No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between OLYMPTRADE and FIBO Group ?

In the table below, you can compare the features of OLYMPTRADE , FIBO Group side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of olymptrade, fibo-group lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | St. Vincent and the Grenadines |

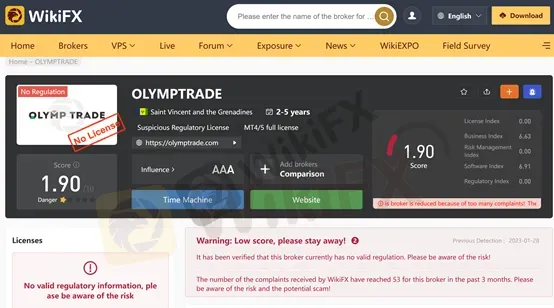

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Information not available |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

Note: At this time, we only have a cursory look at OLYMPTRADE as the company's official website (https://olymptrade.com/ ) does not open properly.

Screenshot time: 01/28/2023

WikiFX provides dynamic scoring, it will track the broker's dynamic real-time scoring, the current time screenshot scores do not represent past and future scoring.

OLYMPTRADE is registered in St. Vincent and the Grenadines and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet.

OLYMPTRADE caters to a diverse range of traders, including beginners and experienced traders alike.The platform offers a wide range of financial instruments for trading, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC, and composites. Traders have the flexibility to choose between two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, while the Demo Account provides a risk-free environment for practice. While specific information about spreads is not available on the website, OLYMPTRADE mentions that there are no commissions charged.Traders can access the OLYMPTRADE trading platform via a downloadable application on both mobile and desktop devices. The platform offers a user-friendly interface with various trading tools, features, educational resources, market analysis reports, and customer support services available 24/7.

When choosing a forex broker, you should know that a regulatory license does not necessarily guarantee the reliability of a broker as it may be an expired or cloned regulatory license, but a broker without any regulatory license has a high probability of being unreliable.

OLYMPTRADE offers a user-friendly trading platform with a wide range of market instruments, a demo account for practice, comprehensive customer support, and educational resources. However, it is not regulated by a reputable authority, lacks transparency on leverage and spreads, provides limited information on fees and commissions, has a relatively low minimum deposit requirement, and offers limited advanced features. Traders should carefully consider these pros and cons before deciding to trade with OLYMPTRADE.

| Pros | Cons |

| User-friendly trading platform with a range of tools and features. | Not regulated by a reputable financial authority, which carries higher risk. |

| Wide selection of market instruments, including currencies, stocks, metals, cryptocurrencies, and more. | Lack of transparency regarding leverage and spreads. |

| Demo account available for practice and learning. | Limited information on trading fees and commissions. |

| Comprehensive customer support available 24/7. | Relatively low minimum deposit requirement may attract inexperienced traders. |

| Educational resources to enhance trading knowledge and skills. | Limited availability of advanced trading features and platforms. |

OLYMPTRADE offers a diverse range of market instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites, providing traders with ample opportunities to engage in various trading strategies.

Currencies: OLYMPTRADE offers a wide range of currency pairs for trading, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs like USD/TRY and NZD/CAD. Traders can speculate on the exchange rate movements between these currency pairs.

Stocks: OLYMPTRADE provides access to a variety of stocks from global markets. Traders can invest in individual company stocks, such as Apple, Amazon, or Google, and speculate on their price movements. Stock trading allows traders to benefit from the performance of specific companies.

Metals: OLYMPTRADE allows trading in precious metals like gold, silver, platinum, and palladium. These metals are often seen as safe-haven assets and can be used as a hedge against inflation or economic uncertainties. Traders can speculate on the price fluctuations of these metals.

Indices: OLYMPTRADE offers trading on major stock indices from around the world, including the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Index trading allows traders to speculate on the overall performance of a specific stock market, rather than individual stocks.

Commodities: OLYMPTRADE provides access to various commodities such as oil, natural gas, and agricultural products like corn and wheat. Commodity trading allows traders to speculate on the price movements of these essential goods, which can be influenced by factors like supply and demand dynamics, weather conditions, and geopolitical events.

Cryptocurrencies: OLYMPTRADE offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading allows traders to speculate on the price volatility of these digital assets, which have gained significant popularity in recent years.

ETFs (Exchange-Traded Funds): OLYMPTRADE allows trading in ETFs, which are investment funds traded on stock exchanges. These funds are composed of a basket of assets, such as stocks, bonds, or commodities. Traders can invest in ETFs to gain exposure to a diversified portfolio of assets.

OTC (Over-the-Counter): OLYMPTRADE provides over-the-counter trading, which refers to trading financial instruments directly between two parties without the involvement of an exchange. OTC trading allows for more flexible and customized transactions, particularly for certain derivatives and exotic instruments.

Composites: OLYMPTRADE offers composite instruments, which are synthetic assets created by combining multiple financial instruments. These composites can represent various strategies or themes, such as a basket of stocks from a particular sector or a combination of different asset classes. Traders can speculate on the performance of these composites.

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade.

OLYMPTRADE offers two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, providing access to the full range of market instruments and features offered by OLYMPTRADE. Traders can deposit funds into their Real Account and trade in real-time market conditions, experiencing the actual risks and rewards of trading.

On the other hand, the Demo Account is a practice account that allows traders to simulate trading without using real money. It is an excellent option for beginners or those who want to test trading strategies and explore the platform's functionalities. The Demo Account provides virtual funds, enabling traders to practice and gain confidence before venturing into live trading.

Here is a brief description of the account opening process for OLYMPTRADE:

Registration: Visit the OLYMPTRADE website and click on the “Register” button to start the registration process. Fill in the required information, such as your name, email address, and preferred password. Make sure to read and agree to the terms and conditions before proceeding.

Account Verification: After completing the registration, you may need to verify your account. OLYMPTRADE may require you to provide certain documents for verification purposes, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by OLYMPTRADE to submit the necessary documents.

Account Funding: Once your account is verified, you can proceed to fund your account. OLYMPTRADE offers various deposit methods, such as credit/debit cards, bank transfers, and electronic payment systems. Choose your preferred payment method and follow the instructions to make a deposit. Be aware of any minimum deposit requirements set by OLYMPTRADE.

Platform Access: Once your account is funded, you will gain access to the OLYMPTRADE trading platform. You can log in using your registered email address and password. The platform provides a user-friendly interface with a range of trading tools and features.

Account Configuration: Before you start trading, you may need to configure your account settings. This includes selecting your preferred language, setting up notifications, and adjusting other platform preferences according to your trading preferences. Take some time to explore the platform and familiarize yourself with its features.

It's important to note that the specific steps and requirements may vary, so it's advisable to refer to the official OLYMPTRADE website or contact their customer support for the most accurate and up-to-date information regarding the account opening process.

The official website of OLYMPTRADE does not provide specific information about leverage. However, it is common for similar types of brokers to offer leverage ratios ranging from 100:1 to 500:1. Please note that leverage allows traders to multiply their trading positions, but it also amplifies both potential profits and losses. It is important to fully understand the implications of leverage and exercise responsible risk management when trading on any platform. For accurate and up-to-date information about leverage on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

Spreads & Commissions (Trading Fees)

OLYMPTRADE's official website does not provide specific information about spreads. However, it is mentioned that there are no commissions charged. In general, similar brokers in the industry offer spreads that start from 0 to 0.1 pips. Spreads refer to the difference between the bid and ask prices of a financial instrument and can vary depending on market conditions and the specific asset being traded. For accurate and up-to-date information about spreads on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

OLYMPTRADE provides a simple and convenient deposit and withdrawal process for its traders. The minimum deposit amount is 10 USD/10 EUR, making it accessible for traders with varying budgets. OLYMPTRADE supports multiple deposit and withdrawal methods, including Bank Transfer, Credit/Debit Cards, Bank Wire Transfer, E-wallets, and Cryptocurrency.

Traders can choose to deposit funds using popular payment options such as credit or debit cards, bank transfers, and e-wallets.

Similarly, when it comes to withdrawing funds, OLYMPTRADE supports the same methods used for deposits. The withdrawal process is typically straightforward, and the platform strives to process withdrawal requests promptly. However, the processing time may vary depending on the chosen withdrawal method and the policies of the respective financial institutions involved.

The support service provided by OLYMPTRADE is not very extensive. It can only be accessed via email, address and a phone number. Since the company's website is not currently open, we do not know if it offers other services such as live chat, callback, FAQ, 24/7 or 24/5 service, etc.

Below are the details about the customer service.

Email: support@olymptrade.com

support-en@olymptrade.com

Phone Number: +356 20341634

Address: 54, Immakulata, Triq il-Mina ta Hompesch, ZABBAR ZBR 9016.

On our website, you can see that many users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

OLYMPTRADE is an online trading platform that caters to a diverse range of traders, offering a wide selection of market instruments and account types. The platform provides a user-friendly interface, downloadable on mobile and desktop devices, with access to real-time market quotes, trading tools, and educational resources. However, it is important to note that OLYMPTRADE is not regulated by a reputable financial authority, which poses a higher risk for traders. The platform lacks transparency on leverage and spreads, limited information on fees and commissions, and advanced features. Traders should carefully evaluate these pros and cons before deciding to trade with OLYMPTRADE. While OLYMPTRADE offers convenience and comprehensive customer support, traders should exercise caution and conduct thorough research before opening an account.

Q: Is OLYMPTRADE a regulated broker?

A: No, OLYMPTRADE is not a regulated broker.

Q: What is the minimum deposit required to open an account with OLYMPTRADE?

A: The minimum deposit required to open an account with OLYMPTRADE is 10 USD/10 EUR.

Q: What trading instruments are available at OLYMPTRADE?

A: OLYMPTRADE offers a wide range of trading instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites

Q: Does OLYMPTRADE offer a demo account?

A: Yes, OLYMPTRADE offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What trading platforms does OLYMPTRADE offer?

A: OLYMPTRADE offers their our trading platform.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | The Virgin Islands |

| Found | 1998 |

| Regulation | CYSEC & BaFin |

| Market Instrument | Forex CFDs, spot metals, cryptocurrencies |

| Account Type | MT5 NDD, cTrader NDD, MT4 NDD No Commission, MT4 NDD, MT4 Fixed, and MT4 Cent |

| Demo Account | yes |

| Maximum Leverage | 1:1000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4, MT5, cTrader |

| Minimum Deposit | $0 |

| Deposit & Withdrawal Method | Bank Wire Transfer, Bank Card or e-payment systems |

FIBO Group, a trading name of FIBO Group Holdings Limited, is an online financial dealer, established in 1998 with four offices worldwide in Shanghai, Alma-Ata, Limassol, and Munich.

FIBO Group, or International Financial Holding FIBO Group, is an international financial holding company that was established in 1998. It offers online trading services, primarily in the foreign exchange market, but also provides a platform for the trading of CFDs, commodities, and cryptocurrencies. Headquartered in Vienna, Austria, the company has a global presence with subsidiaries in the British Virgin Islands, Cyprus, Australia, Singapore, and Russia, as well as offices in several other countries. FIBO Group started as an investment consulting firm and evolved into a prominent player in the forex market, and in 2017 it expanded into cryptocurrency derivatives.

Here is the home page of this brokers official site:

FIBO Group is under the regulations of several regulation authorities, including CySEC in Crypus ( Regulatory license no. 182/11), BaFin in Germany (Regulatory license no.124031), a European Authorized Representative license from FCA (revoked) in the UK, with registration number 532885, and an offshore retail forex license from FSC in the Virgin Islands ( regulatory license number SIBA/L/14/1063).

Note: The screenshot date is January 30, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

FIBO Group presents a range of advantageous features for traders. Firstly, they offer multiple trading platforms, ensuring flexibility and choice. Competitive spreads are provided across various trading instruments, contributing to cost-efficiency. The availability of flexible leverage options allows traders to tailor their exposure according to their risk preferences. FIBO Group also caters to diverse trading needs through a variety of account types. In addition, they provide valuable trading tools, including market sentiment data, economic calendars, and trading signals, enhancing decision-making capabilities. Traders can further benefit from the educational resources offered by FIBO Group's Academy, which includes webinars and a comprehensive glossary. It's important to note that PAMM account availability may be limited on certain platforms, and customer support availability may primarily be on weekdays.

| Pros | Cons |

| Multiple Trading Platforms | Limited Availability of PAMM Accounts |

| Competitive Spreads | Limited Customer Support Availability |

| Flexible Leverage Options | |

| Diverse Account Types | |

| Additional Trading Tools | |

| Educational Resources |

FIBO Group offers mainstream and popular financial products in the global financial market for investors, including forex (60 currency pairs), precious metals (gold and silver), cryptocurrencies (Bitcoin, Ethereum, Litecoin, Zcash, Dash, Monroe), CFDs, etc.

CFD Trading:

CFD trading, which stands for Contract for Difference, allows traders to speculate on the price movements of various financial instruments, such as currencies, shares, commodities, and indices. Traders do not own the underlying asset but rather enter into a contract based on the price difference between the opening and closing of the trade.

Spot Metals:

FIBO Group provides access to spot metals trading, particularly gold and silver. Spot metals are traded based on the current market price and allow traders to take advantage of price movements in these precious metals.

Forex:

Forex, also known as foreign exchange, involves the trading of currencies. It is the largest and most liquid financial market globally, where traders aim to profit from fluctuations in currency exchange rates. FIBO Group offers a wide range of currency pairs for forex trading.

Cryptocurrencies:

FIBO Group also enables trading in cryptocurrencies, which are digital assets that utilize cryptographic technology. Traders can speculate on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and others. Cryptocurrency trading with FIBO Group is typically conducted through CFDs, allowing traders to benefit from price speculation without owning the actual digital tokens.

By offering these market instruments, FIBO Group provides traders with a diverse range of opportunities to participate in global financial markets and capitalize on price fluctuations across different asset classes.

MT4 Cent Account:

The MT4 Cent Account is designed for traders who want to start with smaller amounts. It operates on the market maker order execution technology. This account has a minimum deposit requirement of 0 cents, making it accessible to those with limited funds. The account uses the fifth decimal point, allowing for more precise pricing. The minimum lot and volume step are set at 0.01, providing flexibility in trade sizes. The spread starts from 0.6 pips, and there is no commission charged. The leverage offered is 1:1000, allowing traders to amplify their positions. The stop out level is set at 20%, meaning positions will be automatically closed if the account equity falls below this threshold. The account currency options include USD cent and GLD Cent1. CFD trading is not available in this account. Traders can access 32 currency pairs and can have a maximum of 50 open orders. The maximum order volume is set at 100 lots or 1 standard lot. Managed account (PAMM) feature is not available in this account.

MT4 Fixed Account:

The MT4 Fixed Account is suited for traders who prefer a fixed spread model. It also operates on the market maker order execution technology. The minimum deposit requirement for this account is $50. The account uses a standard four decimal point pricing system. The minimum lot and volume step are the same as the MT4 Cent Account, set at 0.01. The spread starts from 1 pip, and no commission is charged. The leverage offered is 1:200. The stop out level is set at 20%. The account currency options include EUR, USD, RUR, CHF, and GBP. CFD trading is available in this account. Traders can access 43 currency pairs, although information regarding the maximum open orders and maximum order volume is not provided. The account offers a managed account (PAMM) feature, allowing traders to invest in PAMM accounts and allocate funds to professional traders.

MT4 NDD Account:

The MT4 NDD Account operates on the No Dealing Desk (NDD) order execution technology, providing traders with direct market access. The minimum deposit requirement is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are set at 0.01, similar to the other MT4 accounts. The spread starts from 0 pips, but there is a commission of 0.003% charged based on the transaction amount. The leverage offered is 1:400, providing increased buying power. The stop out level is set at 50%, allowing for more flexibility in margin requirements. The account currency options include EUR, USD, and GLD2. CFD trading is available in this account. Traders can access 32 currency pairs, and the account offers a managed account (PAMM) feature.

cTrader NDD Account:

The cTrader NDD Account is designed for traders who prefer the cTrader platform and the benefits of No Dealing Desk (NDD) execution. The minimum deposit requirement for this account is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are the same as the other accounts, set at 0.01. The spread starts from 0.8 pips, and there is no commission charged. The leverage offered is 1:400. The stop out level is set at 50%. The account currency options include EUR, USD, GLD2, BTC3, and ETH4, providing additional flexibility. CFD trading is not available in this account. Traders can access 32 currency pairs, and the account offers a managed account (PAMM) feature.

MT5 NDD Account:

The MT5 NDD Account is designed for traders who prefer the MT5 platform and direct market access through No Dealing Desk (NDD) execution. The minimum deposit requirement for this account is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are set at 0.01. The spread starts from 0 pips, and there is a commission of 0.005% charged based on the transaction amount. The leverage offered is 1:400. The stop out level is set at 50%. The account currency option is limited to USD. CFD trading is not available in this account. Traders can access 33 currency pairs, and information regarding the maximum open orders and maximum order volume is not provided. The account offers a managed account (PAMM) feature.

Demo Account: A demo account is a practice account that allows traders to simulate trading without using real money. It is useful for learning and testing trading strategies in a risk-free environment.

7. Managed Account:

The Managed Account option is available only for the MT4 Fixed and MT4 NDD account types. With a Managed Account, clients can have their trading account managed by a professional fund manager. The fund manager trades on behalf of the client, aiming to generate profits. However, the availability of Managed Accounts may be subject to certain conditions and requirements set by the broker.

It is important for clients to thoroughly understand the terms and conditions, fees, and risks associated with managed accounts before opting for this service.

FIBO Group provides leverage to traders, which is the capital offered by the broker to potentially amplify funds by using a ratio of the trader's capital to the broker's credit. While leverage presents an opportunity to increase funds, it's important for traders to understand that higher leverage also comes with higher risks. FIBO Group adheres to regulatory restrictions, offering leverage ratios of up to 1:30 for major currency pairs and 1:10 for commodities, while the MT4 Cents account offers leverage up to 1:1000 and NDD accounts offer leverage up to 1:400.

Spreads and Commissions

Forex brokers generate income through commissions and spreads. Commissions refer to the fees charged by brokers for facilitating trades, and they vary depending on the instrument and account type. FIBO Group does not charge commissions on its MT4 Cent and MT4 Fixed accounts.

On the other hand, spreads are the difference between the bid price (the price at which traders can sell) and the ask price (the price at which traders can buy). Spreads can be either variable or fixed, depending on market conditions such as interest rates. FIBO Group offers a range of spreads, with minimum spreads ranging from 0 pips to 2.0 pips, depending on the specific account type.

Additionally, some brokers impose rollover or swap fees for positions held open overnight. These fees are determined by the interest rate differential between the currency pairs involved in the open position.

For the MT4 NDD, cTrader NDD, and MT5 NDD accounts offered by FIBO Group, commissions are charged ranging from 0.003% to 0.005% of the transaction amount. It's important to note that the specific fees may vary depending on the account type and trading conditions.

Overall, understanding the fees involved in trading is essential for traders to manage their costs and make informed decisions when choosing a broker.

1. Sign up-Creating your Client Area. The first stage of registration with the company is creating your Client Area. To do this, you need to indicate your email address and phone number in the sign-up form on the site.

2. Verification of email, phone number and proof of identity. To verify your email, this broker will send you an email to the address you indicate while signing up. Click the link in the message to confirm your email address.

3. Depositing funds to your account and starting trading.

The minimum spread for MT4 Cent Accounts is 0.6 pips, with no commission. The minimum spread for MT4 Fixed Accounts is 2 pips, with no commission. The minimum spread for MT4 NDD Accounts is 0 pips, and the commission is 0.003% of the trading volume. MT4 NDD No-Commission Account has a minimum spread of 0.8 pips. cTrader NDD Accounts has a minimum spread of 0 pips, and the commission is 0.003% of the trading volume. MT5 NDD Account has a minimum spread of 0 pips, and the commission is 0.005% of the trading amount.

FIBO Group provides traders with a choice of three reliable and widely-used trading platforms. The cTrader platform offers direct trading with international banking institutions and features high-speed order execution, customizable indicators, and market depth display. The MetaTrader 4 platform is customizable and user-friendly, with a range of technical indicators, strategy tester, and one-click trading. The MetaTrader 5 platform offers multi-asset trading, advanced strategy tester, netting and hedging modes, and comprehensive analytical tools such as built-in indicators, financial news, and an economic calendar. All platforms are available on desktop, Android, and iOS devices, catering to traders' diverse needs and preferences.

cTrader Tools is a collection of features and functionalities available on the cTrader trading platform. Two notable features include:

cTrader Mirror: This feature enables social trading, allowing traders to become either strategy providers or investors. Strategy providers can share their trading strategies and allow other traders to copy their trades. Investors, on the other hand, can browse and select strategies to automatically replicate trades in their own accounts.

cAlgo: cAlgo is a platform within cTrader that allows users to create custom indicators, trading robots, and other software using the C# programming language. Traders can develop their own tools and automate their trading strategies based on their unique requirements.

PAMM Accounts:

PAMM (Percentage Allocation Management Module) Accounts are investment accounts offered by some brokers. Here are key points regarding PAMM accounts:

Manager and Investor Options: PAMM accounts allow clients to participate either as a manager or an investor. Managers are responsible for trading on behalf of investors, while investors provide the funds to be traded.

Diversification and Risk Preferences: Investors can choose from various PAMM accounts based on their risk preferences. Each account may have different trading strategies and risk levels, providing options for diversification and accommodating different investor profiles.

Performance and Risk: It's important to note that while PAMM accounts offer potential profitability, there is no guarantee of returns. Past performance of PAMM managers is not indicative of future results, and investors should carefully consider the risks involved.

Assets Management:

Assets Management is a service offered by the FIBO Group that allows clients to invest in portfolios managed by experienced asset managers. Here are some key points about this service:

Portfolio Options: FIBO Group offers various portfolios to suit different risk preferences and financial goals. Clients can choose from a range of portfolios that align with their investment objectives.

Performance-based Fees: Asset managers charge performance-based fees, meaning their compensation is tied to the performance of the portfolio. If the portfolio performs well, the manager receives a higher fee, incentivizing them to strive for positive returns.

Market Sentiment:

Market Sentiment is a feature that provides real-time trade statistics to assist traders in gauging market sentiment. Here are some details:

Real-time Trade Statistics: Market Sentiment offers traders access to real-time trade statistics. These statistics are derived from aggregated data obtained from clients' accounts, providing insights into the prevailing market sentiment.

Market Analysis:

FIBO Group's analyst team regularly provides updates on news, events, and fundamental factors that impact the financial markets. Key points about Market Analysis include:

Expert Insights: FIBO Group's analyst team shares their analysis and commentary on various financial markets, helping traders stay informed about significant market developments.

Economic Calendar:

The Economic Calendar is a customizable tool that displays important economic events, analysts' forecasts, and historical data. Here's what you should know about it:

Event Tracking: The Economic Calendar tracks significant economic events, such as interest rate decisions, GDP releases, and employment reports. It also includes forecasts and historical data for reference.

Trading Signals:

Trading Signals are available on the MT4 and MT5 trading platforms. Here's an overview of this feature:

Signal Services: Clients can search for and subscribe to signal services provided by other traders. These signals can be used to receive trade recommendations, helping traders make informed trading decisions.

The deposit method supports SWIFT ( deposit accepting EUR & USD, the commission generally 35 to 50 US dollars, and the transfer time takes 2-5 working days; the withdrawal accepting EUR, USD, BGP & CHF, and the withdrawal fee usually 35 to 50 US dollars.), UnionPay (accepting RMB, no commission, credited immediately after payment is successful), VISA/MASTERCARD (deposit accepting EUR & USD, no commission, credited immediately after payment is successful; withdrawal accepting EUR & USD, and the commission 2.5%+1.5 Euros), RegularPay (accepting EUR and USD, no commissions, through the RegularPay system processing centre to use bank cards to inject funds; withdrawal accepting EUR &USD, with a withdrawal fee of 10 dollars or other equivalent amounts), ZOTAPAY (supporting RMB, no commission for deposits, the payment is processed immediately when the invoice is paid, and the withdrawal with 2.2% commission), Neteller (supporting EUR &USD, no commission), WebMoney (deposits and withdrawals both supporting EUR &USD, a commission of 0.8% is charged, and it will be credited automatically after successful payment). The company also supports a series of cryptocurrency deposits and withdrawals.

The customer support team at FIBO Group operates from multiple office locations and is available from Monday to Friday. They offer support in up to 12 languages, which is advantageous for non-English speakers. You can easily reach the support team through online instant web chat, email, and dedicated phone lines for different regions. Additionally, the website provides a helpful FAQ section for quick answers to common queries. FIBO Group is also active on various social media platforms, providing additional channels for communication.

FIBO Group offers a comprehensive educational resource called the FIBO Group Academy, which caters to both beginner and experienced traders. This shows their commitment to providing traders with the knowledge they need to make informed decisions. The Academy brings together experienced teachers and practicing traders who aim to help participants understand the fundamental principles of financial markets and apply their knowledge effectively.

One of the educational resources provided by FIBO Group is webinars. These video courses are conducted by experienced traders who cover topics such as the basics of forex trading, terminology, and trading instruments in the forex market. The webinars can be accessed online and are available for on-demand viewing in case participants are unable to attend the live sessions.

Additionally, FIBO Group's website features a glossary that contains over 230 trading-related terms and their explanations. This searchable glossary allows traders to familiarize themselves with important trading terms that they may encounter in their trading journey.

Overall, FIBO Group's educational resources serve as valuable tools for traders to enhance their understanding of the financial markets and improve their trading skills.

FIBO Group is a well-established brokerage firm with a strong reputation in the industry. They provide access to multiple trading platforms, including cTrader, MetaTrader 4, and MetaTrader 5, offering a wide range of trading instruments such as forex, CFDs, and futures. The company offers competitive spreads, flexible leverage options, and various account types to suit different trading preferences. Traders have access to a range of tools and resources, including market analysis, economic calendars, and trading signals, which can help them make informed trading decisions. FIBO Group also offers educational resources through their Academy, including webinars and a comprehensive glossary, to enhance traders' knowledge and skills.

Overall, FIBO Group offers a comprehensive trading experience with its diverse range of platforms, competitive trading conditions, and additional trading tools. The provision of educational resources demonstrates their commitment to supporting traders in their journey.

Q1: What trading platforms does FIBO Group offer?

A1: FIBO Group offers cTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) as trading platforms.

Q2: What is the minimum deposit requirement for opening an account with FIBO Group?

A2: The minimum deposit requirement to open an account with FIBO Group is $100.

Q3: What is the maximum leverage available for trading with FIBO Group?

A3: FIBO Group offers leverage of up to 500:1, allowing traders to control larger positions with a smaller initial investment.

Q4: Does FIBO Group charge commissions on all account types?

A4: No, FIBO Group does not charge commissions on the MT4 Cent and MT4 Fixed account types. However, commissions are charged on the MT4 NDD, cTrader NDD, and MT5 NDD accounts.

Q5: What customer support options are available at FIBO Group?

A5: FIBO Group provides customer support through online live chat, email, and dedicated phone lines. Their support team operates from Monday to Friday and offers assistance in multiple languages.

| Q 1: | At FIBO Group, are there any regional restrictions for traders? |

| A 1: | Yes. The services of FIBO Group are not provided to residents of the United Kingdom, North Korea and the USA. |

| Q 2: | Can I have more than one account? |

| A 2: | Yes, you may open more than one account with FIBO Group. To open an additional account you should log in to your client area and click “Open a new trading account.” It is not necessary to submit your ID and Utility bill again (Unless the details have changed). |

| Q 3: | Can I trade with an EA (Expert Advisor or robot)? |

| A 3: | Yes, you may trade with any forex Expert Advisors you like. |

| Q 4: | What is the minimum deposit for FIBO Group? |

| A 4: | There is no minimum initial deposit requirement. |

| Q 5: | Is FIBO Group a good broker for beginners? |

| A 5: | Yes. FIBO Group is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive olymptrade and fibo-group are, we first considered common fees for standard accounts. On olymptrade, the average spread for the EUR/USD currency pair is -- pips, while on fibo-group the spread is from 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

olymptrade is regulated by --. fibo-group is regulated by FCA,CYSEC,FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

olymptrade provides trading platform including -- and trading variety including --. fibo-group provides trading platform including MT5 NDD,cTrader NDD ,MT4 NDD No Commission,MT4 NDD,MT4 Fixed,MT4 Cent and trading variety including --.