简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ORIENT SECURITIES Information Revealed

Abstract:ORIENT SECURITIES, also known as 上海东证期货有限公司, is a regulated entity in China holding a futures license. It operates under the licensed number 0156 and is affirmed by the China Financial Futures Exchange. The company offers various market instruments, including equity market instruments like A-shares, H-shares, and N-shares, as well as debt market instruments and derivatives. They also provide structured products. ORIENT SECURITIES offers brokerage services, custody and outsourcing, distribution of fixed-income products, corporate finance, and has various business subsidiaries. It provides multiple account types and fee structures. Clients can use the Orient Winner mobile app, THS Financial Terminal, Tongdaxin Financial Terminal, and a MAC version for trading. The company offers educational resources and customer support through a hotline and physical address. Some reviews have raised concerns about difficulties in fund withdrawals, indicating potential issues with the company's financia

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 5-10 years ago |

| Company Name | 上海东证期货有限公司 (Orient Securities) |

| Regulation | Regulated by Chinese authorities, licensed number 0156 |

| Fees & Commissions | Varied fee structures for different types of investments |

| Trading Platforms | 1. Orient Winner (东方赢家) 2. THS Financial Terminal (东方证券同花顺金融终端) 3. Tongdaxin Financial Terminal (东方证券通达信金融终端) 4. Orient Winner for MAC (东方赢家—东方证券网上交易MAC版) |

| Tradable Assets | Equity market instruments, debt market instruments, derivatives, structured products |

| Account Types | Capital accounts, Shanghai and Shenzhen A-share securities accounts, on-market fund accounts, over-the-counter (OTC) trading accounts, simplified accounts for opening off-market fund accounts |

| Demo Account | N/A |

| Islamic Account | N/A |

| Customer Support | Hotline: 021-63325888 Physical Address: 119 Zhongshan South Road, Huangpu District, Shanghai |

| Payment Methods | Bank-to-broker transfers through various channels |

| Educational Tools | Investor education resources, simulation trading |

Overview of ORIENT SECURITIES

ORIENT SECURITIES, also known as 上海东证期货有限公司, is a China-based financial institution with a history spanning 5-10 years. The company operates under regulatory oversight from Chinese authorities, particularly the China Financial Futures Exchange, affirming its legitimacy and commitment to adhering to industry regulations. ORIENT SECURITIES provides a wide array of financial instruments, including equity market offerings like A-shares, H-shares, and N-shares, debt market instruments such as bonds and notes, derivatives like futures and options contracts, and structured products like CDOs and CDSs. This diverse portfolio caters to investors with varying risk appetites and investment objectives, positioning ORIENT SECURITIES as a versatile player in the financial markets.

ORIENT SECURITIES offers multiple account types, including capital accounts, A-share securities accounts, on-market fund accounts, over-the-counter (OTC) trading accounts, and simplified accounts for off-market fund accounts. These account options accommodate diverse investment preferences, allowing clients to choose the most suitable option for their investment activities.

The company employs a fee structure across different investment types, with commission rates ranging from not more than 3‰ for B-shares to 0.2‰ for Shanghai and Shenzhen bonds. The fee schedule includes specific rates for various asset classes, including A-shares, bond trading, fund trading, Hong Kong Stock Connect, and options trading. These fees are essential considerations for investors planning their trading activities.

Pros and Cons

ORIENT SECURITIES offers several advantages, including its status as a regulated and legitimate entity, providing a diverse range of market instruments, a variety of account types, and multiple deposit and withdrawal options. However, there are concerns about fund withdrawal difficulties, relatively high commissions, limited payment methods, lack of specific account type information, and the absence of well-known trading platforms. Additionally, while they provide educational resources, specific details on these resources are not available.

| Pros | Cons |

| Regulated and legitimate entity | Concerns about fund withdrawal difficulties |

| Diverse range of market instruments | Some commissions may be relatively high |

| Offers a variety of account types | Limited payment methods |

| Multiple deposit and withdrawal options | No details provided regarding account types |

| Multiple trading platforms available | No popular trading platforms available |

| Provides educational resources |

Is ORIENT SECURITIES Legit?

Orient Securities is indeed a regulated entity, holding a futures license under the jurisdiction of Chinese authorities. This prestigious institution, also known as 上海东证期货有限公司, operates under the licensed number 0156. The status and legitimacy of the institution's operations are affirmed by the China Financial Futures Exchange, among the largest regulatory agencies in China. The extensive regulation underscores the commitment towards client protection and high standards of service delivery.

Market Instruments

EQUITY MARKET INSTRUMENTS:

Orient Securities offers a range of equity market instruments, including A-shares, which represent shares of Chinese companies listed on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE). Additionally, they provide access to H-shares, representing shares of Chinese companies listed on the Hong Kong Stock Exchange (HKEX), and N-shares, which pertain to shares of Chinese companies listed on foreign stock exchanges, like the New York Stock Exchange (NYSE) and the Nasdaq Stock Exchange. Furthermore, Orient Securities facilitates trading in Global Depositary Receipts (GDRs) and American Depositary Receipts (ADRs), both of which offer ownership in foreign companies.

DEBT MARKET INSTRUMENTS:

Orient Securities caters to the debt market with a variety of instruments, including bonds issued by governments, corporations, and other entities. They also provide short-term debt securities known as notes, with maturities of less than one year, as well as government-issued bills with similar short-term maturities. The firm facilitates trading in municipal bonds issued by local governments and corporate bonds issued by companies of different sectors.

DERIVATIVES MARKET INSTRUMENTS:

In the derivatives market, Orient Securities offers financial instruments such as futures contracts, which bind the buyer to purchase or sell an asset at a predetermined price on a specified date. They also provide options contracts, granting the buyer the right, though not the obligation, to buy or sell an asset at a predetermined price on a specified date. Additionally, the company offers swaps, which enable two parties to exchange payments based on differing interest rates, currencies, or other financial benchmarks.

STRUCTURED PRODUCTS:

Orient Securities provides structured products, including Collateralized Debt Obligations (CDOs), which are financial instruments backed by a pool of debt securities. They also offer Credit Default Swaps (CDSs), which are financial contracts designed to insure against the default of a debt security. Additionally, Orient Securities facilitates trading in Mortgage-Backed Securities (MBSs), financial instruments backed by a pool of mortgage loans. These structured products cater to various investment needs and strategies in the market.

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | No specific mention of trading fees or costs |

| Access to global and domestic markets | Information on trading platforms is not provided |

| Structured products for investment | Limited information on liquidity and market conditions |

Products & Services

BROKERAGE SERVICES: Orient Securities provides brokerage services in securities and over-the-counter (OTC) transactions. The brokerage services include the buying and selling of securities on behalf of clients and OTC business which involves various non-standardized financial contracts directly traded between two parties.

CUSTODY AND OUTSOURCING: The company offers custody and outsourcing Services (IB business). Essentially, this involves the safekeeping of clients' assets and facilitation of administrative functions for the management of those assets.

DISTRIBUTION OF PRODUCTS: Orient Securities enters into distribution agreements to sell fixed-income products. These are investments that provide returns in the form of fixed periodic payments and the eventual return of principal at maturity.

CORPORATE FINANCE: Moreover, Orient Securities offers corporate finance services, including RQFII and WFOE operating in domestic stock options.

SUBSIDIARY BUSINESS: The company has various business subsidiaries that operate under its umbrella. This includes Investment Banking by Dongfang Investment Bank, Fund Management by Huitianfu, Futures by Dongzheng Futures, and Innovative Investments by Dongzheng Innovation.

Account Types

Orient Securities offers a range of account types, including capital accounts, Shanghai and Shenzhen A-share securities accounts, on-market fund accounts, over-the-counter (OTC) trading accounts, and simplified accounts for opening off-market fund accounts through China Securities Depository and Clearing Corporation (中登99, 98).

Pros and Cons

| Pros | Cons |

| Diverse range of account types available | Limited information provided about account types |

| Simplified accounts for off-market funds | Lack of details regarding benefits or features |

Fees & Commissions

Orient Securities offers a diverse range of fee structures for various types of investments. For B-shares, the commission is not more than 3‰ of the transaction amount, starting at 1 USD for Shanghai B-shares and 5 HKD for Shenzhen B-shares, with additional settlement fees and stamp duties. A-shares trading on the Shanghai and Shenzhen Stock Exchanges incurs commissions not exceeding 3‰, starting at 5 CNY, along with stamp duty and transfer fees. Bond trading involves a 0.2‰ commission for Shanghai bonds and Shenzhen bonds, while Shenzhen convertible bonds have a 1‰ commission. Fund trading costs include 3‰ commissions for LOF and ETF funds, with specific fees for off-exchange transactions based on fund company rates. Hong Kong Stock Connect trading fees comprise various taxes and levies, with commission rates not exceeding 0.2%. Third Board stock trading commissions are set at 3‰ for A-shares and 4‰ for B-shares. Lastly, options trading involves handling fees ranging from 1.3 to 3 CNY per contract and settlement fees from 0.3 to 0.6 CNY per contract, with specific rates for ETF and stock options.

Deposit & Withdraw

Orient Securities provides a range of options for depositing and withdrawing funds. Clients can use the Orient Winner mobile app, computer clients like Orient THS or Orient Tongdaxin, or the telephone service 95503 to initiate bank-to-broker transfers. Specific steps depend on the chosen channel, but these options provide various for clients using various banks. It's important to note that the choice of bank may impact the process, with some banks requiring the initial transfer to be made through their own systems, especially if linked with China Merchants Bank, Ping An Bank, or Bank of Ningbo.

Pros and Cons

| Pros | Cons |

| Range of deposit options | Bank choice may impact the deposit process |

| Multiple channels for deposit and withdrawal | Lack of specific details on each channel's procedures |

| Options cater to clients with various banks | Limited types of payment methods |

Trading Platforms

1. Orient Winner (东方赢家): Orient Winner is a comprehensive mobile trading and financial platform developed by Orient Securities. It serves as both a stock trading app and a financial information hub. This platform provides real-time stock market data, secure and fast stock trading, financial management tools, access to the Hong Kong stock market, industry news, and AI-powered customer support. New customers can quickly open accounts through this platform, enabling all Orient Securities users to enjoy a one-stop brokerage service.

2. Orient Securities THS Financial Terminal (东方证券同花顺金融终端): This terminal is an upgraded version of the THS Financial Terminal 1.0, offering a wealth of information services. It supports various functions related to the registration reform in the Shanghai and Shenzhen stock markets, including issuance, market data, and trading. Additionally, it allows for secure code-based login.

3. Orient Securities Tongdaxin Financial Terminal (东方证券通达信金融终端): This is a next-generation financial terminal that builds upon the Orient Securities Tongdaxin market trading system. It features a redesigned interface with more powerful functionalities. It also supports the registration reform in the Shanghai and Shenzhen stock markets and allows for secure code-based login.

4. Orient Winner for MAC (东方赢家—东方证券网上交易MAC版): This MAC version of Orient Winner supports the registration reform in the Shanghai and Shenzhen stock markets, credit trading, and query functions. It offers fast login speeds, low-latency market data, operation, customizable layouts, voice assistant, comprehensive company information, and order placement tools.

Pros and Cons

| Pros | Cons |

| Multiple Trading Platforms Available | No Popular Trading Platforms Available |

| Orient Winner Provides Real-time Data and AI Support | |

| Orient Winner for MAC Offers Features |

Educational Tools

Orient Securities provides various educational tools for investors, including the “Investor Education,” “Investor Services Activities,” “Equity Protection,” “Policy and Regulations,” “Interactive Experiences,” and “Visiting Bases.” These resources aim to support investors in their financial growth and understanding of the investment landscape. Additionally, Orient Securities offers a “Simulation Trading” feature that allows users to experience a realistic trading environment and learn through simulated trading activities.

Customer Support

Orient Securities offers customer support through their hotline at 021-63325888 and their physical address located at 119 Zhongshan South Road, Huangpu District, Shanghai, in the Orient Securities Building.

Reviews

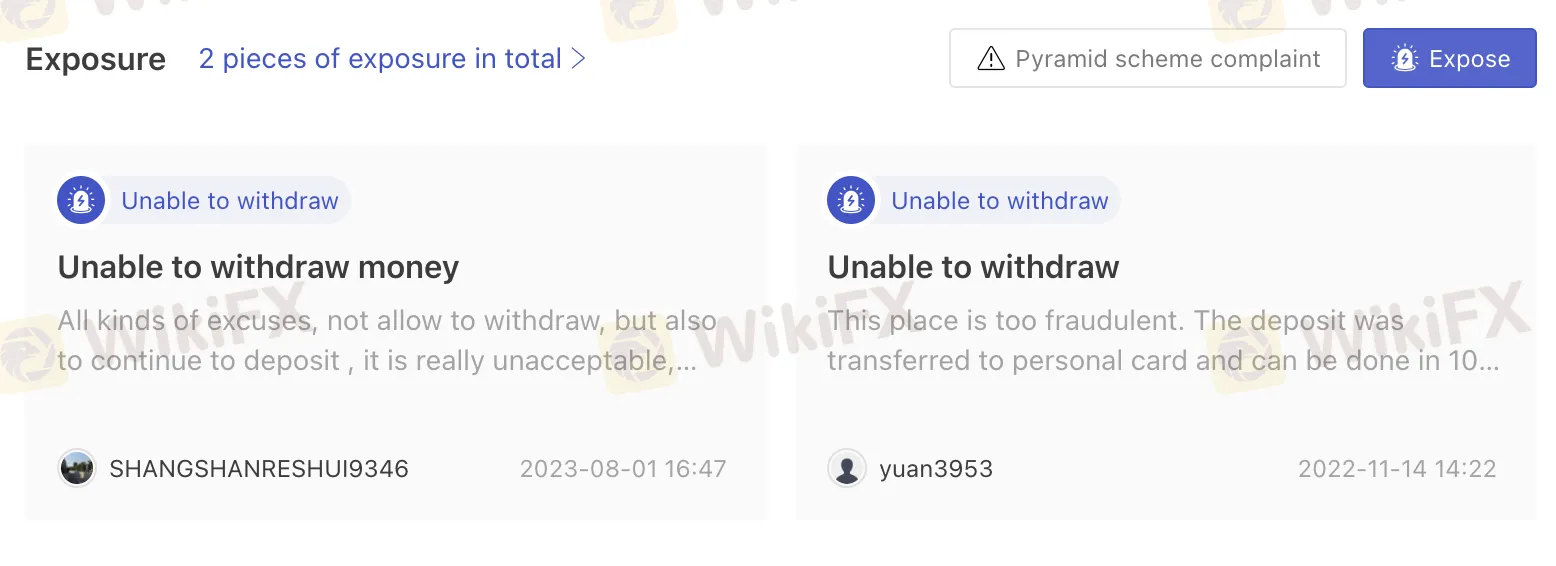

Two reviews of Orient Securities on WikiFX have raised concerns about difficulties in withdrawing funds. In both cases, clients reported being unable to withdraw their money and encountered various excuses and obstacles, such as requests for additional payments or credit points. These complaints highlight frustrations with the withdrawal process, suggesting issues with the company's financial operations.

Conclusion

In conclusion, Orient Securities, also known as 上海东证期货有限公司, operates within the regulated framework of the Chinese financial industry, holding a futures license. It offers a range of market instruments, including equity, debt, derivatives, and structured products, catering to diverse investment needs. The company provides various services, such as brokerage, custody, distribution, corporate finance, and has subsidiary businesses. Orient Securities offers multiple account types and a variety of fee structures for different investments. It provides options for depositing and withdrawing funds, although the choice of bank may impact the process. The trading platforms offered include Orient Winner, THS Financial Terminal, Tongdaxin Financial Terminal, and Orient Winner for MAC. The company also provides educational tools to support investor growth and offers customer support via a hotline and a physical address in Shanghai. However, it is worth noting that there have been concerns raised by clients regarding difficulties in withdrawing funds, which may raise questions about the company's financial operations.

FAQs

Q: Is ORIENT SECURITIES a legitimate company?

A: Yes, ORIENT SECURITIES, also known as 上海东证期货有限公司, is a regulated entity in China, holding a futures license (licensed number 0156) under the supervision of the China Financial Futures Exchange.

Q: What types of market instruments does ORIENT SECURITIES offer?

A: ORIENT SECURITIES provides various market instruments, including A-shares, H-shares, N-shares, GDRs, ADRs, bonds, notes, government bills, futures contracts, options contracts, swaps, CDOs, CDSs, and MBSs.

Q: What services does ORIENT SECURITIES offer?

A: ORIENT SECURITIES offers brokerage services, custody and outsourcing services, distribution of fixed-income products, corporate finance services, and operates various subsidiary businesses.

Q: What are the account types available at ORIENT SECURITIES?

A: ORIENT SECURITIES offers a range of account types, including capital accounts, A-share securities accounts, on-market fund accounts, OTC trading accounts, and simplified accounts for off-market fund accounts.

Q: What are the trading platforms provided by ORIENT SECURITIES?

A: ORIENT SECURITIES offers trading platforms like Orient Winner, THS Financial Terminal, Tongdaxin Financial Terminal, and Orient Winner for MAC, catering to various trading needs and preferences.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

J.P. Morgan triumphs with five top Euromoney awards, recognizing its role as a leader in FX trading with innovative solutions and global market reach.

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

FOREX.com teams up with Kalshi to offer event-based trading on the US Presidential Election, blending political outcomes with market predictions. Find out more about this collaboration.

Hong Kong’s Bold Move: AI Framework & Tax Incentives Set to Boost Fintech Growth

Hong Kong is strengthening its position as a fintech leader with the introduction of new policies that support artificial intelligence (AI) integration in the financial sector and explore tax breaks for virtual asset investments.

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Plus500 reports a strong Q3 2024, with revenue up by 11%, active users rising to nearly 121,000, and average deposits per user climbing to $6,150, fueled by strategic growth.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Can Blockchain Technology Protect Your Money from Risk?

Hong Kong Court Rules in Favor of Investors in JPEX Case

Currency Calculator