简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EasyProfit

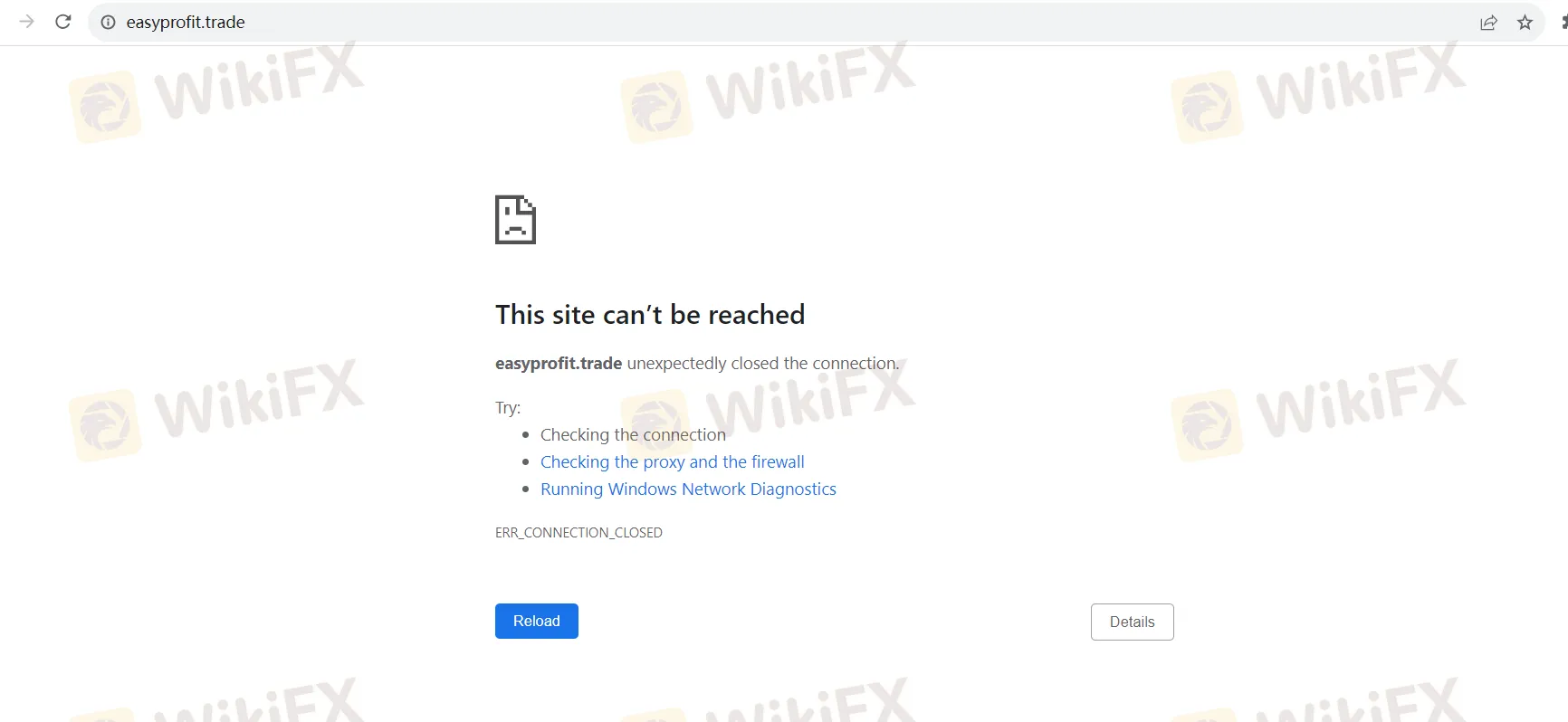

Abstract:EasyProfit is an unregulated brokerage based in China, operating without the oversight and protection provided by financial regulatory authorities. The lack of regulatory backing raises concerns about transparency and investor protection. Unfortunately, the company provides limited information about critical aspects such as the minimum deposit, maximum leverage, spreads, and available trading platforms. This lack of transparency leaves traders in the dark, making it a risky choice for those seeking financial services. While the brokerage offers a variety of tradable assets, including forex, stocks, and commodities, it does so with unclear details regarding account types, potentially high withdrawal fees, and no educational resources. Additionally, the unavailability of the website at the time of this assessment further erodes confidence in its reliability. Potential traders should exercise extreme caution and explore alternative, more transparent options when considering EasyProfit as

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | EasyProfit.trade |

| Regulation | Unregulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Forex, Stocks, Commodities |

| Account Types | Standard, VIP, Premium (specifics unclear) |

| Demo Account | Available |

| Customer Support | Limited to email contact (mail@easyprofit.trade) |

| Payment Methods | Vague information on available methods |

| Educational Tools | Not offered |

Overview

EasyProfit is an unregulated brokerage based in China, operating without the oversight and protection provided by financial regulatory authorities. The lack of regulatory backing raises concerns about transparency and investor protection. Unfortunately, the company provides limited information about critical aspects such as the minimum deposit, maximum leverage, spreads, and available trading platforms. This lack of transparency leaves traders in the dark, making it a risky choice for those seeking financial services. While the brokerage offers a variety of tradable assets, including forex, stocks, and commodities, it does so with unclear details regarding account types, potentially high withdrawal fees, and no educational resources. Additionally, the unavailability of the website at the time of this assessment further erodes confidence in its reliability. Potential traders should exercise extreme caution and explore alternative, more transparent options when considering EasyProfit as their trading platform.

Regulation

Easyprofit is an unregulated broker, which means it operates without oversight from financial regulatory authorities, leaving investors vulnerable to potential risks such as fraud, lack of transparency, and limited protection. Unregulated brokers often lack the safeguards and regulations that protect investors when compared to their regulated counterparts, making them a risky choice for those seeking financial services.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

In summary, while EasyProfit offers a variety of market instruments and opportunities for diversification, its unregulated status, lack of transparency in trading conditions, high withdrawal fees, and absence of educational resources raise substantial concerns about its suitability as a trading platform. Traders should approach this broker with caution and consider alternative options.

Market Instruments

Easyprofit offers a wide range of market instruments, including forex, stocks, and commodities. This diverse selection caters to various trading strategies and risk preferences, providing traders and investors with opportunities in the global financial markets.

Forex: Easyprofit offers a rich and extensive selection of currency pairs, allowing traders to participate in the vast and liquid foreign exchange markets. Whether you're looking to trade major, minor, or exotic currency pairs, Easyprofit provides access to a broad spectrum of global currencies, enabling you to seize opportunities in the ever-fluctuating forex arena.

Stocks: Easyprofit offers an expansive menu of stocks from various global markets, giving traders the ability to invest in some of the world's most renowned companies. From tech giants like Apple and Amazon to traditional stalwarts such as General Electric, you can diversify your portfolio with a wide range of stocks, thereby harnessing the potential for capital growth and dividend income.

Commodities: Easyprofit empowers traders with exposure to the exciting world of commodities, including precious metals like gold and silver, energy resources such as oil and natural gas, and agricultural products like wheat and soybeans. This allows traders to speculate on price movements in these essential resources, potentially profiting from fluctuations in global supply and demand dynamics.

Account Types

Easyprofit despite its questionable reputation, claims to offer different client categories rather than traditional account types. The three categories they describe are as follows:

Standard Client: This category is intended for individuals who have little to no experience with trading and have deposited less than EUR 10,000. Unfortunately, Easyprofit does not provide detailed information about the specific trading conditions for standard clients, such as leverage, spreads, or available trading platforms.

VIP Client: VIP clients are presumably those with more trading experience and have invested more than EUR 50,000. As with the standard client category, Easyprofit does not offer comprehensive information regarding trading conditions for VIP clients. They claim to offer “improved” spreads for this category, but the exact details remain unclear.

Premium Client: Premium clients are experienced traders who have invested a significant amount of money, although the precise threshold is not disclosed. Easyprofit promotes “minimal” spreads for premium clients, but, like the other categories, specifics regarding leverage and other trading conditions are not provided.

Leverage

The provided information about Easyprofit does not specify the exact leverage levels they offer to traders. Leverage in the trading industry typically refers to the ability to control a larger position with a relatively smaller amount of capital. It allows traders to amplify potential gains but also increases the risk of substantial losses.

In the case of Easyprofit, the lack of detailed information regarding leverage is concerning and may raise additional doubts about the transparency and legitimacy of the platform. Reputable and regulated brokers commonly provide clear and specific details about the leverage levels they offer for different trading instruments.

Given the lack of transparency and the warning signs associated with Easyprofit, potential traders should exercise extreme caution and thoroughly research any broker they intend to use, especially concerning critical factors like leverage, before deciding to invest their funds. It is crucial to choose a broker with a transparent and regulated approach to ensure the safety and security of your investments.

Spreads and Commissions

Easyprofit's website lacks transparency when it comes to providing specific details about spreads and commissions. Unlike reputable brokers that offer distinct trading account types with clear variations in these costs, Easyprofit's website does not offer such distinctions.

This lack of transparency concerning spreads and commissions raises concerns about the brokerage's commitment to fair and honest trading practices. Traders typically rely on this information to assess the cost of trading and make informed decisions.

In summary, Easyprofit's failure to provide clear and detailed information about spreads and commissions adds to the overall uncertainty and raises questions about the legitimacy of the brokerage. Traders are advised to be cautious and consider alternative options that offer greater transparency and regulatory oversight.

Deposit & Withdrawal

Easyprofit's deposit and withdrawal processes appear to be associated with several concerning aspects. Here's a description of the deposit and withdrawal processes based on the provided information:

Deposit Process:

Easyprofit's website displays logos of well-known payment methods such as MasterCard, Sofort, UnionPay, and iDeal. However, the availability of these payment methods is uncertain due to the reviewer's inability to register an account and confirm the options. It's essential to note that using reputable and established payment methods is a common practice in the industry.

Withdrawal Process:

The review highlights a significant 5% withdrawal fee associated with all withdrawal methods. This fee is notably high and could significantly impact the profitability of traders. Additionally, the withdrawal information on the website mentions other e-wallets like QIWI, WebMoney, Neteller, PerfectMoney, and Skrill, although their actual availability remains unverified due to the inability to register an account.

Account Maintenance Fees:

Easyprofit imposes hefty monthly account maintenance fees, with standard customers facing an EUR 90 fee. Furthermore, the brokerage charges monthly fees for inactive accounts, escalating to EUR 80 after two months, EUR 120 after three months, and EUR 200 after six months. These fees could pose a financial burden and deter traders.

The lack of clarity surrounding the availability and costs of deposit and withdrawal methods, coupled with high withdrawal fees and substantial account maintenance fees, raises concerns about the overall transparency and cost-effectiveness of Easyprofit's financial processes.

In summary, Easyprofit's deposit and withdrawal processes are marked by a lack of transparency, high withdrawal fees, and significant account maintenance costs. Traders are advised to carefully consider these aspects and explore alternative options with more clarity and competitive fee structures.

Trading Platforms

Easyprofit's website makes a general claim of offering a “trading platform with innovating trading tools and world-class speed execution.” However, the platform is not specified by name, and there is no available link for traders to download the software.

This lack of transparency regarding the trading platform raises concerns about whether such a platform truly exists. Reputable brokers typically offer well-known and established trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are considered industry standards due to their robust features and user-friendly interfaces.

In summary, Easyprofit's vagueness regarding its trading platform, along with the absence of a download link, contributes to the overall opacity surrounding the brokerage's services. Traders are encouraged to approach such uncertainty with caution and to consider alternative brokers that provide clear information about their trading platforms and their features.

Customer Support

The customer support offered by Easyprofit, which relies solely on the email address mail@Easyprofit.trade, displays a concerning lack of transparency and efficiency. The absence of a dedicated phone number and other essential contact details raises questions about their commitment to providing timely and accessible support to traders, reflecting a subpar customer service experience.

Educational Resources

The absence of educational resources on Easyprofit's platform reflects a significant shortcoming for traders seeking to enhance their knowledge and skills in the financial markets. Access to educational materials, such as tutorials, webinars, or market analysis, is a valuable feature offered by reputable brokers to help traders make informed decisions and improve their trading strategies. Easyprofit's omission of such resources limits its ability to support and empower its clients in their trading endeavors, which is a notable drawback for potential investors.

Summary

EasyProfit, an unregulated broker, leaves investors vulnerable to potential risks such as fraud, lack of transparency, and limited protection. The lack of clarity and transparency regarding spreads, commissions, and leverage raises serious concerns about the legitimacy and honesty of the platform. Additionally, the absence of educational resources hinders traders from improving their skills. To add to the uncertainty, the website is currently down, further eroding confidence in this brokerage's reliability. This combination of issues paints a bleak picture, and potential traders should exercise extreme caution when considering EasyProfit as a trading platform.

FAQs

Q: Is EasyProfit.trade a regulated broker?

A: No, EasyProfit.trade is an unregulated broker, operating without oversight from financial regulatory authorities.

Q: What market instruments can I trade with EasyProfit?

A: EasyProfit offers a diverse range of market instruments, including forex, stocks, and commodities, allowing you to participate in various global financial markets.

Q: Are there different account types at EasyProfit?

A: EasyProfit categorizes clients into three categories: Standard, VIP, and Premium, based on trading experience and deposit amounts. However, specific trading conditions for each category are not provided.

Q: What are the withdrawal fees at EasyProfit?

A: EasyProfit imposes a significant 5% withdrawal fee for all withdrawal methods, which could impact the profitability of traders.

Q: Does EasyProfit offer educational resources?

A: No, EasyProfit does not provide educational resources, which may limit traders seeking to enhance their knowledge and skills in the financial markets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Saxo Singapore Discontinues SaxoWealthCare and SaxoSelect

Saxo Singapore will discontinue SaxoWealthCare and SaxoSelect by December 2024, advising clients to withdraw funds and offering alternative investment options.

FP Markets Partners with xsee to Offer Live Trading Signals

FP Markets partners with xsee to provide real-time trading signals, empowering traders with expert strategies and data-backed insights for informed decisions.

WikiFX Broker Assessment Series | Decode Global: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Decode Global, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platforms, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

FunderPro Integrates cTrader for Enhanced Prop Trading Options

FunderPro now offers the cTrader platform, a favored choice among prop firms, to expand trading options for users with seamless integrations and a robust liquidity network.

WikiFX Broker

Latest News

Caroline Ellison Begins Two-Year Sentence for FTX Scandal

FCA Convicts 2 Individuals from CCX Capital & Astaria Group in £1.5M Crypto Scam

Beginner 101: WikiFX’s Guide on How to Choose the Right Broker

Why Do Experienced Traders Care About Forex Spreads?

Saxo Singapore Discontinues SaxoWealthCare and SaxoSelect

Trading is Not Gambling—Unless You Make It So

Polish Financial Regulator Issues Warning on Crypto.com

Octa partnered with "Keeping it Real" Foundation to help Nigerian women

TradingView Expands to Include Irish Stocks from Euronext Dublin

Naga Group Appoints Mike Tyson as its Brand Ambassador

Currency Calculator