Score

TCC

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.topcapitalcorporations.com/en

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:Top Capital Corporation Limited

License No.:796510

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed TCC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

topcapitalcorp.com

Server Location

Hong Kong

Website Domain Name

topcapitalcorp.com

Server IP

103.43.188.125

topcapitalcorporations.com

Server Location

United States

Website Domain Name

topcapitalcorporations.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2018-08-06

Server IP

208.101.21.43

topcapitalcorporation.com.cn

Server Location

Hong Kong

Website Domain Name

topcapitalcorporation.com.cn

Website

WHOIS.CNNIC.CN

Company

阿里云计算有限公司(万网)

Domain Effective Date

0001-01-01

Server IP

36.255.220.246

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Company Name | Top Capital Corporation Limited |

| Registered Country/Area | United Kingdom |

| Founded Year | 2009 |

| Regulation | Revoked by the Financial Conduct Authority (FCA) |

| Minimum Deposit | USD 200 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.03 pips |

| Trading Platforms | MetaTrader4 (MT4) |

| Tradable Assets | Forex, CFDs, Derivatives |

| Account Types | Standard Account |

| Customer Support | Phone at +4402038806803 email at support@topcapitalcorporations.com |

| Deposit & Withdrawal | Bank wire transfer, credit card, debit card |

| Educational Resources | Limited educational resources |

Overview of Top Capital Corporation Limited

TCC, or Top Capital Corporation Limited, purports to offer traders access to the MetaTrader4 trading platform. Registered in the United Kingdom since 2009, TCC claims to provide a variety of market instruments, including Forex, CFDs, and derivatives.

However, it's crucial to note that TCC's license has been revoked by the UK's Financial Conduct Authority (FCA), raising regulatory concerns. Despite its diverse offerings, traders should exercise caution and consider the revoked license when evaluating TCC as a potential trading partner.

Is TCC legit or a scam?

It's important to note that TTC's license has been revoked by the Financial Conduct Authority (FCA), the regulatory agency in the United Kingdom. This means that TTC is no longer authorized to provide financial services or act as an appointed representative in the UK. TTC's regulatory status is as follows:

Current Status: Revoked

License Type: Appointed Representative (AR)

Regulated By: United Kingdom

License No.: 796510

Pros and Cons

| Pros | Cons |

| MT4 Trading Platform | Lack of Regulatory |

| Mobile Trading | Complaints |

| Competitive spread | Limited Educational Resources |

| Competitive leverage | Unstable Customer Support Processing |

Pros:

MT4 Trading Platform: TCC offers the widely acclaimed MetaTrader 4 (MT4) trading platform. MT4 is renowned for its user-friendly interface, extensive charting tools, and support for automated trading through Expert Advisors (EAs).

Mobile Trading: TCC provides the flexibility of mobile trading, allowing traders to access their accounts and execute trades from anywhere at any time.

Competitive Spread: TCC offers highly competitive spreads, starting from as low as 0.03 pips. These narrow spreads contribute to cost-efficiency in trading, potentially maximizing traders' profit margins.

Competitive Leverage: TCC offers competitive leverage of up to 1:500. Leverage allows traders to amplify their market exposure, potentially magnifying profits.

Cons:

Lack of Regulatory: One of the notable drawbacks is the lack of clear regulatory information for TCC. Regulatory oversight provides a layer of protection and transparency for traders.

Complaints: TCC has received a significant number of complaints, which raises concerns about the broker's reliability and customer satisfaction.

Limited Educational Resources: TCC lacks comprehensive educational resources. While they may provide basic trading guides and video tutorials, the absence of in-depth educational materials can be a drawback for traders seeking to enhance their knowledge and skills in the financial markets.

Unstable Customer Support Processing: There have been reported concerns about the stability and responsiveness of TCC's customer support.

Market Instruments

TCC boasts an extensive array of market instruments designed to cater to the diverse needs of traders. These encompass:

Foreign Exchange (FX): TCC provides access to the foreign exchange market, also known as Forex. Forex trading involves the exchange of currencies and is renowned for its high liquidity and potential for profit in the global currency markets. Traders can engage in various currency pairs, allowing them to capitalize on fluctuations in exchange rates.

CFDs (Contracts for Difference): TCC offers Contracts for Difference (CFDs) as part of its market instruments. CFDs enable traders to speculate on the price movements of various assets without owning the underlying asset itself. This includes indices, commodities, stocks, and more. CFD trading provides flexibility and the potential for profit whether prices are rising or falling.

Derivatives: TCC's market instruments also encompass derivatives. Derivatives are financial contracts whose value derives from an underlying asset, index, or reference rate. These instruments enable traders to hedge against market risks, enhance portfolio diversification, and engage in sophisticated trading strategies.

By offering such a broad spectrum of market instruments, TCC ensures that traders have access to diverse trading opportunities, allowing them to tailor their portfolios and strategies to their specific financial goals and risk tolerance.

Account Types

TCC exclusively offers a single account type, the Standard Account. With a substantial leverage of 1:500, this account allows for significant market exposure, making it suitable for both beginners and experienced traders. Traders can benefit from competitive spreads starting at just 0.03 pips, enhancing the cost-efficiency of their trades.

To get started, a minimum deposit of USD 200 is required, making it accessible to a wide range of traders. Deposits and withdrawals can be conveniently made via bank wire transfer, credit card, and debit card.

| Account Type | Standard Account |

| Leverage | 1:500 |

| Spread | Starting from 0.03 pips |

| Minimum Deposit | USD 200 |

| Payment method | Bank wire transfer, credit card, debit card |

| Demo Account | No |

| Trading Tool | MetaTrader 4 |

| Customer Support | 24/5 customer support via phone, email |

How to Open an Account?

Opening an account with TCC is a straightforward process. Here are the steps broken down into six clear and concise points:

Visit TCC's Official Website: Start by accessing TCC's official website through a web browser.

Select “Open an Account”: On the website's homepage, look for the “Open an Account” or “Sign Up” button and click on it.

Choose Account Type: You'll be prompted to select your preferred account type. TCC typically offers a Standard Account. Choose the one that aligns with your trading preferences.

Fill Out the Online Application: Complete the online application form with your personal information. This may include your full name, contact details, and financial information. Ensure all details are accurate.

Submit Required Documentation: Upload the necessary identification documents, which often include a valid ID, proof of address (e.g., utility bill or bank statement), and any other documents specified by TCC.

Review and Approval: TCC will review your application and documents. Once approved, you will receive confirmation along with your account login details. Be prepared for a Know Your Customer (KYC) process if required.

Leverage

TCC offers leverage up to 1:500 for FX trading. Leverage is indeed a potent tool that can amplify your profits, but it's crucial to recognize that it can equally heighten your level of risk.

Spreads & Commissions

TCC offers a competitive spreads, starting from an impressively tight 0.03 pips. These low spreads are a significant advantage for traders as they contribute to cost-efficiency in their trading activities.

Trading Platform

TCC offers traders access to the widely acclaimed MetaTrader4 (MT4) trading platform, recognized for its exceptional features and versatility. Below, we delve into the key aspects of this platform:

User-Friendly Interface: MT4 boasts a user-friendly interface that caters to traders of all experience levels. Its intuitive layout makes navigation and order placement seamless, even for beginners.

Advanced Charting Tools: The platform provides robust charting tools, empowering traders to conduct in-depth technical analysis. It offers a diverse range of technical indicators and charting options, allowing traders to customize their charts to suit their preferences.

Automated Trading with Expert Advisors (EAs): MT4 supports automated trading through the use of Expert Advisors (EAs). This feature enables traders to implement automated trading strategies, execute trades, and manage positions without constant manual intervention. EAs can be developed or acquired from the vast MT4 marketplace.

Technical Indicator Library: MT4 offers an extensive library of technical indicators that traders can employ to enhance their trading strategies. These indicators help in analyzing market trends, identifying potential entry and exit points, and making informed trading decisions.

Customizable Charts: Traders can personalize their charts on MT4, adjusting colors, timeframes, and layouts to create a trading environment that suits their preferences.

Vast Marketplace: MT4 features a marketplace with over 10,000 trading apps, including indicators, EAs, scripts, and custom tools. This extensive ecosystem allows traders to enhance their trading experience and tailor the platform to their specific needs.

Deposit & Withdrawal

TCC currently offers the following payment methods:

Bank wire transfer

Credit card

Debit card

For account funding, a minimum deposit of USD 200 is required. It's important to note that TCC does not impose any fees for deposits, ensuring that your initial funding goes entirely toward your trading capital.

However, when it comes to withdrawals, TCC does apply certain fees. Please refer to the following table for a breakdown of TCC's withdrawal fees:

| Withdrawal Method | Fee |

| Bank wire transfer | Free |

| Credit card | 2.50% |

| Debit card | 2.50% |

Payment processing times vary depending on the payment method used. Bank wire transfers typically take 3-5 business days to process, while credit and debit card deposits are processed immediately.

Customer Support

TCC's customer support can be reached via telephone at +4402038806803 and through email at support@topcapitalcorporations.com. The company's physical address is 15 Bishopsgate, London, UNITED KINGDOM, EC2N 3AR. Clients can use these channels to seek assistance or address any trading-related inquiries.

Educational Resources

TCC's deficiency in offering comprehensive educational resources may present a limitation for traders in their quest for valuable learning materials and in-depth trading insights. A robust educational suite is often a crucial component for traders, particularly those who are new to the financial markets or wish to enhance their trading skills. Such resources typically include trading guides, webinars, tutorials, and market analysis tools that facilitate informed decision-making.

The absence of these resources at TCC might leave traders with fewer opportunities to expand their knowledge, develop effective strategies, and stay updated on market trends. Therefore, prospective clients should consider their educational needs when evaluating TCC as their trading partner and seek alternative sources of education to supplement their trading journey.

Conclusion

In conclusion, TCC presents a range of market instruments and the MetaTrader4 trading platform. However, its revoked license by the UK's Financial Conduct Authority (FCA) raises significant regulatory concerns. Traders should approach TCC with caution due to this regulatory issue, as it may impact the safety and security of their investments. As with any financial service provider, thorough research and due diligence are essential before considering TCC as a trading partner.

FAQs

Q: Is TCC regulated by any financial authority?

A: No, TCC's license has been revoked by the UK's Financial Conduct Authority (FCA).

Q: What trading platform does TCC offer?

A: TCC provides access to the MetaTrader4 (MT4) trading platform.

Q: Are there any educational resources available for traders?

A: TCC lacks comprehensive educational resources.

Q: What market instruments can I trade with TCC?

A: TCC offers trading in Forex, CFDs (Contracts for Difference), and derivatives.

Q: What is the minimum deposit required to open an account with TCC?

A: The minimum deposit is USD 200.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- United Kingdom Appointed Representative(AR) Revoked

- High potential risk

Review 99

Content you want to comment

Please enter...

Review 99

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2681488600

United States

3 months after my first withdrawal and i still couldn't withdraw the larger part of my profit as well as my invested capital while it's been 10 days I think it is actually difficult to get a withdrawal directly from Top Capital Corporation Limited after the first time, they allow you withdraw once and try to convince you to deposit more, then they abscond.

Exposure

2021-04-02

FX3234627962

United States

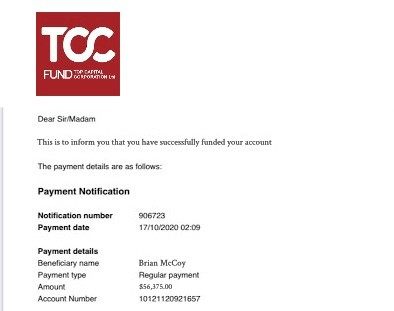

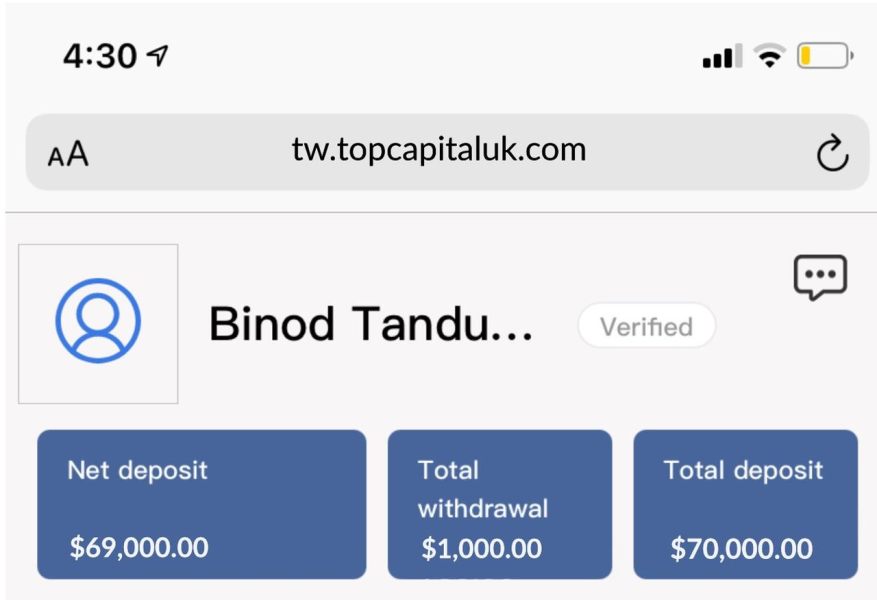

I made two bank transfers of $70,000 to TCC and was suppose to be used for trade and it wasn't. I requested for withdrawal in my account and i was only able to withdraw a $1000 and my 69,000 in the account is not accessible. TCC wanted to abscond with my money like they did for others.

Exposure

2021-03-30

FX3601601069

United Kingdom

I was introduced to TCC by somebody called Angela. She taught me how to use MT4 and arranged for me to be added to a WhatsApp group run by Professor Jason and his assistant Elsie. After depositing money into my MT4 account via UKEX, I then acted upon trading signals given by Prof. Jason through the WhatsApp groups. Within about 6 weeks of using the group, everybody just disappeared, including Angela. I have been unable to withdraw my money from my account and nobody can be contacted.

Exposure

2021-03-28

troy

Australia

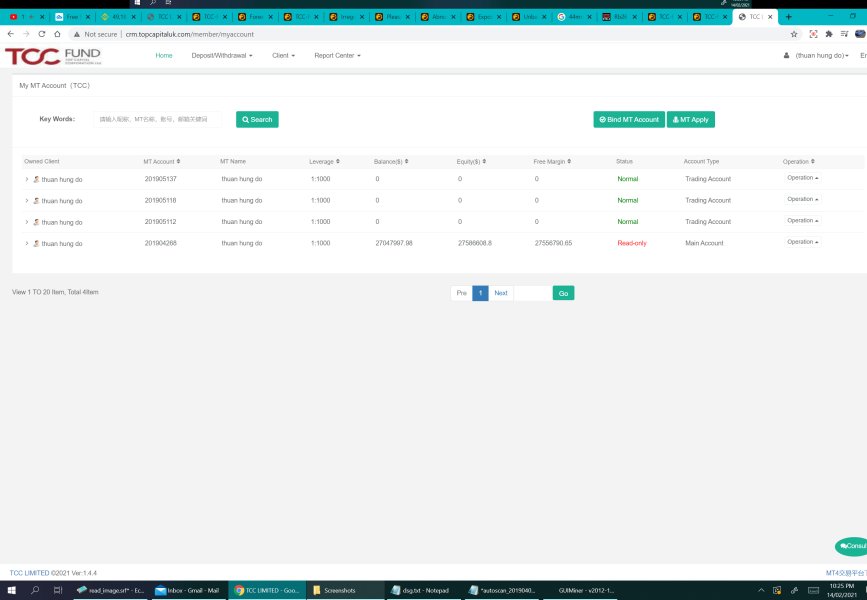

have $27,000,000 in account but can't withdrawal

Exposure

2021-02-14

YOUNG43485

Hong Kong

This platform is going to bankrupt. The boss embezzled customers’ money

Exposure

2020-12-15

从零开始6371

Hong Kong

TCC has already absconded. The platform was founded by Haoqiang Li from Shenyang. He is in Shenyang now and embezzled lots of money. Let's get together and sue him.

Exposure

2020-12-07

Dennis888

Malaysia

TCC is a scam platform. They manipulated the price movements. Recently under their VIP group, they advised me to key in GBPCHF and followed by 2 rounds to add positions, the price sudden crashed and cause my account wiped up. I did crossed check using tradingview, I noticed no such sharp movement in tradingview. It is definitely a scam to cause clients account to force closed. Beware of TCC.

Exposure

2020-10-29

浅色夏沫

Hong Kong

TCC is a fraud platform. I can't withdraw since March. There is tens of thousands of money in it.

Exposure

2020-09-12

古月云飘

Hong Kong

I withdrew in 111 since March 31. But I do't receive the withdrawals. IS it a fraud platform? Abscond? The customer service is disabled now. My emails are not responded. Account: 201805070、201901055、201804574、201804891

Exposure

2020-09-07

FX2306749122

Hong Kong

111 gave no access to withdrawal. I withdrew in the middle of May and now is September, already four months. But my witdhrawal hasn't been to my account. My emails to 111 were all refused. If there is someone who is the same with me, call the police immediately!!!

Exposure

2020-09-07

一次就好73257

Hong Kong

I withdrew in June and don’t receive the withdrawal yet. Now my account is closed by the platform.

Exposure

2020-09-03

Jinsin Kang

South Korea

line ID-yiran1314-Girlfriend line profile-Anthony-broker was introduced by a girlfriend ID above Be careful I am deaf My precious money lost my life TCC [3c][3c] Has many address sites Steal money Change site address Iterative technique I,'Line' I want to contact you with the victims Please tell me how to contact

Exposure

2020-09-02

欢乐马34625

Hong Kong

Unable to withdraw. The head of LiLuo company in Nanning and customer service don’t respond to my calls or WeChat messages. Absolutely scam!

Exposure

2020-09-02

helen88454

Hong Kong

I applied for the withdrawal of $600 on May 1, while it is yet to be received for 3 months. The platform gave no access to withdrawal of several hundred dollars, let alone 10 million or so. I knew that there must be other victims.

Exposure

2020-08-03

troy

Australia

is there any way to contact other victims to try get money back

Exposure

2020-08-01

欣然33517

Hong Kong

The withdrawal is unavailable. And the service didn’t reply to me. The trusteeship party kept fending me off.

Exposure

2020-07-29

troy

Australia

cannot withdrawal my balance

Exposure

2020-07-28

Yx.

Hong Kong

The website has been shut. All my emails have been rejected. I reckon that there must must other victims. I appeal you to get united and call the police.

Exposure

2020-07-28

一次就好73257

Hong Kong

The withdrawal in May is unavailable. Both the mailbox and website are disabled.

Exposure

2020-07-25

helen88454

Hong Kong

Suddenly, all my emails are rejected. The withdrawal applied on May 11st is yet to be received. Has TCC absconded?

Exposure

2020-07-25