简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tamam Brokerage Services-Some Important Details about This Broker

Abstract:Registered in Uganda, Tamam Brokerage Services (TBS) is a forex broker providing access to a massive financial market. With the Tamam Brokerage Services platform, three trading accounts are available, with the minimum deposit to open a professional starting at $5, and the maximum trading leverage that traders can use is up to 1:1000.

| Aspect | Information |

| Company Name | Tamam Brokerage Services |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded year | 2-5 years |

| Regulation | Unregulated |

| Market Instruments | Over 350 trading assets including Forex, Shares, Indices, Commodities, Cryptocurrencies, Metals |

| Account Types | Standard, Pro, and Cent accounts |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | As low as 0 pips |

| Trading Platforms | MetaTrader 5 platform |

| Customer Support | Phone at +256 783 880 269 and +256 753 244 147, email at info@tamambrokerage.com |

| Deposit & Withdrawal | Credit/debit card (coming soon), mobile money, M-pesa, and cryptocurrency |

Overview of Tamam Brokerage Services

Tamam Brokerage Services, based in Saint Vincent and the Grenadines, has been operational for 2-5 years.

Offering over 350 trading assets, it accommodates various trader needs. Advantages include a low minimum deposit of $10, multiple account types, and competitive spreads as low as 0 pips.

However, the brokerage faces drawbacks such as being unregulated, delayed bonus issuance, and reported issues with customer support responsiveness.

Regulatory Status

Tamam Brokerage Services operates without any regulatory oversight.

This means there's no external authority ensuring they comply with rules and standards. Without regulation, there's a risk of misconduct or negligence in handling clients' investments. Customers might face challenges in seeking recourse for any grievances or losses.

Pros and Cons

| Pros | Cons |

| Low minimum deposit ($10) | Unregulated |

| Multiple account types | Delayed bonus issuance |

| Over 350 trading assets | Lack of responsiveness from customer support |

| MetaTrader 5 platform | |

| Spread as low as 0 pips | |

| Leverage up to 1:1000 |

Pros:

Low minimum deposit ($10): Tamam Brokerage Services offers a low minimum deposit requirement of $10, allowing traders with limited capital to start trading and access the financial markets.

Multiple account types: The brokerage provides three account types: Standard, Pro, and Cent accounts. This variety enables traders to choose an account type that best suits their individual needs and objectives.

Over 350 trading assets: Tamam Brokerage Services offers a wide range of trading assets, providing traders with ample opportunities to diversify their portfolios and explore various financial markets.

MetaTrader 5 platform: The brokerage utilizes the MetaTrader 5 (MT5) platform, a popular and widely-used trading platform known for its advanced charting tools, technical analysis capabilities, and customizable interface.

Spread as low as 0 pips: Tamam Brokerage Services offers competitive spreads, with some starting as low as 0 pips. Low spreads can reduce trading costs for traders, especially those who engage in high-frequency trading or scalping strategies.

Leverage up to 1:1000: The brokerage offers leverage of up to 1:1000, allowing traders to amplify their trading positions and potentially increase their profits. Higher leverage can offer greater trading flexibility but also entails higher risk.

Cons:

Unregulated: One notable drawback is that Tamam Brokerage Services operates without regulatory oversight. The lack of regulation means that there is no external authority monitoring the brokerage's activities to ensure compliance with industry standards and protect the interests of traders.

Delayed bonus issuance: Some users have reported delays in receiving bonus rewards promised by the brokerage. This delay in bonus issuance can be frustrating for traders who are expecting additional funds to boost their trading capital or take advantage of promotional offers.

Lack of responsiveness from customer support: Another downside is the reported lack of responsiveness from the brokerage's customer support team. Traders may experience difficulties in reaching support representatives or receiving timely assistance with their inquiries or issues.

Market Instruments

Tamam Brokerage Services offers over 350 trading assets.

CFDs (Contracts for Difference) enable traders to speculate on the price movements of various financial instruments without owning the underlying asset. This flexible trading instrument allows for potential profit from both rising and falling markets.

Shares represent ownership in a particular company and are tradable assets on Tamam's platform. Traders can speculate on the price movements of shares from a wide range of global companies, allowing for diversification and exposure to different sectors and industries.

Indices are comprised of a basket of stocks representing a particular market or sector, providing traders with an opportunity to invest in the overall performance of an economy or industry. Tamam Brokerage Services offers access to major indices from around the world, allowing traders to capitalize on broader market trends.

Commodities are tangible goods such as oil, gas, and agricultural products, which are traded globally. Trading commodities through Tamam's platform enables investors to hedge against inflation, diversify their portfolios, and potentially profit from price fluctuations in these essential goods.

Metals, including gold, silver, platinum, and palladium, are popular assets for investors seeking safe-haven assets or protection against currency devaluation.

Account Types

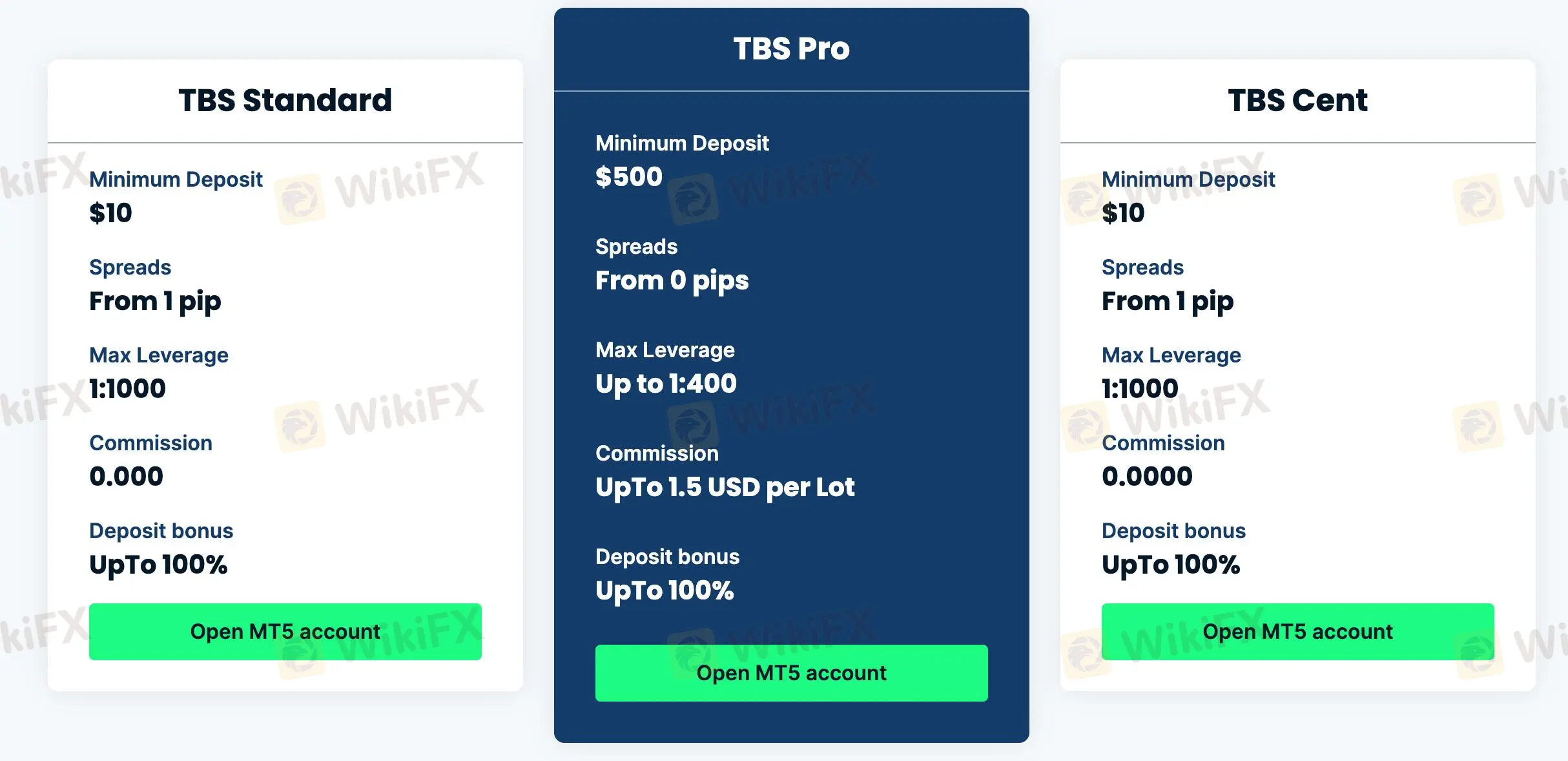

Three types of trading accounts are provided to satisfy different traders trading needs: Standard, Pro, and Cent accounts.

TBS Standard account at Tamam Brokerage Services requires a minimum deposit of $10, making it accessible to those who are just starting with limited capital. With spreads starting from 1 pip and a maximum leverage of 1:1000, this account type may be suitable for beginner traders or those who prefer lower risk and are comfortable with wider spreads. The absence of commission and the possibility of up to 100% deposit bonus can be attractive features for those looking to maximize their trading potential without incurring additional costs.

TBS Pro account, on the other hand, demands a higher minimum deposit of $500. It offers competitive advantages such as spreads starting from 0 pips and a maximum leverage of up to 1:400. This account type may appeal to more experienced traders or those who are willing to invest a larger sum to access tighter spreads and higher leverage. However, traders should be aware of the commission, which can go up to 1.5 USD per lot traded, potentially affecting their overall profitability. The option for up to 100% deposit bonus could be advantageous for traders seeking additional funds to enhance their trading strategies.

Lastly, the TBS Cent account also requires a minimum deposit of $10, similar to the TBS Standard account. It offers spreads starting from 1 pip and a maximum leverage of 1:1000. This account type may be suitable for beginner traders or those with limited capital who still want to access the forex market.

With no commission charges and the possibility of up to 100% deposit bonus, the TBS Cent account provides an opportunity for traders to explore the market with minimal financial commitment and potentially maximize their returns through bonus incentives.

| TBS Standard | TBS Pro | TBS Cent | |

| Minimum Deposit | $10 | $500 | $10 |

| Spreads | From 1 pip | From 0 pips | From 1 pip |

| Max Leverage | 1:1000 | Up to 1:400 | 1:1000 |

| Commission | 0 | Up to 1.5 USD per Lot | 0 |

| Deposit bonus | Up to 100% | Up to 100% | Up to 100% |

| Open MT5 account | Yes | Yes | Yes |

How to Open an Account?

Opening an account with Tamam Brokerage Services involves the following concrete steps:

Visit the Tamam Brokerage Services website: Navigate to the official website of Tamam Brokerage Services using a web browser.

Click on the Register button: Look for the Register or similar button prominently displayed on the website's homepage or navigation menu.

Fill out the registration form: Complete the online registration form with accurate personal information, including your full name, email address, phone number, and residential address.

Choose an account type: Select the type of trading account you wish to open, such as TBS Standard, TBS Pro, or TBS Cent, based on your trading preferences and requirements.

Submit required documents: Upload any necessary identification documents, such as a government-issued ID or passport, as well as proof of address, to verify your identity and residency.

Agree to terms and conditions: Review and agree to the terms and conditions of opening an account with Tamam Brokerage Services before submitting your application. Once your application is processed and approved, you will receive confirmation of your new trading account, along with login credentials to access the trading platform.

Leverage

Tamam Brokerage Services offers maximum leverage of 1:1000 for TBS Standard and TBS Cent accounts, enabling traders to amplify their buying power up to a thousand times their initial investment. TBS Pro account provides leverage up to 1:400, still offering significant leverage but slightly lower compared to the other account types.

Spreads & Commissions

Tamam Brokerage Services offers varying spreads and commissions across its account types.

TBS Standard features spreads starting from 1 pip with zero commission, making it suitable for traders who prioritize lower trading costs and are comfortable with wider spreads.

In contrast, TBS Pro provides tighter spreads starting from 0 pips but may charge commissions of up to 1.5 USD per lot traded. This account type could appeal to more experienced traders seeking competitive pricing and willing to pay commissions for enhanced trading conditions.

TBS Cent mirrors TBS Standard with spreads from 1 pip and no commissions, making it accessible to beginner traders or those with limited capital.

Comparing these fees with popular brokers, Tamam Brokerage Services' offerings align with industry standards, providing a balance between cost-effectiveness and trading conditions suitable for traders across different experience levels.

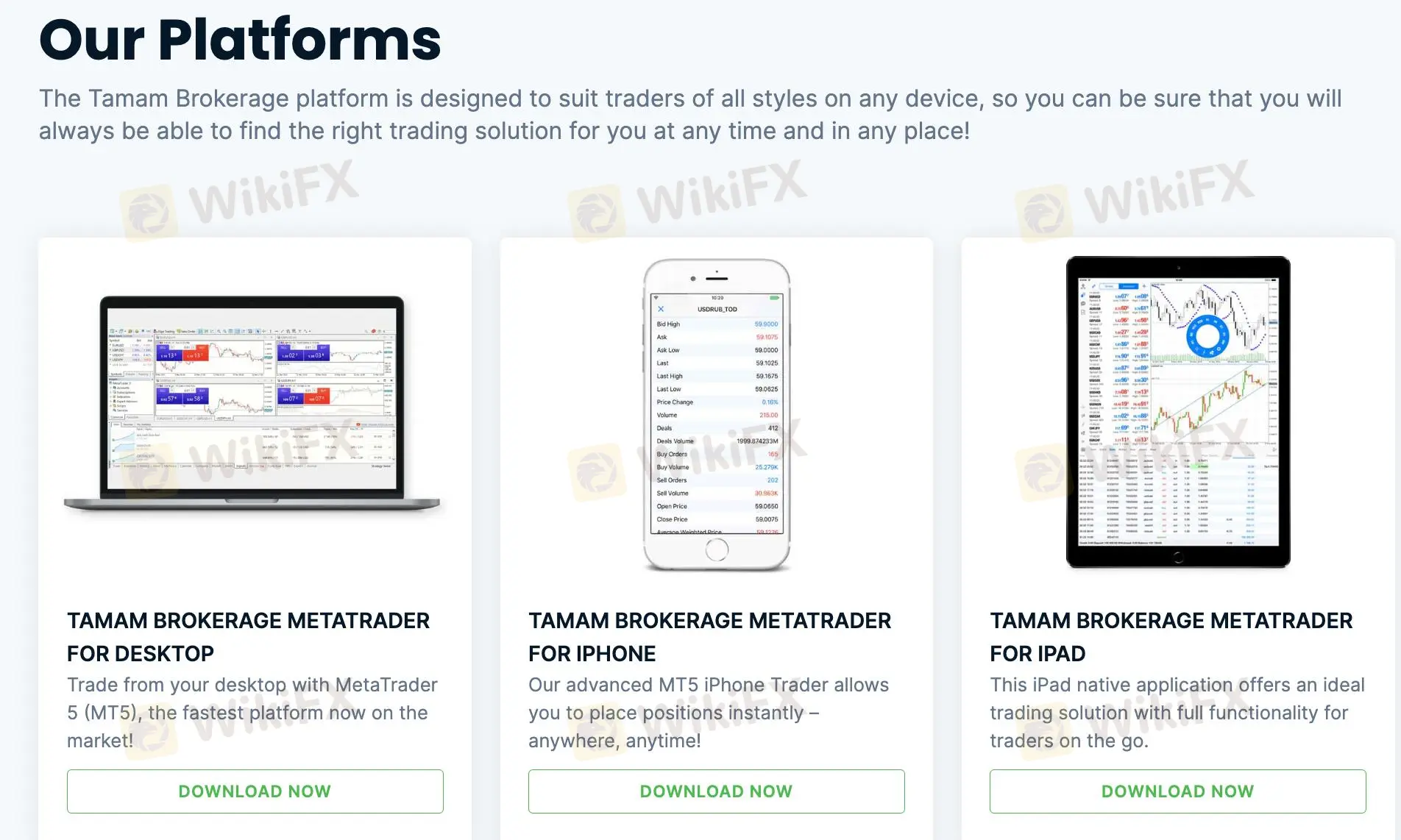

Trading Platform

Tamam Brokerage Services employs the MetaTrader 5 (MT5) platform, which is accessible across various devices including desktop computers, smartphones, and web browsers.

This platform offers traders the flexibility to manage their investments and execute trades easily regardless of their location or preferred device. With MT5, users can access a wide range of trading tools and features designed to facilitate efficient market analysis and execution.

The platform's availability on multiple devices ensures that traders can stay connected to the markets and manage their portfolios efficiently, enhancing their overall trading experience. MT5's cross-device functionality enables traders to transition easily between different devices without compromising on performance or functionality.

Deposit & Withdrawal

Tamam Brokerage Services provides a range of payment methods to accommodate various customer preferences. These methods include credit/debit card (coming soon), mobile money, M-pesa, and cryptocurrency.

In terms of minimum deposit requirements, Tamam Brokerage Services maintains varying thresholds across its account types. For the TBS Standard and TBS Cent accounts, the minimum deposit stands at $10, making trading accessible to individuals with limited capital or those who are new to the forex market.

On the other hand, the TBS Pro account necessitates a higher minimum deposit of $500.

Unlike some brokerage firms that impose fees on deposits and withdrawals, Tamam Brokerage Services distinguishes itself by not charging any fees for these transactions.

Customer Support

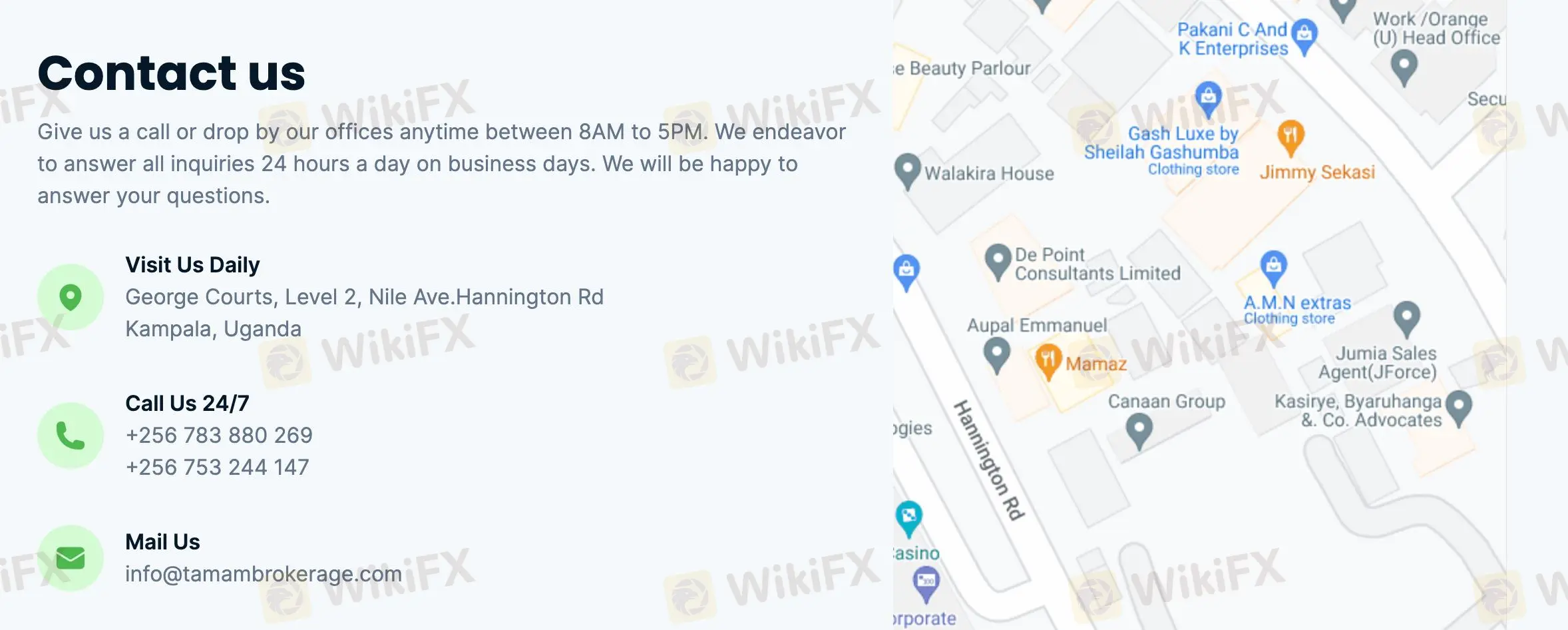

Tamam Brokerage Services offers comprehensive customer support to assist traders with their inquiries. Customers can visit their offices located at George Courts, Level 2, Nile Ave. Hannington Rd, Kampala, Uganda, during business hours from 8 AM to 5 PM.

For immediate assistance, they provide 24/7 phone support at +256 783 880 269 and +256 753 244 147. Additionally, traders can reach out via email at info@tamambrokerage.com.

User Reviews

User reviews of Tamam Brokerage Services highlight issues regarding issues with trade execution, customer support responsiveness, and bonus promotions.

One user reported difficulties in closing profitable trades due to “Off Quotes” errors, leading to significant losses and frustration with the broker's dealing desk model. Another user expressed disappointment in not receiving a promised deposit bonus, citing delays and excuses from the brokerage.

Additionally, skepticism was voiced regarding the company's reliability, as it is registered in Saint Vincent and the Grenadines, perceived as a risky location for forex brokers. These reviews may influence traders' decisions by raising doubts about the broker's reliability, customer service quality, and transparency in promotional offers.

Conclusion

In conclusion, Tamam Brokerage Services offers a range of advantages, including a low minimum deposit of $10, over 350 trading assets, and competitive spreads as low as 0 pips.

However, its unregulated status raises risks about oversight and protection for traders. Delays in bonus issuance and reported issues with customer support responsiveness further detract from the overall trading experience.

Despite these drawbacks, the brokerage's leverage of up to 1:1000 and utilization of the MetaTrader 5 platform provide traders with flexibility and advanced trading tools.

FAQs

Question: What is the minimum deposit required to open an account with Tamam Brokerage Services?

Answer: The minimum deposit is $10.

Question: What trading platforms does Tamam Brokerage Services offer?

Answer: Tamam Brokerage Services utilizes the MetaTrader 5 platform, available for desktop, mobile, and web trading.

Question: Are there any fees for deposits and withdrawals?

Answer: No, Tamam Brokerage Services does not charge any fees for deposits or withdrawals.

Question: What is the maximum leverage offered by Tamam Brokerage Services?

Answer: The maximum leverage available is up to 1:1000, depending on the account type.

Question: How many trading assets are available on Tamam Brokerage Services?

Answer: Tamam Brokerage Services offers over 350 trading assets across various markets.

Question: Is Tamam Brokerage Services regulated by any financial authority?

Answer: No, Tamam Brokerage Services operates without regulation.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM570,000 Lost in a Gold Trading Scam in Malaysia

In a distressing case of financial deception, a retired female teacher in Malaysia lost RM570,000 of her personal savings and pension to a gold trading investment scheme.

Many Social Media 'Investment Gurus' Are Scammers Preying on Malaysian Traders

Social media platforms have become breeding grounds for scammers posing as investment gurus, exploiting the growing interest in forex and cryptocurrency trading among Malaysians. Fraudulent "financial experts" often create the illusion of legitimacy by offering enticing stock analyses and promises of high returns.

Arumpro Capital Ltd Faces Regulatory Setbacks as CySEC Withdraws CIF Licence

The Cyprus Securities and Exchange Commission (CySEC) has officially withdrawn the Cyprus Investment Firm (CIF) licence of Arumpro Capital Ltd. The decision was finalised during a CySEC meeting on 11 November 2024, marking another chapter in the firm's ongoing regulatory challenges.

Webull Expands Trading Services to Japan via TradingView

Webull launches in Japan, offering low-cost trading for U.S. and Japanese securities via TradingView. Start trading with investments as low as $5.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator