简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert: Forex Scammer FinexTrader is Not Regulated

Abstract:As a forex investor, it is very necessary to know about forex regulators as some scams are designed to deceive newbies in the market.

Take fraudster FinexTrader, it falsely claims to be regulated, but none of the regulators it mentions are true. If you don't know what forex regulators are in the world, you are likely to fall into this kind of trap.

Invalid “Regulations”

Opening the Regulation of FinexTrader, a rookie may be convinced that the broker is regulated. The three “forex regulators” mentioned on the website include:

1)International Regulators & Brokerage E-Markets (IRBEM);

2)Market Financial Authority (MFA);

3)Swiss Financial Securities (SFINS).

Notably, none of the “regulators” are authorities that can regulate forex brokers or issue forex licenses.

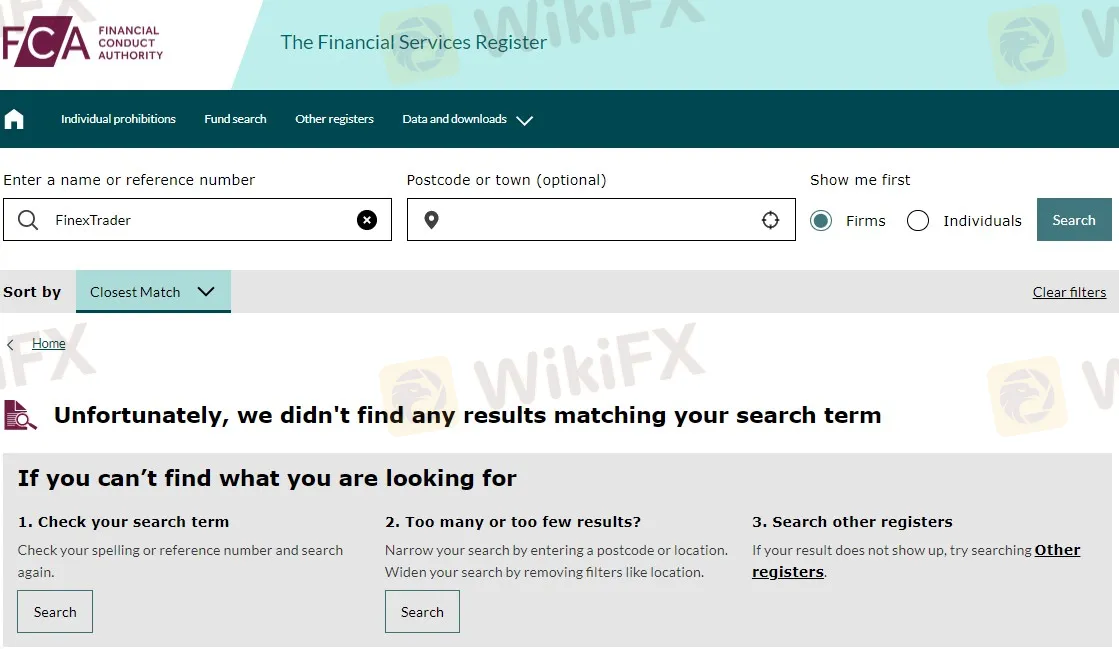

According to the website, the broker is located in the UK. As per the United Kingdom laws, it shall obtain a forex license issued by UK FCA. However, we cannot find any regulatory information on this broker in UK FCA.

In other words, FinexTrader is not overseen by any real regulatory body in the world.

Unreasonable Clause

Many people are not used to reading the Terms and Conditions carefully, so some scammers will secretly write some unreasonable terms and claim that everything is agreed by the investor in advance when there is a problem with the trades.

Just like FinexTrader, it says it can suspend a client's use of the website at any time without any reason or prior notice to the client. Once a customer signs such an unreasonable clause, whether it is legal or not, it will become an excuse for fraudsters when you encounter disputes.

Multiple Warnings

Scammers have come under increasing scrutiny from regulators over time. In the past three months, FinexTrader has received warnings from three different forex regulators.

On 19 July 2022, the Austrian Financial Market Authority (Austria FMA) issued a warning that FinexTrader is not authorized to carry out banking transactions in Austria that require a license, which means the company is not permitted to conduct forex trade.

The France Autorité des Marchés Financiers (AMF) and the Italy Commissione Nazionale per le Società e la Borsa (CONSOB) also warned that FinexTrader is not authorized to provide forex services in France or Italy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Starting from January 1, 2025, Russia will implement a comprehensive ban on cryptocurrency mining in 10 regions for a period of six years. The ban will remain in effect until March 15, 2031.

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator