简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

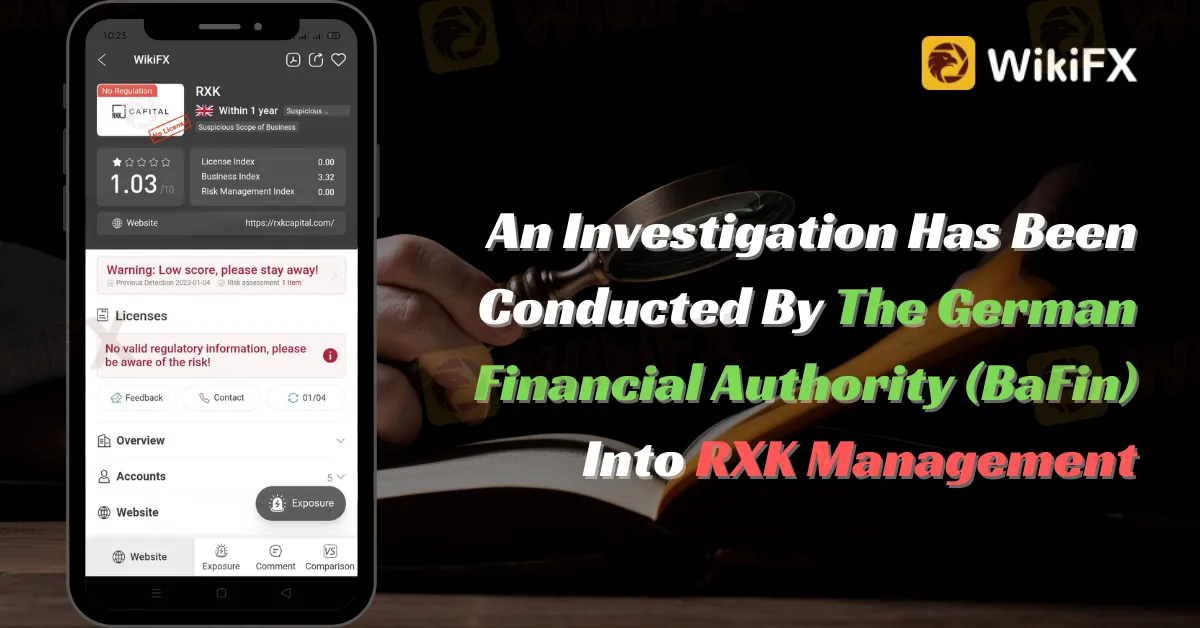

An Investigation Has Been Conducted By The German Financial Authority (BaFin) Into RXK Management

Abstract:The German Federal Financial Supervisory Authority (BaFin) is looking into RXK Management Ltd., a firm that offers online trading in a variety of products, including Forex and cryptocurrency.

The German Federal Financial Supervisory Authority (BaFin) is looking into RXK Management Ltd., a firm that offers online trading in a variety of products, including Forex and cryptocurrency.

According to Section 37(4) of the German Banking Act (Kreditwesengesetz, - KWG), BaFin cautions that RXK Management Ltd. is not authorized to conduct banking activity or offer financial services under the KWG. BaFin does not oversee the firm.

The material on the company's website, rxkcapital.com, suggests that RXK Management Ltd. is doing banking activity and offering financial services in Germany without the necessary permission.

According to WikiFX data, RXK has not been authorized by any financial authorities, which essentially implies that the company has no permission to do financial business or any other kind of financial investment activity.

WikiFX attempted to search RXK Capital on two major financial regulators, BaFin and FCA but found no results.

Companies that do banking activity or provide financial services in Germany must be licensed under the KWG. However, some businesses operate without the proper permits. BaFin's business database contains information on whether a certain firm has been given authorization.

BaFin, the German Federal Criminal Police Office (Bundeskriminalamt - BKA), and the German state criminal police offices (Landeskriminalämter) advise consumers seeking to invest money online to exercise extreme caution and conduct extensive research ahead of time in order to detect fraud attempts early on.

About BaFin

The Federal Financial Supervisory Body, or Bafin, is Germany's financial regulatory authority. It is in charge of overseeing the country's financial markets and financial service providers, which include banks, insurance companies, financial consultants, and investment businesses. Bafin also seeks to ensure that these businesses comply with consumer protection laws and regulations, and it has the right to take enforcement action against those that do not. Bafin is an autonomous organization in Germany that answers to the Federal Ministry of Finance.

Stay tuned for more Forex Broker news.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

FCA Alerts Traders to New List of Unregulated and Clone Brokers

Protect your investments! Learn about unregulated firms flagged by the FCA and discover how WikiFX helps traders avoid scams and choose legitimate brokers.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Former Director Sentenced for Share Disclosure Breach

PayPal Expands PYUSD Use for Seamless Cross-Border Transfers

Trump Media in Talks to Acquire Crypto Firm Bakkt

Currency Calculator