简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Leading Alliance

Abstract:Leading Alliance, based in Hong Kong, is a company that operates without valid regulation. As such, caution is advised when dealing with this broker due to potential risks. They offer trading in Forex, commodities, and indices instruments, providing bid and ask prices for buying and selling these assets. Limited information is available about their account types, but it seems they only offer a live account option. Opening an account with Leading Alliance requires providing personal details through their website. They offer a maximum leverage of 400:1 and spreads starting from 0.0. The minimum deposit requirement is $1000, but information on deposit and withdrawal methods is not provided. Their trading platform of choice is MetaTrader 5 (MT5), which offers advanced trading features, algorithmic trading capabilities, and mobile access. Educational resources include materials on Forex trading basics and a guide to using MT5. Customer support is available through email communication.

| Registered Country/Area | Hong Kong |

| Founded Year | 1-2 years |

| Company Name | Leading Alliance Holding Limited |

| Regulation | Not verified or recognized |

| Minimum Deposit | $1000 |

| Maximum Leverage | 400:1 |

| Spreads | Starting from 0.0 |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Commodities, Indices |

| Account Types | Limited information available |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email support at leadingallianceltd@gmail.com |

| Payment Methods | Information not available |

| Educational Tools | Learn Forex, MT5 guide |

Overview of Leading Alliance

Leading Alliance Holding Limited is a Hong Kong-based company that offers trading services in the Forex, commodities, and indices markets. However, it is important to note that Leading Alliance's regulatory status is currently not verified or recognized, and the broker operates without valid regulation. This lack of oversight raises potential risks, and caution should be exercised when considering trading with them.

In terms of market instruments, Leading Alliance provides access to the Forex market, allowing traders to engage in currency trading with instruments such as GBP/USD, AUD/USD, USD/JPY, and EUR/USD. They also offer commodities instruments for investing in raw materials like silver, gold, and cocoa. Additionally, traders can access indices instruments representing the performance of a group of stocks from specific markets or sectors.

While details about the account types offered by Leading Alliance are limited, it appears that only a live account option is available. More specific information about account types can be obtained by directly contacting Leading Alliance for clarification. The company offers a maximum leverage of 400:1 to its clients, and their spreads start from 0.0.

Leading Alliance utilizes the MetaTrader 5 (MT5) platform for trading. MT5 offers a comprehensive set of trading orders, algorithmic trading capabilities, and a wide range of trading assets. It provides powerful charting capabilities, multiple timeframes, and an inbuilt system of alerts to keep traders updated on market events. The platform supports desktop and mobile trading, enabling traders to access the markets anytime and anywhere.

Overall, it is important to exercise caution due to the lack of regulatory recognition for Leading Alliance. Traders should carefully consider the risks involved and thoroughly research before engaging in any trading activities with the company.

Pros and Cons

Leading Alliance has several notable pros and cons. On the positive side, it offers a variety of market instruments, including forex, commodities, and indices, providing traders with diverse investment options. Additionally, the broker provides spreads starting from 0.0, which can be advantageous for cost-conscious traders. The maximum leverage of 400:1 is another benefit, allowing traders to amplify their positions. Moreover, Leading Alliance offers the popular MetaTrader 5 platform for trading, providing access to advanced trading features and tools. Traders also have access to educational resources focused on Forex and MT5, which can enhance their trading knowledge. On the downside, Leading Alliance lacks a verified regulatory status, which may raise concerns about the level of oversight and potential risks involved. There is limited information available about the account types offered, and the minimum deposit requirement is relatively high at $1000. Furthermore, details regarding deposit and withdrawal methods, as well as payment options, are not provided. Customer support is limited to email communication.

| Pros | Cons |

| Offers forex, commodities and indices | Lack of regulatory status and oversight |

| Spreads starting from 0.0 | Limited information on account types |

| Maximum leverage of 400:1 | Minimum deposit requirement of $1000 |

| Provides MetaTrader 5 platform for trading | No information on deposit and withdrawal methods |

| Access to educational resources for Forex and MT5 | No information on payment methods |

| Seamless switching to MT5 platform | Limited customer support through email communication |

| Trading on-the-go with the MT5 mobile app | No information on payment options |

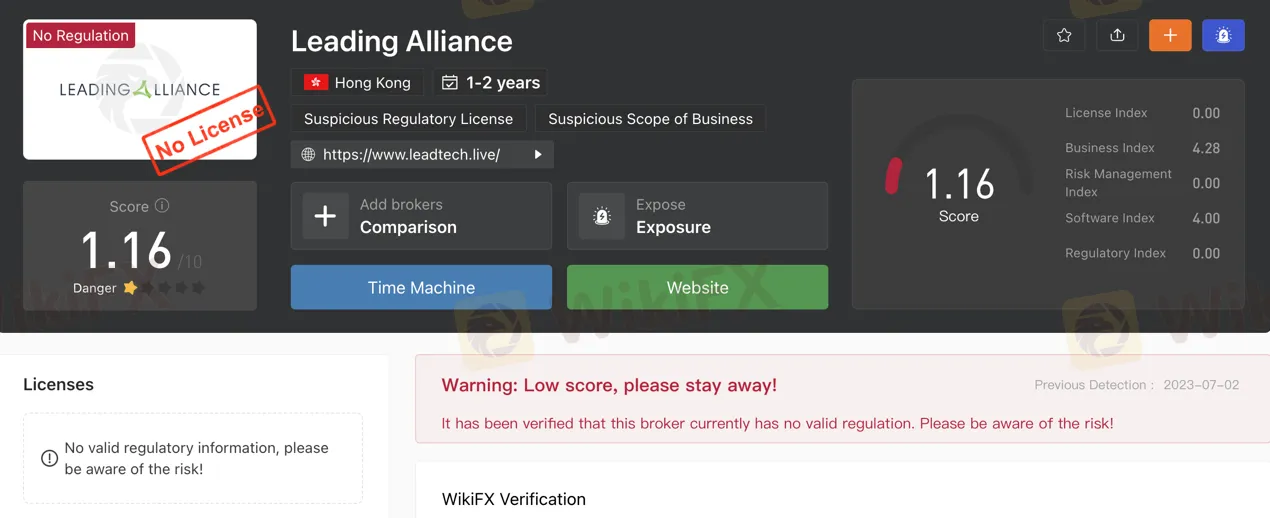

Is Leading Alliance Legit?

The regulatory status of Leading Alliance is currently not verified or recognized. It is essential to note that this broker operates without valid regulation. This lack of oversight exposes potential risks, and caution should be exercised when dealing with them.

Market Instruments

Forex

The Forex market offers a range of instruments for traders to engage in currency trading. Some examples of Forex instruments include GBP/USD, AUD/USD, USD/JPY, and EUR/USD. These instruments provide bid and ask prices, indicating the rates at which traders can buy or sell the currencies.

Commodities

Commodities instruments allow traders to invest in various raw materials and resources. Examples of commodities instruments include CL-OIL, XAGUSD (silver), XAUUSD (gold), and Cocoa-C. These instruments provide bid and ask prices, indicating the rates at which traders can buy or sell the commodities.

Indices

Indices instruments represent the performance of a group of stocks from a specific market or sector. Traders can invest in these instruments to gain exposure to the overall market or a specific industry. Examples of indices instruments include SP500, DJ30, FRA40, and DAX30. These instruments provide bid and ask prices, indicating the rates at which traders can buy or sell the indices. Spreads are displayed, representing the difference between the bid and ask prices.

Pros and Cons

| Pros | Cons |

| Traders can engage in currency trading with Forex instruments | Lack of information on specific features or advantages of the instruments |

| Access to commodities instruments for investing in raw materials | Limited types of market instruments |

| Allows investment in indices representing market performance |

Account Types

There is limited information available about the account types offered by Leading Alliance. Currently, it appears that only a live account option is available, and details regarding any other specific account types are not provided. For more detailed information on the available account options, it is recommended to contact Leading Alliance directly for clarification and assistance.

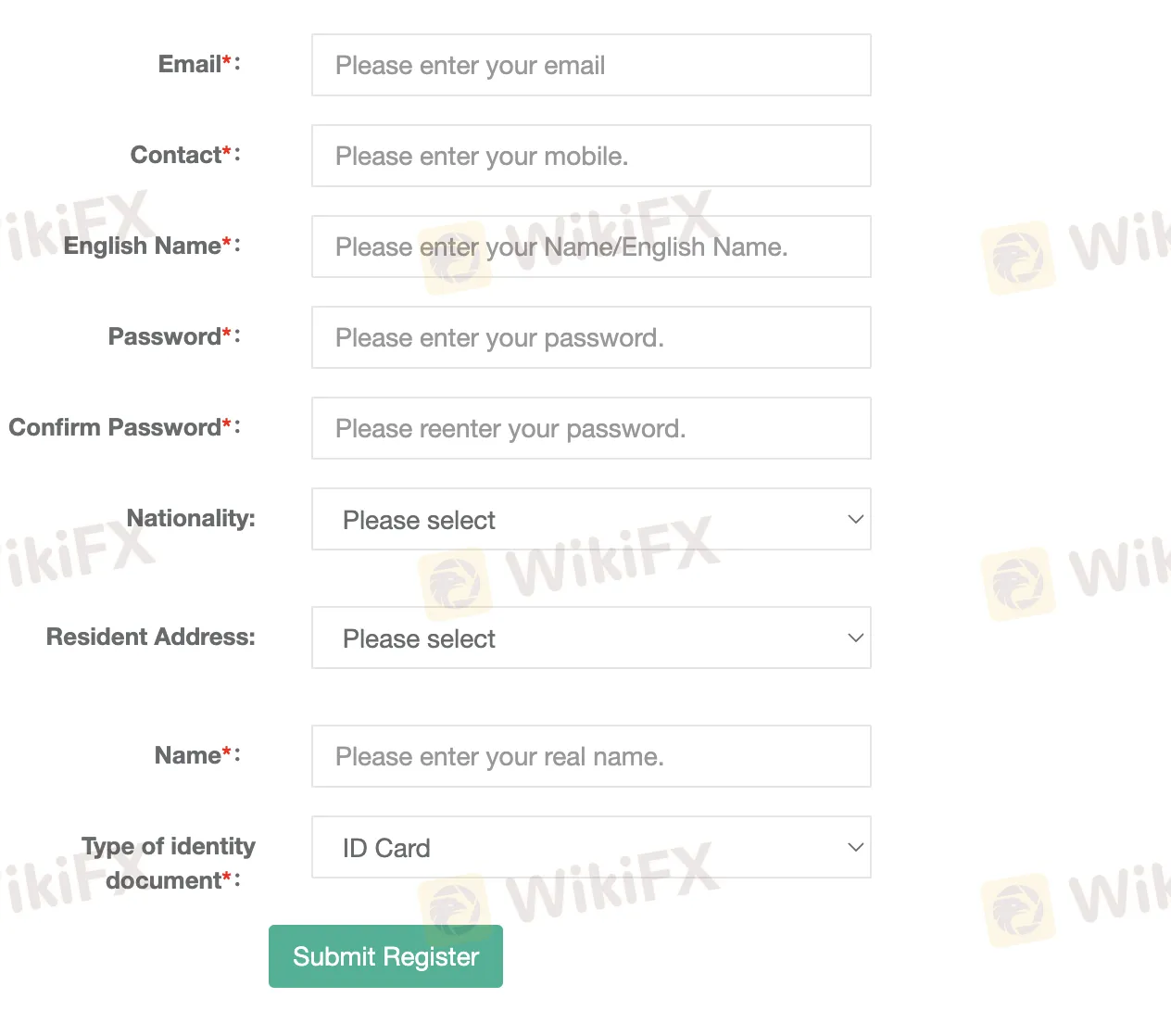

How to Open an Account?

To open an account with Leading Alliance, follow these steps:

Visit the Leading Alliance website and locate the “Open a Live Account” option.

Provide your email address in the designated field.

Enter your mobile contact number.

Fill in your name or English name as required.

Create a password and enter it in the corresponding field.

Confirm your password by reentering it.

Select your nationality from the options provided.

Choose your resident address from the available options.

Enter your real name in the specified field.

Select “ID Card” as your type of identity document.

Finally, click on the “submit register” button to complete the account opening process.

Leverage

Leading Alliance offers a maximum leverage of 400:1 to its clients.

Spreads & Commissions

Leading Alliance require no deposit fees, ensuring accessibility for their customers. When it comes to spreads, Leading Alliance provides pricing with spreads starting from 0.0.

Minimum Deposit

Leading Alliance has a minimum deposit requirement of $1000.

Deposit & Withdrawal

Information regarding the deposit and withdrawal methods, as well as payment options, for Leading Alliance is not available on the official website.

Trading Platforms

Leading Alliance offers the MetaTrader 5 (MT5) platform for trading. MT5 is the next generation forex trading platform developed by MetaQuotes. It provides a full set of trading orders for flexible trading in forex, commodities, and indices. Traders using MT5 have access to Leading Alliance Holding Limited's liquidity provider's market depth, allowing them to see significant orders on the price ladder and make informed trading decisions.

MT5 offers improved trade management, including algorithmic trading capabilities with the MQL5 language. It also provides a wide range of trading assets and additional built-in analytic tools. Traders can gain an edge in their forex trading with MT5.

The platform supports multiple timeframes, allowing traders to analyze charts in various intervals. MT5 also includes an inbuilt system of alerts to help traders stay updated on important market events. Additionally, the MT5 mobile app enables traders to access the Leading Alliance Holding Limited servers and trade anytime and anywhere for free.

Switching from the previous MetaTrader 5 platform to MT5 is a seamless process. New clients can easily start using MT5 by filling out a form, while existing clients can open an additional account and select MetaTrader 5 through their client portal. The option of trading on the go is provided by the MT5 mobile app, which allows users to connect to Leading Alliance Holding Limited servers 24/7.

Pros and Cons

| Pros | Cons |

| Offers MetaTrader 5 (MT5) platform for trading | Lack of information on other available trading platforms |

| Access to Leading Alliance's liquidity provider's market depth for informed decisions | Limited information on specific features and tools offered by the MT5 platform |

| Lightning-fast execution speeds, and powerful charting capabilities | Lack of information on advanced trading features and customization options of the MT5 platform |

Educational Resources

The Educational Resources provided by the Leading Alliance focus on two main areas: Learn Forex and the MT5 guide.

The Learn Forex section offers a comprehensive understanding of the Forex market. It covers essential topics such as Forex market overview, basics of Forex trading, and types of currency pairs. It explains concepts like going long and going short, lot size and leverage, and the calculation of Forex Pip values. Additionally, it provides insights into different types of Forex orders and the functioning of Forex swaps and oil rollovers. The Learn Forex resources aim to equip individuals with knowledge about Forex trading without using positive or subjective terms.

The MT5 guide is designed to assist users in utilizing Leading Alliance's MT5 platform effectively. It offers step-by-step instructions for installing MT5 on a personal computer, including an introduction to Leading Alliance Holding Limited's MT5 services. The guide also provides information on upgrading the MT5 terminal and offers useful tips and tricks to maximize the benefits of the platform. The MT5 guide helps users navigate and make the most of the MT5 trading platform in a neutral and objective manner.

Pros and Cons

| Pros | Cons |

| Comprehensive educational resources for Forex and MT5 | No information on other trading topics or strategies |

| Covers essential topics in Forex trading without subjective terms | Limited focus on Learn Forex and MT5 guide |

| Step-by-step instructions and tips for utilizing the MT5 platform | No interactive or hands-on learning opportunities |

Customer Support

Leading Alliance offers customer support through email communication. If customers have any inquiries or require further assistance, they can reach out by sending an email to the official website email address at leadingallianceltd@gmail.com.

Conclusion

In conclusion, Leading Alliance Holding Limited operates without verified or recognized regulation, which raises potential risks for traders. The lack of information about account types and deposit/withdrawal methods adds to the limited transparency of the company. However, Leading Alliance offers a range of market instruments such as Forex, commodities, and indices, and provides the MetaTrader 5 platform for trading, which offers a variety of features and analytic tools. The educational resources focus on providing objective information about Forex trading and the platform. Customer support is available via email.

FAQs

Q: Is Leading Alliance a legitimate company?

A: Leading Alliance's regulatory status is currently not verified or recognized, and it operates without valid regulation.

Q: What market instruments are available for trading?

A: Leading Alliance offers Forex, commodities, and indices instruments for trading.

Q: What are the account types offered by Leading Alliance?

A: Limited information is available regarding account types. It appears that only a live account option is available.

Q: What is the maximum leverage offered by Leading Alliance?

A: Leading Alliance offers a maximum leverage of 400:1.

Q: What are the spreads and commissions at Leading Alliance?

A: Leading Alliance provides low pricing with spreads starting from 0.0, and there are no deposit fees.

Q: What is the minimum deposit requirement at Leading Alliance?

A: The minimum deposit requirement is $1000.

Q: What are the available payment methods for deposits and withdrawals?

A: Information regarding payment methods is not available on the official website.

Q: What trading platform does Leading Alliance offer?

A: Leading Alliance offers the MetaTrader 5 (MT5) platform for trading.

Q: What educational resources are provided by Leading Alliance?

A: Leading Alliance offers educational resources on Forex trading and a guide for using the MT5 platform.

Q: How can I contact customer support at Leading Alliance?

A: Customer support can be reached by email at leadingallianceltd@gmail.com.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Italy’s CONSOB ordered seven unauthorized investment websites blocked, urging investors to exercise caution to avoid fraud. Learn more about their latest actions.

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

STARTRADER warns against counterfeit sites and apps using its brand name. Protect yourself by recognizing official channels to avoid fraudulent schemes.

Dukascopy Bank Expands Trading Account Base Currencies

Dukascopy Bank now offers AED and SAR as base currencies for trading, expanding options for clients to fund accounts in Dirham and Riyal.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator