简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OctaFX in Malaysia | Revealing the Truth!

Abstract:In this comprehensive article, WikiFX delves into an in-depth exploration of OctaFX, thoroughly examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. By the end of this review, you'll have all the essential information to make an informed decision on whether to choose this platform. Continue reading to uncover the details!

OctaFX, a renowned and award-winning online Forex broker established in 2011, has gained recognition for its global presence, with registrations in St. Vincent and the Grenadines under license number 19776 IBC 2011 and regulation by CySEC (372/18). The company has physical offices in Spain, Cyprus, and Malaysia, further solidifying its reputation in the industry.

As a comprehensive trading platform, OctaFX offers access to an extensive range of trading instruments, including 35 currency pairs, gold, silver, 3 energy assets, 10 global indices, 30 cryptocurrencies, and 150 stocks. Clients can choose between MT4 and MT5 accounts, both of which are well-respected platforms in the trading world.

OctaFX distinguishes itself with its attractive features, such as low spreads, commission-free accounts, fast and free deposit and withdrawal methods, up to 50% margin increase, an exclusive replicated trading platform, and a highly rewarding IB program for referrals.

Notably, the company goes beyond its financial endeavors by actively supporting charitable and humanitarian initiatives, striving to enhance educational infrastructure and uplift local communities in Malaysia and beyond. Recently, OctaFX joined hands with Ideas Academy, a Malaysian educational organization, to spearhead the digitalization of multiple learning centers, benefiting refugees and underprivileged students.

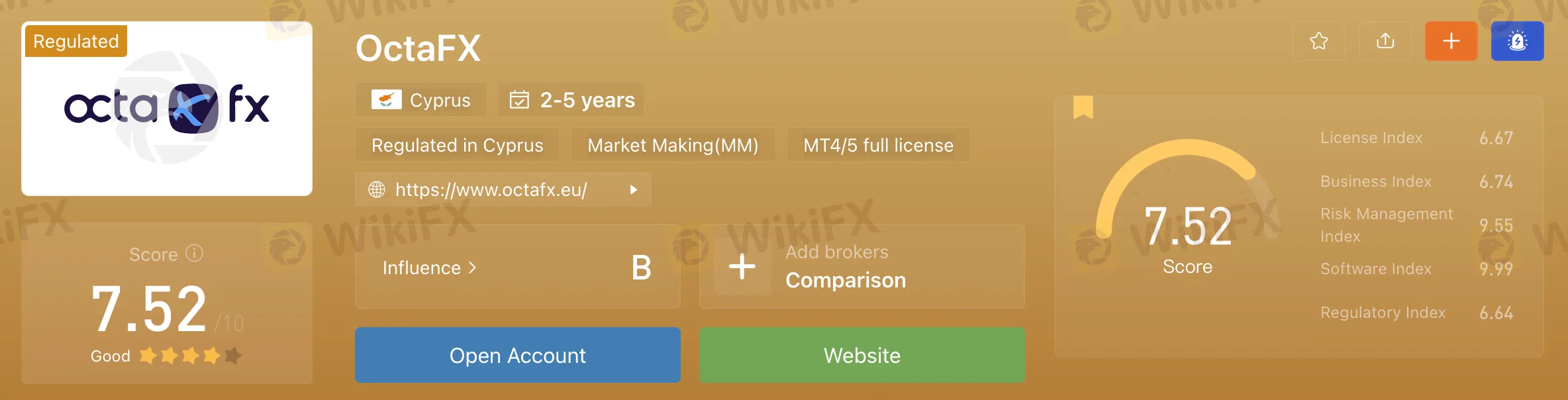

Our WikiFX database states that OctaFX has a fairly high WikiScore of 7.52, meaning it is a reliable broker. Simultaneously, we also verified the license which OctaFX claims to possess.

Accounts offered:

Traders can opt for three types of accounts, namely the MT4 account, which is commission-free and suitable for convenient and swift account setup, providing spreads starting at 0.6. The MT4 account allows trading in 35 currency pairs, gold, silver, 3 energy assets, 4 indices, and 30 cryptocurrencies (stocks are excluded).

On the other hand, the MT5 account caters to innovative traders who prefer intelligent technical analysis. Similar to the MT4 account, the MT5 account is commission-free and grants access to 35 currency pairs, gold, silver, 3 energy assets, 10 indices, 30 cryptocurrencies, and 150 stocks.

OctaFX also accommodates traders requiring an Islamic account that adheres to Sharia principles, eliminating interest while retaining all the key features of regular accounts.

Deposits and withdrawals:

Regarding deposit and withdrawal methods, OctaFX accepts various options, including credit cards, bank wire transfers, e-wallets (e.g., Skrill and Neteller), and digital currencies, ensuring seamless transfers without any commissions or handling fees. However, the availability of deposit and withdrawal methods may vary based on the client's location, necessitating consultation with customer service before opening an account. It's important to note that users from certain countries can use their local banks for payments, though this option is not available for users from Taiwan.

OctaFX prioritizes swift withdrawal processes, returning funds using the same method as the initial deposit, with withdrawal requests processed and approved within 1-3 hours.

Trading platforms:

Regarding trading platforms, OctaFX offers two highly regarded options: MT4 and MT5. Additionally, clients who face difficulties with downloading or using the MetaTrader mobile application can utilize OctaFX's official mobile application (OctaTrader), which directly connects to a MetaTrader trading account.

Customer service:

The OctaFX customer support team is highly accessible, offering 24-hour service from Monday to Friday. Traders can reach them through various channels, including live chat, phone, WhatsApp, Telegram, email, and traditional mail. Additionally, the platform features a helpful FAQ section for those who prefer finding answers on their own.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator