简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HFM Introduces "CENT ACCOUNTS" For New Traders To Have Safe Trading

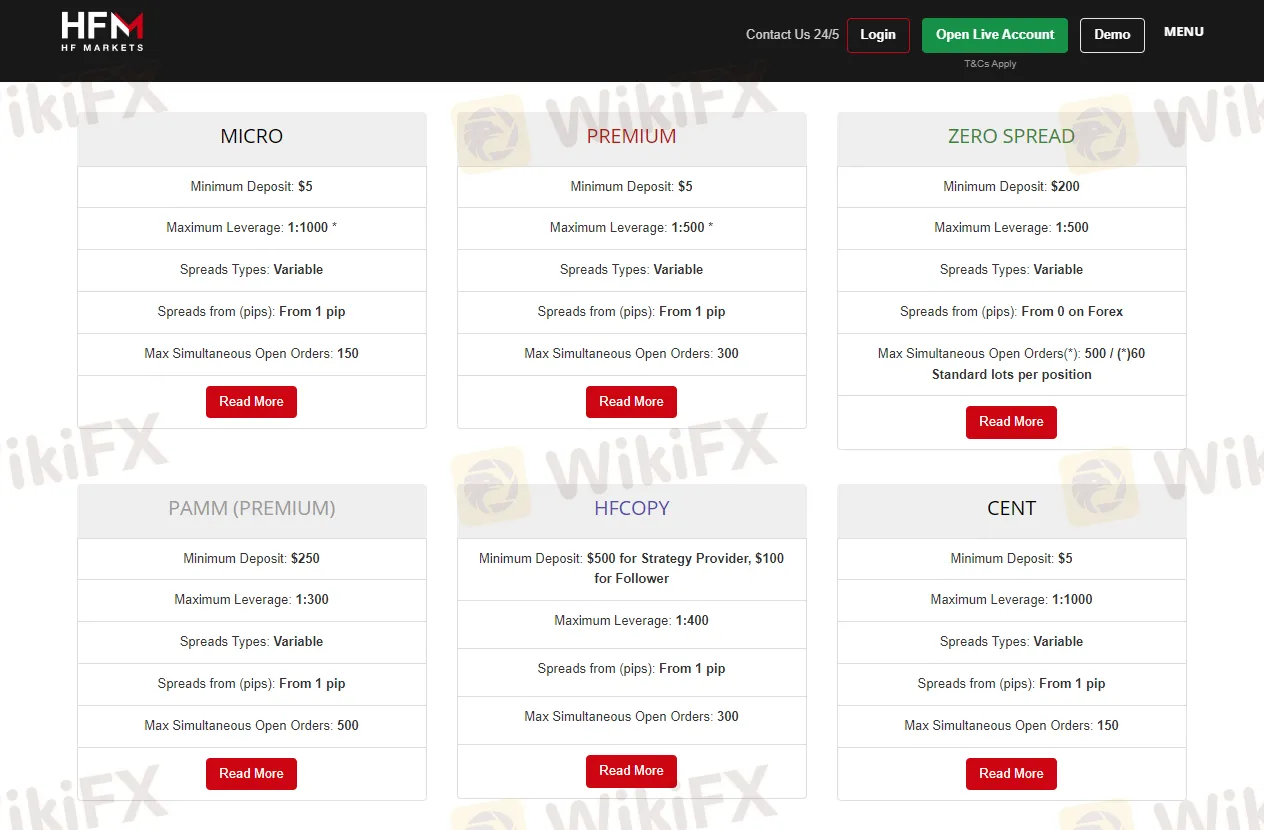

Abstract:HFM, the former Hot Forex FX, and CFD broker has announced the debut of Cent Accounts, which allows customers to have their accounts valued in cents.

“By providing this cent account, we are opening up a world of potential for our consumers while also promoting sensible and secure online market participation.”

Cent Accounts are ideal for inexperienced traders, but also for experienced traders who want to attempt new methods or explore a new asset class since this feature allows users to trade in lower quantities, particularly smaller lots.

“Traders choosing to 'play it safe most of the time”

“At HFM, we endeavor to constantly be responsive to the requirements of our valued consumers. We understand that in the current economic climate, traders want to 'play it safe' more often than not, and we are here to assist. ”By providing this cent account, we are opening up a world of potential for our members while promoting sensible and secure market participation online,“ stated an HFM representative. ”I can certainly state that we planned this deal with every single detail in consideration. I am certain that our competitive cent account offer will appeal to a broad range of dealers.

HFM's new cent account also allows for leverage of up to 1:1000, which is normally not suitable for novices. Such huge leverage is obviously not permitted at the broker's CySEC-licensed firm.

The brokerage business also provides commission-free trading and a $5 minimum deposit. All account holders are assigned a personal manager who will guide them through the process.

About HF Markets

HF Markets (HotForex) is a worldwide forex and CFD broker that allows traders to trade currency pairs, commodities, equities, indices, and cryptocurrencies. The Financial Services Commission (FSC) of the Republic of Mauritius regulates the corporation, which has offices across Europe, Asia, and Africa. They provide trading platforms such as MetaTrader 4 and MetaTrader 5 as well as instructional materials like webinars and market research to help customers with their trading. They provide several account kinds and leverage ratios. The broker has been in the market for a decade and has a reputation for supplying its customers with high-quality services.

Keep an eye out for more Forex broker news.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How to Know if the Market is Correcting or Reversing?

In trading, distinguishing between a market correction and a market reversal is crucial for making sound decisions. Misjudging one for the other can lead to missed opportunities or significant losses. While both involve price movements, their causes, duration, and implications differ substantially. Understanding these differences can help traders improve their strategies and adapt to market conditions effectively.

Empowering the Next Generation in Finance with WikiFX: Gen Z’s Investment Journey

With a steadfast commitment to fostering sustainable financial literacy and providing clear, strategic guidance to the next generation, WikiFX has collaborated with Van Lang University and Hoa Sen University to host an exclusive series of financial education workshops. This marks a pioneering initiative by WikiFX in Vietnam, designed not only to deliver foundational knowledge but also to instill a sense of responsibility and cultivate prudent financial decision-making among aspiring young traders.

Robinhood Launches Options Trading in the UK by 2025

Robinhood to introduce options trading in the UK by 2025 following FCA approval. Discover how this expansion aligns with Robinhood's strategy for global growth and new features.

What Impact Does Japan’s Positive Output Gap Have on the Yen?

The Japanese government has announced that, due to a tight labor market, the country’s economic output is expected to return to full capacity in the next fiscal year for the first time in seven years.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator