简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Famous Brokers that Offer Islamic Trading Accounts

Abstract:In this article, we will explore some of Malaysia's highly-reputable brokers that offer Islamic trading accounts.

Malaysia, a country with a significant Muslim population, has a thriving forex market that caters to the needs of Muslim traders seeking Shariah-compliant trading accounts. In this article, we will explore some of Malaysia's highly-reputable brokers that offer Islamic trading accounts, ensuring adherence to Islamic finance principles and providing a trustworthy trading environment for Muslim traders.

XM sets itself apart from other brokers in the Forex industry by not imposing any additional charges on Islamic accounts. While most brokers either charge a commission or widen the spread to compensate for the absence of swap fees, XM does neither. This means that the Islamic account offered by XM provides traders with the same favourable trading conditions as a regular trading account, with the sole difference being the exclusion of swap fees. Furthermore, opening an Islamic account with XM is a straightforward process. Traders first need to open and validate a standard account, and then submit a request for an Islamic account to the XM back office. The approval process is typically quick, often taking just a few minutes.

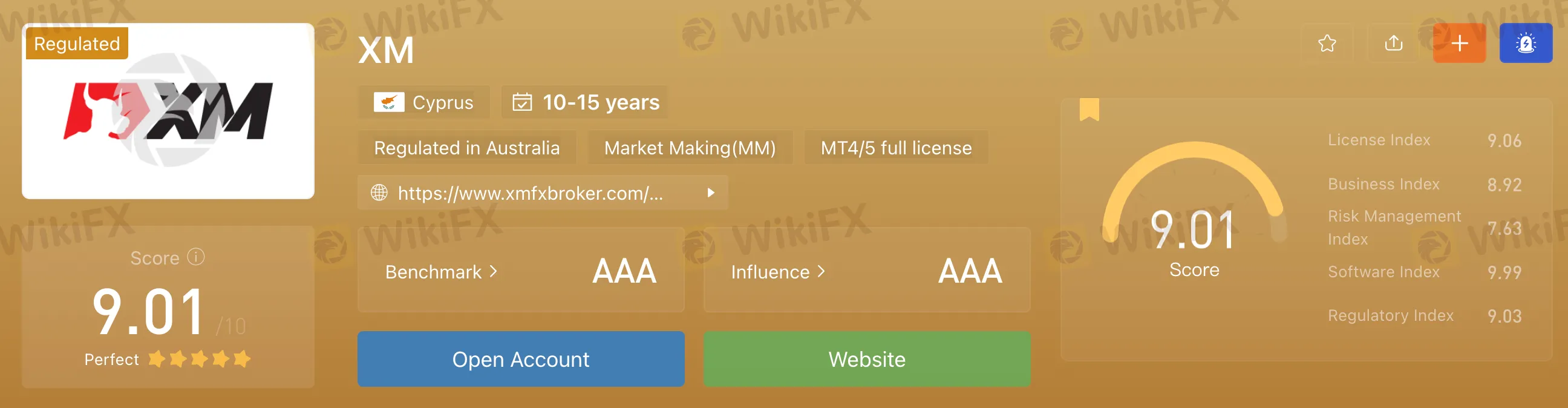

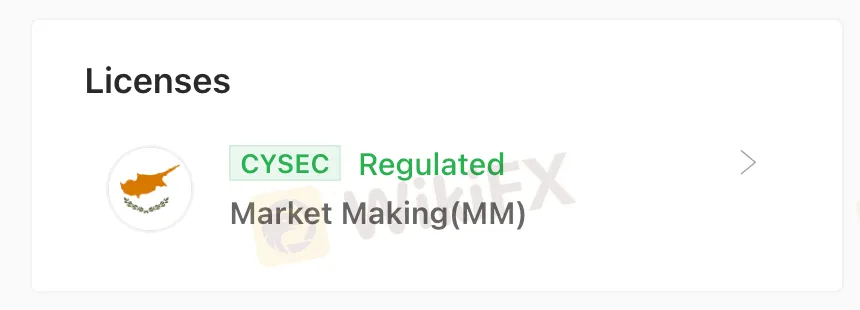

Renowned for its stringent regulatory compliance, XM is among the most regulated market makers in the Forex industry. The broker excels in offering exceptional trading conditions, a wide range of account options, rapid execution speeds, and an extensive selection of CFD assets available on both the MT4 and MT5 platforms. With a minimum deposit requirement of just 50 USD, traders can open an XM Ultra Low Account, which features spreads starting at 0.6 pips, without any additional commission charges.

While most brokers typically charge an additional commission or spread markup for Islamic trading accounts to compensate for the absence of overnight swap fees, OctaFX takes a different approach. OctaFX is one of the rare brokers that does not impose any extra commission charges on Islamic accounts. This sets them apart from the majority of brokers in the industry. Moreover, OctaFX offers Islamic accounts on all three of its trading platforms: MT4, MT5, and OctaTrader, providing flexibility and choice to traders.

Opening an Islamic account with OctaFX is a straightforward process that requires just a single click. No additional forms or proof of religious status are necessary, making it hassle-free. All Islamic accounts at OctaFX operate on market execution and offer commission-free trading with incredibly low spreads starting as low as 0.6 pips. The leverage for Forex pairs is set at 500:1 across all three account types, and the minimum deposit requirement is 100 USD. OctaFX ensures that all clients benefit from negative balance protection, offering a layer of security. Furthermore, customer support is available 24/7 in English and Bahasa Melayu, ensuring assistance is readily accessible to clients whenever needed.

IC Markets stands out among its peers by not imposing any additional fees or commission charges for Islamic accounts. This sets them apart from many other brokers in the industry. Furthermore, IC Markets is one of the rare brokers that offer Islamic accounts across multiple platforms, including MT4, MT5, and cTrader, covering both the Raw Spread and commission-free account types.

By opting for an Islamic account with IC Markets, traders benefit from a range of advantages. These include access to leverage of up to 1:500, a wide selection of 90 tradeable instruments, and remarkably tight spreads starting as low as 0 pips on major currency pairs like the EUR/USD. For those choosing the Raw Spread account, commissions start at a competitive rate of 5 USD per traded lot. The process of opening an Islamic account is straightforward and can be completed directly on IC Market's website. However, it is worth noting that customer service may request proof of Islamic faith as part of the registration process to ensure compliance with Shariah principles governing Islamic finance.

For Muslim traders in Malaysia seeking reputable brokers that provide Islamic trading accounts, XM, OctaFX, and IC Markets stand out as highly-reputable options. These brokers offer swap-free accounts, transparent trading conditions, and strong regulatory oversight, ensuring compliance with Islamic finance principles. By choosing one of these brokers, Muslim traders can engage in forex trading with confidence, knowing that their trades align with their religious beliefs and are conducted in a secure and trustworthy environment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator