简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Belgium's FSMA Flags 3 Unauthorized Companies

Abstract:Amidst the vigilant efforts of Belgium's Financial Services and Markets Authority (FSMA) to combat financial fraud, the regulatory body has issued a stern warning against three companies allegedly conducting "boiler room" operations, cautioning the public against their unauthorized investment services and aggressive sales tactics.

Belgium's Financial Services and Markets Authority (FSMA) remains steadfast in its financial industry oversight, as evidenced by its recent alert regarding three entities suspected of engaging in “boiler room” operations.

In its latest regulatory advisory, announced on Monday, the FSMA identified IWL Consulting, May Capital Group, and South Pass Partners as entities lacking the authorization to offer investment services within Belgium. Despite this absence of authorization, these companies have been employing assertive sales strategies to target Belgian individuals.

In no uncertain terms, the regulatory body advises individuals to exercise extreme caution when confronted with financial service offers from the entities above. Furthermore, the FSMA strongly discourages any financial transactions involving the account numbers provided by these entities.

Efforts to access one of the blacklisted websites proved futile for Finance Magnates. However, the remaining two websites promote financial service advisory and wealth management solutions. Notably, one of the companies boasts a clientele of 12,000, managing an impressive $5 billion in assets. The other entity alleges a success rate of 78 per cent.

The common thread among boiler room scams involves fraudsters initiating unsolicited contact with consumers, often using telephone communication. These scammers peddle shares or financial products through aggressive and insistent sales tactics.

As elucidated by the FSMA, these fraudulent operations adeptly mimic legitimate service providers, complete with polished websites and official forms. This veneer of professionalism, however, masks their true intent: to deceive unsuspecting victims with fictitious or worthless offerings.

These unscrupulous actors allure victims with promises of substantial gains from nominal initial investments. Regrettably, the mirage of profit quickly dissipates, compelling victims to consider further investment. At this juncture, retrieving the initially invested sum becomes a near-impossible endeavour, often necessitating additional payments. The FSMA underscores that these fraudulent entities exert relentless pressure on victims, coercing them into continuous financial commitment. Ultimately, the victims are left without recourse, unable to recover their invested capital.

This recent cautionary statement from the FSMA is merely one instance in an ongoing campaign against boiler room scams. The regulatory body has previously issued numerous public advisories concerning firms implicated in similar fraudulent financial services, including boiler rooms. In a noteworthy case earlier this year, the US securities market regulator intervened against a company employing boiler room tactics, resulting in the illicit procurement of $35 million from over 300 investors.

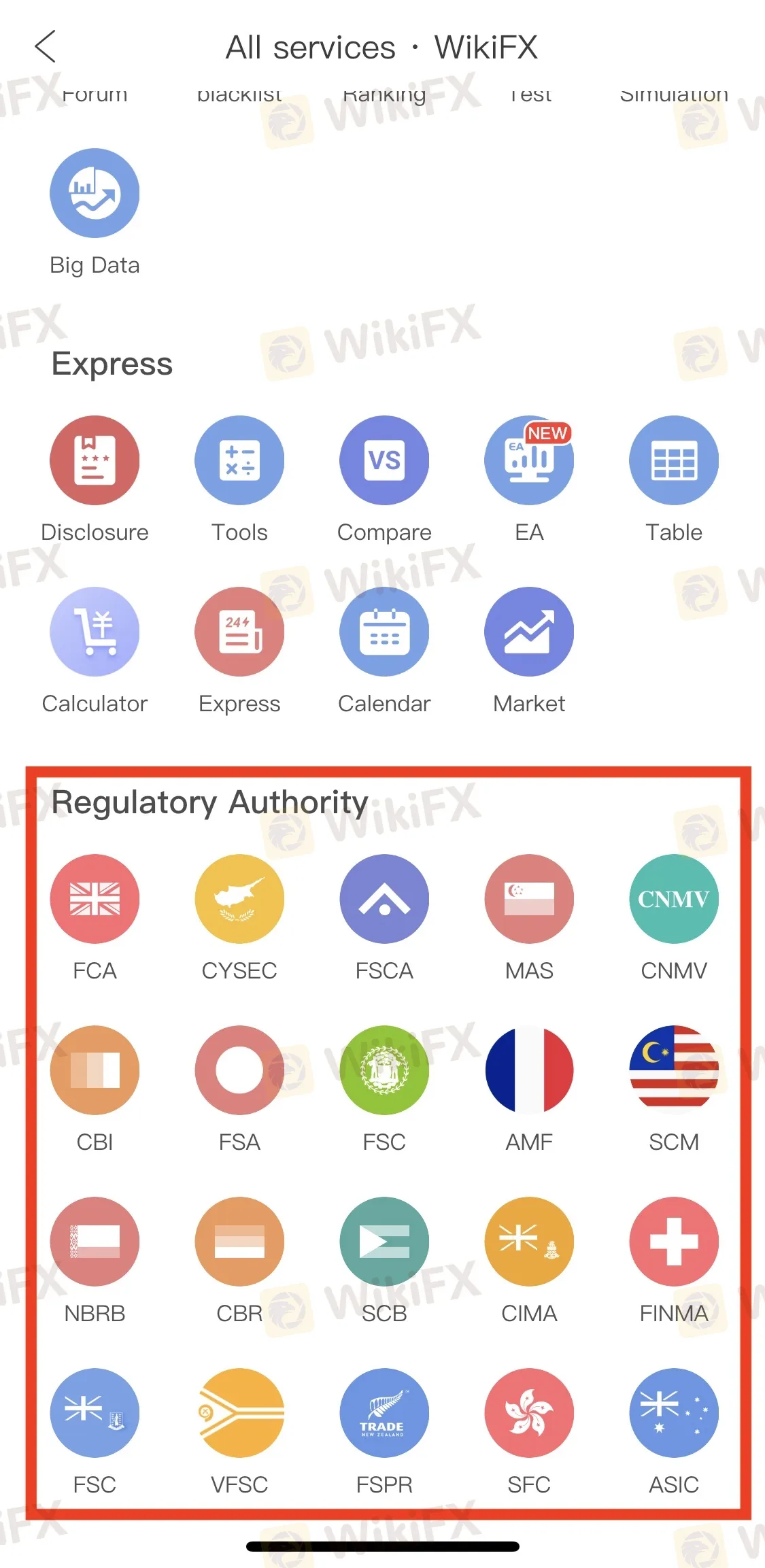

WikiFX is a valuable tool for individuals seeking to choose reputable brokers based on regulatory oversight. By offering a comprehensive database of brokers and their corresponding regulatory affiliations, WikiFX enables users to make informed decisions. Users can easily access information about a broker's licenses, registrations, and compliance with various financial authorities. This functionality empowers investors to prioritize brokers that adhere to strict regulatory standards, ensuring higher trust, transparency, and security in their trading activities.

Download WikiFX's free mobile application from Google Play or App Store, or visit www.wikifx.com before engaging with any forex brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator