简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

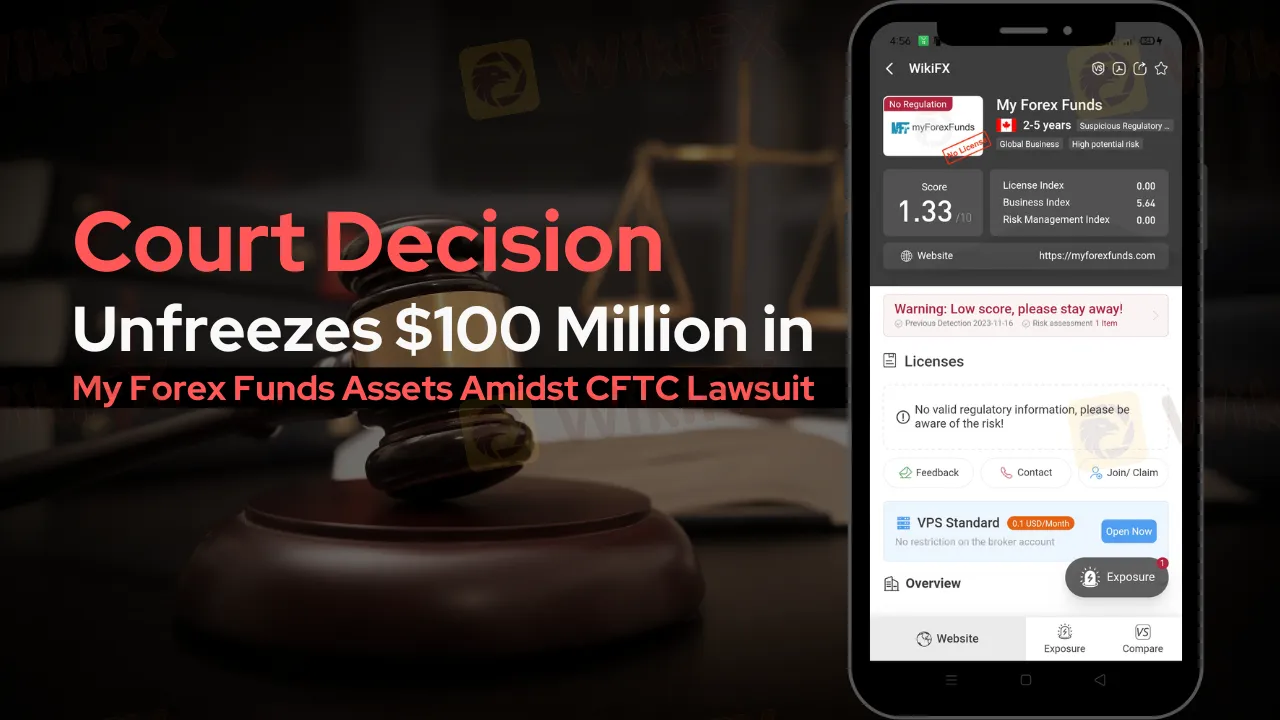

Court Decision Unfreezes $100 Million in My Forex Funds Assets Amidst CFTC Lawsuit

Abstract:Key legal developments in the My Forex Funds vs. CFTC case, including the unfreezing of $100 million in assets. Insights into regulatory challenges for prop trading firms.

In a recent court ruling in New Jersey, My Forex Funds (MFF), a prominent player in the proprietary trading industry, achieved a significant legal victory. The court ordered the unfreezing of approximately $100 million of the company's assets, a decision that marks a turning point in the ongoing legal battle with the US Commodity Futures Trading Commission (CFTC).

Despite this win for MFF, the court has maintained the freeze on $12.08 million of the assets and rejected the proposal for a new temporary receiver. This ruling comes amid allegations by the CFTC against MFF and its CEO, Murtuza Kazmi, for fraudulent activities involving over $300 million.

Key Highlights of the Case

MFF's defense team has vigorously contested the CFTCs allegations, arguing against the agency's jurisdiction and the nature of the statutory restraining order.

The CFTC's complaint highlights various deceptive practices in leveraged retail FX and commodity transactions, including unjust account terminations and unfavorable execution of customer orders.

The case illuminates broader concerns about proprietary trading practices, particularly regarding drawdown rules and revenue generation methods.

MFF, during the period under scrutiny, distributed $137 million to its clients, reflecting its substantial role in the prop trading sector.

MFF's Defense Stance

MFF's defense refutes the CFTC's portrayal of financial transactions, asserting that the funds in question were earmarked for Canadian tax authorities.

The defense also challenges the CFTCs claim regarding the solicitation and acceptance of customer investments, highlighting the firm's compliance with tax obligations.

CFTC's Concerns

The CFTCs investigation into MFF's operational practices raises questions about the transparency and legality of prop firms' income sources and payout mechanisms.

The focus is particularly on how trader payouts were funded and the use of evaluation fees.

Implications for the Proprietary Trading Industry

This case could set a precedent for how prop firms are regulated, especially regarding risk management measures and evaluation fees.

It underscores the need for greater clarity in the regulatory framework governing the proprietary trading sector.

About CFTC

The Commodity Futures Trading Commission (CFTC) is a key regulatory body in the United States, overseeing the futures, options, and derivatives markets. Established in 1974, the CFTC's mandate includes promoting competitive and efficient futures markets while protecting market participants against manipulation, abusive trade practices, and fraud. The CFTC plays a crucial role in ensuring the integrity of the financial markets, a responsibility that extends to overseeing entities like My Forex Funds.

Looking Forward

As the legal proceedings continue, the unfolding case between My Forex Funds and the CFTC remains a focal point in the financial world. It highlights the evolving nature of regulatory challenges in the dynamic and complex domain of proprietary trading. The outcome of this case could potentially reshape regulatory approaches and compliance requirements within the industry, emphasizing the importance of transparency and fair trading practices.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator