简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro Adds 94 UCITS ETFs To Its Platform With Zero Commission

Abstract:eToro adds 94 UCITS ETFs to its platform, offering zero commission and new data insights. Learn more about the benefits of investing in these ETFs and how to access them on eToro.

Online broker eToro has announced that it has added 94 UCITS ETFs to its list of investment instruments, giving its users more options to diversify their portfolios.

UCITS ETFs are exchange-traded funds that comply with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, a set of rules that regulate mutual funds and other investment products in the European Union. UCITS ETFs offer investors exposure to various asset classes, sectors, regions, and themes while ensuring high standards of investor protection, liquidity, and transparency.

The list of new additions includes ETFs like: $IQQQ.DE, $IQQI.DE, $IS3R.DE, $XUTC.DE, $ICGB.DE, $MDAXEX.DE, $IS04.DE, $2B78.DE $ICGA.DE, $VVSM.DE, $QDVH.DE, $G2X.DE, $GC40.DE, $IQQK.DE, $ZPDH.DE, $INDUEX.DE, and $PCOM.DE. These ETFs cover various categories such as technology, healthcare, sustainability, emerging markets, and more.

Zero commission applies to the newly added stocks and ETFs for users where the zero commission policy is offered. Zero Commission means that no additional fees will be charged or added to the raw market spread on your stocks & ETF positions. Also, there are no limits on commission-free positions, and you can buy fractional shares.

The brokerage has recently announced three new data resources that are on all ETF pages on its platform. These data points give traders a load of valuable information and help simplify the world of ETFs.

The three new data insights are Expense Ratio, Prospectus Link, and Annualized Return Chart. These three points are visible on the Stats tab of any ETF.

- Expense Ratio: This shows how much an ETF charges in annual fees as a percentage of its total assets. A lower expense ratio means lower costs for investors.

- Prospectus Link: This provides a direct link to the official document that contains detailed information about an ETFs objectives, strategies, risks, fees, and performance.

- Annualized Return Chart: This displays the historical returns of an ETF over different time periods (1 year, 3 years, 5 years), as well as the average annual return since inception.

About eToro

eToro is a well-known online trading platform that allows users to trade a wide range of financial assets, including stocks, cryptocurrencies, commodities, and more. It is well-known for its user-friendly design and social trading features, which let users observe and copy the actions of expert investors.

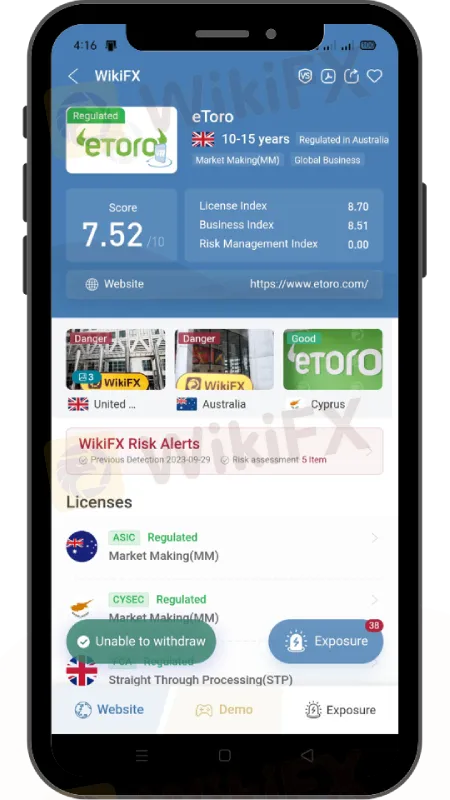

In terms of regulatory status, eToro takes its regulatory duties seriously in order to provide its customers with a safe and secure trading environment. It is regulated by multiple authorities, including:

- Financial Conduct Authority (FCA): eToros operations in the United Kingdom are regulated by the FCA, one of the most reputable financial regulatory bodies globally. This regulation ensures that eToro adheres to strict standards of conduct and transparency.

- Cyprus Securities and Exchange Commission (CySEC): eToros operations in Europe are regulated by CySEC, which oversees the investment services market in Cyprus and the European Economic Area. This regulation ensures that eToro complies with the Markets in Financial Instruments Directive (MiFID) and other relevant laws.

- Australian Securities and Investments Commission (ASIC): eToros operations in Australia are regulated by ASIC, which is responsible for enforcing and regulating company and financial services laws in Australia. This regulation ensures that eToro meets the requirements of the Corporations Act and other relevant legislation.

eToro also operates under other licenses in various jurisdictions around the world. For more information about eToros regulations and licenses, please visit their website.

eToro is constantly striving to improve its platform and offer more choices and opportunities to its users. By adding 94 UCITS ETFs to its list of investment instruments with zero commission, eToro has once again demonstrated its commitment to providing a diverse and accessible trading experience for everyone.

Stay updated on the latest news on eToro, install WikiFX App on your smartphone.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Why Is UK Inflation Rising Again Despite Recent Lows?

October inflation rises to 2.3%, driven by energy costs. Renters face 8% annual hikes, while house price inflation climbs. Interest rates stay elevated.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator