简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold buy bias if there is a big US Core PCE miss

Abstract:Gold has been gaining this week on a miss in the US JOLTS job openings print and a miss in the US consumer confidence print on Tuesday. A slowdown in the US job market aligns with the Federal Reserve’s objectives, indicating that the impact of interest rate hikes is beginning to cool the US economy. The miss in these two data points sent gold surging higher on Tuesday, as yields and the dollar fell.

Gold has been gaining this week on a miss in the US JOLTS job openings print and a miss in the US consumer confidence print on Tuesday. A slowdown in the US job market aligns with the Federal Reserves objectives, indicating that the impact of interest rate hikes is beginning to cool the US economy. The miss in these two data points sent gold surging higher on Tuesday, as yields and the dollar fell.

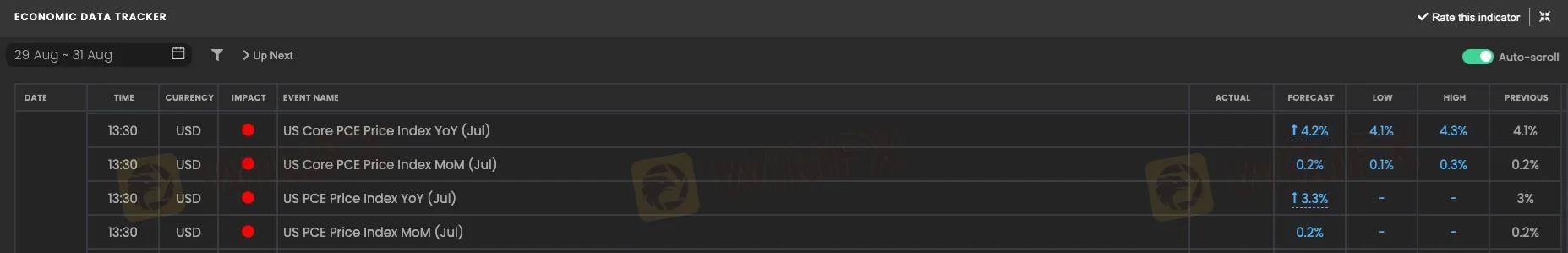

Anticipating Thursday's PCE Data Release and Its Influence on Gold There's another chance for gold to attract significant buyers as we anticipate this Thursdays PCE print. Should the PCE print fall below the lower limit of market expectations, we're likely to witness a drop in yields once more, parallel to the dollar. This scenario will consequently boost gold. The Core PCE print is projected to register at 4.2%, slightly above June's reading of 4.1%. The headline print, on the other hand, is anticipated to reach 3.3%, an increase from the previous figure of 3%. It's important to note that PCE inflation data is the Federal Reserve's favored measure of inflation, thus they'll be closely monitoring this data. Please, see the data expectations given below.

What to expect

Opportunities for purchasing gold are likely to arise if significant discrepancies occur in the data. How do we define discrepancies? Indicators would include a headline figure below 3% and a core reading less than 4.1%. These parameters would ease the burden on the Federal Reserve to increase interest rates, subsequently instigating a decrease in yields and the dollar, while pushing the value of gold upwards. Additionally, data discrepancies as specified could also positively influence the EURUSD, and might even boost US stocks. Nevertheless, market responses are unpredictable, therefore this should always be considered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator