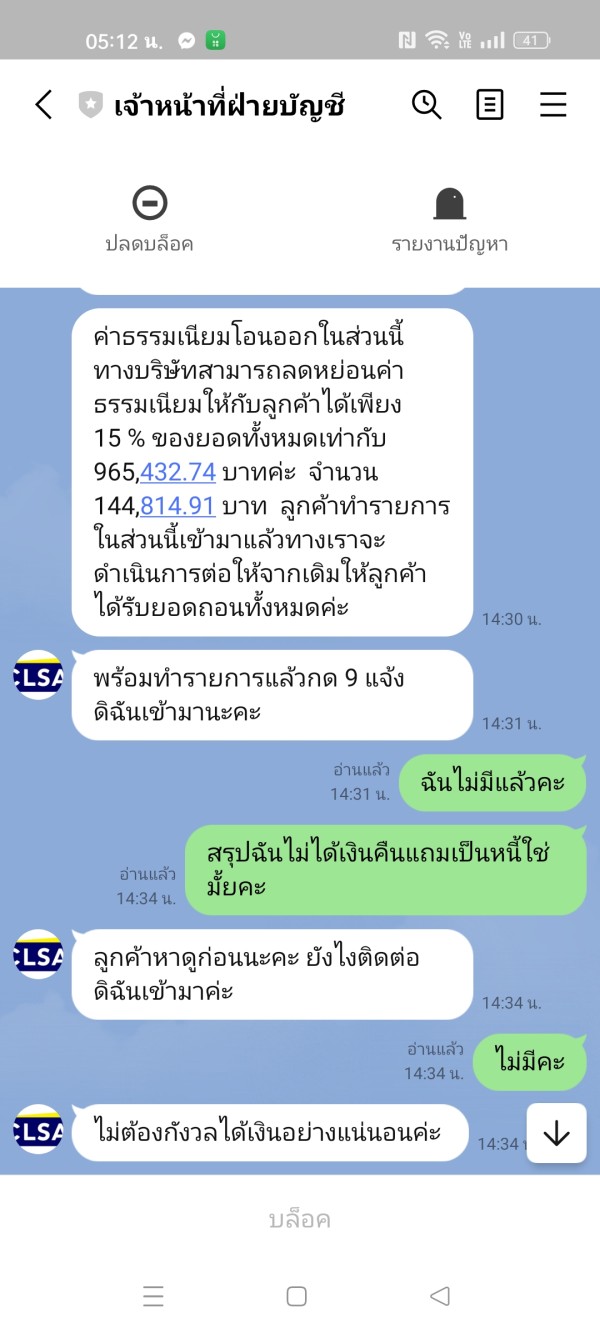

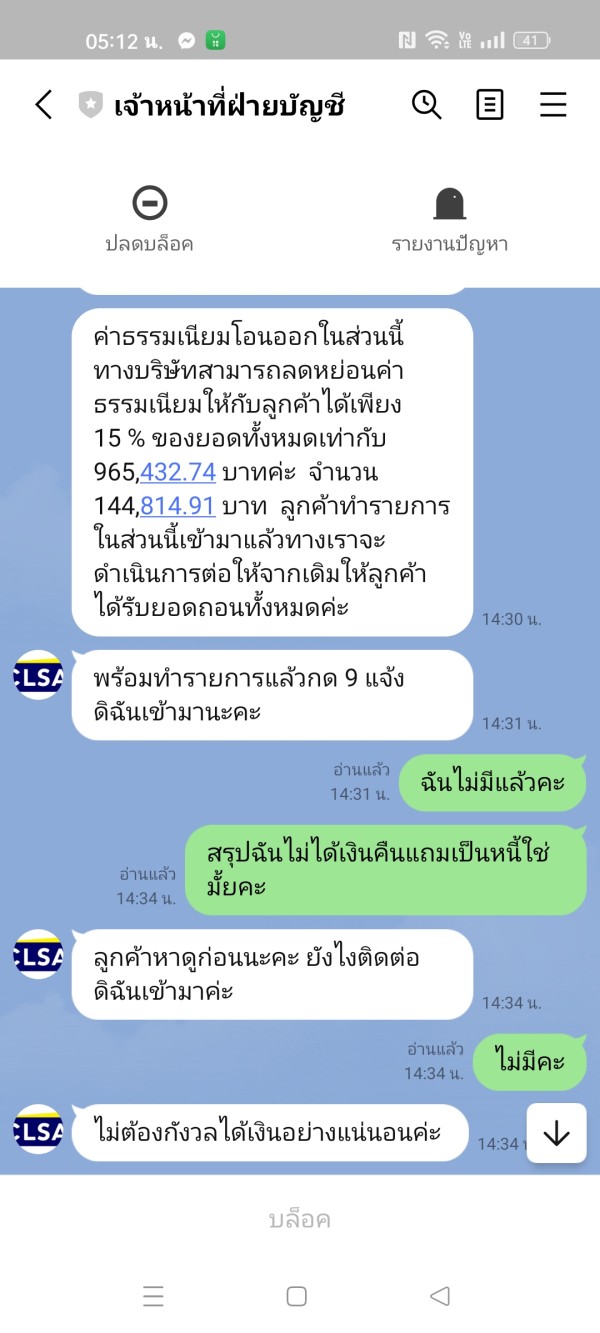

Exposure on WikiFX: There are two pieces of exposure to CLSA on WikiFX, which indicate risks to fund safety.

Is CLSA Safe or Scam?

There are significant red flags about the safety and legitimacy of CLSA. Operating without regulatory oversight means CLSA could potentially use misleading tactics or mishandle client funds without facing consequences. Additionally, negative exposure on WikiFX is troubling, suggesting potential past client issues, a tarnished reputation, or non-compliance with industry standards.

Services

CLSA offers a wide range of financial services, connecting institutional investors to ideas and companies to capital.

Asset Management: CLSA offers active investments focusing on alpha-driven strategies in Greater China, fixed-income solutions, equity strategies, liquidity management, structured investments, and quantitative investment portfolios.

Equities: CLSA provides research-driven equity services to asset managers worldwide, supporting investment mandates and buy-side trading strategies. They have specialized sales teams for Asian, Australian, and Japanese equities, serving clients from Hong Kong, London, and New York.

FICC (Fixed Income, Currencies, and Commodities): CLSA is a market leader in fixed-income products and services, providing global clients access to liquidity, products, and services. They are known for their Asian bond trading expertise and structured solutions across Asia.

Fund Services: CLSA Fund Services (Asia) Limited offers solutions to international and mainland Chinese asset managers operating in overseas markets. Their services include fund accounting, transfer agency, tax compliance, and middle-back office support.

EQD & Prime Services: Unique combination of local expertise and global access in equity derivatives. Solutions include risk management, yield enhancement, financing, and cross-border market access.

Corporate Finance & Capital Markets: CLSA offers a full suite of services to support corporates' growth ambitions, including equity and debt capital market fundraisings, equity-linked products, and M&A advisory.

Alternative Investment Management: CLSA Capital Partners, CLSA's alternative investment management arm, is a pioneer in private equity in Asia, managing over US$7 billion across various strategies in the APAC region.

Forums

CLSA organizes forums to foster connections and knowledge sharing in the financial industry. One upcoming event is the 20th CITIC CLSA Japan Forum, scheduled for 21st to 23rd May 2024 in Tokyo, Japan. This forum aims to facilitate engagement between investors and over 160 companies, as well as top-rated Japanese and regional research analysts. Expert speakers will also contribute to discussions on various topics, providing diverse viewpoints and insights into pressing issues.

Charity Efforts

CITIC CLSA Trust serves as the overseas platform for CITIC Securities' global philanthropic efforts. It provides financial and human capital to support communities in the markets where CITIC CLSA operates. The Trust funds charitable initiatives aimed at making a positive and sustainable social impact, with key objectives in education improvement and poverty alleviation. Additionally, the Trust reserves funds for emergency aid in case of global or regional disasters, demonstrating its commitment to supporting communities in times of crisis.

Customer Services

CLSA offers various channels for customer support.

Telephone: Clients can contact CLSA's customer support team at +852 2600 8888 for assistance.

Email: For non-urgent inquiries or support requests, clients can email CLSA at info@citicclsa.com.

Social media: CLSA is active on Twitter, where clients can follow them at https://twitter.com/clsainsights for updates and news. They also have a YouTube channel (https://www.youtube.com/channel/UC0qWp_lLnOcRYmBlCNQgZKA) and a LinkedIn page (https://www.linkedin.com/company/clsa).

Conclusion

CLSA positions itself as a comprehensive financial services firm offering a diverse range of services, spanning asset management, equities, fund services, and corporate finance, with a particular emphasis on the Asian market. However, a significant issue arises due to the absence of regulatory oversight surrounding CLSA. Negative exposure on WikiFX further compounds these risks. It's advisable to avoid CLSA and explore alternative options.

Frequently Asked Questions (FAQs)

Q: Is CLSA regulated?

A: No, CLSA operates without valid regulation.

Q: What services does CLSA offer?

A: CLSA offers a wide range of financial services, including asset management, equities, FICC, fund services, corporate finance & capital markets, and alternative investments.

Q: What is the main market of CLSA?

A: CLSA's main market is in Asia.

Q: Does CLSA support some charities?

A: Yes, CLSA supports charities through the CITIC CLSA Trust.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now