简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Fraud Notice: IronFX Withdrawal Problems

Abstract:Forex trading is a lucrative investment activity, but all goes in vain if you face withdrawal issues with your chosen FX broker. IronFX is one of the red-flagged brokers who make people suffer while initiating withdrawal requests. Today, we'll share some incidents reported on social channels concerning the lousy conduct of IronFX and discuss what to do if you ever face such a situation.

IronFX Clientele Feedback

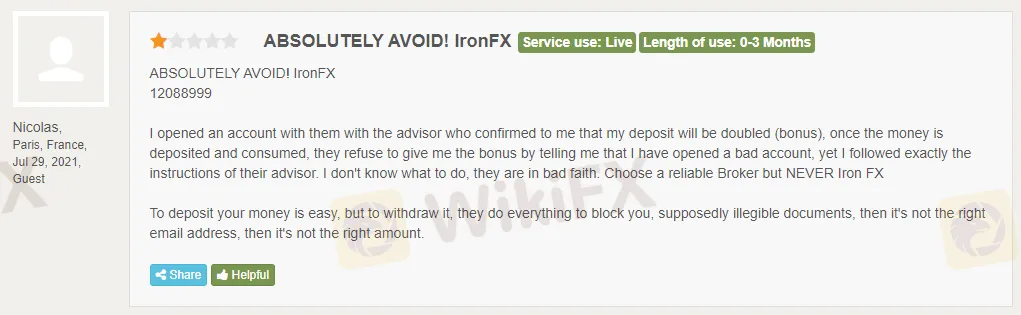

Starting from customer reviews on IronFX, let us share the screenshots of the broker's existing and former customers' feedback about the company.

The image above shows that the customer deposited funds with IronFX before verifying his account. However, he subsequently submitted all the verification documents, but the issue remained unresolved.

The second image tells another story concerning the bad conduct of IronFX's financial advisor. According to the customer, the broker's funds manager instigated him to add some funds to the trading account following his recommendations to avail of the bonus offers. However, the broker notified him of making the wrong deposits after receiving funds and declined to provide the bonus reward.

Here comes another scam incident. Despite receiving explicit instructions from the customer to put his account on AutoPilot, the company didn't pay any heed. Secondly, IronFX didn't release his residual funds even after multiple email requests.

Besides its poor reputation on FPA, people also post negative reviews about the company on several other platforms. Moreover, social media platforms, such as Twitter and Facebook, have also been full of complaints concerning IronFX withdrawal issues.

IronFX Regulation Status

After reading the above issues, one might wonder if the broker is regulated? So, it shouldnt surprise you that the company holds various licenses in multiple jurisdictions. For instance, IronFX is registered with the UK's Financial Conduct Authority (FCA) under license number 585561. The broker is also fully regulated and authorized by the Cyprus Securities and Exchange Commission (CySEC - 125/10) and the Australian Securities and Investment Commission (ASIC - 417482).

Notably, regulations don't guarantee that the broker will not scam clients. Instead, they exist to protect investors' rights. For instance, when a financial entity breaches the code of conduct, the regulatory authorities impose hefty penalties and sometimes even cancel its license.

What should you do if you have deposited funds with IronFX?

Although IronFX holds multiple regulations worldwide, the company never gets tired of scamming people in different ways. As evident above, various regulators have found the company guilty of misconduct and verdict against it. However, the company doesn't seem much concerned about its reputation.

Therefore, if you have deposited funds with the company, try withdrawing them as soon as possible. We won't recommend highlighting your issues with concerned regulatory authorities since the firm might pay the penalty and find a new way to trap customers again. So it is better to stay away from it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM5.9M Lost to "Davidson Kempner Capital Management" Facebook Scam

A private contractor in Malaysia faced a devastating loss of over RM5.9 million after falling victim to a fraudulent investment scheme promoted on Facebook. Tempted by the scheme’s impressive claims and credentials, the victim began investing in September 2024. The investment process required him to download an application called A-Trade, which was readily available on the Apple Store.

Is There Still Opportunity as Gold Reaches 4-Week High?

Gold Continues to Rise, can the Bulls Keep Going? Recently, gold prices have been on the rise, especially following the release of the non-farm payrolls data, as demand for gold as a safe-haven asset continues to increase.

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

The latest data shows that Japan’s base wages in November rose by 2.7% year-on-year, marking the largest increase in 32 years, fueling speculation about a potential BOJ rate hike, but Governor Kazuo Ueda’s dovish remarks in December have shifted market expectations toward a potential delay in policy adjustments.

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator