简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OvalX (formerly ETX Capital) Loses Money in 2021, Client Count Increases

Abstract:Moncor (London) Limited, trading as OvalX (previously ETX Capital), announced a pre-tax loss of £9.2 million for the fiscal year 2021, which concluded on December 31, due to large investments and macroeconomic changes.

Brexit has reduced its income.

Due to investments, its costs have also climbed dramatically.

Moncor (London) Limited, which operates as OvalX (formerly ETX Capital), reported a pre-tax loss of £9.2 million for the fiscal year 2021, which ended on December 31, owing to overwhelming investments and macroeconomic developments.

After deducting tax, the net loss for the year was £6.8 million. The retail FX and CFD broker made £428,000 in net earnings last year.

The broker has previously disclosed that its trading income has fallen to £24.1 million from £31.7 million the previous year. Its spread income fell 45 percent year on year, but just 10 percent from pre-pandemic levels. Its finance income, on the other hand, surged by 39% as a result of its professional clientele. Furthermore, income from corporate broking climbed by 37%, from £1.1 million to £1.5 million.

The broker's trading income suffered, owing mostly to the effect of Brexit. Last year, the London-based broker moved its European business and customers to a sibling company in the EU.

According to the most recent Companies House statement, it concluded the year with a net operating income of £17.3 million, a decrease from £21.2 million the previous year.

After deducting administrative costs, the broker made an operational loss of £9.2 million in fiscal 2020, compared to a profit of £595,000 in fiscal 2019.

In addition, the company's administrative expenditures climbed by more than 30% last year. A huge investment period in technology and infrastructure drove it.

Furthermore, the broker grew its staff by 28% last year, despite a 27% rise in fixed assets and intangible amortization expenses. It has hired a team of quantitative analysts to improve its hedging tactics.

Meanwhile, the platform's registered customers climbed by 16% last year, from 14,354 to 16,582.

The statement claimed that “the view for 2022 continues to be centered on investment in the firm's technology, infrastructure, and brand.”

Earlier today, WikiFX reported on Luca Merolla taking over as CEO of Oval Money, which includes the London-based broker. Adler currently serves as the company's Chief Business Development Officer.

About OvalX

Oval X is a well-known internet trading firm based in London (formerly ETX Capital). The broker provides trading in CFDs and spread betting, as well as excellent customer services, and has decades of expertise and a variety of trading platforms. Before reaching a conclusion, this Oval X review will evaluate all parts of its product, including trading costs, sample accounts, and mobile applications.

Since the ESMA regulation reforms, Oval X has become the “go-to” broker for professional customers.

OvalX Regulation

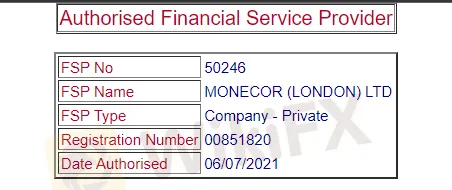

Finding a trustworthy exchange is becoming more vital, as shown by forex and CFD broker evaluations. This is due to an increase in the number of negative actors and shady brokers. A brief business check reveals that Oval X is regulated by the FCA, with Financial Services Register number 124721.

In South Africa, Oval X just got a license from the Financial Services Conduct Authority (FSCA).

Because they are regulated, businesses must comply with a variety of consumer-protection procedures. This should reassure intraday traders that Oval X is a reputable broker concerned with both clients and dividends.

About WikiFX

WikiFX is a search engine for worldwide corporate financial information. Its primary duty is to search for basic information, regulatory licenses, the credit assessment, platform identification, and other services for the participating foreign currency trading firms.

There are about 39,000 brokers listed on the marketplace, both licensed and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is accurate and up to date.

Stay tuned for more Broker News.

Download the WikiFX App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator