简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: Beware Of Possible Scam Broker Like OneFXTrade

Abstract:Forex scams are misleading enterprises that offer investors the opportunity to benefit from foreign currency trading but are really designed to steal money from unsuspecting customers. These scams often use deceptive marketing and high-pressure sales tactics to get people to invest in a forex trading program or system that does not work. Forex scams may take numerous forms, including Ponzi schemes, pyramid schemes, and bogus trading platforms. Before investing in any forex trading strategy or methodology, individuals should take prudence and conduct an extensive study.

Forex scams are deceptive operations that promise to provide investors the potential to profit from foreign currency trading but are really meant to steal money from unwary consumers. These scams often include misleading marketing and high-pressure sales methods to get individuals to invest in a forex trading program or system that does not work. Forex scams may take many different forms, such as Ponzi schemes, pyramid schemes, and phony trading platforms. Individuals should exercise caution and do thorough research before investing in any forex trading method or technique.

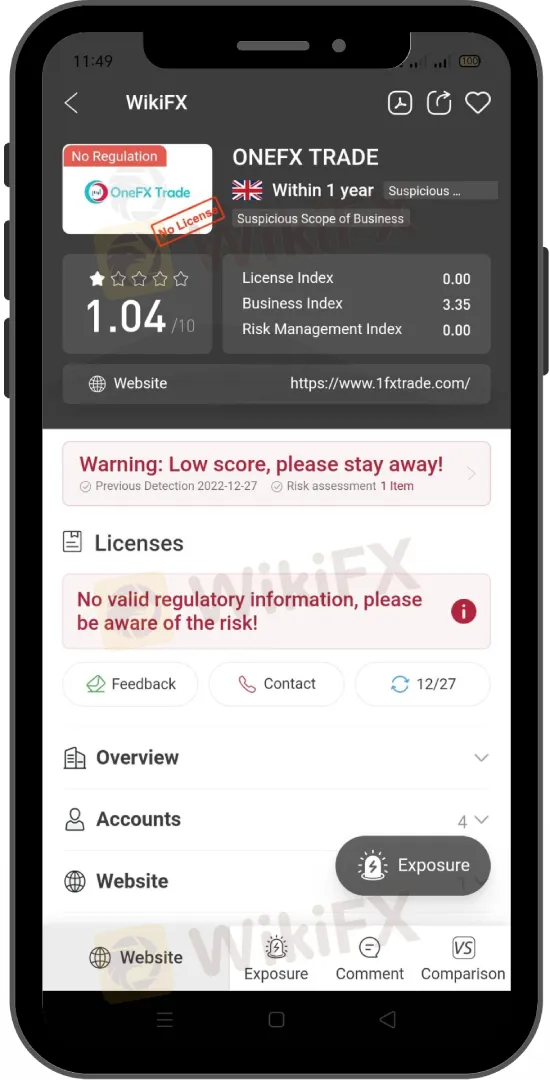

OneFXTrade is an example of a fraudulent forex broker.

OneFXTrade Overview

OneFX Trade (https://www.1fxtrade.com/) claims to be a UK-based forex and CFD brokerage service. The firm offers retail trading services in currency and commodities markets. While the MT5 trading platform is the sole way to connect to liquidity providers, the broker's selection of marketable instruments seems to be restricted. Clients may join up for four account kinds at OneFX Trade, according to their preferences: Micro, Standard, VIP, and ECN. Although the company promotes copy-trade services, it does not provide educational opportunities. While the information on minimum deposits and payment methods is unavailable, the firm does not discuss the safeguards in place to secure consumers' assets. Customer service is available through phone, email, and live chat.

Is OneFX Trade a regulated broker?

Nowhere in the world is OneFX Trade registered or regulated. Although the business claims to be a registered brokerage firm, it does not provide any documentation to back up its claim. Also broken is the link to the legal information page.

Is OneFX Trade Trustworthy?

No! We do not feel it is a reputable company for a variety of reasons. First and foremost, the broker's website seems amateurish. In certain places, the text is written in French. It seems that the corporation neglected to update it with essential information.

Second, the firm claims to be in business for 10 years. The broker's domain, on the other hand, is just two months old.

Because the business claims to have an office in the United Kingdom, we investigated the FCA database to see whether the firm is subject to FCA rules and discovered that it is not. Furthermore, the FCA has issued a warning to the firm for offering unlicensed trading services inside the nation and has advised investors not to join up with it.

How does scam works?

Forex scams may take numerous forms, however, some of the more popular ones are as follows:

Currency scams may claim exaggerated returns or assured earnings, yet it is very difficult to continuously generate a profit in the forex market.

Scammers may use bogus endorsements or pretend to have insider knowledge to persuade others to participate in their plan.

High-pressure sales methods may be used by forex scammers to persuade customers to invest in a trading program or strategy that does not truly perform.

Unregulated forex brokers: Because certain forex brokers are not regulated, they are not subject to the same regulation and safeguards as regulated brokers. These brokers may be more inclined to engage in deceptive or unethical behavior.

Scammers may build false trading platforms or websites that seem to be genuine but are really meant to steal money from naive consumers.

Before investing in any forex trading method or technique, it is critical to exercise caution and do comprehensive research and be aware of offers that seem too good to be true.

What would be the best course of action if you were duped by OneFXTrade?

If you have been a victim of a forex scam, you must move as quickly as possible to attempt to recoup your losses. Here are some things you can do:

Contact your bank or credit card provider as follows: If you paid the fraudster using your bank account or credit card, report the fraud and seek a chargeback from your bank or credit card provider.

Make a formal complaint: You may complain to the appropriate authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom or the Commodity Futures Trading Commission (CFTC) in the United States.

Seek legal advice: Consult with a lawyer or legal adviser who can advise you on your choices and assist you in pursuing legal action if necessary.

Share you experience: Consider sharing your story with others to help raise awareness of the scam and avoid others from becoming victims. This may be accomplished by sharing it on social media, writing a review, or calling a consumer protection agency.

It is vital to keep in mind that recovering your losses may be difficult, particularly if the fraudster is operating from another nation if the hoax is well-crafted. You may be able to recover part or all of your damages if you take action and seek legal counsel.

Last words

Forex trading entails a high degree of risk and may result in big losses, therefore it is critical to exercise caution and do extensive research before investing in any forex trading method or system. Increase your usage of the WikiFX App for checking and identifying brokers.

Find out more about OneFXTrade news here: https://www.wikifx.com/en/dealer/3122990188.html

Follow for more FX Broker news.

Download and install the WikiFX App on your mobile phones from the download link below to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator