简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXVC Applied the Cancellation of its CIF License of CySEC

Abstract:Recently, WikiFX learned that FXVC has decided to voluntarily renounce its CIF license (238/14) of CySEC to operate as an investment firm.

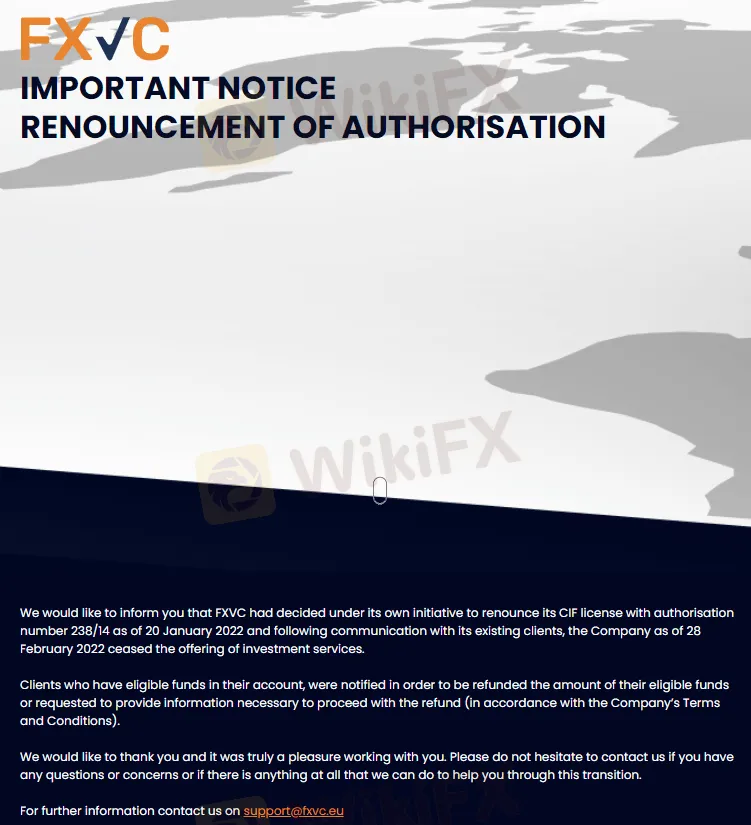

(Screenshot from FXVC)

As a result, FXVC was no longer to provide/carry out investment services or enter into business transactions from 1 March 2022.

Voluntarily Renounces Its CIF License of CySEC

FXVC(https://www.fxvc.com/eu/) announced that it has applied to abandon its CIF license of CySEC with authorisation number 238/14 as of 20 January 2022 and ceased the offering of investment services to its clients as of 28 February 2022.

According to the notice, all open trades will need to be closed by the end of 28 February 2022. If investors do not close their open positions by the date, they will be closed automatically.

In addition, the company will not accept any new clients and existing clients who have eligible funds in their account will be refunded in accordance with the companys Terms and Conditions.

When checking on the CySEC register, we found the regulatory status of FXVC changed into under examination for voluntary renunciation of the authorisation. That means the FXVC‘s surrender of license is entirely voluntary based on the company’s decision and does not arise as a result of any regulatory action.

(Screenshot from CySEC)

The reasons leading up to this decision remain unclear, but CySEC will certainly maintain supervision over the financial service company until it has taken care of its responsibilities under the license.

It's worth noting that another domain https://www.fxvc.com/int related to FXVC, is still available, and is offering investment services under the supervision of the Seychelles FSA.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Why Is UK Inflation Rising Again Despite Recent Lows?

October inflation rises to 2.3%, driven by energy costs. Renters face 8% annual hikes, while house price inflation climbs. Interest rates stay elevated.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator