简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

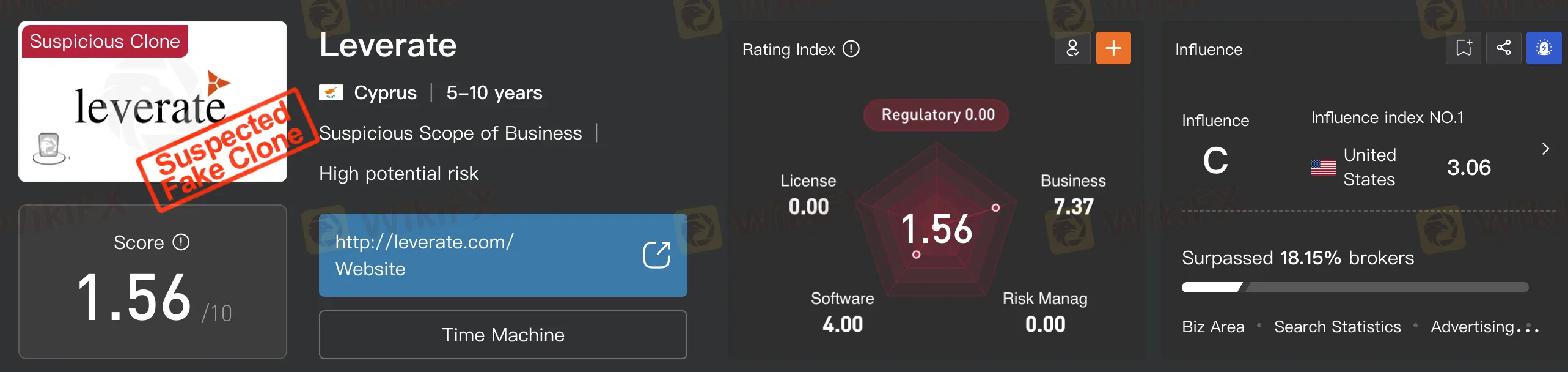

Leverate Losses ICF Membership & CIF Authorization

Abstract:CySEC recently addressed the termination of Leverate Financial Services Ltd.'s membership in the Investors Compensation Fund (ICF), clarifying that clients remain eligible for compensation despite the loss of membership, while highlighting broader regulatory actions and enforcement measures undertaken by the commission.

Cyprus Securities and Exchange Commission (CySEC) recently addressed the Investors Compensation Fund (ICF) and the termination of membership status for Leverate Financial Services Ltd.

According to CySEC, Leverate Financial Services Ltd.'s loss of ICF membership doesn't mean clients covered under the fund lose their right to compensation for previous investment activities. The criteria for compensation as per the Directive remain intact.

The decision to withdraw ICF membership followed CySEC's move to revoke Leverate Financial Services Ltd.'s authorization as a Cyprus Investment Firm. Leverate Financial Services Ltd. voluntarily relinquished its authorization, leading to CySEC's withdrawal of CIF authorization on December 4, 2023. This action barred the company from operating under CySEC's supervision, with no mention of a judicial review, implying finality pending legal developments.

View WikiFXs evaluation on Leverate here: https://www.wikifx.com/en/dealer/9351661905.html

In 2023, CySEC conducted over 700 inspections, both on-site and remote, on supervised entities, imposing fines exceeding $2.2 million to ensure regulatory compliance and protect investors. Thematic audits focused on entities affected by Russia-Ukraine sanctions, examining their business relationships and probing forced transfers of Russian securities.

The Market Surveillance and Investigations Department completed 42 investigations, with one case referred to the Attorney General for possible criminal prosecution, while ongoing inquiries totalled 48 by year-end. CySEC imposed administrative penalties totalling approximately €2.2 million, with one investment firm facing a penalty of €1 million.

Over three years, sanctions totalling €6 million have been imposed, primarily against investment firms for regulatory breaches. In comparison, the UK's Financial Conduct Authority revoked licenses for 1,266 unauthorized firms and issued record fines of £52,802,900, while U.S. regulators collectively imposed fines exceeding $9 billion. CySEC also directed entities to rectify issues in 103 cases, with 35 entities required to comply with anti-money laundering and counter-terrorist financing laws.

Moreover, CySEC revoked or suspended licenses for 19 investment firms and two collective investment undertakings. In an exclusive interview, George Theocharides, CySEC's Chairman, emphasized cryptocurrencies and artificial intelligence as key regulatory concerns, foreseeing their transformative impact on the financial sector.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator