简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex vs. Stock Which Is More Profitable?

Abstract:The Forex market is very volatile and is best if you are interested in short term investments and want to make a profit.

Nowadays, people have a wide variety of financial products to choose from and want to maximize their investment returns. As the most active financial market turnover of foreign exchange and stocks are highly favored by investors, so which earns money faster, forex or stocks? In fact, high returns are often accompanied by high risks, and today we will analyze the differences.

Which is more profitable, forex or stocks? In fact, there is no exact answer to this question, forex retail business and stock trading, both belong to the financial secondary market a way to call.

Each investor has their own area of expertise, and some people speculate in stocks and shares will also have a loss calculation, and some people are just the opposite. Forex is more flexible than stocks, and there are more products to choose from. You have more opportunities to make money, and the time to make money will be faster, but of course the risk is also higher compared to stocks.

Lets find the reasons to prefer forex vs stock…

Key Takeaways:

1. Definition of Forex and Stock

2. What Are the Differences between Forex and Stock?

3. Five-Year Key Data: Forex Trading vs. Stock Trading

4. Tips: Forex and Stocks Are Both Risky

5. Conclusion

1. Definition of Forex and Stock

- What is Forex?

Forex, which stands for “foreign exchange,” refers to the market where currencies are traded for one another. Although all currencies are susceptible to manipulation by governments or central banks since they control the supply of money and have the power to generate new money whenever they choose, the majority of currencies are traded freely today. There is no single market for forex, and four major banks and central banks control the majority of the market. With an average daily currency transaction of $4 trillion, foreign exchange is the largest market in the world. Although there was an incident in 2015 that lasted for about an hour where it was impossible to exchange a Swiss franc, demonstrating that even a relatively major currency is not guaranteed liquidity, liquidity is excellent in the major currency pairs, especially during the London / New York sessions overlap. The U.S. dollar, by far the most significant currency in the world, is used in more than half of all transactions by volume on the Forex market.

- What is Stock?

Stocks are ownership interests in corporations. A major stock exchange, which organizes and controls trading in the stocks of the biggest publicly traded corporations, may be found in almost every nation. Contrary to Forex, volume data is always available when trading shares of publicly listed firms, which must always be done through controlled exchanges.

Although less so than in the major Forex currency pairings, trading on major stock exchanges is often very liquid. Occasionally, significant developments involving a single firm cause liquidity to dry up or trade to temporarily halt. Trading indexes built upon a large number of companies, like the S&P 500 Index, often offers deeper and smoother liquidity.

Despite being banned in the stock market, short-term market manipulation is more prevalent in stocks than in Forex due to lower quantities and fewer influential buyers and sellers, despite the fact that publicly traded equities are carefully regulated. A stock's price will be greatly influenced by the specific company's financial standing and projected future income stream, but it can also be significantly impacted by general economic conditions, where a rising tide can elevate even fragile boats or a falling tide can sink them.

2. What Are the Differences between Forex and Stock?

The Forex and Stock markets need not be mentioned when it comes to the best trading platforms. Liquidity, dependable shareholder and forex trader education services, and market volume all contribute to their appeal.

You should be aware of their distinctions before trading any of them. You can learn easily how to differentiate between Forex and Stock from the table given below:

As the figure shows, there are as many as 12 differences between the two. Here we will focus on trading leverage. How much leverage can and should be used is a very pertinent question for retail traders. To begin with, let us look at stock trading from the point of view of the SEC. At the end of the day when you buy real stocks from a licensed broker, your maximum leverage is 2:1. You must contribute at least half of the cost. Short sellers have to adhere to a range of rules that range from slightly over 3:1 to 1:1 depending on the price of the stock. It is common to pay an annualized interest rate of 4% on leverage (typically calculated as LIBOR plus 2.5%), which means that for the leverage to be worthwhile, the stock must gain at least 4% per year.

Of course, retail brokers offering CFDs that are based upon the price of the stock are far more generous with leverage, but generally the leverage they offer in Forex trading is even more generous. Typically, a Forex broker might offer a maximum leverage of 100:1 on Forex currency pairs in offshore centers (capped at 30:1 in Europe and Australia), but only 20:1 on individual stocks. This means you can potentially profit five times as much on a Forex movement than you can on a stock movement, on a like for like basis.

3. Five-Year Key Data: Forex Trading vs. Stock Trading

It makes sense to trade where there is a lot of price volatility. After all, you need the price of a thing to fluctuate significantly in order to make a profit when you buy or sell it. The easiest way to make money is to trade something whose price goes up or down in a straight line, but of course, it's rarely that straightforward.

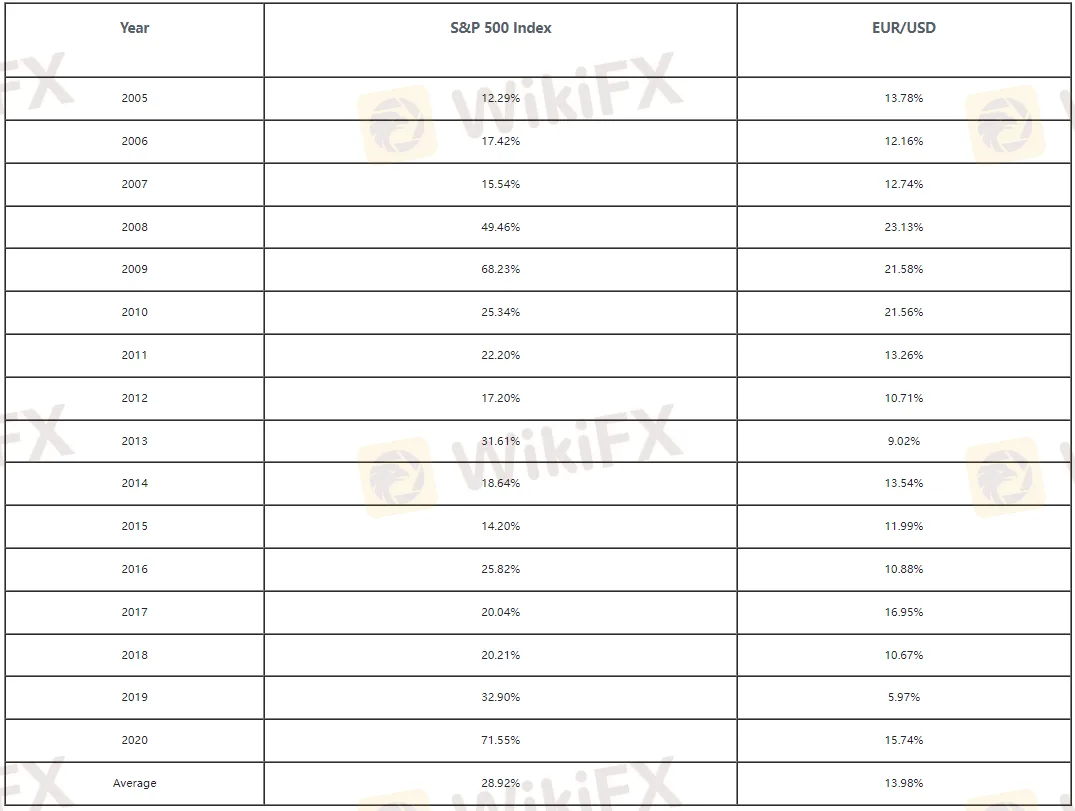

In this regard, stock trading usually offers better opportunities than major Forex currency pairs, no matter how well you know the basics of Forex trading. To demonstrate this, take a look at the table below, which shows the maximum annual absolute percentage changes over the last 15 years for the EUR/USD currency pair and the world's largest stock index, the S&P 500:

We can see that from 2005 to 2020, on average, the S&P 500 has been a little more than twice as volatile as the EUR/USD currency pair. During these 16 years, the EUR/USD volatility exceeds that of the S&P 500 in only one year (2005). In addition, individual stocks can be much more volatile than the index. Therefore, it is clear that on an unleveraged basis, there is more potential profit in stock trading than in forex trading.

For a more visual comparison of the S&P 500 Index and EUR/USD, see also the following linear table.

A very important difference between the forex market and the stock market is that the stock market has a long-term long term bias - the overall price of the market will rise over time. Traders and investors can try to follow the prevailing wind - go long - to take advantage of the stock market. In the foreign exchange market, the market is neutral in direction, even if it takes years to return to parity. This important distinction means that successfully trading the forex and stock markets requires you to be long in the stock market and neutral when going long or short in the forex market.

4. Tips: Forex and Stocks Are Both Risky

Currencies are riskier for private investors than stocks due to country, leverage and counterparty risk. It is true that you do not need to use leverage to invest in forex, but this will make your potential returns almost negligible. You are better off focusing on what you can do to anticipate the movement of Forex prices.

- Know the country whose currency you are using. There are many factors to consider when trading currencies, so research the country pair you are trading in depth. A crucial starting point is to observe how your country responds to historical events that have a significant impact on its exchange rate.

- Keep track of the news. Pay close attention to national, regional and international news on a daily basis. Even a small event can have a huge impact on the exchange rate like a snowball.

- Use stop loss orders and profit limit orders. Use these orders to protect your Forex portfolio by automatically closing your positions. These will limit your potential gains, and you may be charged a fee for doing so.

- Don't risk more than you can afford to lose. Many currencies have experienced roller coaster swings recently. Understand that if you are unable to meet a margin call, your position may be closed out immediately and you may not be able to recover any of your initial investment.

Conclusion

The Forex market is very volatile and is best if you are interested in short term investments and want to make a profit. The Forex market is more volatile than the stock market and therefore Forex trading is more profitable. However, because of the high volatility, the risk is also high.

The stock market is your best option if you are interested in holding your investment for a longer period of time. The stock market is a regulated market and with a little patience you can get a great return on your investment.

As an investor, you actually have the potential to make good returns from both financial markets. However, it is crucial that you learn the skills of trading and have a strategy that suits your trading goals.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator