简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

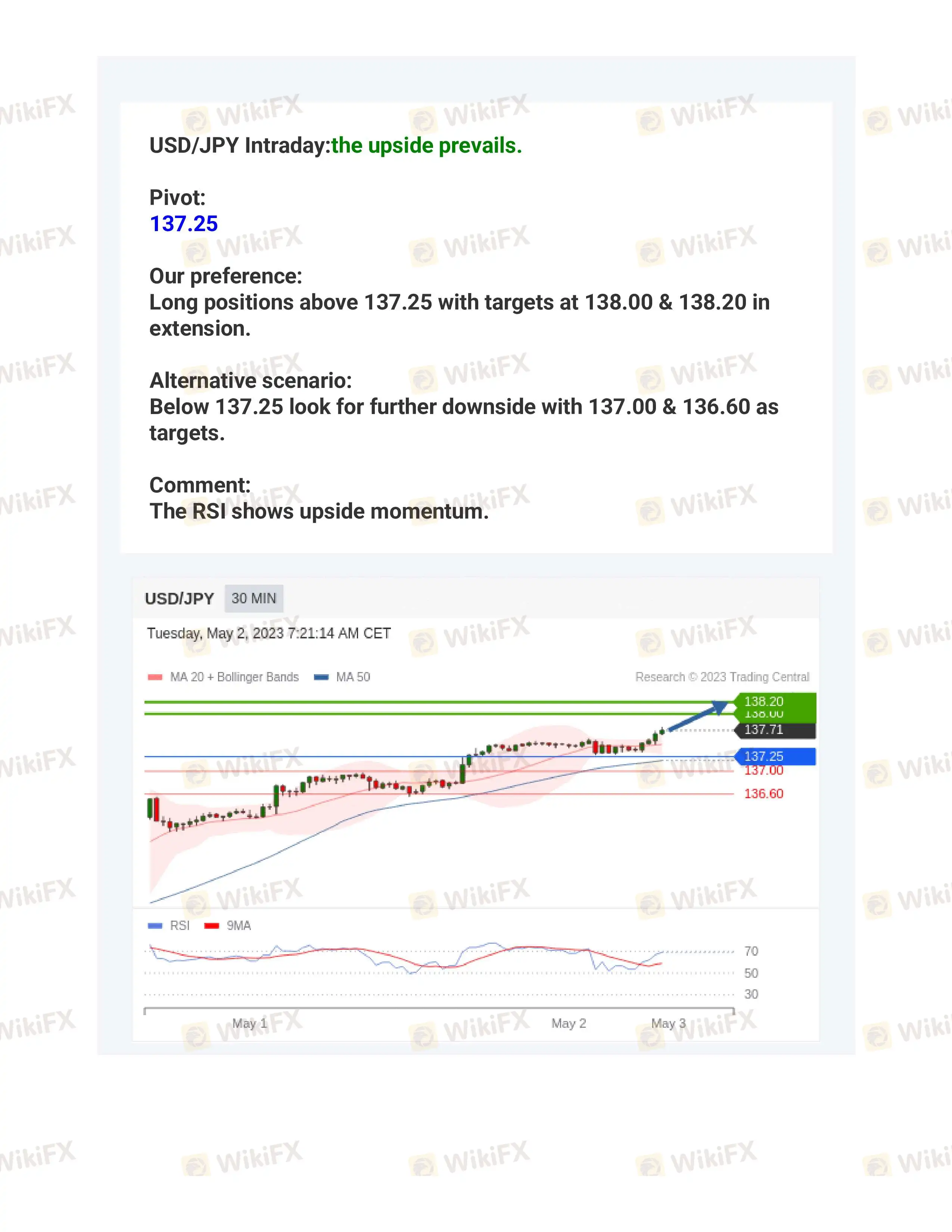

Intraday Chart Tips

Abstract:Powered by WikiFX: (GOLD, EUR/USD, GBP/USD, USD/JPY, ) Technical Analysis May 2, 2023

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Data to Watch This Week

Last week, U.S. employment data significantly exceeded expectations, further solidifying market expectations that the Federal Reserve will not be making aggressive interest rate cuts. This week, the focus shifts to important economic data and the start of earnings season.

Confirmed! US December non-farm payroll exceeded expectations

Last Friday, the U.S. Bureau of Labor Statistics released strong employment data, further diminishing market expectations for interest rate cuts by the Federal Reserve this year. Currently, the market widely expects the Fed to begin cutting rates again in October.

FxPro Adds CoP via tell. Money for Safer Financial Transfers

FxPro teams up with tell.money to enhance BnkPro security with CoP technology, offering clients safer financial transfers and reducing fraud risks.

How Did the Dollar Become the "Dominant Currency"?

Since the fourth quarter of last year, the strong trend of the U.S. dollar has intensified, and as we enter 2025, investors face a contradictory situation.

WikiFX Broker

Latest News

How to Automate Forex and Crypto Trading for Better Profits

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Singapore Blocks Polymarket Access, Following U.S. and France

OneZero Collaborates with Ladies Professional Golf Association (LPGA)

FxPro Adds CoP via tell. Money for Safer Financial Transfers

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

Currency Calculator