简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is Accumarkets Reliable?

Abstract:Accumarkets is an online forex broker offering a bunch of financial instruments. Recently this broker has come to our eyes. In this article, we want to show you the reliability of Accumarkets by analyzing different aspects.

About Accumarkets

Registered in South Africa, Accumarkets, owned by Elite Financial Services(Pty) Ltd, is an online forex broker offering traders various financial instruments, including Forex, Shares, Indices, Metals, and so on. This broker is newly established and the target market is South Africa. According to WikiFX, this broker has multiple business addresses.

Lack of Information on The Website

The website of this broker looks pretty shabby. There is a lot of information we cannot find on its website. We dont know what the leverage is and what trading platform Accumarkets use.

Is It Legit?

Accumarkets claimed to be regulated by FSCA. However, we found out that this broker exceeds the business scope regulated by FSCA with license number: 52677. Therefore, we cannot consider Accumarkets a regulated broker. Investing in an unlicensed broker is extremely dangerous as your money can not be protected under the regulation. WikiFX has given this broker a low score of 3.12/10. Investors need to think carefully before making a decision.

Account Types & Minimum Deposit

Accumarkets offers traders three different types of accounts. They are Cent Account, 100% Bonus Account, and Standard Account. The minimum deposit of this broker is $5.

Accumarkets on Social Media

Although Accumarkets does not have a long history in the industry, it has made a lot of efforts on social media platforms in order to promote itself. It has established official accounts on both Facebook and Instagram.

Withdrawal & Deposit

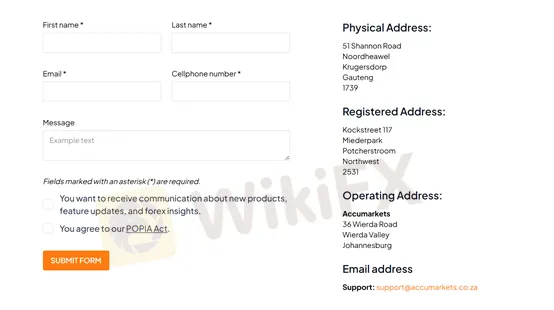

Contact Information

Accumarkets offers multiple choices for investors to contact them. Investors can contact Accumarkets via phone calls and sending emails.

Conclusion: Should We Trust Accumarkets?

As an unregulated broker, Accumarkets cannot protect traders funds if something goes wrong. You may lose all your fund if you invest in an unregulated broker. Besides, this broker has been given a low score by WikiFX, which is another red flag you should be aware of. WikiFX. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator