简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Starek

Abstract:Starek is an unregulated multi-asset broker registered in the United Kingdom that claims to offer a variety of trading instruments, including forex, commodities, indices, stocks and cryptocurrencies with average 1 pip on EUR/USD pair and leverage up to 1:500 via the MetaTrader5 platform.

Note: Stareks official site - https://www.starekco.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Starek Review Summary in 10 Points | |

| Founded | 2022 |

| Registered Country/Region | United Kingdom |

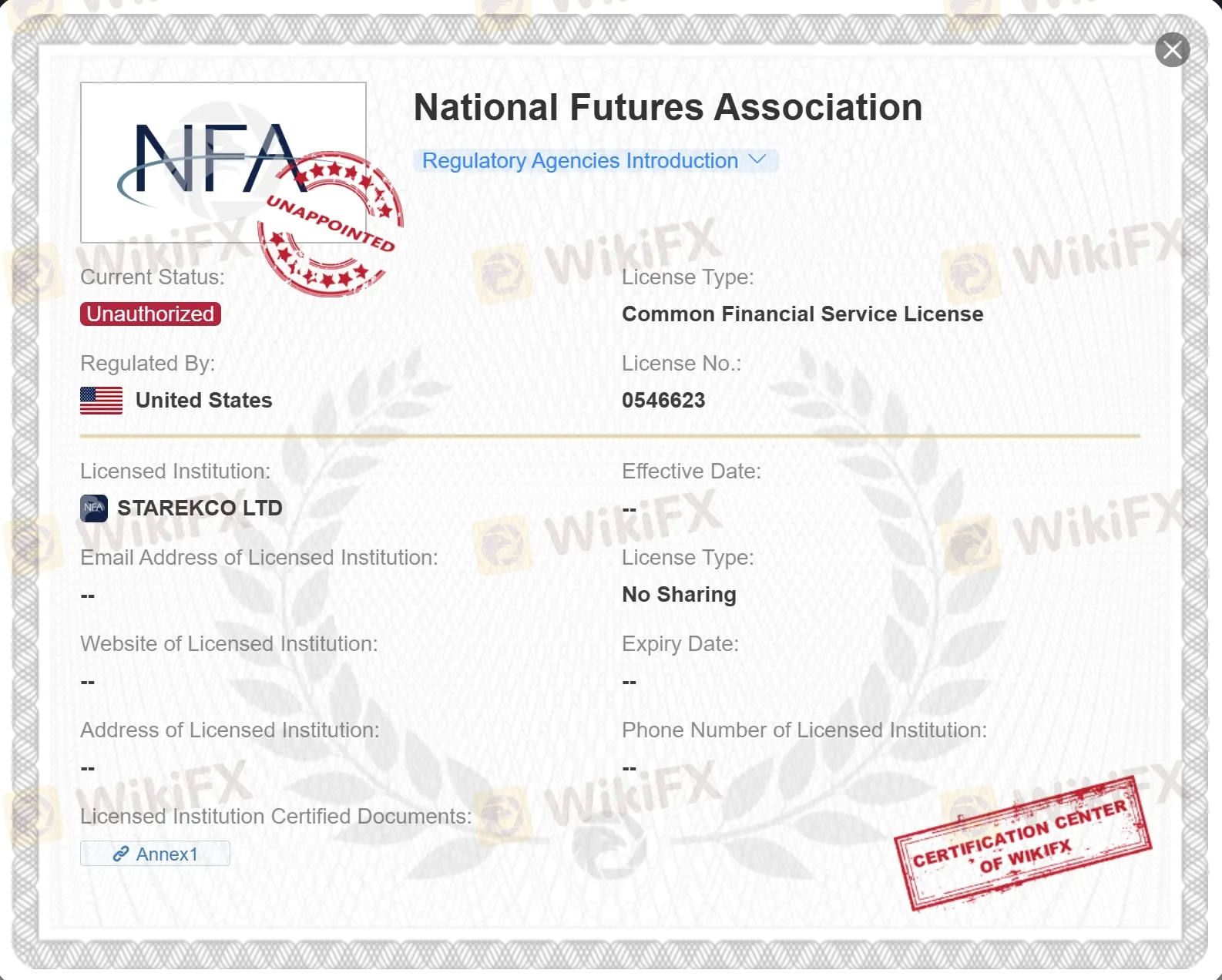

| Regulation | NFA (Unauthorized) |

| Market Instruments | Forex / Commodities / Indices / Shares / Cryptocurrencies / CFDs |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | Average 1 pip |

| Trading Platforms | MT5 |

| Minimum Deposit | N/A |

| Customer Support | Email: cs@starekco.com |

What is Starek?

Starek is an unregulated multi-asset broker registered in the United Kingdom that claims to offer a variety of trading instruments, including forex, commodities, indices, stocks and cryptocurrencies with average 1 pip on EUR/USD pair and leverage up to 1:500 via the MetaTrader5 platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Demo accounts available | • Unauthorized NFA license |

| • Tight EUR/USD spread | • Unavailable website |

| • MT5 supported | • No info on minimum deposit amount |

| • Wide range of trading instruments | • Many reports of withdrawal difficulties and scams |

| • Only email support | |

| • No Islamic accounts |

Starek Alternative Brokers

There are many alternative brokers to Starek depending on the specific needs and preferences of the trader. Some popular options include:

Admiral Markets: A reputable brokerage with a wide range of trading instruments and advanced trading platforms, suitable for experienced traders.

Windsor Brokers: A well-established broker offering competitive spreads and a user-friendly trading environment, ideal for beginners.

ActivTrades: A reliable broker known for its excellent customer service and a comprehensive range of educational resources, making it suitable for both novice and experienced traders.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Starek Safe or Scam?

Based on the information available, it is highly likely that Starek is a scam. Here are some of the reasons why:

Starek has no valid regulation. The United States National Futures Association (NFA, License No.0546623) is a government-recognized regulatory body for the futures industry, and Starek's license is unauthorized. This means that Starek is not subject to any regulatory oversight, which makes it more likely that they are engaging in fraudulent activity.

There are many reports of unable to withdraw and scams. This is a common sign of a scam, as scammers often make it difficult or impossible for investors to withdraw their funds.

Starek's website is currently unavailable. This is another red flag, as scammers often take down their websites when they are exposed.

In conclusion, the evidence suggests that Starek is a scam. I would advise you to avoid investing with them.

If you have already invested with Starek, I would recommend that you contact your financial advisor or the authorities to see if there is anything you can do to recover your funds.

Here are some tips to help you avoid scams in the future:

Only invest with regulated companies.

Do your research before investing.

Be wary of high-pressure sales tactics.

Never give out your personal or financial information to anyone you don't trust.

Market Instruments

Starek offers a variety of market instruments across different asset classes, including:

Forex market (currency pairs): This is the largest and most liquid market in the world, and it allows you to trade the value of one currency against another. Some of the most popular currency pairs include EUR/USD, GBP/USD, and USD/JPY.

Commodities: This market includes tradable goods such as oil, gold, and silver. Commodities are often used as a hedge against inflation, and they can also be a source of high volatility.

Indices: This market tracks the performance of a group of stocks. Some of the most popular indices include the NASDAQ 100, the Dow Jones Industrial Average, and the S&P 500.

Shares: This market allows you to trade individual stocks. Some of the most popular stocks include Apple, Amazon, and Microsoft.

Cryptocurrencies (cryptos): This is a new and volatile market, but it has the potential to offer high returns. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

CFDs: This is a contract for difference, which allows you to trade the difference in price between an asset and its underlying value. CFDs are a leveraged product, which means that you can control a large position with a relatively small amount of capital.

Accounts

Starek offers two types of accounts: demo and live. The demo account is a free account that allows you to trade with virtual funds. This is a good way to learn about the platform and test out different trading strategies. The live account is a real account that allows you to trade with real money.

Starek does not offer Islamic accounts. Islamic accounts are designed to comply with Islamic law, which prohibits the payment or receipt of interest.

The minimum deposit requirements for Starek accounts are not revealed. This is a bit unusual, as most brokers typically disclose their minimum deposit requirements.

Leverage

Starek offers a maximum leverage of up to 1:500. This means that you can control a position worth 500 times your account balance. However, beginners are not advised to use too high leverage ratio. If you are considering using leverage, it is important to understand the risks involved. You should also make sure that you have a trading plan in place and that you are comfortable with the amount of risk you are taking.

Here are some of the risks associated with leverage:

Losses can be magnified: If the market moves against you, your losses can be magnified. This is because you are controlling a larger position than you have deposited.

It can be difficult to manage: Leverage can be difficult to manage, especially if the market is volatile. If you are not careful, you could end up losing more money than you deposited.

It can be addictive: Leverage can be addictive. If you start to see big profits, you may be tempted to use more leverage to increase your profits. However, this can also lead to big losses.

Spreads & Commissions

Starek's spreads are relatively tight, with an average spread of 1 pip on EUR/USD. This means that you will only pay $10 per lot traded. However, specific details about commissions are not provided, making it difficult to assess the commission structure for other trading instruments or account types.

Overall, Starek's spreads and commissions are relatively competitive. However, it is important to compare the fees of different brokers before you decide which one to use. And dont forget the fact that Starek currently has no valid regulation.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Starek | 1 pip | N/A |

| Admiral Markets | 0.6 pips | Variable |

| Windsor Brokers | 0.2 pips | $0 |

| ActivTrades | 0.5 pips | €1 per lot |

Note: Note that these values are not fixed and can vary. Additionally, commissions may vary based on account type and trading volume. It's advisable to contact each broker directly or visit their websites for accurate and up-to-date information.

Trading Platforms

Starek offers the MetaTrader 5 (MT5) trading platform to its clients. MT5 is a comprehensive and popular trading platform that provides traders with a wide range of tools and features. With Starek's MT5 platform, traders can access various financial markets, including Forex, commodities, indices, and more. The platform offers advanced charting capabilities, technical analysis tools, and a user-friendly interface. Traders can execute trades efficiently, monitor real-time market prices, and access historical data to make informed trading decisions.

MT5 also supports automated trading through the use of expert advisors (EAs) and allows for customization with the use of indicators and scripts. Overall, Starek's MT5 platform aims to provide traders with a robust and feature-rich trading environment to cater to their diverse trading needs.

See the trading platform comparison table below:

| Broker | Trading Platform |

| Starek | MT5 |

| Admiral Markets | MT4, MT5, Webtrader |

| Windsor Brokers | MT4 |

| ActivTrades | ActivTrader, MT4, MT5 |

Deposits & Withdrawals

Starek claims that they accept a variety of deposit methods, including credit/debit cards, wire transfers, e-wallets, and local payment solutions. However, they do not specify which local payment solutions are accepted.

Starek minimum deposit vs other brokers

| Starek | Most other | |

| Minimum Deposit | N/A | $100 |

Starek does not mention anything about withdrawals or fees. This is a bit unusual, as most brokers typically disclose their withdrawal fees and other fees.

Overall, the deposit and withdrawal information provided by Starek is very limited. It is important to contact Starek directly to get more information about their deposit and withdrawal methods, fees, and other terms and conditions.

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Starek provides customer service only through email with the address cs@starekco.com. While specific details about the quality and responsiveness of their customer service are not available, having an email contact option allows customers to reach out with their inquiries or concerns. However, most regulated brokers offer more direct contact ways such as live chat and phone support.

Conclusion

Starek is a relatively new and unregulated broker. There is limited information available about them online, and they have not been subject to any regulatory oversight. Additionally, their website is currently unavailable. These make them a risky choice for traders. However, they do offer a variety of trading instruments with competitive trading condition via the leading MT5 trading platform. If you are considering using Starek, it is important to do your own research and to understand the risks involved. Overall, Starek is a risky choice for traders. There are other more reputable brokers available that offer similar services.

Frequently Asked Questions (FAQs)

| Q 1: | Is Starek regulated? |

| A 1: | No. Their United States National Futures Association (NFA, License No.0546623) is unauthorized. |

| Q 2: | Does Starek offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Starek offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT5. |

| Q 4: | Is Starek a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator