Score

GKFX

United Kingdom|10-15 years|

United Kingdom|10-15 years| https://www.gkfx.eu

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Argentina 3.16

Argentina 3.16Contact

Licenses

Licenses

Licensed Institution:Trive Financial Services UK Limited

License No.:501320

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomAccount Information

Users who viewed GKFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

Most visited countries/areas

Turkey

gkfx.eu

Server Location

United States

Website Domain Name

gkfx.eu

Server IP

107.154.80.92

gkfxcambodia.com

Server Location

United States

Website Domain Name

gkfxcambodia.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2019-03-06

Server IP

69.171.246.9

gkfx.de

Server Location

United States

Website Domain Name

gkfx.de

Server IP

107.154.215.92

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Company Name | GKFX(Also named Trive) |

| Registered Country/Area | United Kingdom |

| Founded Year | 2005 |

| Regulation | Suspicious Clone |

| Minimum Deposit | £1000 |

| Market Instruments | Currencies,Indices,Commodities,Stocks |

| Spreads&commissions | As low as 0 pip |

| Trading Platforms | Trive app(MT4/5 based platform) |

| Demo Account | Available |

| Customer Support | Email:hello@trive.com |

| Deposit & Withdrawal | Bank transfer,debit/credit card,third-party payment(through app) |

| Educational Resource | Learning articles |

Overview of GKFX

GKFX, also known as Trive, is a financial services company based in the United Kingdom, established in 2005. It operates under suspicion as a clone entity and requires a minimum deposit of £1000.

GKFX offers a variety of market instruments, including currencies, indices, commodities, and stocks, through their accounts. Their spreads and commissions are competitively low, starting at 0 pip. The company provides the Trive app, a trading platform based on MT4/5, and also offers a demo account.

Customer support is accessible via email at hello@trive.com. For deposit and withdrawal, options include bank transfers, debit/credit cards, and third-party payments through the app. Additionally, GKFX provides educational resources in the form of learning articles.

Is GKFX Limited Legit or a Scam?

The Financial Conduct Authority (FCA) has identified Trive Financial Services UK Limited as a suspicious clone operating in the United Kingdom. The company, using license number 501320, holds an Institution Forex License. It offers a regulated situation of trading.

Pros and Cons

| Pros | Cons |

| Variety of Trading Instruments | Suspicious Clone Status |

| Competitive Spreads and Commissions | High Minimum Deposit |

| Established Trading Platform | Lack of License Transparency |

| Educational Resources | Limited Customer Support Options |

| Multiple Payment Options | Potential Risk for Investors |

Pros of Trive Financial Services UK Limited:

Variety of Trading Instruments: Offers a wide range of market instruments including currencies, indices, commodities, and stocks, catering to diverse trading interests.

Competitive Spreads and Commissions: The company advertises spreads and commissions as low as 0 pip, which can be advantageous for traders seeking cost-effective trading options.

Established Trading Platform: Utilizes the Trive app, which is based on the popular and widely-used MT4/5 platform, providing a familiar and reliable trading experience.

Educational Resources: Offers learning articles, which can be beneficial for new traders or those looking to expand their knowledge of trading.

Multiple Payment Options: Supports various methods for deposit and withdrawal, including bank transfers, debit/credit cards, and third-party payments, offering convenience for users.

Cons of Trive Financial Services UK Limited:

Suspicious Clone Status: Identified as a suspicious clone by the Financial Conduct Authority, raising significant concerns about its legitimacy and operational integrity.

High Minimum Deposit: A minimum deposit of £1000 is relatively high, which may not be suitable or accessible for all traders, especially beginners.

Lack of License Transparency: The absence of a clear expiry date for the license and the classification as a “No Sharing” license type may indicate potential regulatory issues or lack of transparency.

Limited Customer Support Options: Customer support seems to be limited to email, which might not be sufficient for immediate or complex issues that traders often face.

Potential Risk for Investors: Given its status as a suspicious clone and the uncertainties surrounding its regulatory compliance, there is a heightened risk for investors, particularly in terms of security and protection of funds.

Market Instruments

The market instruments offered by Trive Financial Services UK Limited include:

Currencies: This includes trading in various global currency pairs, allowing investors to speculate on the exchange rates of different currencies.

Indices: Trading in indices provides an opportunity to speculate on the performance of specific sections of the stock market, typically representing a portfolio of top-performing company stocks within a particular market.

Commodities: This encompasses trading in various physical goods such as precious metals, oil, and agricultural products.

Stocks: Involves trading shares of individual companies, allowing traders to invest in and speculate on the performance of these companies.

How to Open an Account?

Opening an account with Trive Financial Services UK Limited typically involves the following steps:

Visit the Official Website: Start by navigating to Trive Financial Services UK Limited's official website. This is usually the first step to ensure you are accessing the legitimate platform and avoiding any potential clone or fraudulent sites.

Complete the Registration Form: On the website, look for the option to open a new account, which will typically lead you to a registration form. Fill in the required details, which usually include personal information such as your name, address, email, and contact number. It's important to provide accurate information for verification purposes.

Verification of Identity and Residence: To comply with regulatory requirements, you will likely need to verify your identity and residence. This usually involves uploading government-issued identification documents (like a passport or drivers license) and a proof of residence document (such as a utility bill or bank statement). This step is crucial for the Know Your Customer (KYC) process.

Fund Your Account: Once your account is verified, you can proceed to fund it. Trive Financial Services UK Limited offers various funding methods, including bank transfers, debit/credit cards, and third-party payments. Choose the method that is most convenient for you, and deposit the minimum required amount or more, as per your trading needs.

Remember, it's important to read all terms and conditions carefully and understand the risks involved in trading before opening an account with any financial service provider.

Trading Platform

The Trive investment platform offers a user-friendly and intuitive trading experience, suitable for both novice and experienced investors. Key features include:

Quicktrade: Integrated tools for fast and efficient trading.

Intuitive Design: Flexible layout with customizable watchlists and real-time charts.

Easy Monitoring: Track orders and positions easily, with customizable alerts.

Accessibility: Available on both the App Store and Google Play for trading on the go.

Comprehensive Tools: Includes one-click trading, price alerts, and an integrated economic calendar.

Additional Platforms: Supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), Trading Central analysis, and MetaBooster add-ons for an enhanced experience.

Deposit & Withdrawal

Trive Financial Services UK Limited requires a minimum deposit of £1000. This amount is necessary to start trading and is applicable across their various deposit methods, which include:

Bank Transfer: Users can transfer the minimum amount or more from their bank accounts.

Debit/Credit Card: This option allows for quick transactions, with a minimum deposit requirement of £1000.

Third-Party Payment: Through the Trive app, users can also utilize third-party payment systems to meet the minimum deposit requirement.

The £1000 minimum deposit might be relatively high for some traders, especially beginners, and should be considered when planning to open an account with Trive Financial Services UK Limited.

Customer Support

Trive Financial Services UK Limited offers customer support that can be reached via email at hello@trive.com. For those looking to get in touch with their team, their customer service is housed in a central location at Floor 5, The Penthouse, Lifestar, Testaferrata Street, Ta Xbiex XBX1403, in Malta.

This setup suggests a dedicated support team ready to assist with inquiries, account issues, or any other service-related concerns.

However, it appears that their primary mode of communication with clients is through email, which may be a consideration for those who prefer more immediate forms of contact such as phone or live chat.

Educational Resource

Trive Financial Services UK Limited provides a range of educational resources aimed at expanding the knowledge of its users and elevating their investment strategies.

This includes a variety of articles that cover fundamental topics like “How can I invest in stocks?” and “How does the stock market work?”, as well as more focused subjects such as “Benefits of investing in sustainability.” Additionally, they offer insights into thematic investment areas like cybersecurity, 5G technology, and semiconductors.

These resources provide not just basic understanding but also strategic advice on investing in these specific sectors, emphasizing the importance of aligning investments with current technological and industrial trends.

This educational content is likely accessible through their platform, offering valuable information to both novice and experienced investors.

Conclusion

In conclusion, Trive Financial Services UK Limited presents itself as a comprehensive trading and investment platform, catering to a diverse range of investors with its user-friendly interface, wide array of market instruments, and competitive spreads.

Despite concerns over its regulatory status as a suspicious clone, the platform offers a variety of deposit and withdrawal methods and a substantial educational resource section focusing on current investment trends. The primary customer support is via email, with operations based in Malta.

FAQs

Q:How can I open an account with Trive?

A:To open an account, visit Trive's official website, complete the registration form, submit necessary identity and residence verification documents, and then fund your account following the verification approval.

Q:What is the minimum deposit required to start trading?

A:Trive requires a minimum deposit of £1000 to start trading on their platform.

Q:What are the deposit and withdrawal options available?

A:Trive supports various methods including bank transfer, debit/credit card transactions, and third-party payments through their app.

Q:Is there customer support available?

A:Yes, customer support can be reached via email at hello@trive.com, with their support team based in Malta.

Q:What educational resources does Trive provide?

A:Trive offers educational articles on basic investment concepts and thematic investment areas such as cybersecurity, 5G technology, and semiconductors.

Q:What trading platforms does Trive use?

A:Trive uses an intuitive and user-friendly platform available on both web and mobile. It also supports popular platforms like MetaTrader 4 and MetaTrader 5, along with additional tools like Trading Central and MetaBooster for enhanced trading experiences.

Keywords

- 10-15 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News GKFX changed its name to Trive, and the original website is unavailable

Back in October 2022, Turkey's Global Kapital Group(GKG) restructured some of its operations, which included the transfer of ownership of its main FX brokerage businesses GKFX and GKPro to an Amsterdam based company called Trive Financial.

2023-03-09 08:39

News WIKIFX REPORT: U.S. oil output rises 1.7% June to highest since April 2020

U.S. crude oil production rose in June by 1.7% to its highest since April 2020, according to a monthly report from the U.S. Energy Information Administration on Wednesday last week

2022-09-06 19:09

Review 16

Content you want to comment

Please enter...

Review 16

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

红高粱

Hong Kong

I was introduced by someone in May 2020. I invested in the "GKFX Prime" platform, and 142000 of funds were remitted to a trading company in Xiantao City, Hubei. Doctor, (what the introducer said) has 13 years of experience in foreign exchange trading, 20% retracement mechanism for risk control and so on. I lost money in the first month (I don't understand, it's all the introduction, remittance, cash withdrawal, operation), Chen gave me 2,400 yuan at 2% monthly interest, which made me grateful. The withdrawal in July is 1,000 US dollars, and the withdrawal in August is 2,000 US dollars. It started to lose money in September, and the highest monthly compensation was 45% without withdrawing, looking for various reasons not to close the position (the public account of Capgemini was discovered in October of the same year, and it was closed due to too many complaints). By the 29th day of the twelfth lunar month before the Spring Festival, all the money will be made. After the Spring Festival in 21 years, I asked the introducer to ask for an explanation. Wang said that he had communicated with Mr. Chen in Hong Kong, and he would not let you lose money. In 21 years and 3 months, he gave about 1.5W. In October, I heard that the Shanghai office of Jiekai Financial was closed for unknown reasons (please answer, thank you very much!). Later, Wang said that Hong Kong Chen Xi had an accident and could not be contacted. Pure Nima gang liars. I implore the platform to expose it and help me recover my losses. Everyone should take this as a warning.

Exposure

2022-05-09

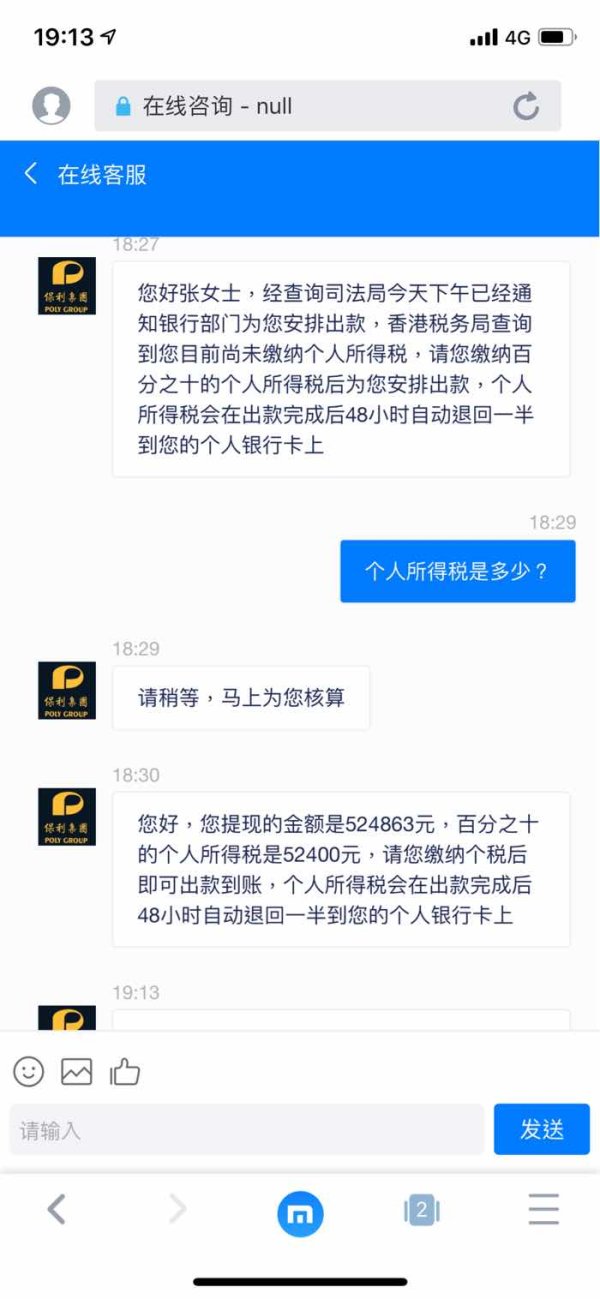

Linda66460

Hong Kong

This is a scam, a romance scam. Inducing you step by step. Pay the margin first and then personal income tax.

Exposure

2021-12-02

Grace S

Hong Kong

A person I knew from social platform recommended this broker to me. I was cheated. The person even induced me to open more positions. You must be careful

Exposure

2021-03-02

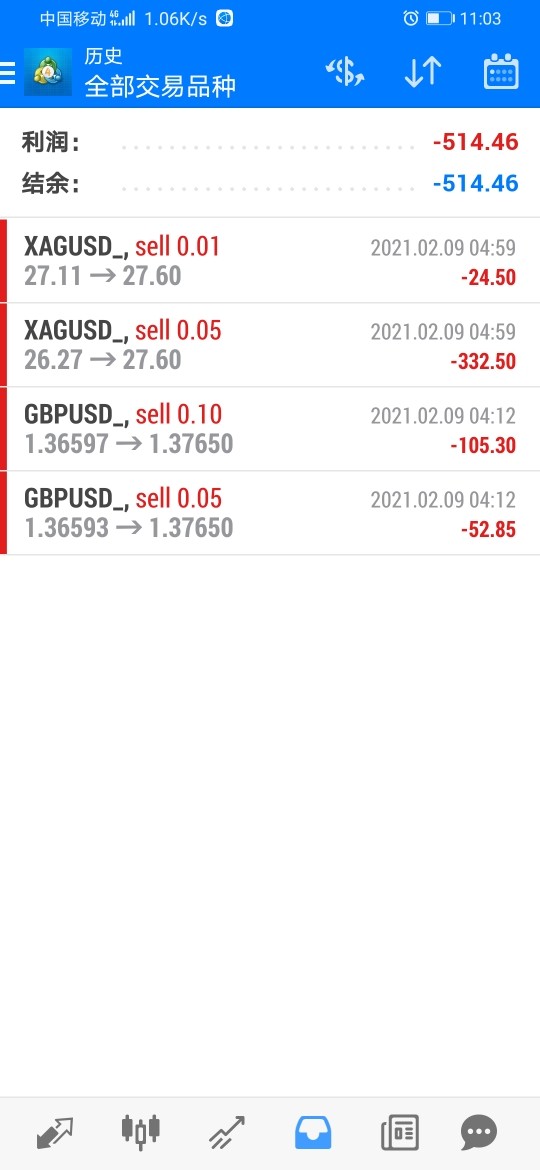

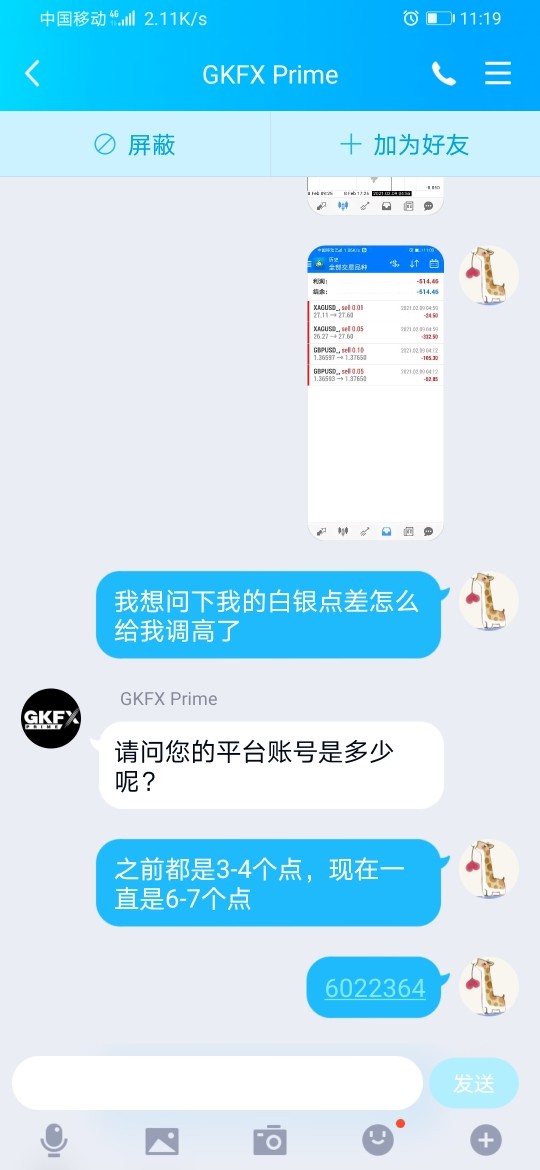

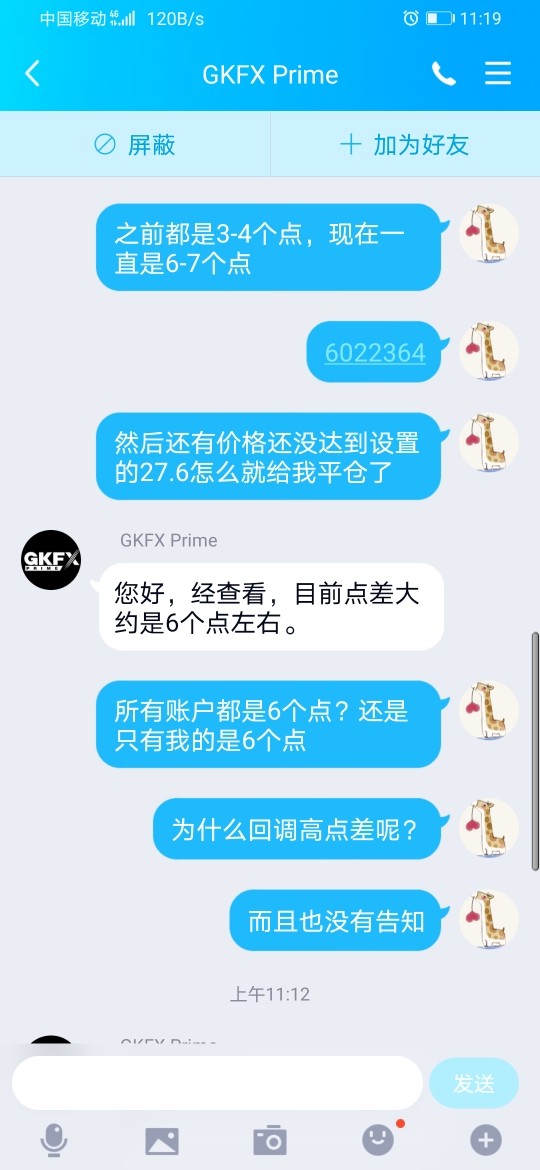

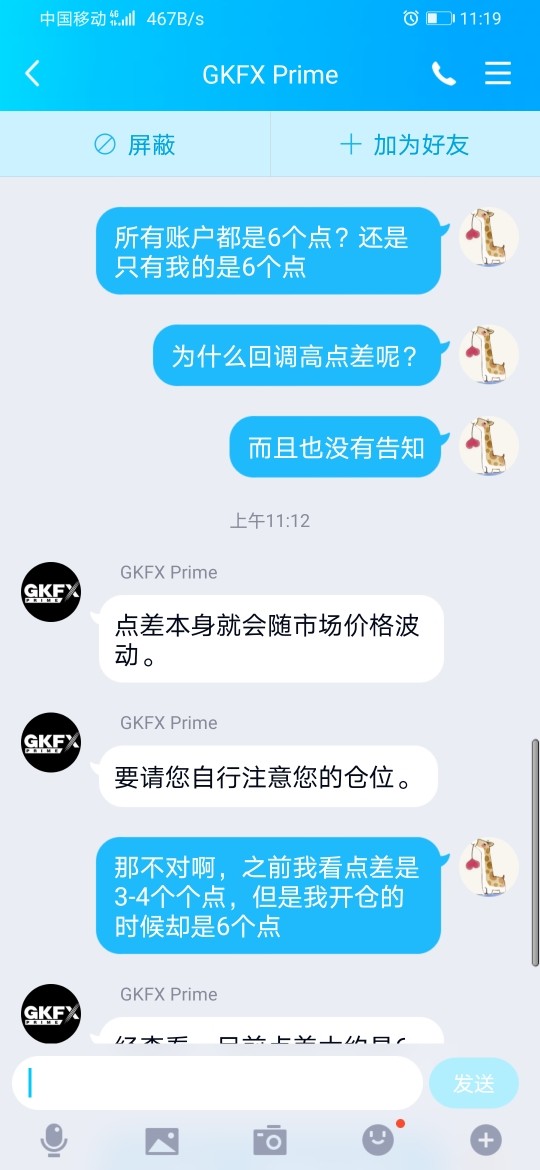

FX3520007468

Hong Kong

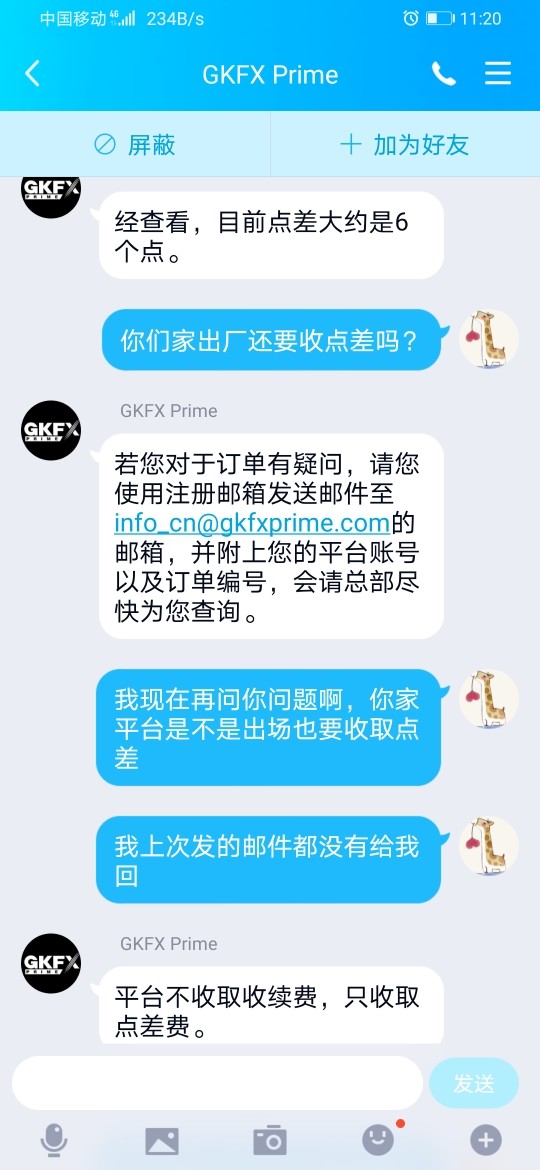

There is a slippage of 6 pips of XAG/USD. But the figure here is accurate to two decimal places so one pip equals to $50. I set the SL at 27.60 while activated at 27.55.

Exposure

2021-02-09

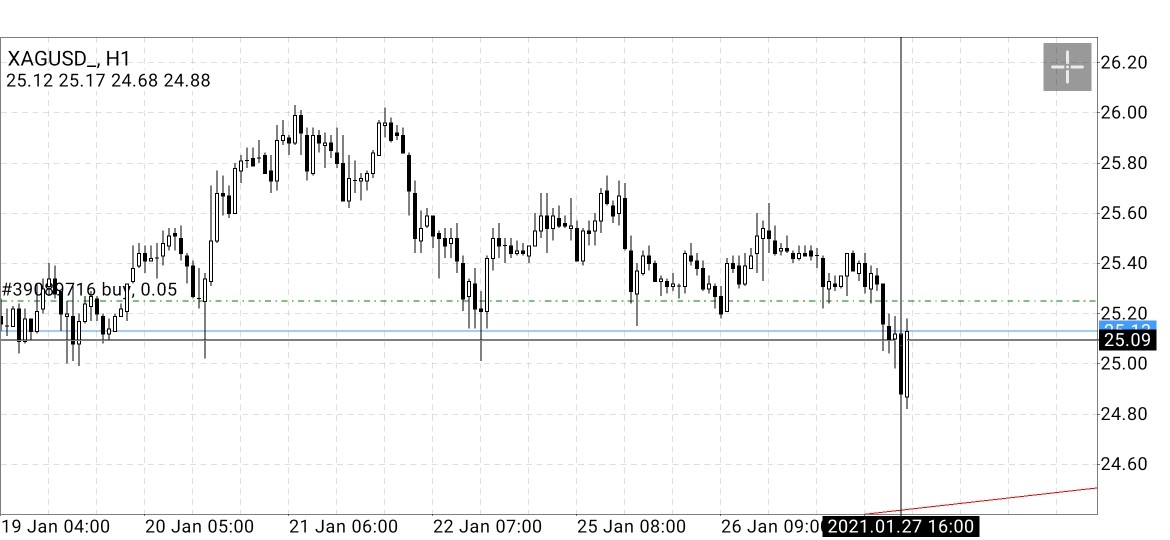

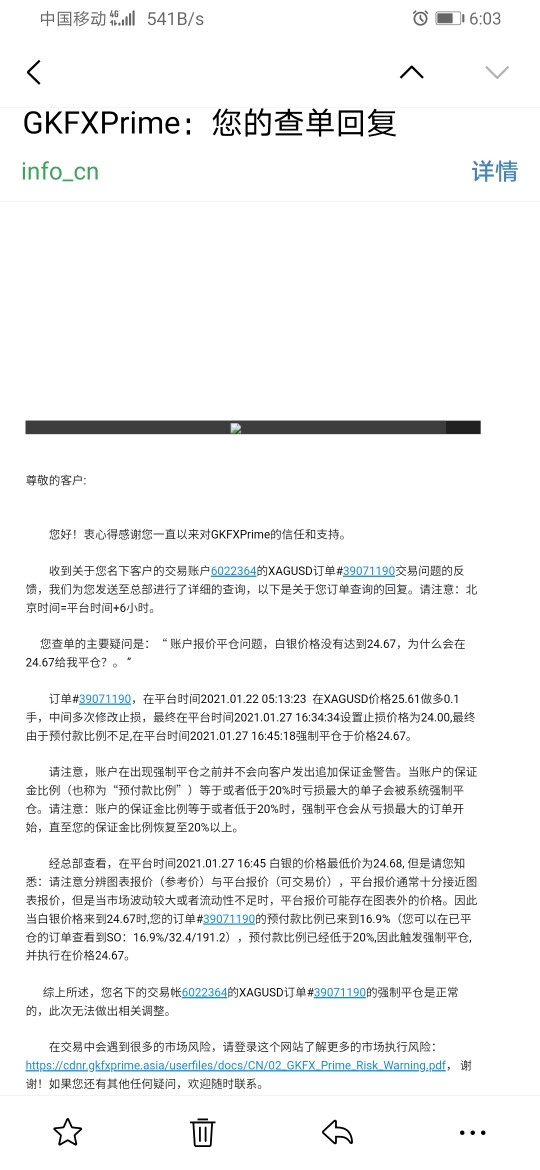

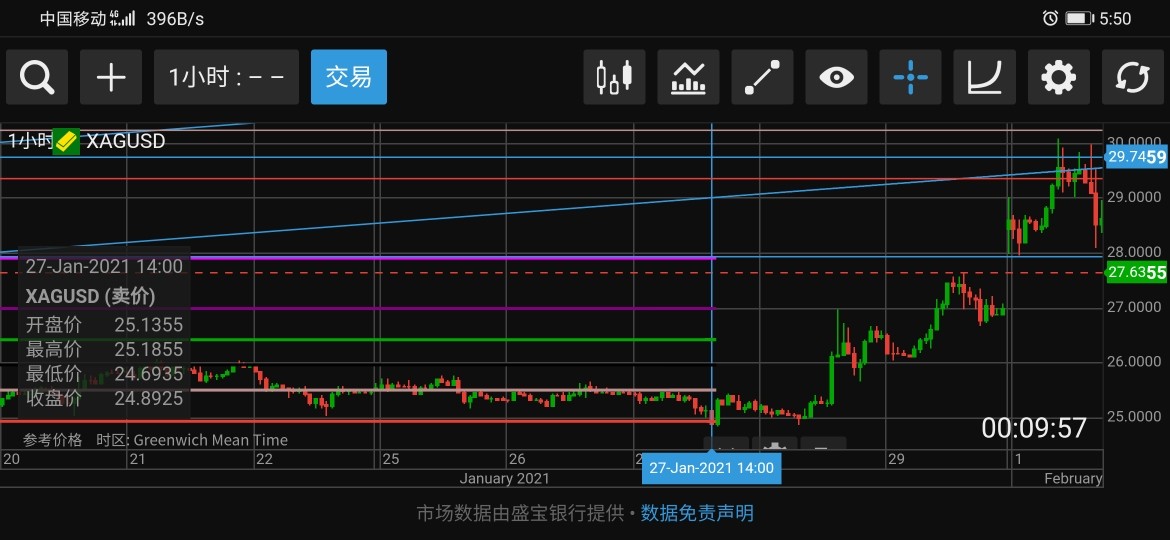

FX3520007468

Hong Kong

They didn’t reach 24.67 but customers’ position was closed at 24.67. Brand deception.

Exposure

2021-02-02

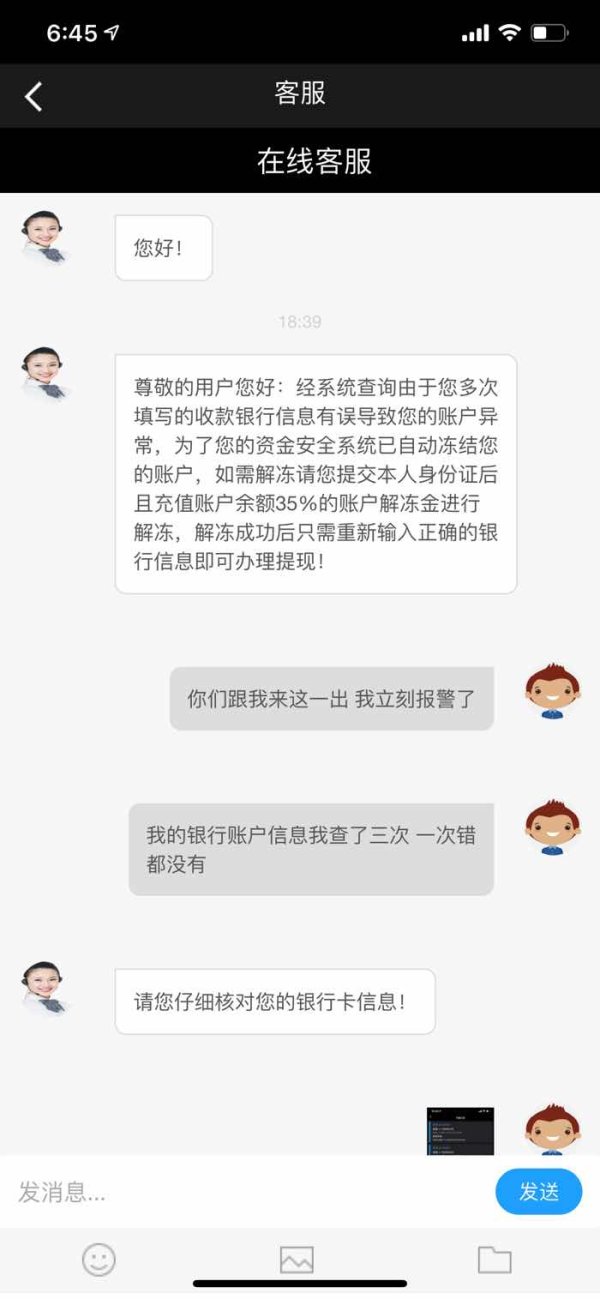

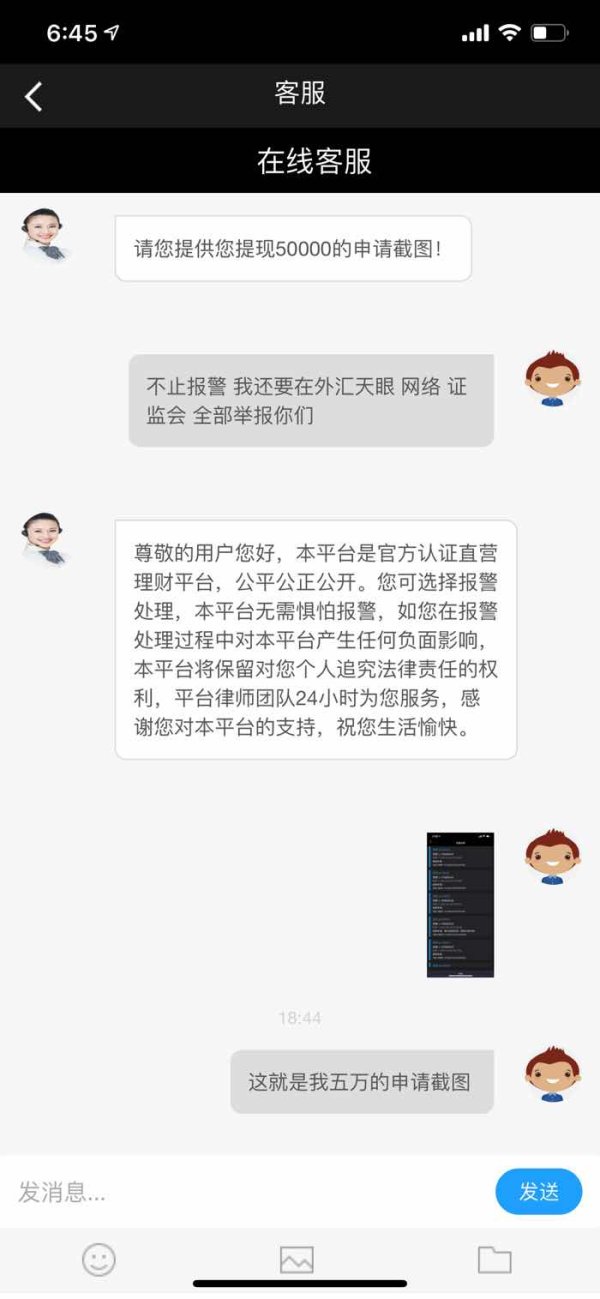

FX2058509833

Hong Kong

My account was frozen cuz they said my bank card number was wrong. And they asked me to deposit the same amount of my account balance to unfreeze my account. After that, they continued asking me to add money for no reason.

Exposure

2020-12-04

FX3228016583

Hong Kong

Can't withdraw. You have to pay margin and rick fund. Induce you to deposit step by step.

Exposure

2020-11-05

FX1789284519

Vietnam

They pull candles to burn the client account. No dividends. And they blocked guest accounts.

Exposure

2020-10-01

FX4781961532

Hong Kong

Is there anybody cheated by this platform? I was swindled out of ¥93,000

Exposure

2020-09-29

若$愚

Hong Kong

I wanna expose GKFX for I can’t withdraw without adding funds. Fraud platform.

Exposure

2020-08-27

攒钱买辣条

Hong Kong

The customer service of GKFX said my band card was illegal and asked me to pay the insurance as I should use the third party payment.

Exposure

2020-08-22

FX2629199858

Hong Kong

I was asked yo pay margin since my account was wrong, which I didn’t believe. Now the the fraudulent service is disappeared.

Exposure

2020-05-21

FX2629199858

Hong Kong

I have been applying for the withdrawal since April 30th, while the service kept holding off with such excuse as May Day or long queue, saying that I could become the VIP to tap the fund. On May 15th, with the excuse of system maintenance, it disabled the website. I seriously doubted that I had been blocked.

Exposure

2020-05-20

Lisa jin

Hong Kong

The platform closed ten or so of my orders with the excuses of slippage,wrong instruction and contract expiration.It is a rip-off.I made a loss of 26800 RMB.The platform ignored me completely.

Exposure

2019-10-29

Dantistatic

Morocco

As a user, I can say GKFX is pretty good. The processing of deposits and withdrawals are swift, which meets my needs. The size of the leverage is also selectable, making it quite handy to use.

Neutral

2023-12-13

Sameer Butt

Pakistan

buttsameer624@gmail.com

Positive

2022-09-24