简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound goes with the flow. Forecast as of 05.10.2023

Abstract:The GBPUSD is going down despite the positive UK economic reports and the BoE's hawkish stance. The price dropped to a six-month low and might fall deeper. Let us discuss the Forex outlook and make up a trading plan.

The GBPUSD is going down despite the positive UK economic reports and the BoE's hawkish stance. The price dropped to a six-month low and might fall deeper. Let us discuss the Forex outlook and make up a trading plan.

Weekly Pound fundamental forecast

Even though the UK domestic data are quite positive, the negative news from abroad presses down the sterling. The pound versus the US dollar rebounded from a six-month low only because of a weaker-than-expected ADP US jobs report. The Treasury yield went down while the GBPUSD soared. Will the bulls go further?

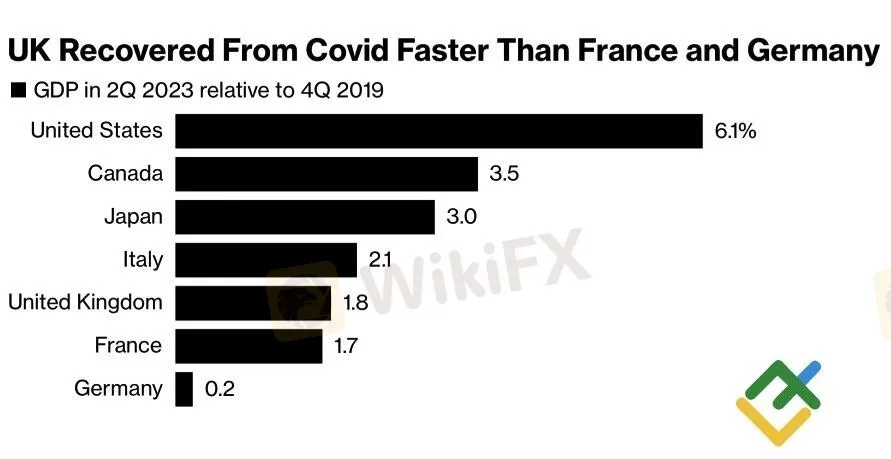

According to the Office for National Statistics, UK GDP by the end of June was 2% higher than previously expected. The UK is no longer the outsider in Europe, and its economy appears to have recovered from the pandemic faster than Germany‘s and France’s.

Such a trend can explain the pound's performance in the first half of the year. The market takes everything into account, and the underestimation of the UK economy‘s strength had a favourable effect on the sterling. When the Bank of England predicts a protracted recession, and it doesn’t happen, investors' optimism increases.

By the way, some of the BoE officials with the regulator‘s opinion. Catherine L. Mann says that her own inflation estimates are higher than the central bank's forecasts. The Bank rate has just reached a restrictive level, and it would be nice to raise it even higher. However, this hawkish speech hasn’t supported the GBPUSD. The derivatives market estimates the chances of a rate hike to 5.5% in 2023 at a modest 22%. This is lower than the 37% chance of a federal funds rate hike. It looks like the Bank of England's monetary tightening cycle has ended, which deprives the pound of its main benefit. In mid-summer, derivatives estimated the BoE rate ceiling at more than 6%. Its decline has sent the sterling down to the lowest level since March.

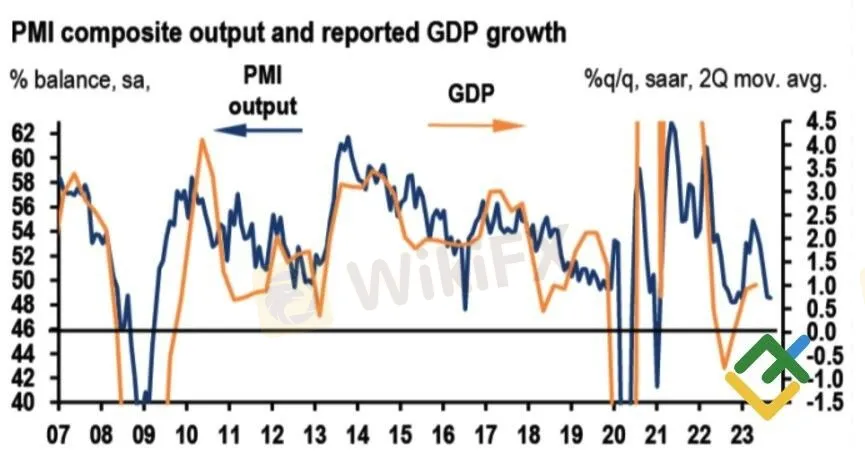

GBPUSD bears are betting on divergence in the economic growth of the UK and the US. The UK composite purchasing managers' index in September decreased from 49.5 to 49.3. Its presence below the critical level of 50 indicates a recession in the economy.

Dynamics of UK PMI and GDP

Despite the rebound of sterling from the six-month low against the US dollar, there will hardly be a full correction, not to mention a bearish trend reversal. As long as the greenback is supported by the rally in Treasury yields, it will be unstoppable. And the US 10-year bond yield can well rise to 5%-5.5%.

Weekly GBPUSD trading plan

One should interpret the US jobs report for September as an opportunity to enter the GBPUSD shorts at favourable prices. Following a weak APD report, the US nonfarm payrolls could be worse than predicted. If so, the US dollar will be corrected down, but the overall trend wont reverse. When the target at $ 1.208 is reached, enter new shorts on a correction with a target at $1.195.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Boosts IBKR Desktop with Advanced Tools

Interactive Brokers upgrades IBKR Desktop with powerful tools like MultiSort, Option Lattice, and enhanced charting, simplifying global trading for all skill levels.

Eightcap Becomes UK’s Dedicated TradingView Broker

Eightcap is now the UK’s exclusive TradingView broker, offering unique benefits like a free TradingView Plus subscription to all UK clients for a seamless experience.

Malaysian Authorities Crack Down on 12M Cross-Border Forex Scam

A sophisticated cross-border Forex investment scam has recently come to light in Malaysia. The Commercial Crime Investigation Department (CCID) of Bukit Aman receiving 51 police reports related to the incident. The scam, which has resulted in total losses nearing RM12 million, involved a network of individuals from Malaysia and Indonesia.

FxPro Launches BankPro: Digital Banking with Trading and Forex

FxPro launches BankPro, a game-changing private digital bank with multi-currency accounts, Visa Platinum cards, and seamless investment & trading features.

WikiFX Broker

Latest News

HTFX Clone Firm Exposed

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

TradeExpert: A Forex Broker Under Scrutiny

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

WikiFX Review: Is IQ Option trustworthy?

IOTA Leads Blockchain Innovation in Southeast Asia by 2025

Currency Calculator