简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Why You Shold Be Alert to TF Global

Abstract:Stay away from brokerage firms like TF Global that are not authorized by national financial institutions.

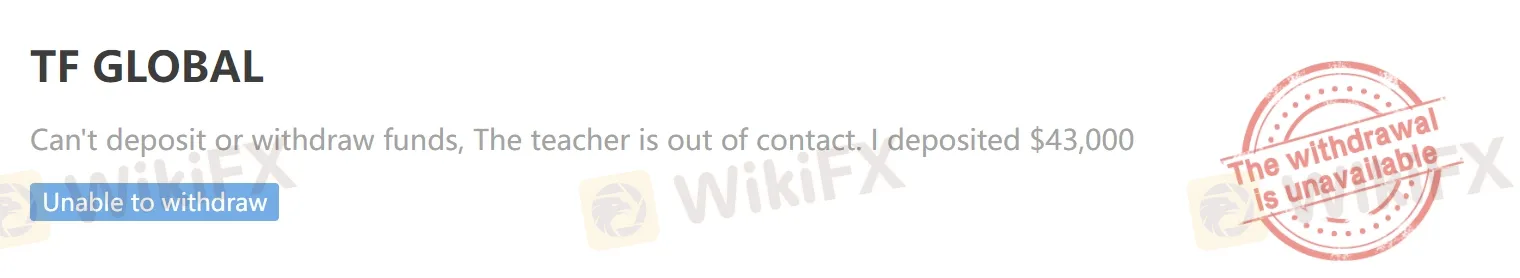

Anyone who invests in the forex market has to bear some of the risk, but that is no reason for brokers to commit fraud. Recently, WikiFX received a number of exposures from users about bad dealers, the broker TF Global is one of them. You may check the exposure by investors on the screenshot below.

We can understand that the victim complained that TF Global refused his withdrawal request on the grounds of irregularities, and the teacher who had been in charge of his forex learning did not respond to any messages or calls, as if he had disappeared. As a matter of fact, this is a classic foreign exchange scam. Let's take a look at the signs of fraud at TF Global, a broker that we should be warned against.

TF Global said its a financial derivatives broker and based in the United States. The first step to verifying whether the broker is a viable one is to visit their national financial regulator's website to see if the broker is registered and authorized by an authoritative national financial institution.

As we can see from the figure above that the query result is quite negative –no company named “TF Global” is shown on the National Futures Association(NFA). It clearly proves that TF Global is not authorized by NFA. The Commodity Futures Trading Commission (CFTC) makes it clear that individuals or companies that are not registered with the CFTC and are not members of the NFA are not subject to regulation by the US financial authorities. All members of the public in the United States should stay away from these companies because the financial services they provide are illegal. If anything goes wrong you're unlikely to get your money back.

In addition, to get a better idea of TF Global, WikiFX also paid a visit to its official website. However, the outcome was disappointed, the official website can‘t be reached and tfgloblefx.com’s server IP address could not be found.

Without access to the website, we can't see for ourselves whether it meets the requirements of financial industry. As a broker who claims to be a professional trader, but does not show even the most basic information to users. Obviously, it's covering up something shady.

Moreover, in order to find out more about TF Global, WikiFX made an attempt to access the domain tool to learn about the domain information.

It can be found by tracking its website information that the tfgloblefx.com is for sale! It is easy to know that TF Global did not intend to be in business for the long term when it was registered. It expected to get money and then switch to a new domain name and continue scamming. As it stands now, TF Global 's scam appears to have been busted and can no longer operate, so it is running away with clients' money.

When faced with the little information on Internet, we can totally trust and use WikiFX to learn more about forex broker. It is certainly the most convenient and quick inquiry mode for investors. Now let's search “TF Global” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/7381798151.html), TF Global currently has no valid regulatory license and the score is rather negative - only 1.43/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker.

Please note that WikiFX is also reminding the majority of users: low scores, please stay away!

WikiFX suggest that trusting a broker like TF Global is simply not worth it – you will certainly end up robbed. The so-called brokerage is nothing more than an outright scam, which is not authorized by the national financial institution. Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

If you want to know more information about the reliability of certain brokers, you can click the information you want on this page Or you can download the WikiFX APP (https://wikifx1.onelink.me/QUVu/fiona) to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator