简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

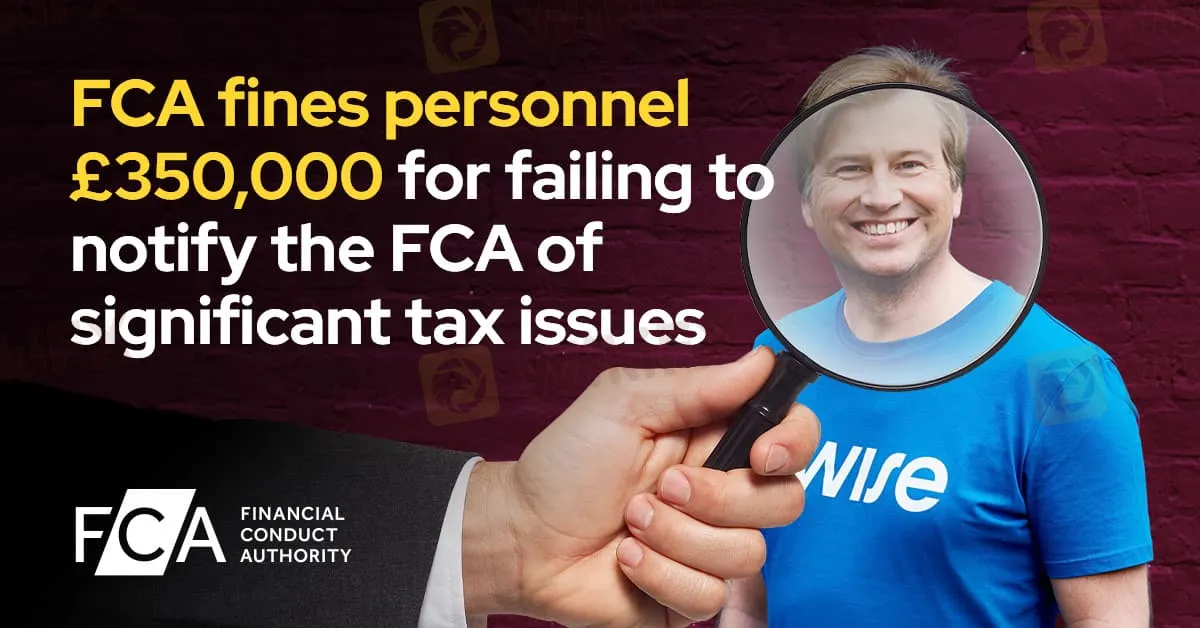

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

Abstract:This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

In a recent move emphasizing regulatory transparency and accountability, the Financial Conduct Authority (FCA) imposed a £350,000 fine on Kristo Käärmann, CEO of Wise plc and senior manager at Wise Assets UK Ltd. This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

The penalty originates from tax-related issues dating back to 2017, when Mr. Käärmann sold shares worth £10 million, incurring a capital gains tax liability. However, he failed to notify HM Revenue & Customs (HMRC) of this liability, a move deemed “deliberate” by HMRC. In February 2021, Mr. Käärmann paid a substantial fine of £365,651 to HMRC, and in September 2021, he was added to HMRC's public tax defaulters list.

According to the FCA, the period between February and September 2021 was critical in its assessment of Mr. Käärmann's “fitness and propriety” as a senior manager. The FCA determined that he failed to appropriately assess the significance of these tax issues and did not inform the FCA, despite his knowledge of the matter for over seven months. Such a lapse, the FCA stated, highlights a failure to maintain the level of accountability expected of senior executives in financial institutions.

Therese Chambers, Joint Executive Director of Enforcement and Oversight at the FCA, underscored this sentiment, stating, “We, and the public, expect high standards from leaders of financial firms, including being frank and open. It should have been obvious to Mr. Käärmann that he needed to tell us about these issues which were highly relevant to our assessment of his fitness and propriety.”

At the time, Mr. Käärmann held significant roles across Wise entities regulated by the FCA, including his position as CEO of Wise plc and as both Chief Executive (SMF1) and Executive Director (SMF3) of Wise Assets UK Ltd. The FCA noted that the original fine was set at £500,000, yet Mr. Käärmanns willingness to resolve the matter early qualified him for a 30% reduction, resulting in the final fine of £350,000.

This penalty underscores the FCAs commitment to ensuring that senior figures within regulated financial firms adhere to rigorous standards of conduct, especially concerning transparency with both tax obligations and regulatory oversight.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Prop Trading vs. Algo Trading: How They Shape Modern Markets

This article will provide an overview of these two strategies, examining what sets them apart and why each has its place in today’s markets.

FCA Fines Metro Bank £16.7 Million for Lapses in Anti-Money Laundering Controls

The Financial Conduct Authority (FCA) has imposed a £16,675,200 fine on Metro Bank PLC due to critical shortcomings in its financial crime prevention systems. Between June 2016 and December 2020, Metro Bank’s inadequate transaction monitoring controls left more than 60 million transactions, valued at over £51 billion, exposed to potential money laundering risks.

Tradeweb and TSE Partnership Enhances Access to Japanese ETFs

Tradeweb and Tokyo Stock Exchange partner to improve ETF liquidity for global investors, offering streamlined access and competitive trading in Japan’s ETF market.

ATFX Connect Partners with Your Bourse for Enhanced Broker Liquidity

ATFX Connect collaborates with Your Bourse to boost broker liquidity options, offering tailored solutions, advanced tools, and real-time reporting capabilities.

WikiFX Broker

Latest News

Is WesternFX a Reliable Broker?

ATFX Expands LATAM Presence with New Mexico Office

CySEC Warns against Public Review Websites

Former Alameda Executives Hand Over Assets in FTX Creditor Recovery Effort

Tradeweb and TSE Partnership Enhances Access to Japanese ETFs

ThinkMarkets Expands Mobile Integration with TradingView

Binance Ordered to Unmask Account Holder in €186,000 Crypto ‘Pig Butchering’ Scam

Will Trump’s Second Term Drive Economic Growth Through Tax Cuts?

InstaForex Lucky Trader Contest

What Happens if A Broker Goes Bust?

Currency Calculator