简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Invest Markets 1780339776

Abstract:Invest Markets is an online trading platform that provides access to a wide range of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. The company offers multiple account types with varying minimum deposits and spreads, as well as leverage of up to 1:500. Invest Markets also provides educational resources and customer support services to its clients. The platform can be accessed through its own web-based platform and MT4.

| Registered in | Belize |

| Regulated by | FSC, offshore |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex pairs, commodities, cryptocurrencies, indices and stocks |

| Minimum Initial Deposit | $250 |

| Maximum Leverage | 1:500 |

| Minimum spread | EURUSD spreads of 1.6 pips onwards |

| Trading platform | own platform, MT4 |

| Deposit and withdrawal method | Credit CardElectronic PaymentWire Transfer |

| Customer Service | Email, phone number |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Invest Markets

Pros:

Wide range of account types with varying minimum deposit requirements.

Multiple platforms including their own web-based platform and MT4.

Educational resources available to all account holders.

24/5 customer support available through phone and email.

High maximum leverage of up to 1:500 for all account types.

No deposit fees and varying withdrawal fees based on account type.

Cons:

Limited information on commissions charged for trading.

Inactivity fee charged on accounts with no transactions for at least one month.

Limited payment options for deposits and withdrawals.

Limited availability of live chat support.

Demo account with virtual funds is only available for a limited time.

Withdrawals are capped at the available funds in your account.

Limited information on regulatory bodies and licenses.

What type of broker is Invest Markets?

| Advantages | Disadvantages |

| Invest Markets offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Invest Markets has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Invest Markets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Invest Markets acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Invest Markets has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Invest Markets or any other MM broker.

General information and regulation of Invest Markets

Invest Markets is an online trading platform that provides access to a wide range of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. The company offers multiple account types with varying minimum deposits and spreads, as well as leverage of up to 1:500. Invest Markets also provides educational resources and customer support services to its clients. The platform can be accessed through its own web-based platform and MT4.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diverse range of instruments | Limited options for some niche instruments |

| Covers popular markets | No information on spreads and trading conditions |

| Opportunities for portfolio diversification | Limited information on available assets and trading hours |

Invest Markets offers a wide range of instruments for trading, including forex pairs, commodities, cryptocurrencies, indices, and stocks. This diversity presents traders with the opportunity to choose instruments that align with their trading strategies, risk tolerance, and market preferences. In addition, the availability of popular markets such as forex, stocks, and cryptocurrencies may attract a broader range of traders. However, there is limited information available on trading conditions, including spreads, and some niche instruments may not be available. Nonetheless, the ability to diversify a trading portfolio across multiple instruments can potentially increase opportunities for profitability while minimizing risks.

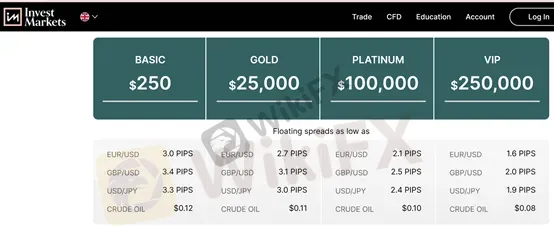

Spreads and commissions for trading with Invest Markets

| Advantages | Disadvantages |

| Competitive variable spreads | Spreads may vary depending on account type |

| No information about commissions | Inactivity fee charged after one month of inactivity |

| Wide range of trading instruments | Lack of transparency on additional fees |

Invest Markets offers competitive variable spreads on various trading instruments, ranging from 1.6 to 3.0 pips depending on the account type. However, there is no information provided about any commissions charged. Traders should also be aware of the inactivity fee that is charged if there are no transactions on their trading account for at least one month. While Invest Markets offers a wide range of trading instruments, the lack of transparency on additional fees may be a concern for some traders.

Trading accounts available in Invest Markets

| Advantages | Disadvantages |

| Multiple account types to suit different trading needs | High minimum deposit for top-tier accounts |

| Demo account available for traders to test the platform | Limited information on benefits and features of each account type |

| Variable spreads based on account type | Limited account type options compared to other brokers |

| Access to more competitive spreads with higher-tier accounts |

Invest Markets offers four different account types, each with varying minimum deposits and average spreads for different currency pairs. The Basic account has the lowest minimum deposit of $250 and offers spreads starting from 3.0 pips for EUR/USD, while the VIP account requires a minimum deposit of $250,000 and offers the most competitive spreads starting from 1.6 pips for EUR/USD. Traders can choose the account type that best suits their trading needs and level of experience. However, the high minimum deposit for the top-tier VIP account may deter some traders from opening an account with Invest Markets. Nonetheless, the availability of a demo account allows traders to test the platform before committing to a live account.

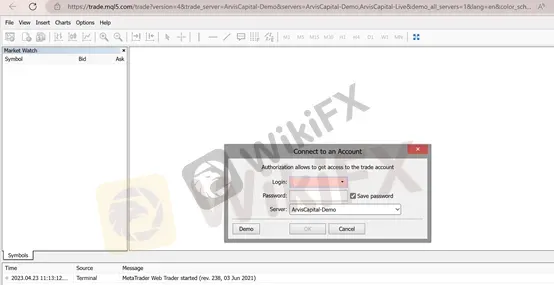

Trading platform(s) that Invest Markets offers

| Advantages | Disadvantages |

| User-friendly interface | Limited third-party plugins and tools |

| Customizable platform | Not available on all devices |

| Availability of mobile app | Limited charting options |

| Access to MT4 platform | Limited educational resources |

| Advanced technical analysis tools | No social trading feature |

| Automated trading available | |

| Multi-language support |

Invest Markets offers its own proprietary trading platform which is web-based and accessible through various devices. The platform is user-friendly and customizable, with a range of technical analysis tools and automated trading capabilities. The platform also has a mobile app available for traders who want to access their accounts on-the-go. Additionally, the company offers the popular MT4 platform for those who prefer it. However, the platform does have some limitations, including a lack of third-party plugins and tools, limited charting options, and limited educational resources. Also, the platform is not available on all devices, and it does not offer social trading.

Maximum leverage of Invest Markets

| Advantages | Disadvantages |

| Can amplify potential profits with a smaller initial investment | High leverage also means higher risk of loss |

| Allows for greater flexibility in trading strategies | Novice traders may be tempted to use high leverage, leading to potential losses |

| Can increase trading volume and exposure to multiple markets | Higher leverage may attract more aggressive traders, leading to more volatile markets |

| Offers potential for higher returns in shorter periods of time | Greater focus and discipline are required to manage risk effectively with high leverage |

Invest Markets offers a maximum leverage of 1:500 to its clients. This high leverage allows traders to open larger positions with smaller amounts of capital, which can increase their potential profits. It also allows for greater flexibility in trading strategies and the ability to access multiple markets. However, it is important to note that high leverage also means higher risk, which can lead to significant losses. Therefore, traders must have a disciplined approach to risk management and avoid over-leveraging to mitigate these risks. Overall, the high leverage offered by Invest Markets can be a powerful tool for experienced traders with a strong understanding of risk management.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| Multiple deposit options including credit/debit card, e-wallets, and wire transfer | Withdrawal charges vary with account type and frequency |

| Withdrawal requests are processed within 24 business hours | Minimum limits apply for withdrawals made by wire transfer |

| VIP account holders can make unlimited free withdrawals | Withdrawals are capped at available funds, excluding open trades |

| No minimum amount for withdrawals made to credit cards, Skrill or Neteller | |

| Deposits are free |

Invest Markets offers several convenient deposit and withdrawal options, including credit/debit cards, e-wallets, and wire transfer. Deposits are free, and withdrawal requests are processed within 24 business hours. However, withdrawal charges vary with the type of account you have, and there are minimum limits for withdrawals made by wire transfer. Additionally, withdrawals are capped at the available funds in your account, excluding any funds currently invested in open trades. VIP account holders can make unlimited free withdrawals, while the number of free withdrawals decreases with lower account types. Overall, Invest Markets provides a range of deposit and withdrawal options to suit different needs, but it's important to be aware of the charges and limitations associated with each account type.

How to deposit and withdraw?

In order to deposit, log in to your account, and then click on Deposit button. Here are multiple deposit methods you can choose from. You can deposit using one of the following methods:

Credit Card

Electronic Payment

Wire Transfer

For making a withdrawal, simply log in to your account, click on the Banking tab, then on the Withdrawal tab. Enter in the amount you wish to withdraw and click on Next button. Fill in the required fields and then click on Submit button.

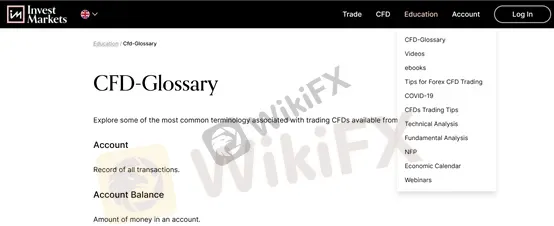

Educational resources in Invest Markets

| Advantages | Disadvantages |

| Provides a wide range of educational resources | Some resources may not be updated regularly |

| Webinars and video tutorials are available | No access to a demo account until the minimum deposit is made |

| Offers an economic calendar and market reports | Educational resources may not be tailored to individual needs |

| Provides trading tips, technical analysis and fundamental analysis | No one-on-one training or coaching available |

| Allows traders to develop their trading knowledge and skills | Educational resources may not cover all trading topics or strategies. |

Invest Markets offers a variety of educational resources to help traders improve their trading knowledge and skills. These resources include an economic calendar, market reports, video tutorials, webinars, trading tips, technical analysis and fundamental analysis. The educational resources provide a great opportunity for traders to learn and develop their trading strategies. However, it should be noted that some of the resources may not be updated regularly, and some traders may prefer personalized one-on-one training or coaching. Additionally, the educational resources may not cover all trading topics or strategies, and there is no access to a demo account until the minimum deposit is made. Despite these limitations, the availability of a wide range of educational resources makes Invest Markets an attractive option for traders looking to improve their skills and knowledge.

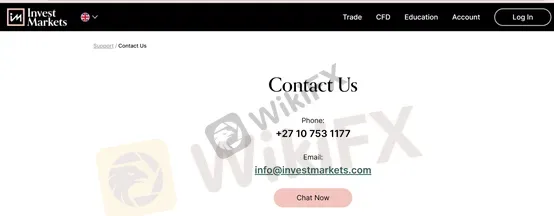

Customer service of Invest Markets

| Advantages | Disadvantages |

| 24/5 multilingual customer support | No 24/7 support |

| Multiple channels of communication (phone, email) | No live chat support |

| Dedicated account manager for Platinum and VIP account holders | No specific response time mentioned |

| FAQ section on website | No physical address provided on website |

Invest Markets offers 24/5 customer support through multiple channels of communication including phone and email. The website also has an FAQ section that can provide answers to common queries. However, the customer support is not available 24/7 and there is no live chat support available. In addition, the response time to queries is not mentioned on the website. On a positive note, Platinum and VIP account holders have access to a dedicated account manager who can assist with their queries.

Conclusion

In conclusion, Invest Markets is a forex and CFD broker that provides a range of trading instruments, account types, and platforms for traders. Its offering includes various educational resources and a responsive customer support team, which can be reached via email and phone. The broker provides competitive spreads and leverage of up to 1:500 for traders. However, it has some limitations, such as high withdrawal fees for some account types, limited customer support channels, and lack of regulation by major financial authorities. Despite these drawbacks, Invest Markets can be a suitable choice for traders looking for an accessible and user-friendly trading experience.

Frequently asked questions about Invest Markets

Question: What is the minimum deposit required to open an account with Invest Markets?

Answer: The minimum deposit required to open an account with Invest Markets is 250 USD for the Basic account.

Question: What is the maximum leverage offered by Invest Markets?

Answer: Invest Markets offers a maximum leverage of up to 1:500.

Question: What trading platforms are available at Invest Markets?

Answer: Invest Markets offers its own web-based platform and the popular MT4 platform.

Question: What types of accounts are available at Invest Markets?

Answer: Invest Markets offers four types of accounts: Basic, Gold, Platinum, and VIP.

Question: How can I deposit funds into my Invest Markets account?

Answer: You can deposit funds into your Invest Markets account through credit/debit card, e-wallets, and wire transfer.

Question: Are there any fees for withdrawals at Invest Markets?

Answer: Withdrawal fees vary based on the account type. Basic account holders can make one free withdrawal, while Gold account members can make one free withdrawal per month. Platinum account holders can make three free withdrawals per month, and VIP account holders have unlimited free withdrawals.

Question: What educational resources are available at Invest Markets?

Answer: Invest Markets offers a range of educational resources, including an economic calendar, market reports, video tutorials, webinars, trading tips, technical analysis, and fundamental analysis.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator