简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Moneta Markets Launches a New Asset Class of 7 Bonds to Their Range of Products

Abstract:Popular Forex and CFD broker, Moneta Markets, has just announced the launch of 7 new bonds to its range of 1000+ tradable products.

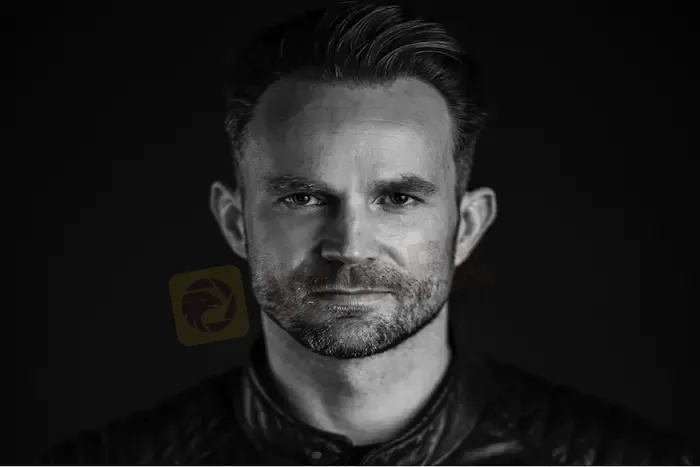

We spoke with Moneta Markets CEO and Founder, David Bily, to find out more.

The introduction of Moneta Markets futures on Bonds follows the launch of a range of ETFs. Has there been an increase in demand to add Bond markets to your portfolio of trading products?

Treasuries and Bonds are some of the largest markets in the world and are a key indicator of an economys health. The past few years have seen a major shift in global economies, and our clients are noticing this, and are increasingly expressing interest in accessing Bond markets with Moneta Markets.

Our objective as a true multi-asset brokerage is to cater to traders of all levels, from the novice trader who is just getting started with Forex, to some of the more astute traders who can tend to want exposure to other markets, like Bonds or ETFs.

“With inflation on the rise and economic uncertainty in general, the introduction of futures on Bonds allows our clients to take advantage of what could be a multi-year investment opportunity, or use Bonds as a hedge or additional vehicle to assist in diversifying their existing trading strategies.”

“We are constantly seeking feedback from our clients and partners, so based on this and the trading volume we see coming into new products, in this instance, Bonds, we will look to expand even further on what we offer. As a client-centric broker, its vital that we provide the products and services that attract demand, so this means that we are in a constant process of evolution to meet and exceed the expectations of our clients. This also has the added benefit of attracting new clients, who are looking to trade markets that many of our competitors fail to offer.”

Fresh off the back of its separation from the Vantage Group, Moneta Markets appears to be moving ahead in leaps and bounds as it attracts more attention from the industry at large, and with the addition of its range of new futures on Bonds that trend looks set to continue into the end of the year and into 2023!

Moneta Markets is a multi-regulated FX and CFD brokerage offering 1000+ FX pairs, Indices, Commodities, Cryptos, Share CFDs, ETFs, and Bonds on the popular MT4, MT5, and PRO Trader platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Revolut Leads UK Neobanks in the Digital Banking Revolution

Revolut dominates the UK neobanking scene with 15.6M downloads in 2024, surpassing traditional banks. Explore how innovation drives this fintech leader’s growth.

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator