简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

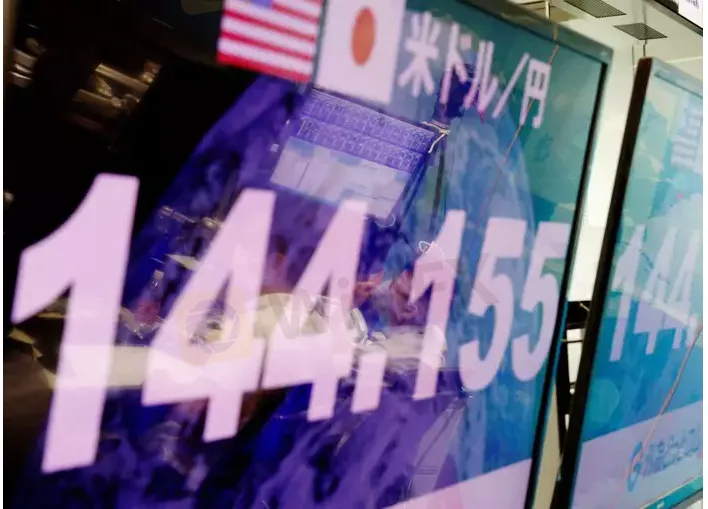

Japan’s solo FX intervention won’t be that effective

Abstract:Japan lacks effective means to combat the yen’s sharp falls, as intervening unilaterally in the currency market will likely have a limited impact in reversing its downtrend, Satsuki Katayama, head of a ruling party panel on financial affairs, said.

“Solo currency intervention wont be that effective” in stemming sharp yen falls, which are driven by the interest-rate gap between the United States and Japan, she told Reuters.

Raising Japan‘s ultra-low interest rates would also be difficult given the impact that could have on the country’s 550 trillion yen ($3.84 trillion) of bank loans, Katayama, chairperson of the Liberal Democratic Partys (LDP) research commission on finance and banking systems, said on Wednesday.

A former Ministry of Finance (MOF) official, Katayama has deep expertise on financial markets.

Japanese authorities on Wednesday signalled the chance of intervening to prop up the yen by conducting a rate check with banks, though many analysts doubt Tokyo will actually step in due to the difficulty of convincing its G7 counterparts.

($1 = 143.3300 yen)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Euro Investors Can't Afford to Miss

For euro investors, geopolitical factors, inflation data, and the European Central Bank's policy direction will determine the market trends over the next few months.

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

The U.S. Federal Reserve's repeated rate cuts and the narrowing of the U.S.-Japan interest rate differential are now in sight. So, why is the U.S.-Japan interest rate differential so important for the yen’s safe-haven appeal, especially when global economic uncertainty rises?

Malaysian Man Killed in Alleged Forex Dispute-Related Attack

A 44-year-old Malaysian businessman, Wong Kai Lai, died after being attacked by about 20 men in Jenjarom, Kuala Langat, on 19 December. Police believe the attack may have been linked to a foreign currency exchange dispute.

Turkey Resumes Rate Cuts Amid Easing Inflation

Turkey’s inflation has eased, prompting the central bank to resume interest rate cuts. Striking a balance between economic recovery and inflation control has become a critical focus. However, significant challenges lie ahead, as Turkey continues to navigate complex economic conditions.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Has the Yen Lost Its Safe-Haven Status?

Currency Calculator