简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Maximize Profits with Octa?

Abstract:Octa is a CYSEC- regulated forex brokerage company who started its business in Cyprus since 2018. It offers trading services in forex, commodities, cryptos and indices, with an affordable minimum deposit of EUR 50. Clients can open a demo to get familiar with the platform, or test their trading strategies before tapping into live trading. The company has also developed a proprietary web-based trading platform, with an app version downloadable on both iOS and Android phones.

| Octa |  |

| Founded in | 2011 |

| Registered Country | Cyprus |

| Regulatory Oversright | Regulated by CYSEC |

| Market Instruments | Forex, commodities, indices, cryptos |

| Demo Account | ✅ |

| Account Minimum | EUR 50 |

| EURUSD Spread | 0.8 pips |

| Leverage | Up to 30x for forex, 20x for commodities and indices |

| Commission | Free for deposit, withdrawals, opening orders |

| Fees | -1662-0 points/0.01 lots |

| App/Platforms | OctaTrader |

| Security Measures | Segregated funds, 3D secure Visa authorization, SSL |

| Promotions | ❌ |

| Restricted Areas | Belgium, USA, Canada, Spain, UK, non-EEA countries except for Switzerland |

Octa is a CYSEC- regulated forex brokerage company who started its business in Cyprus since 2018. It offers trading services in forex, commodities, cryptos and indices, with an affordable minimum deposit of EUR 50. Clients can open a demo to get familiar with the platform, or test their trading strategies before tapping into live trading. The company has also developed a proprietary web-based trading platform, with an app version downloadable on both iOS and Android phones.

Leverage is up to 30x for forex, 20x for commodities and indices, in line with European authorities' standard level. The minimum spread for the major currency pairs like EURUSD is 0.8 pips, with no commission for deposit, withdrawal or opening orders. Such low fee structure is competitive and advantageous over many peer brokers. However, if you leave position open after 12 a.m. server time (EET/EST), there will be overnight charges which range from -1662 to 0 points per 0.01 lots. These charges can add significant costs to trading.

While assessing costs, you can use Octa's trading tools such as profit calculators and trading calculators. These tools help you to estimate potential expenses before executing trades so you'll have a better understanding and control over your transaction costs.

Octa Pros & Cons

| Pros✅ | Cons❌ |

| Regulated by CYSEC | Negative reviews on WikiFX |

| Acceptable minimum deposit | Limited account options |

| Demo accounts available | Overnight fees charged |

| Segregated funds | Long list of non-service countries |

| Positive reviews on WikiFX |

Octa Trading Conditions

Account Review

For those just starting out, Octa provides a demo account for user to practice trading and get familiar with the platform without financial risk.

While for live accounts, the broker requires an affordable minimum deposit of EUR 50. The entry point is friendly to most investors and allows beginners or those with limited capital to start their investment journey and explore opportunities.

Spread

Spread is the difference between bid and ask price, which is also a key indicator of how to evaluate a broker's overall trading costs.

| Asset Class | Instrument | Minimum Spread (Points) | Typical Spread (Points) |

| Cryptocurrencies | BCHUSD (Bitcoin Cash vs USD) | 2.4 | 2.6 |

| BTCUSD (Bitcoin vs USD) | 1.9 | 2.5 | |

| ETHUSD (Ethereum vs USD) | 1.1 | 1.2 | |

| LTCUSD (Litecoin vs USD) | 3.1 | 3.4 | |

| XRPUSD (Ripple vs USD) | 2.6 | 2.7 | |

| Forex Major Pairs | EURUSD (Euro vs USD) | 0.8 | 0.9 |

| GBPUSD (British Pound vs USD) | 0.4 | 0.7 | |

| USDJPY (USD vs Japanese Yen) | 0.4 | 0.5 | |

| USDCHF (USD vs Swiss Franc) | 0.4 | 0.9 | |

| AUDUSD (Australian Dollar vs USD) | 0.6 | 0.7 | |

| NZDUSD (New Zealand Dollar vs USD) | 0.8 | 1 | |

| Commodities | XAGUSD (Silver on Spot) | 1 | 2.4 |

| XAUUSD (Gold on Spot) | 0.8 | 2 | |

| XBRUSD (Brent Crude Oil) | 0.2 | 0.6 | |

| XNGUSD (US Natural Gas) | 0.2 | 0.6 | |

| Indices | AUS200 (ASX SPI 200 Index) | 0.4 | 2.2 |

| UK100 (FTSE 100 Index) | 0.4 | 1.8 | |

| NAS100 (Nasdaq 100 Index) | 0.2 | 1.1 | |

| SPX500 (S&P 500 Index) | 0.2 | 1.5 | |

| US30 (Dow Jones 30 Index) | 1 | 5 | |

| JPN225 (Nikkei 225 Index) | 0.1 | 1.1 |

Note: Above are the figures up to Dec 8, and spreads charged by brokers usually subject to market fluctuations and may change dynamically.

We can see that Octa's spreads are competitive, especially for major pairs and popular commodities such as EURUSD, GBPUSD, and USDJPY, which is advantageous for day traders and scalpers.

Cryptocurrency spreads like BTCUSD and ETHUSD are slightly higher than traditional forex pairs but still reasonable when compared to industry competitors. Spreas for commodities like Gold and Silver are also within the competitive range.

Commissions

Octa claims it does not charge commissions on trading, meaning trades, deposits, or withdrawals are free of charge, decreasing traders' costs significantly. Such fee structure is attractive to both beginners and experienced traders, especially those focusing on minimizing trading costs to maximize their profit gainings.

Overnight Fees

OctaFX charges swap fees for different financial instruments for orders that keep open after 12 a.m. server time (EET/EST).

| Istrument | Swap Long (Points/0.01 Lots) | Swap Short (Points/0.01 Lots) |

| EURUSD (Euro vs. US Dollar) | -5 | 0 |

| GBPUSD (British Pound vs. US Dollar) | 0 | 0 |

| USDJPY (US Dollar vs. Japanese Yen) | 0 | -22 |

| USDCHF (US Dollar vs. Swiss Franc) | 0 | -10 |

| AUDUSD (Australian Dollar vs. US Dollar) | -3 | 0 |

| NZDUSD (New Zealand Dollar vs. US Dollar) | 0 | 0 |

| USDCAD (US Dollar vs. Canadian Dollar) | 0 | -5 |

| EURGBP (Euro vs. British Pound) | -4 | 0 |

| EURJPY (Euro vs. Japanese Yen) | 0 | -16 |

| EURCHF (Euro vs. Swiss Franc) | 0 | -7 |

| EURAUD (Euro vs. Australian Dollar) | -5 | 0 |

| EURNZD (Euro vs. New Zealand Dollar) | -7 | 0 |

| EURCAD (Euro vs. Canadian Dollar) | -2 | 0 |

| GBPJPY (British Pound vs. Japanese Yen) | 0 | -28 |

| GBPCHF (British Pound vs. Swiss Franc) | 0 | -13 |

| GBPAUD (British Pound vs. Australian Dollar) | 0 | -4 |

| GBPNZD (British Pound vs. New Zealand Dollar) | -2 | 0 |

| GBPCAD (British Pound vs. Canadian Dollar) | 0 | -7 |

| CHFJPY (Swiss Franc vs. Japanese Yen) | 0 | -4 |

| AUDJPY (Australian Dollar vs. Japanese Yen) | 0 | -12 |

| AUDCHF (Australian Dollar vs. Swiss Franc) | 0 | -6 |

| AUDNZD (Australian Dollar vs. New Zealand Dollar) | -1 | 0 |

| AUDCAD (Australian Dollar vs. Canadian Dollar) | 0 | -2 |

| NZDJPY (New Zealand Dollar vs. Japanese Yen) | 0 | -12 |

| NZDCHF (New Zealand Dollar vs. Swiss Franc) | 0 | -6 |

| NZDCAD (New Zealand Dollar vs. Canadian Dollar) | 0 | -3 |

| CADJPY (Canadian Dollar vs. Japanese Yen) | 0 | -12 |

| CADCHF (Canadian Dollar vs. Swiss Franc) | 0 | -5 |

| XAGUSD (Silver on Spot) | -4 | 0 |

| XAUUSD (Gold on Spot) | -36 | 0 |

| XBRUSD (Brent Crude Oil) | -1 | -2 |

| XNGUSD (US Natural Gas) | -20 | 0 |

| XTIUSD (WTI Crude Oil) | -1 | -2 |

| AUS200 (ASX SPI 200 Index) | -10 | -4 |

| UK100 (FTSE 100 Index) | -12 | 0 |

| FRA40 (CAC 40 Index) | -8 | -4 |

| GER40 (DAX 40 Index) | -19 | 0 |

| ESP35 (IBEX 35 Index) | -12 | -5 |

| EUSTX50 (Eurostoxx 50 Index) | -5 | 0 |

| US30 (Dow Jones 30 Index) | -63 | 0 |

| NAS100 (Nasdaq 100 Index) | -28 | 0 |

| SPX500 (S&P 500 Index) | -79 | 0 |

| JPN225 (Nikkei 225 Index) | -1 | -1 |

| BCHUSD (Bitcoin Cash vs. US Dollar) | 0 | 0 |

| BTCUSD (Bitcoin vs. US Dollar) | -1662 | -519 |

| ETHUSD (Ethereum vs. US Dollar) | -60 | -19 |

| LTCUSD (Litecoin vs. US Dollar) | -1 | -1 |

| XRPUSD (Ripple vs. US Dollar) | -13 | -4 |

From above we can see that:

- The swap fees for major Forex pairs are mostly negligible or moderately negative.

- Swap fees on long positions for indices like SPX500 and US30 are relatively high.

- Commodities such as Gold (XAUUSD) incur significant swap fees for long positions.

- Cryptocurrencies like BTCUSD have the highest swap fees, particularly for long positions.

Therefore, traders aiming for long-term positions should evaluate swap-free account options, especially for assets with high overnight costs like cryptocurrencies to avoid high accumulating trading costs.

Leverage

Leverage is a trading tool that can amplify your buying power, enabling you to control larger positions with less capital. While it increases potential profits, it also magnifies losses that you need to implement risk management. Octa offers varying leverage levels according to different instruments.

| Asset Class | Instruments | Maximum Leverage |

| Currency Pairs | 28 most volatile pairs (e.g., EUR/USD, GBP/USD) | 1:30 |

| Commodities | Gold and Silver | 1:20 |

| United States Natural Gas, Brent Crude Oil, WTI | 1:10 | |

| Indices | Up to 10 popular indices (e.g., S&P 500, NASDAQ) | 1:20 |

Higher leverage usually increases the chances of significant profits but also demands strict margin monitoring. For instance, with 1:30 leverage, a 1% price movement in a volatile currency pair can result in a 30% impact on your capital. Stop-loss orders and position sizing strategies are advised to be used to mitigate the risks.

Octa Profit Calculator and Trading Calculator

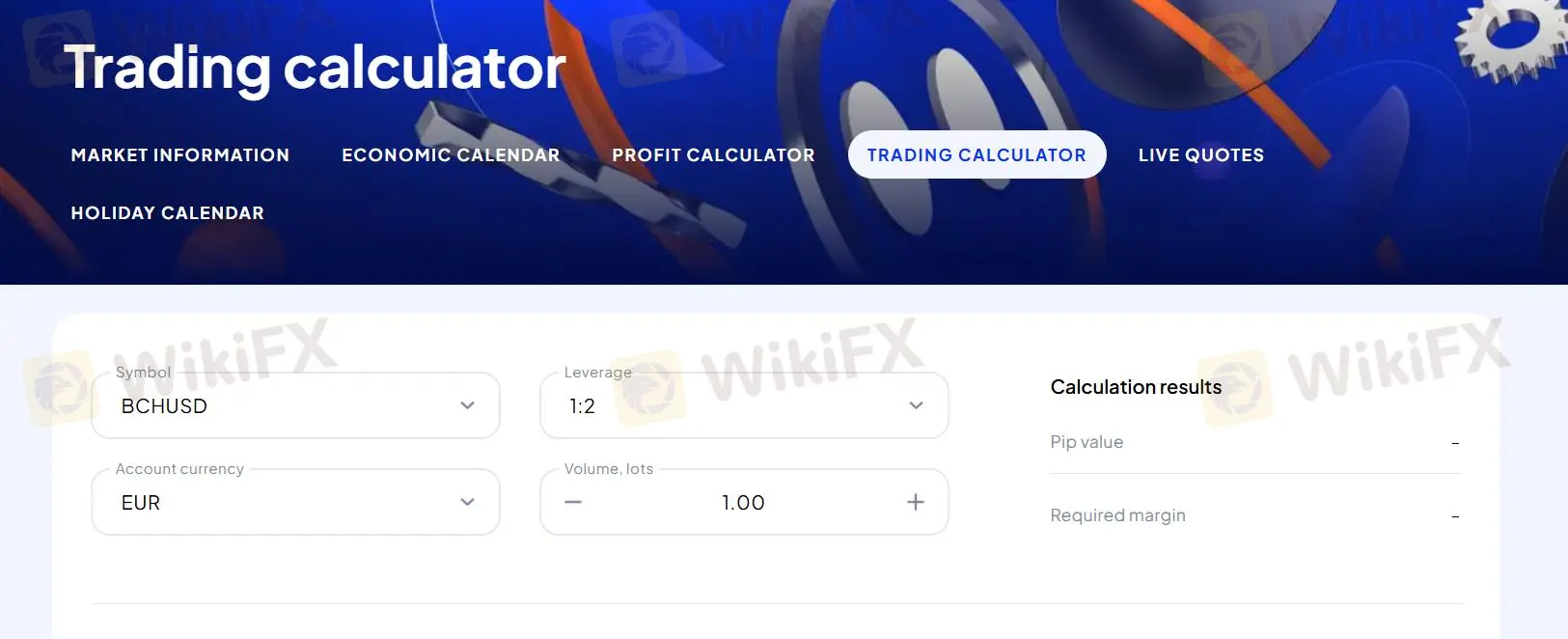

Octa provides a Profit Calculator and a Trading Calculator, which are powerful tools for optimizing trading strategies.

The Trading Calculator assists in calculating margin requirements, determining lot sizes, and evaluating pip values for efficient capital allocation.

Meanwhile, Profit Calculator allows you to input order details like the trading asset, volume, and planned prices to estimate potential profits or losses so you can set informed Stop Loss and Take Profit levels efficiently.

These tools help you enhance risk management and foster informed decision-making by simulating various scenarios and optimizing trade conditions. WikiFX suggest you to use these tools as often as you can to reduce impulsive decisions and improve profitability.

How to Maximize Profits with Octa?

To maximize profits with Octa, you should choose the right trading instruments with competitive spread, swap fees, utilize its tools like profit and trading calculators, favorable leverage options, and implement risk management strategies such as calculated Stop Loss and Take Profit levels effectively to refine entry and exit points.

The combination of right product, strategic planning and risk control are essential for informed trading, ultimately increasing the potential for profitability over time.

Compare to Similar Brokerages

| Logo |  |  |  |  |

| Broker | Octa | SAXO | IG | Oanda |

| Regulators | CYSEC | ASIC, FCA, FSA, AMF, CONSOB, FINMA, MAS | ASIC, FCA, FSA, AMF, FMA, MAS, DFSA | ASIC, FCA, FSA, NFA, CIRO, MAS |

| Product Offerings | Forex, commodities, indices, crypto | Stocks, ETFs, bonds, mutual funds, crypto ETPs, options, futures, forex, forex options, crypto FX, CFDs, commodities and turbos | CFDs on shares, indices, forex, commodities, cryptos, options, interest rates, bonds and ETFs | CFDs on forex, indices, commodities, cryptocurrencies and bonds |

| Account Minimum | EUR 50 | From $0-1 per contract, 0.05% for bonds | $0 | $0 |

| Commission | ❌ | 0.08-0.35% for share CFDs | 0.08-0.35% for share CFDs | $30 per 1M |

| Promotions | ❌ | ✔ | ✔ | ✔ |

The Bottom Line

In summary, OctaFX offers traders a low-entry platform with a minimum deposit of €50 and competitive trading conditions like only 0.8 pips' spread on the benchmark EURUSD pair and zero commissions. With leverage up to 30x for forex and tools like Profit and Trading Calculators, traders can optimize entry/exit strategies and manage risks effectively. These tools allow users to forecast profits, evaluate trading costs, and set informed Stop Loss and Take Profit levels.

By combining strategic planning, risk management, and the instrument best suits you, you can finally make profits with the broker over time.

About WikiFX

WikiFX is an encyclopedia of forex brokers, with the world's largest database covering essential aspects of brokerage companies. For more detailed information like trading conditions, regulatory status, historical performance, risk ratings and community interactions about this broker, you can visit Octa WikiFX in the specific page for further exploration.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator