简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nigeria’s inflation rate ballooned by 170% under President Buhari

Abstract:Nigeria’s consumer price index (CPI), which is used to measure the level of inflation in the country has risen by 170.2% under President Muhammadu Buhari’s administration, between June 2015 and July 2022.

Nigeria‘s consumer price index (CPI), which is used to measure the level of inflation in the country has risen by 170.2% under President Muhammadu Buhari’s administration, between June 2015 and July 2022.

This is according to data tracked and analysed by Nairalytics – the Research arm of Nairametrics. Recall that the president was sworn into office as the 15th President of the federation on Friday, 29 May 2015, following the presidential general election held, a position which he has occupied since then.

During the period, Nigerias consumer price index rose from 171.6 index points recorded in May 2015 to 463.6 points in July 2022, indicating an increase of 170.2%. In the same period, the food index rose by 209.5%, while core inflation spiked by 132.2% in the same vein.

The year-on-year inflation rate accelerated to a 17-year high in July 2022, following significant rise in the cost of energy, and staple food items. The National Bureau of Statistics (NBS) reported that Nigerias inflation rate rose to 19.64% in July 2022 from 18.6% recorded in the previous month.

Nigerians now have to grapple with the high cost of virtually everything, as the underlying issues persist across board. First, let us look at the disaggregated indices.

The health index, which tracks the cost of health services in the country has surged by 122.3% between May 2015 and July 2022, while on a year-on-year basis, the health inflation rate stood at 15.95% in July from 15.6% recorded in the previous month.

Also, clothing and footwear index spiked by 146.3% in the review period, with the year-on-year rate at 17.73%.

Similarly, the transportation index jumped by 141.7% in the seven-year period, education recorded a 132.5% increase, restaurants and hotels (132.5%).

It is worth adding that, despite significant intervention to reduce Nigerias dependence on food importation, we are largely exposed to the global food crisis. Notably, the imported food index rose by 201.5%, a major contributor to the rise in the food index.

In the same vein, house water, electricity, gas, and other fuel recorded a 119.7% increase in its index between May 2015 and July 2022.

Genesis of Nigerias inflationary woes

Though the Nigerian economy is characterised by various structural and socio-economic issues, which have seen the country maintain a double-digit inflation rate since February 2016. Surprisingly, Nigeria enjoyed a single-digit inflationary rate regime between January 2013 and January 2016.

However, a combination of ineffective policies, global economic headwinds, and socio-economic vices, have seen Nigerians purchasing power eroded at a very fast pace. With a 20% inflation rate in sight, last of which was recorded in September 2005 (17 years ago).

We take a look at some of the factors and policies that have bedevilled Nigerians purchasing power.

Over-reliance on oil revenue – 2016 oil crash

In 2016, Nigerias economy dipped significantly characterised by five consecutive quarters of GDP contractions from Q1 2016 through to Q1 2017.

The decline which was attributed to a significant crash in the price of crude oil and Nigeria being overly reliant on crude oil as a source of revenue suffered deeply, with the federal government recording a fiscal deficit of N2.14 trillion and N4.35 trillion the following year.

The economic nosedive during the period also caused a significant hike in price of goods and services as the headline inflation rate rose from 9.62% in January 2016 to a peak of 18.72% in January 2017 before moderating. This is after the Central Bank had raised interest rates twice to curb the racing inflationary pressure.

Land border closure – 2019

Following the downturn caused by the crude oil market volatility from 2016 through to 2017, the Nigerian president in a bid to diversify the economy and encourage local production and consumption of agricultural produce ordered the closure of all land borders in the country.

Specifically, on the 19th of October 2019, the Comptroller-General of the Nigerian Customs Service, retired Col. Hameed Ali at the order of the president, announced complete closure of the Nigerian land border, noting that all import and export of goods from the countrys land border were banned until there is an agreement with neighbouring countries on the kind of goods that should enter and exit Nigeria.

This is following an initial announcement by the CBN in 2015 to ban a list of 41 imported goods and services from accessing the official Nigerian Foreign Exchange Market. This means that international traders, particularly importers would have to source forex on their own to meet import bill obligations.

Fast forward to 2019, the prices of most food items surged significantly, items such as rice and bread, which are major everyday foods for Nigerians witnessed unprecedented levels of price increases during this period.

Consequently, Nigerias inflation rate hit 11.61% in October 2019, and continued upward, further exacerbated by the covid-19 pandemic in 2020.

Covid-19 pandemic/Food supply chain disruption – 2020

The covid-19 pandemic, which struck in 2020 is dubbed one of the worst and most deadly global pandemics in the history of mankind, killing over 6.46 million people worldwide to date. The coronavirus disease due to the way it spread, necessitated the need to order movement restrictions and social distancing, a move which caused the global economy dearly.

As a result of the travel restrictions and lockdown, food supply chains were disrupted, economic activities contracted and prices of food and services, especially in the health sector surged during this period. This is coupled with Nigerias inability to meet local demands, hence relying on importation (imported inflation).

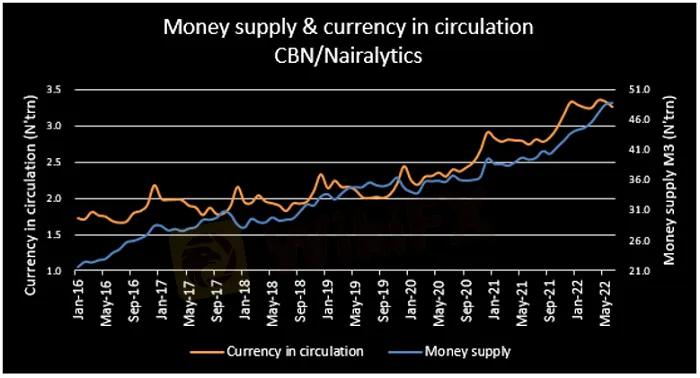

In a bid to fast-track the recovery of the economy, the central bank embarked on numerous interventions, pumping more monies into the economy to drive growth in the real sector, which paid off, as Nigerias GDP recovered immediately after the recession witnessed in Q3 2020.

However, more currency in the economy meant “too many Naira chasing too few goods”, which is a typical definition for demand-pull inflation. Hence, Nigerias inflation rate accelerated from 12.13% recorded in January 2020 to as high as 18.17% in March 2021, before moderating, albeit at a very slow pace.

Russia-Ukraine war, Oil price bubble, FX crisis – 2022

The Russia-Ukraine war was the icing on the cake, which caused an unexpected rise in the price of crude oil, consequently leading to a global energy crisis as prices of gasoline surged across the world and piled more pressure on the Nigerian government which is still paying subsidies for petrol.

However, the prices of diesel increased by almost 300% across the country, while the operating costs of most companies in the country witnessed a tremendous uptick. The companies on the other hand, shifted the high costs to the consumers by increasing prices, hence more inflation.

Similarly, with countries like the USA, Canada, and the UK, all recording record high inflation numbers and Nigeria being an importing country from these countries, it is only fair to say at this point we were dealing with a double whammy problem (high energy prices and imported inflation).

The issue was further worsened by the crash in the exchange rate as a result of sustained FX scarcity, which saw the naira trading at over N700 against the US dollar at the parallel market. Also, as Nigerians continue to import most of their consumption from other countries, a further rise in the cost of almost everything was inevitable, hence a 17-year high inflation rate in July 2022.

It is worth adding that other factors such as insecurity, bad infrastructure, and corruption amongst others are part of the underlying factors also contributing to Nigerias inflationary pressure.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Soegee Futures Review: Should You Trust This Broker?

Indonesia officially joins the BRICS countries

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Currency Calculator