简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UAF

Abstract:United Asset Finance (UAF) is a brokerage firm based in the UK. They offer a wide range of market instruments, including over 50+ forex currency pairs, catering to the preferences of traders interested in various financial assets. UAF provides traders with a proprietary web-based trading platform equipped with real-time market data and advanced charting tools, designed to enhance the trading experience. With multiple account types, such as Gold, Silver, and Standard, traders have the flexibility to choose accounts that align with their trading strategies and preferences.

| Company Name | UAF |

| Headquarters | UK |

| Regulations | No license |

| Market Instruments | Over 50+ forex currency pairs |

| Account Types | Gold, Silver, Maximum Leverage |

| Leverage | Up to 1:400 |

| Spread | From 2 points |

| Minimum Deposit | $100 |

| Deposit/Withdraw Methods | VISA, Mastercard, QIWI, Skrill, Bitcoin, Neteller, WebMoney |

| Trading Platforms | Proprietary web-based platform |

| Customer Support | Phone and email |

| Educational Resources | N/A |

Overview of UAF

United Asset Finance (UAF) is a brokerage firm based in the UK. They offer a wide range of market instruments, including over 50+ forex currency pairs, catering to the preferences of traders interested in various financial assets. UAF provides traders with a proprietary web-based trading platform equipped with real-time market data and advanced charting tools, designed to enhance the trading experience. With multiple account types, such as Gold, Silver, and Standard, traders have the flexibility to choose accounts that align with their trading strategies and preferences.

Is UAF a regulated broker?

It's important to note that UAF operates without a license or regulatory oversight, which poses a significant risk for traders. When trading with an unregulated broker, investors may be exposed to a higher degree of uncertainty and vulnerability. The absence of regulatory supervision means that there is no independent authority overseeing the broker's operations, compliance with financial regulations, or the protection of clients' interests.

One of the primary risks of trading with an unregulated broker like UAF is the potential for fraudulent activities or misconduct. Without regulatory oversight, there is a lack of transparency and accountability, making it easier for unscrupulous brokers to engage in unethical practices such as misappropriating client funds or offering unfair trading conditions. Therefore, traders should exercise extreme caution and thoroughly research the broker's background and reputation when considering trading with an unregulated entity like UAF.

Pros and Cons

UAF offers a diverse range of market instruments, including over 50+ forex currency pairs, enhancing trading versatility. Competitive spreads, starting at 2 points, provide cost-effective trading conditions. Their proprietary platform offers real-time data and advanced charting tools. Multiple account types, such as Gold, Silver, and Standard, cater to various trading strategies. Global customer support through phone and email ensures accessibility.

UAF's primary concern is its lack of regulatory oversight, potentially affecting transparency and security. Limited educational resources hinder trader knowledge and skills development. The fee structure remains unclear, making it challenging to understand trading costs. Trading on the proprietary platform carries risks due to a potential lack of transparency compared to industry-standard platforms. Traders should weigh these factors carefully before choosing UAF as their broker.

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulation |

| Competitive Spreads | Limited Educational Resources |

| Proprietary Trading Platform | Unclear Fee Structure |

| Multiple Account Types | Proprietary Platform Risks |

| Global Customer Support | Regulatory Uncertainty |

Market Instruments

UAF offers an extensive range of market instruments, with over 50+ forex currency pairs available for trading. These pairs include major currencies like EUR/USD, GBP/USD, and USD/JPY, which are highly liquid and widely traded by investors. Additionally, UAF offers exotic currency pairs like the USD/TRY (US Dollar/Turkish Lira) and the EUR/SGD (Euro/Singapore Dollar), providing traders with exposure to less commonly traded but potentially profitable markets.

The main strength of offering such a diverse selection of currency pairs lies in the increased trading opportunities it presents to investors. Traders can diversify their portfolios and take advantage of various market conditions, from the stability of major pairs to the potential volatility of exotic ones. This variety allows traders to implement different trading strategies and adapt to changing market dynamics.

Account Types

UAF offers a diverse range of account types, catering to the varying needs and preferences of traders. These account types are Gold, Silver, and Standard. Each type comes with its own set of features and benefits, allowing traders to choose the one that aligns with their trading strategies.

The Gold account, requiring a minimum deposit of $100, offers maximum leverage of up to 1:400. With a minimum position size of 0.01, it provides access to over 50 Forex currency pairs. The minimum spread starts from just 2 points, making it an attractive choice for traders who prefer lower trading costs and are looking to trade a wide range of currency pairs.

Similar to the Gold account, the Silver account also has a minimum deposit of $100, maximum leverage of up to 1:400, and a minimum spread starting from 2 points. It caters to traders seeking competitive trading conditions and access to diverse Forex currency pairs.

Lastly, the Standard account provides the same trading conditions as the Gold and Silver accounts but underscores the flexibility of leveraged trading. With a minimum deposit of $100, this account type suits traders who are keen on harnessing the power of high leverage to potentially amplify their gains.

How to open an account in UAF?

Opening an account with UAF is a straightforward process that can be completed in just a few steps. Here's how to get started:

Begin by navigating to the official UAF website in your web browser.

Locate the “Open Account” or “Sign Up” button on the website's homepage and click on it.

Complete the online registration form with your personal information, including your name, contact details, and preferred account type.

Upload the required identification and proof of address documents as per UAF's KYC (Know Your Customer) requirements.

Once your account is verified, proceed to deposit funds into your UAF trading account using your chosen payment method.

With your account funded, you can now access the UAF trading platform and begin executing trades in the financial markets.

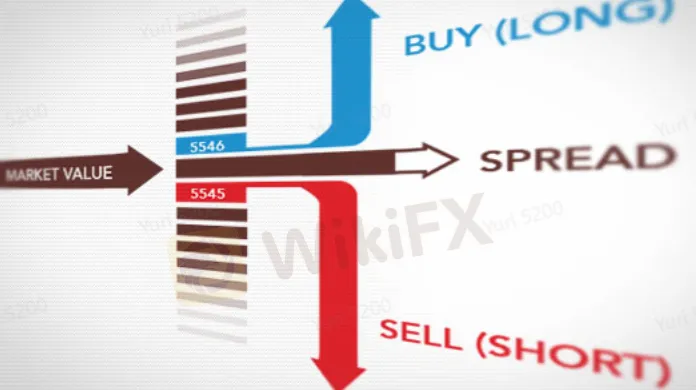

Spread and Commission Fees

UAF offers a competitive minimum spread, starting from as low as 2 points, providing traders with cost-effective trading conditions. This narrow spread can be appealing to traders looking to minimize their trading expenses and capitalize on price differentials in the financial markets.

In addition to spreads, like many other brokers, UAF may apply various fees that traders should be aware of. These fees may include swap rates for positions held overnight, handling fees for specific account activities, and commission fees for certain types of trades. The fee structure at UAF lacks transparency, and there is a need for the broker to provide clearer information regarding its fees. It's essential for traders to review UAF's fee schedule on their website or trading platform to fully understand the costs associated with their trading activities and make informed decisions.

Leverage

UAF provides traders with a maximum leverage of up to 1:400 for margin trading. This level of leverage offers traders the potential to amplify their positions and potentially increase their profits. However, it's important to note that higher leverage also comes with increased risk. While it can magnify gains, it can equally magnify losses, making risk management a crucial aspect of trading on the UAF platform.

Traders should exercise caution and implement effective risk management strategies when utilizing the maximum leverage offered by UAF. This includes setting stop-loss orders, diversifying their portfolios, and not over-leveraging their positions. It's essential for traders to fully understand the implications of using high leverage and only employ it if they have a sound trading strategy and a clear understanding of the associated risks.

Trading Platform

UAF distinguishes itself by providing traders with a proprietary web-based trading platform designed to facilitate their trading activities. This platform comes with several notable features that enhance the trading experience. Traders can access a wide range of financial instruments, including Forex currency pairs, commodities, and indices, directly from their web browsers, eliminating the need for software downloads. The platform also offers real-time market data, advanced charting tools, and a user-friendly interface, making it suitable for both novice and experienced traders.

However, it's important to be aware of the potential risks associated with proprietary trading platforms like UAF's. One concern is the possibility of manipulation or a rigged platform, as these platforms may not have the same level of transparency and oversight as industry-standard platforms like MetaTrader. Traders should exercise caution and conduct due diligence when using proprietary platforms, ensuring they are dealing with a reputable and regulated broker like UAF to mitigate these risks.

Deposit & Withdrawal

UAF offers a diverse range of payment methods to accommodate the preferences of its users. These options include widely recognized credit and debit cards like VISA and Mastercard, making it convenient for traders to fund their accounts with traditional banking instruments. Additionally, UAF also supports digital payment methods such as QIWI, Skrill, Neteller, and WebMoney, providing flexibility for those who prefer online payment solutions.

For those interested in cryptocurrency, UAF extends its payment options to include Bitcoin, allowing traders to deposit and withdraw funds in the popular digital currency. This variety of payment methods not only enhances accessibility but also ensures that users can choose the most suitable and convenient option for their financial transactions on the platform, making UAF an inclusive and versatile trading environment.

Customer Support

UAF offers accessible customer support channels to assist traders with their inquiries and concerns. They provide a phone contact option with two numbers, +44 18 0341 0171 and +74 95 1453 977, offering global reach to their clientele. Additionally, traders can reach out to their customer service team via email at support@united-asset-finance.net. This multi-channel approach ensures that traders have options to seek assistance through their preferred method of communication, enhancing the accessibility and responsiveness of UAF's customer support.

Educational Resources

The absence of educational resources in UAF has a notable impact on the trading experience. Without access to comprehensive educational materials and resources, traders may find it challenging to acquire the knowledge and skills necessary to make informed trading decisions. Educational resources can provide valuable insights, market analysis, and strategies that empower traders to navigate the financial markets effectively. The absence of such resources may hinder traders' ability to develop their trading strategies, understand risk management, and stay updated on market trends, potentially limiting their overall success and confidence in their trading endeavors.

Conclusion

In summary, UAF presents a range of appealing features for traders, including a diverse array of market instruments, competitive spreads, a proprietary trading platform with advanced tools, multiple account types, and global customer support.

However, a significant concern arises due to the absence of regulatory oversight, which could potentially impact transparency and security. Traders considering UAF should weigh the benefits against the risks associated with an unregulated broker and conduct thorough research before making a decision.

FAQs

Q: Is UAF a regulated broker?

A: No, UAF operates without regulatory oversight.

Q: What market instruments are available for trading on UAF?

A: UAF offers a wide range of market instruments, including over 50+ forex currency pairs.

Q: How can I reach customer support at UAF?

A: You can contact UAF's customer support through phone or email using the provided contact details on their website.

Q: What trading platform does UAF offer?

A: UAF provides a proprietary web-based trading platform with features like real-time market data and advanced charting tools.

Q: What types of accounts are available at UAF?

A: UAF offers multiple account types, including Gold, Silver, and Standard, each with different features to suit various trading preferences.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Canadian Watchdog Warns Against Capixtrade

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

ATTENTION! WARNING AGAINST FRAUD BROKERS

The Importance of Backtesting in Forex Trading

Alameda Sues KuCoin to Reclaim $50M in FTX Asset Recovery Drive

The impact of the U.S. presidential elections on gold and Forex prices

The Role of Moving Averages in Trend Trading

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

Currency Calculator