简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

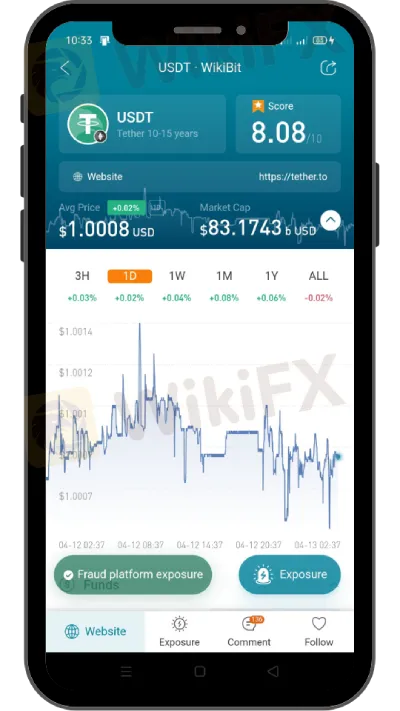

USDT Emerges as Market Leader with 65% Stablecoin Market Cap

Abstract:Tether (USDT) emerges as top stablecoin with 65% market cap, surpassing its previous high, driven by aggressive issuance on Tron Network.

Tether (USDT), the largest stablecoin pegged to the US dollar, has experienced a remarkable resurgence in its market capitalization, surpassing its previous all-time high. Despite a shrinking stablecoin market, Tether's market cap has surged to $83.2 billion, matching its peak achieved over a year ago. This recovery comes after a challenging period for USDT, marked by the Terra-induced turmoil in mid-2022 and a brief loss of its intended $1 peg during the recent banking crisis.

The impressive valuation of Tether has been attributed to its aggressive approach to minting and issuance on the Tron Network. Unlike Ethereum, Tron has a stronger presence in mainland China and places a greater emphasis on facilitating money transfers. Tether operates across various blockchains, including Algorand, Bitcoin Cash's SLP, Ethereum, EOS, Liquid Network, Omni, and Tron.

With its current market cap nearly triple that of USD Coin (USDC), the world's second-largest stablecoin issued by Circle, Tether has established a clear lead in the stablecoin market. Notably, cryptocurrency traders have withdrawn over $20 billion from USDC in less than three months, despite the fading concerns surrounding the Silicon Valley collapse. This substantial outflow has resulted in a reduction in USDC's market capitalization, which dropped from $43 billion to approximately $28 billion, indicating a net outflow of $15 billion. Circle recently regained access to the $3.3 billion previously locked up in Silicon Valley Bank.

Paolo Ardoino, the Chief Technology Officer of Tether, highlighted the importance of the stablecoin in providing a safe haven for the unbanked and individuals in emerging markets, particularly when their national currencies are being devalued. Ardoino expressed Tether's commitment to maintaining its resilience amidst market volatility and emphasized the company's transparency practices, which have earned the trust of customers. Tether aims to expand access to financial freedom globally, with a particular focus on emerging markets.

The recent milestone reached by Tether represents a complete recovery of the $18 billion lost following the collapse of Terra in May 2022, as well as the subsequent market downturn. Currently, Tether accounts for 7.25% of the $1.15 trillion cryptocurrency market capitalization and 64% of the $129 billion stablecoin economy, according to CoinMarketCap.

As the third-largest cryptocurrency by market cap, Tether has been solidifying its dominance in recent months, particularly after US regulators ordered Paxos to halt its issuance. Tether's strong performance continues to attract attention and demonstrates its resilience and market presence.

In the first three months of 2023, Tether reported profits of nearly $1.5 billion, a substantial increase from the $700 million earned during the same period last year. The company's assurance report revealed consolidated total assets amounting to at least $81.8 billion as of March 31, a significant surge compared to the $67 billion reported at the end of 2022.

Tether's remarkable rebound in market capitalization and its financial achievements highlight its ongoing position as a leading stablecoin in the cryptocurrency market. With its renewed strength and commitment to expanding financial access globally, Tether continues to attract investors and solidify its presence in the industry.

Get the WikiFX App on your smartphone and keep up with the latest news by downloading and installing it. Access the App via this link: https://social1.onelink.me/QgET/px2b7i8n.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

Kraken Offers $105 Fee Credit for FTX Fund Recipients

Kraken offers $105 in trading fee credits to FTX fund recipients, enabling $50,000 in crypto trading on Kraken Pro with zero fees. Secure your funds today!

Trading Lessons Inspired by Squid Game

The popular series Squid Game captivated audiences worldwide with its gripping narrative of survival, desperation, and human nature. Beneath the drama lies a wealth of lessons that traders can apply to financial markets. By examining the motivations, behaviours, and strategies displayed in the series, traders can uncover valuable insights to enhance their own approach.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator