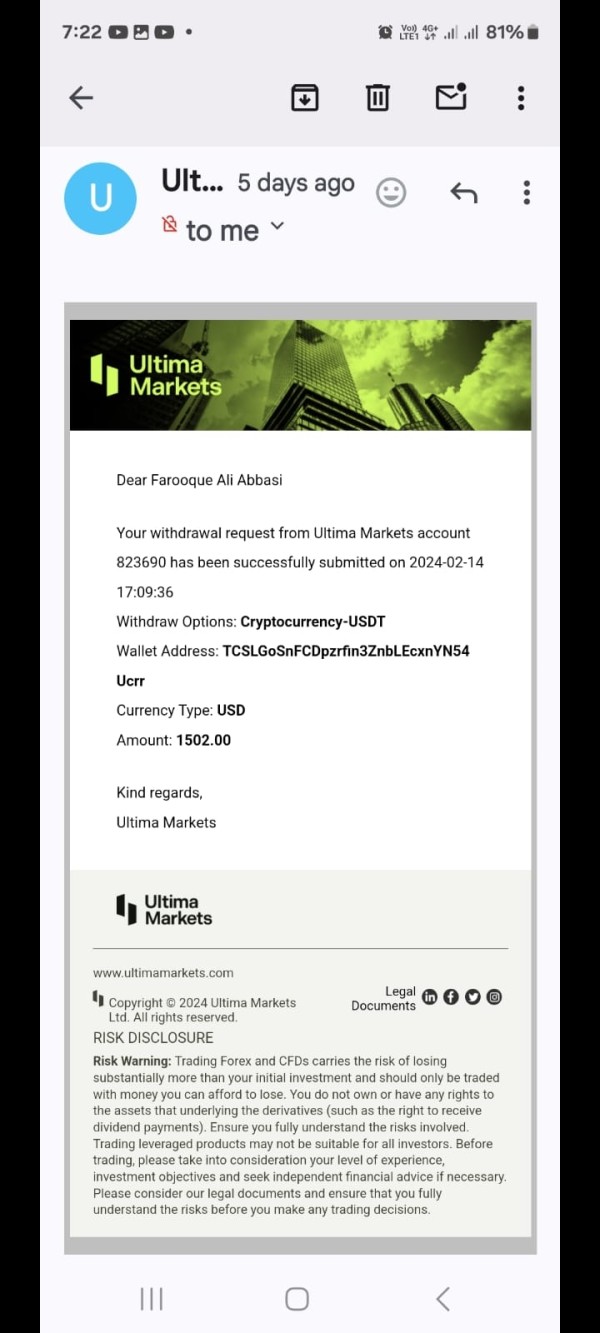

Score

Ultima Markets

Cyprus|5-10 years| Benchmark AAA|

Cyprus|5-10 years| Benchmark AAA|https://www.ultimamarkets.asia/

Website

Rating Index

Benchmark

Benchmark

AAA

Average transaction speed (ms)

MT4/5

Full License

UltimaMarkets-Demo

Hong Kong

Hong KongBenchmark

Speed:A

Slippage:A

Cost:A

Disconnected:C

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

Hong Kong

Hong KongContact

Licenses

Single Core

1G

40G

Contact number

+61 02 7259 6666

Other ways of contact

Broker Information

More

Ultima Markets Ltd

Ultima Markets

Cyprus

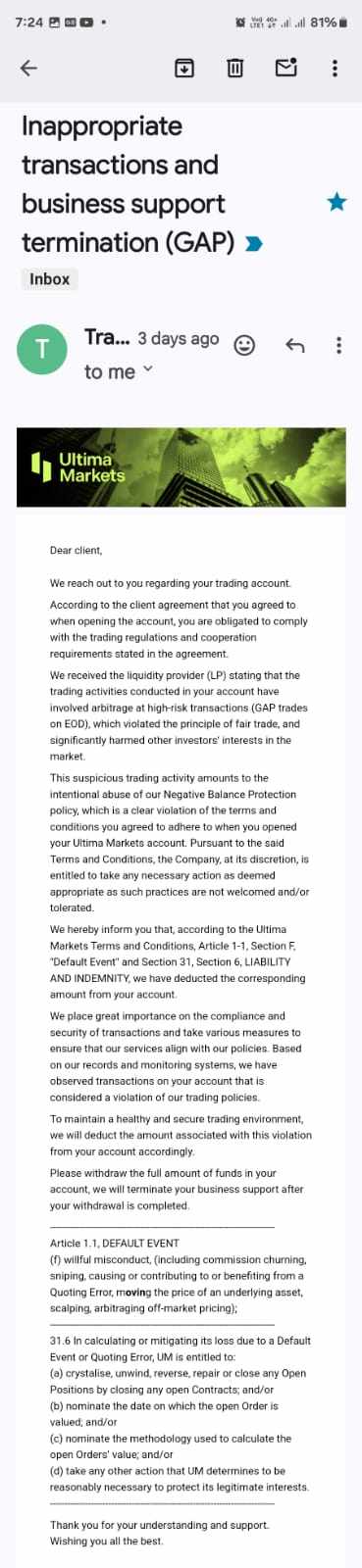

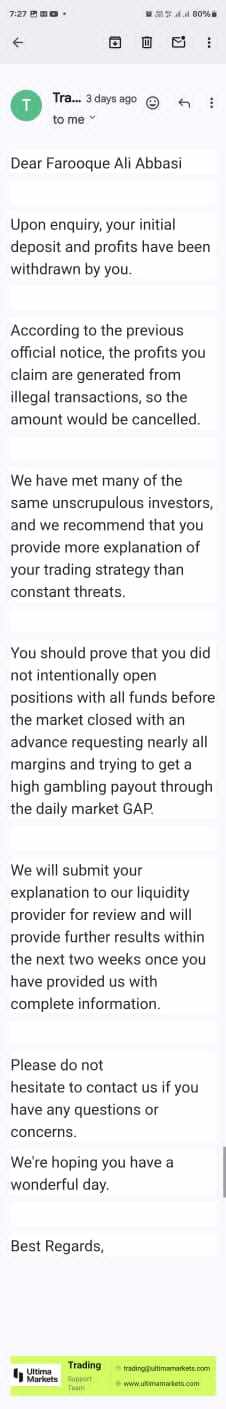

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

| Benchmark | AAA |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | from 0.0 |

| Products | 60+ Currency pairs and Gold |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | 5 USC |

| Benchmark | AAA |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | from 1.0 |

| Products | 60+ Currency pairs and Gold |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | 0 USC |

| Benchmark | AAA |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | from 0.0 |

| Products | 250+ Currency pairs, Indices, Commodities, Share CFDs |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | 5 USD |

| Benchmark | AAA |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | from 1.0 |

| Products | 250+ Currency pairs, Indices, Commodities, Share CFDs |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | 0 USD |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Ultima Markets also viewed..

XM

IUX

MultiBank Group

HFM

Ultima Markets · Company Summary

| Aspect | Information |

| Registered Country/Area | Australia (ULTIMA MANAGEMENT PTY LTD), Cyprus (Ultima Markets Cyprus Ltd) |

| Founded year | Not specified for Ultima Markets Cyprus Ltd, 2016 for ULTIMA MANAGEMENT PTY LTD |

| Company Name | Ultima Markets Cyprus Ltd, ULTIMA MANAGEMENT PTY LTD |

| Regulation | CySEC (Ultima Markets Cyprus Ltd), ASIC (ULTIMA MANAGEMENT PTY LTD) |

| Minimum Deposit | $50 USD (Standard Account), $500 USD (ECN Account), $20,000 USD (Pro ECN Account) |

| Maximum Leverage | Up to 1:2000 |

| Spreads | Starting from 0.0 pips |

| Trading Platforms | MetaTrader 4 (Desktop, Mobile, WebTrader) |

| Tradable Assets | Forex, Metals & Commodities, Indices, Shares CFDs, Cryptocurrencies |

| Account Types | Standard Account, ECN Account, Pro ECN Account |

| Demo Account | Not specified |

| Customer Support | Phone, Email, Live Support, Social Media |

| Payment Methods | Not specified |

| Trading Tools | Economic Calendar, Trading Calculator, Forex Introduction |

Overview of Ultima Markets

Ultima Markets is a reputable financial institution operating under the regulation of the Cyprus Securities and Exchange Commission (CySEC) and the Australia Securities & Investment Commission (ASIC). The brokerage caters to traders' diverse needs by providing a range of trading instruments, including forex, metals, commodities, indices, shares CFDs, and cryptocurrencies.

Traders can choose from three different account types: the Standard Account, ECN Account, and Pro ECN Account, each tailored to specific trading preferences. The Standard Account offers stable trading conditions with instant execution and access to a wide range of products. The ECN Account provides a secure trading environment with zero spreads and low commissions, appealing to trading experts. The Pro ECN Account caters to high-volume traders, offering the lowest commissions and zero spreads.

Ultima Markets offers low spreads and commissions, starting from $0 and as low as 0.0 pips, respectively. Leveraging up to 1:2000, traders can maximize their trading power and explore various trading opportunities. The brokerage operates its main trading server in the NY4 data center in New York, ensuring fast execution and connectivity with multiple liquidity providers.

Traders can access a variety of trading platforms, including the popular MetaTrader 4 (MT4) platform. The MT4 Desktop version provides a comprehensive range of features, customizable charts, and access to over 250 trading instruments. Ultima Markets also offers MT4 Mobile for trading on the go and MT4 WebTrader for browser-based trading.

To support traders in their decision-making, Ultima Markets provides trading tools such as an economic calendar, trading calculator, and Forex introduction. These tools offer valuable information and analysis to enhance trading strategies. Additionally, Ultima Markets offers credit bonuses to boost trading power, subject to specific terms and conditions.

Customer support services are readily available through phone, email, live chat, and social media platforms. Traders can reach out to Ultima Markets for assistance, inquiries, or technical support.

Pros and Cons

Ultima Markets is a regulated brokerage that offers a diverse range of market instruments, low spreads, and multiple trading platforms. They provide useful trading tools and customer support services. However, there are some potential drawbacks to consider. The limited information provided on certain aspects, such as payment methods, deposit, and withdrawal, could be a concern for traders. Additionally, the lack of detailed promotion information and transparency regarding fees and charges may raise questions. It is advisable for traders to conduct thorough research and seek clarification on these matters before deciding to engage with Ultima Markets.

Here is an updated table summarizing the pros and cons of Ultima Markets:

| Pros | Cons |

| Regulated by CySEC and ASIC | Limited information on payment methods, deposit, and withdrawal |

| Wide range of market instruments | Lack of transparency on fees and charges |

| Multiple trading platforms for accessibility | Limited detailed promotion information |

| Various account types to suit different traders |

Is Ultima Markets Legit?

Ultima Markets Cyprus Ltd is a licensed institution regulated by the Cyprus Securities and Exchange Commission (CySEC). They operate under the license number 426/23, which was issued on March 13, 2023. The institution is located at Georgiou Griva Digeni 122A, Kallinicos Court Shop 1 - Upper level, Neapolis 3101 Limassol, Cyprus. You can contact them at +357 25 747 775 or via email at compliance@ultimamarkets.com. Their website is www.ultimamarkets.com.

Ultima Markets Cyprus Ltd is regulated as a Straight Through Processing (STP) entity by the Cyprus regulatory authorities.

On the other hand, ULTIMA MANAGEMENT PTY LTD is a licensed institution regulated by the Australia Securities & Investment Commission (ASIC). They operate as an Appointed Representative (AR) and hold the license number 001249894, which was issued on November 22, 2016. The institution is located at 69 Munro Ave Ashburton VIC 3147, Australia. Unfortunately, no contact phone number or website information is provided in the given details.

Market Instruments

Ultima Markets offers a range of market instruments for trading. Here is a brief description of the different instruments they provide:

1. Forex: Ultima Markets allows trading in the foreign exchange market, commonly known as forex. This instrument is used by market participants to hedge against currency and interest rate risks, speculate on geopolitical events, and diversify portfolios. Ultima Markets offers trading in both bull and bear markets, T+0 trading, leverage up to 1:2000, 24-hour trading on 5 days a week, no commissions and low fees.

2. Metals & Commodities: Ultima Markets provides trading opportunities in metals and commodities. Hard commodities such as oil, gold, and rubber, as well as soft commodities like coffee, wheat, or corn, can be traded. Monitoring the market on the go, supply and demand dynamics impacting commodity markets, attractive options for price speculation with no hidden fees, no dealing desk, no requotes, and fast execution via the Equinix NY4 server are some of the features offered in this category.

3. Indices: Ultima Markets offers index CFDs (Contracts for Difference) covering key indices from around the world. This allows traders from one country to participate in global markets. The features include trading from 0.01 lots, monitoring the market on the go, no stamp duty, low fees, leverage up to 1:500, no requotes with a deep liquidity pool, and fast execution via the Equinix NY4 server.

4. Shares CFDs: Ultima Markets provides share CFDs on popular stocks, including companies like Apple, Amazon, Disney, and Tesla. Traders can participate in the price movements of these stocks without owning the actual shares. The features offered include trading from 0.01 lots, monitoring the market on the go, no stamp duty, low fees, leverage up to 1:333, no requotes with a deep liquidity pool, and fast execution via the Equinix NY4 server.

5. Cryptos: Ultima Markets enables trading in cryptocurrencies, which are digital assets that typically use decentralized control. Traders can monitor the crypto market on the go, access global share CFD markets, enjoy fair trading with two-way transactions, experience no hidden fees, no requotes with deep liquidity pool, and benefit from fast execution via the Equinix NY4 server.

| Pros | Cons |

| Diverse range of market instruments | Limited information on payment methods |

| Forex trading with spreads starting from 0.0 | Lack of transparency on deposit and withdrawal |

| Metals & commodities trading opportunities | Limited transparency on fees and charges |

| Index CFDs covering key indices worldwide | Lack of educational resources for beginners |

| Share CFDs on popular stocks | Limited customer support options |

| Cryptocurrency trading | Potential liquidity issues during volatile markets |

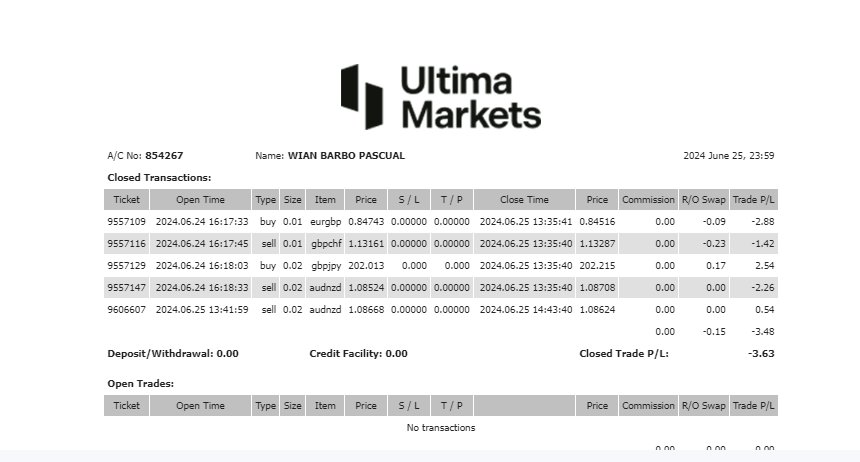

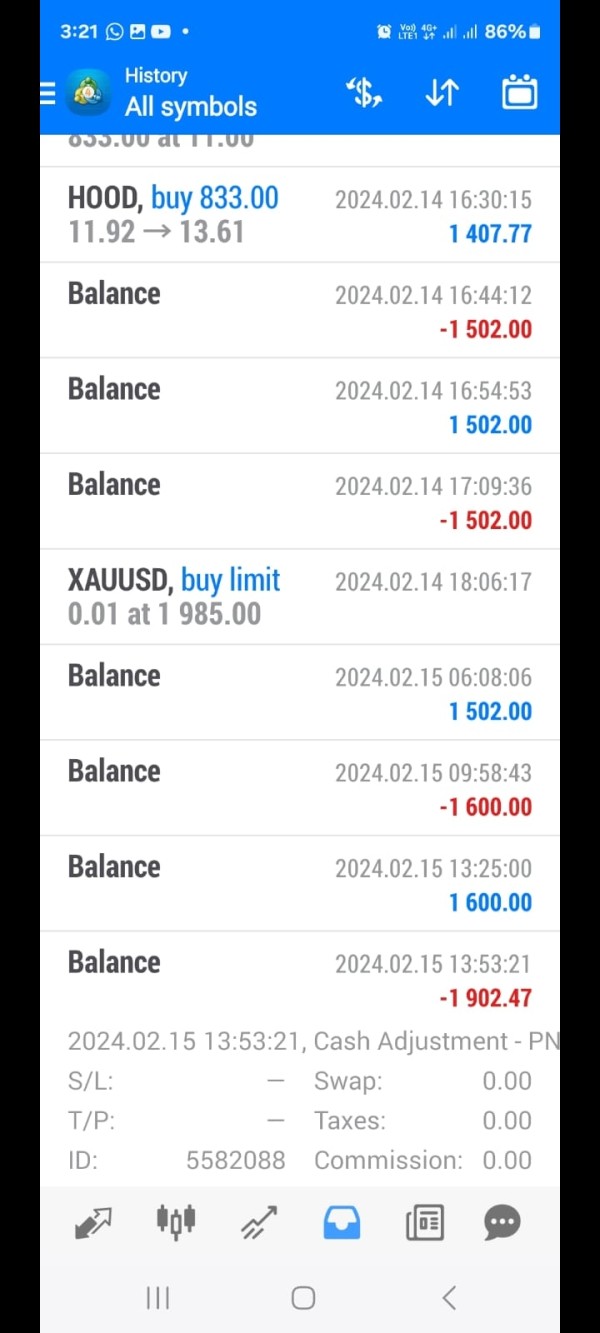

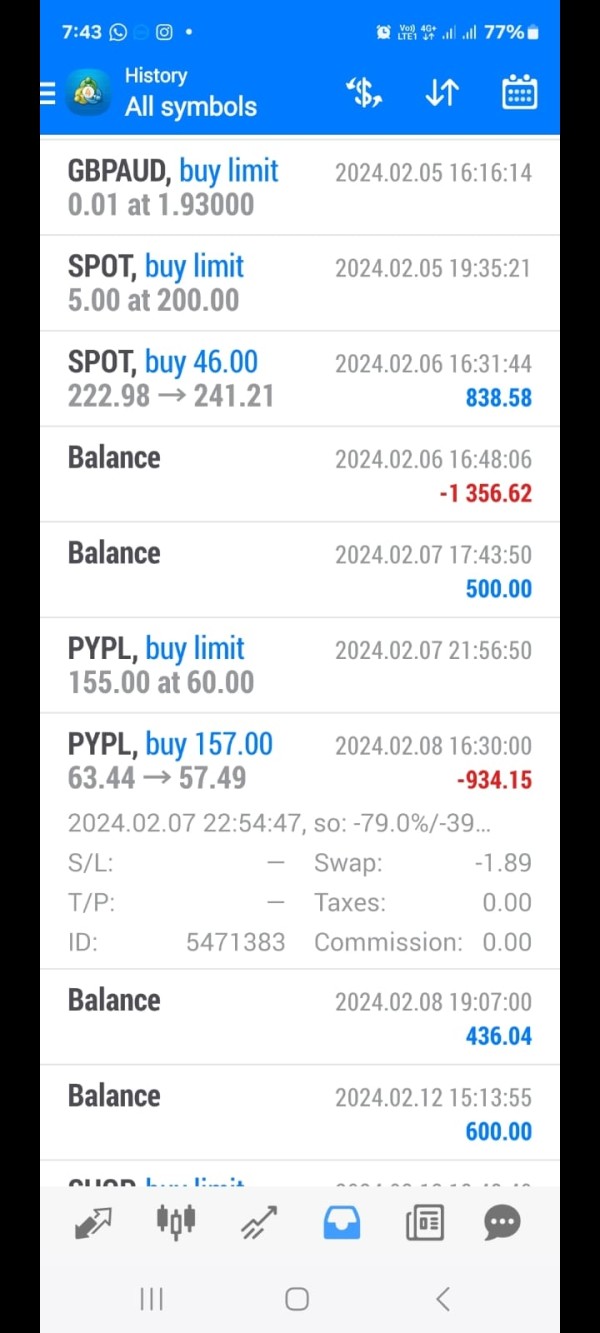

Account Types

Ultima Markets offers three different account types to cater to the needs of traders. Here is a brief description of each account type:

1. STANDARD ACCOUNT: The Standard Account is designed for professional traders and provides stable trading conditions. It offers instant execution, access to a wide range of products including currency pairs, indices, commodities, and share CFDs. The leverage can go up to 2000:1, and the minimum spread starts from 1.0 pips. There are no commissions charged on transactions in the Standard Account. It requires a minimum deposit of 50 USD.

2. ECN ACCOUNT: The ECN Account is suitable for trading experts who seek the best trading conditions. It provides a secure trading environment with zero spreads and low commissions. Traders can enjoy instant execution, access to various trading platforms, and trade a wide range of products. The ECN Account has a leverage of up to 2000:1 and requires a minimum deposit of 500 USD.

3. PRO ECN ACCOUNT: The Pro ECN Account is the premium offering for professional traders who demand the best trading conditions. It offers the lowest commissions among all account types, zero spreads, and a secure trading environment. The Pro ECN Account requires a minimum deposit of 20,000 USD, making it suitable for high-volume traders.

Ultima Markets operates its main trading server in the NY4 data center in New York. The server is an independent physical server, and the Equinix NY4 Fibre Optic Network connects it with more than dozens of liquidity providers via OneZero bridge.

| Pros | Cons |

| Offers multiple account types to cater to traders' needs | Limited transparency on fees and charges |

| Provides stable trading conditions | Lack of detailed information on payment methods, deposits, and withdrawals |

| No commissions on transactions (Standard Account) | Lack of social trading features |

| Access to various trading platforms | Potential for high-risk trading due to high leverage |

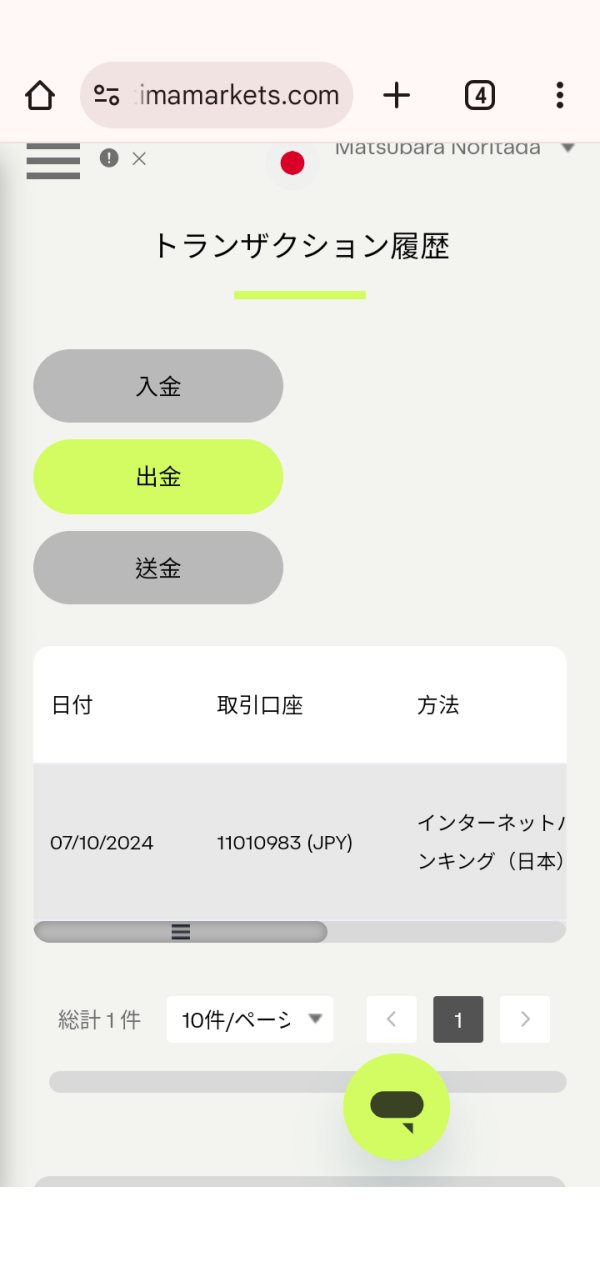

How to Open an Account?

To open an account with Ultima Markets, you can follow these steps:

1. Visit the Ultima Markets website: Go to the Ultima Markets website and locate the “Open Account” or “Register” button. Click on it to begin the account opening process.

2. Fill in the registration form: Provide the required information in the registration form. This typically includes your first name, last name, country of residence, phone number (including the country code), and email address. You may also need to select the account type, which is usually “Individual” for retail traders.

3. ID Check: Ultima Markets will verify your identity. They may require you to submit certain identification documents, such as a passport or national ID card, to verify your personal information. Follow the instructions provided by Ultima Markets to complete this step.

4. Deposit Funds: After your identity is verified, you will need to deposit funds into your Ultima Markets trading account. Ultima Markets offers different deposit methods, such as bank transfer, credit/debit cards, or electronic payment systems. Choose the deposit method that suits you best and follow the instructions provided to transfer funds to your trading account.

5. Start Trading: Once your funds are deposited, you can start trading immediately. Ultima Markets offers trading across various asset classes, including forex, commodities, indices, shares CFDs, and cryptocurrencies. You can access their trading platforms, such as MetaTrader 4, and begin executing trades based on your trading strategy.

Spreads & Commissions

Ultima Markets offers low spreads and commissions to traders. With commissions starting from $0 and spreads from as low as 0.0 pips. The brokerage provides different account types to suit the needs of traders, such as the Standard Account, ECN Account, and Pro ECN Account. Each account type offers unique features and benefits, including varying levels of spreads and commissions.

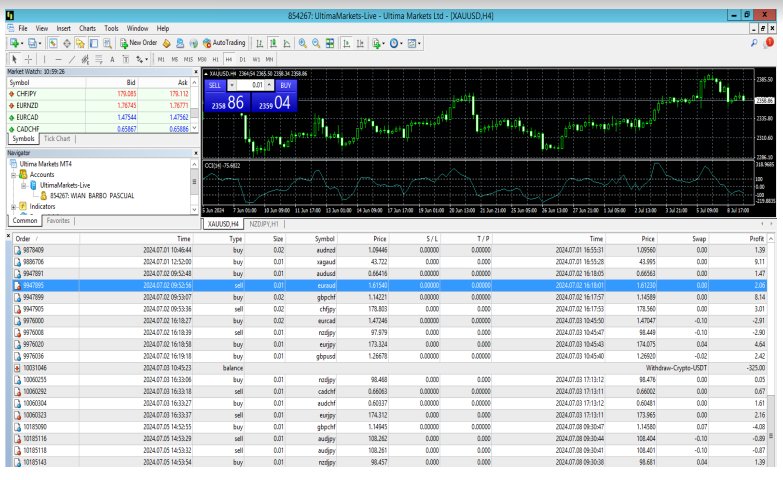

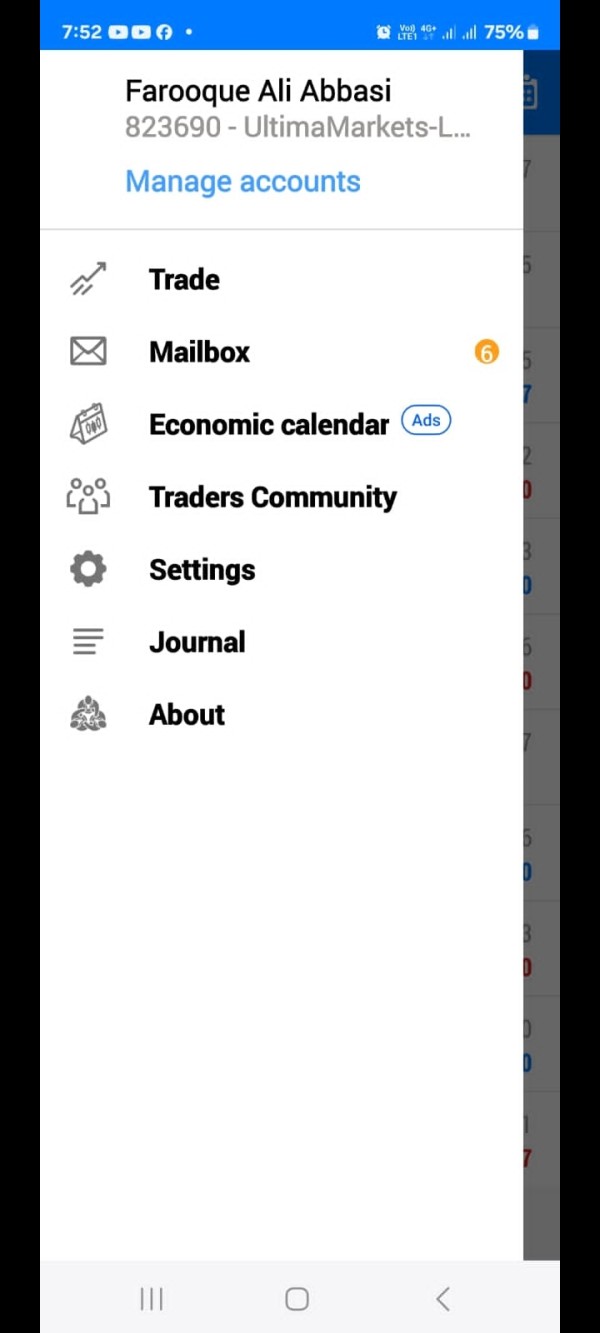

Trading Platforms

Ultima Markets offers trading platforms that provide accessibility to traders. Here is a brief description of their trading platforms:

MT4 Desktop: MetaTrader 4 (MT4) is a widely used electronic trading platform developed by MetaQuotes Software. Ultima Markets provides the MT4 Desktop version, which combines simplicity, speed, and a comprehensive range of features. Traders can customize charts, access over 250 trading instruments, benefit from ultra-fast executions, utilize Expert Advisors (EA) for automated trading, utilize built-in indicators for market analysis, manage risk with guaranteed stop orders, and enjoy an easy-to-customize layout for a seamless trading experience.

MT4 Mobile: Ultima Markets offers MT4 mobile apps for iOS and Android devices. The mobile platform allows traders to stay connected and trade on the go. It provides real-time pricing and execution, the ability to open and close positions anytime, place buy/sell orders, view trading history, access various timeframes and technical indicators for analysis, and utilize 24 analytical charting tools. With MT4 Mobile, traders can monitor their accounts and adjust trading strategies conveniently from their mobile devices.

MetaTrader 4 (MT4) WebTrader: Ultima Markets offers the MT4 WebTrader, which allows traders to access their MT4 accounts through a web interface. Traders can trade directly from their browser without the need for downloading or installing any software. The MT4 WebTrader provides comprehensive trading capabilities, including access to multiple financial markets such as forex, indices, commodities, and stock CFDs. It also offers risk management tools, expert analysis, and a secure trading environment.

These trading platforms offer features such as risk management tools, automated trading with Expert Advisors, customizable charts, market sentiment analysis, real-time pricing, extensive instrument offerings, and secure trading environments.

Pros and Cons

| Pros | Cons |

| Accessibility across devices | Possible platform stability issues |

| Comprehensive features and analysis tools | Lack of transparency on fees and charges |

| Customizable charts and layouts | Potential issues with customer support |

| Automated trading with Expert Advisors | Lack of advanced order types |

Trading Tools

Ultima Markets provides a range of trading tools to assist their clients in making informed trading decisions. Here is a brief description of the trading tools offered by Ultima Markets:

1. ECONOMIC CALENDAR: Ultima Markets provides an economic calendar that displays upcoming events and news releases that can potentially impact the markets. Traders can refer to this calendar to stay informed about important economic indicators, central bank announcements, and other events that may influence their trading strategies.

2. TRADING CALCULATOR: The trading calculator offered by Ultima Markets is a valuable tool for traders. It allows users to calculate essential trading parameters such as point value, spread cost, estimated profit, and potential loss. By using the trading calculator, traders can analyze their trades more effectively and manage their risk accordingly.

3. FOREX INTRODUCTION: Ultima Markets offers an introduction to the Forex market. This resource provides a basic understanding of the Forex market, including its participants (individuals, companies, governments), the concept of currency trading, and the dynamics of buying and selling currencies.

These trading tools, including the economic calendar, trading calculator, and Forex introduction, are designed to provide traders with valuable information and analysis to support their trading strategies. It's important to note that the provided information is a summary, and for detailed and up-to-date information about these trading tools, it is recommended to visit Ultima Markets' official website or contact them directly.

| Pros | Cons |

| Economic Calendar: Keeps traders informed about upcoming events and news releases that impact the markets. | Limited information: Lack of details on specific features and functionalities of the trading tools. |

| Trading Calculator: Helps calculate essential trading parameters and manage risk effectively. | Absence of additional tools: Limited range of advanced tools and resources. |

| Forex Introduction: Provides a basic understanding of the Forex market for beginners. | Lack of user reviews: No user feedback available to evaluate the tools' quality and reliability. |

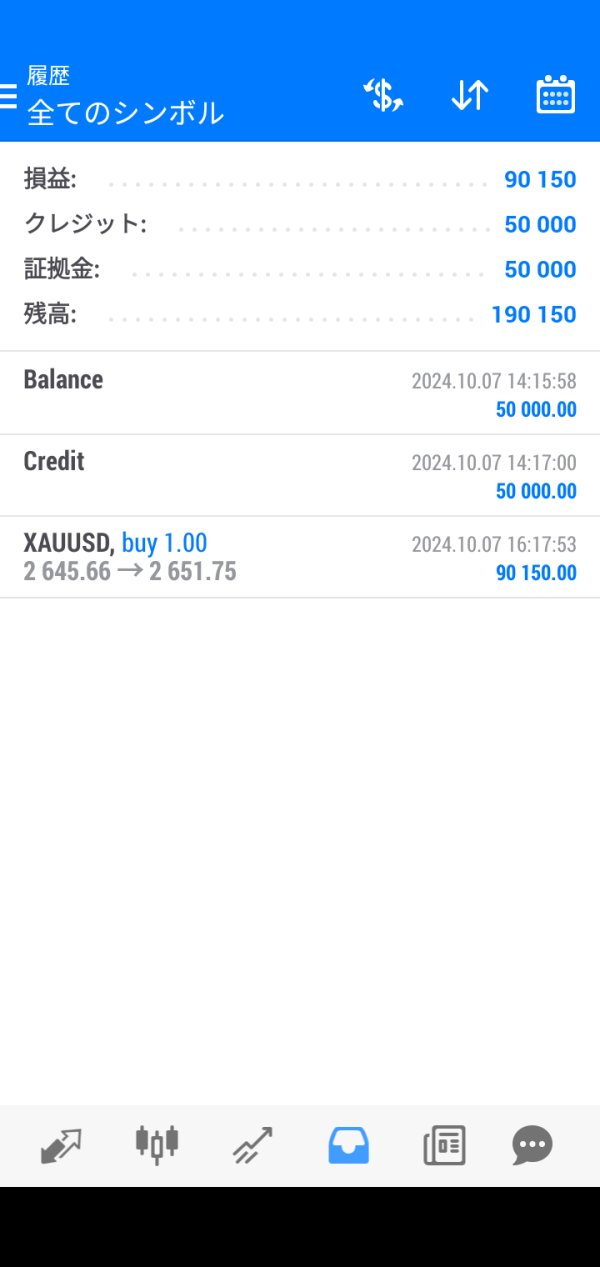

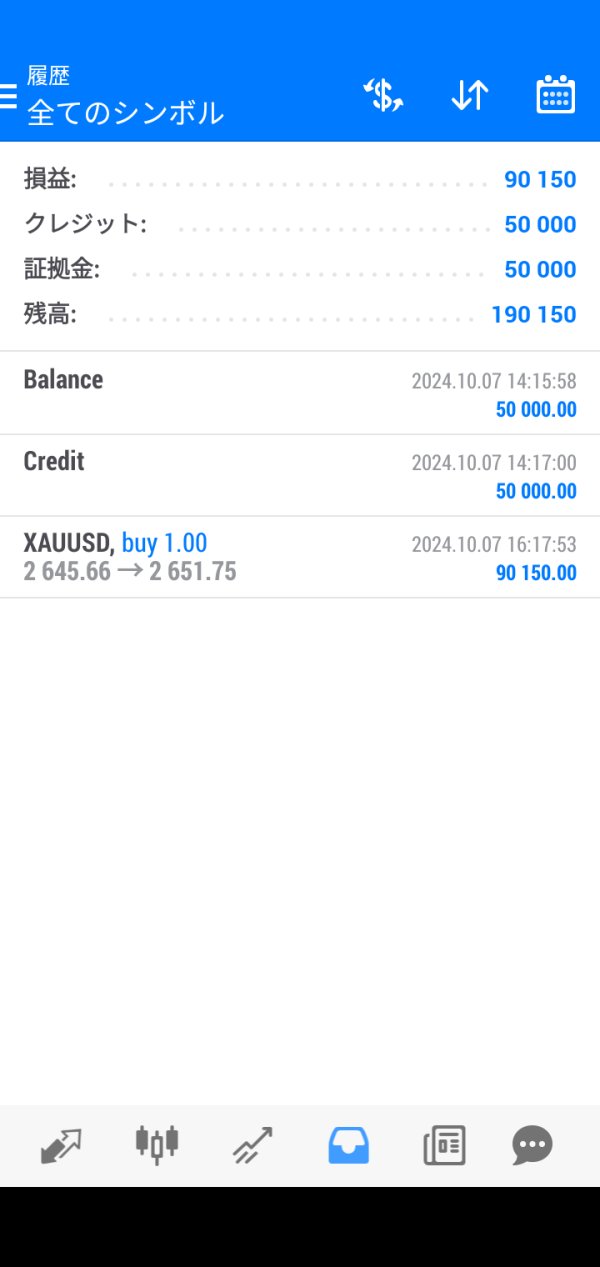

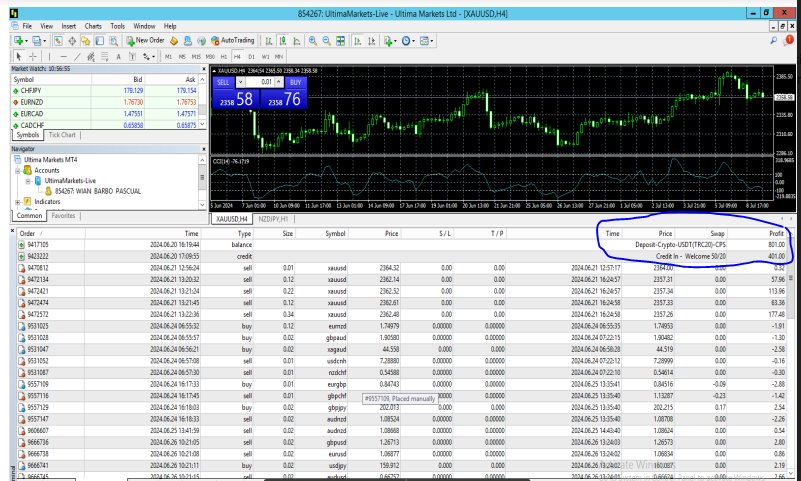

Promotions & Bonuses

Ultima Markets offers credit bonuses as an incentive to traders. Here is an overview of the credit bonus structure:

INITIAL DEPOSIT BONUS: Ultima Markets provides a 50% credit bonus on the initial deposit made by clients. For example, if you deposit $500, you will receive a credit bonus of $250.

SUBSEQUENT DEPOSIT BONUS: After the initial deposit, Ultima Markets offers an additional 20% credit bonus on subsequent deposits. For instance, if you deposit $1,000 in subsequent deposits, you will receive a credit bonus of $200.

It's important to note that credit bonuses are subject to certain terms and conditions, which may include minimum deposit requirements, trading volume conditions, and specific withdrawal conditions. It is advisable to carefully review the terms and conditions associated with the credit bonuses before opting in.

The credit bonus can be utilized to boost your trading power and increase your free margin, allowing you to take larger positions in the market. However, it's crucial to manage your trading risks effectively and consider the impact of increased leverage on your trading strategy.

Customer Support

Ultima Markets provides customer support services to assist traders with their inquiries, concerns, and technical support needs. Here are the available channels through which customers can reach out to Ultima Markets:

1. Phone: Customers can contact Ultima Markets by phone at +61 02 7259 6666. This allows for direct communication with the company's support team to address any immediate concerns or inquiries.

2. Email: Customers can reach out to Ultima Markets via email at info@ultimarkets.com. This provides a convenient way to send detailed inquiries or requests for assistance, and the support team will respond to these emails.

3. Live Support: Ultima Markets offers 24-hour live support to its customers. Traders can access this feature on the company's website or trading platform to engage in real-time chat with the customer service representatives. This enables quick problem-solving and assistance with trading-related issues.

4. Social Media: Ultima Markets maintains an active presence on various social media platforms, including Twitter (https://twitter.com/UltimaMarkets/), Facebook (https://www.facebook.com/ultima.markets), Instagram (https://www.instagram.com/ultima_markets/), and LinkedIn (https://www.linkedin.com/company/ultima-markets/mycompany/). Customers can follow or connect with Ultima Markets on these platforms to stay updated with news, announcements, and also reach out for support if needed.

Conclusion

In conclusion, Ultima Markets is a regulated brokerage that offers a diverse range of market instruments, low spreads, and multiple trading platforms. They provide useful trading tools and customer support services. However, some potential disadvantages include limited information on payment methods, deposit, and withdrawal, as well as a lack of transparency on fees and charges. It is important for traders to carefully consider these factors alongside the advantages before making a decision.

FAQs

Q: Is Ultima Markets a legitimate broker?

A: Yes, Ultima Markets is a legitimate broker. Ultima Markets Cyprus Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 426/23. They operate in compliance with regulatory requirements and provide a secure trading environment.

Q: What markets can I trade with Ultima Markets?

A: Ultima Markets offers a wide range of market instruments for trading. You can trade forex, metals, commodities, indices, shares CFDs, and cryptocurrencies.

Q: What are the different account types offered by Ultima Markets?

A: Ultima Markets offers three account types: Standard Account, ECN Account, and Pro ECN Account. Each account type has its own features and benefits tailored to different trading preferences.

Q: What are the minimum deposit requirements for opening an account with Ultima Markets?

A: The minimum deposit requirements vary depending on the account type. The Standard Account requires a minimum deposit of 50 USD, the ECN Account requires 500 USD, and the Pro ECN Account requires 20,000 USD.

Q: What are the spreads and commissions charged by Ultima Markets?

A: Ultima Markets offers spreads starting from as low as 0.0 pips and commissions starting from $0. However, the specific spreads and commissions may vary depending on the account type and trading conditions.

Q: What trading platforms are available at Ultima Markets?

A: Ultima Markets offers the popular MetaTrader 4 (MT4) platform for desktop, mobile (iOS and Android), and web trading. MT4 provides a comprehensive set of features and tools for efficient trading.

Q: How can I contact Ultima Markets customer support?

A: You can contact Ultima Markets customer support through phone, email, live support chat on their website, or by reaching out to them on their social media platforms.

Review 18

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now